Paperwork

Aflac Paperwork Requirements

Introduction to Aflac Paperwork Requirements

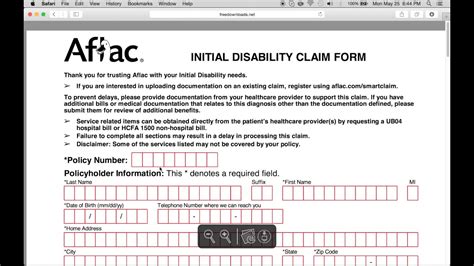

When it comes to filing a claim with Aflac, one of the most crucial steps is ensuring that all necessary paperwork is completed accurately and submitted on time. Aflac paperwork requirements can vary depending on the type of claim, the policyholder’s situation, and the specific benefits being claimed. Understanding these requirements can help streamline the process, reducing delays and stress for those already dealing with health issues or financial burdens.

Types of Aflac Claims and Their Requirements

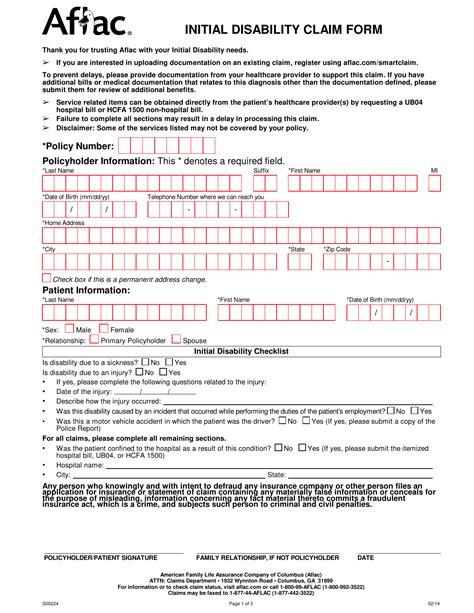

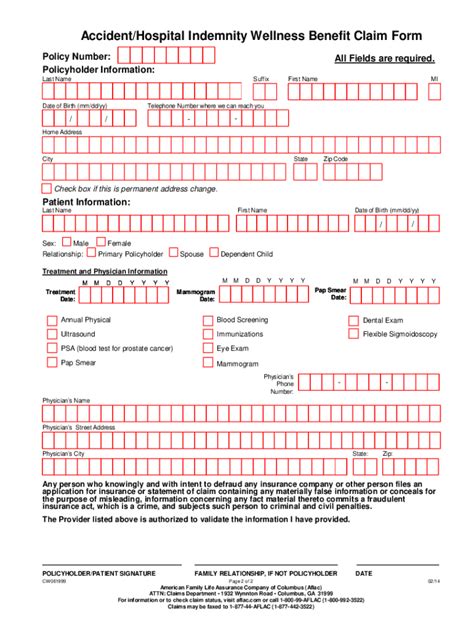

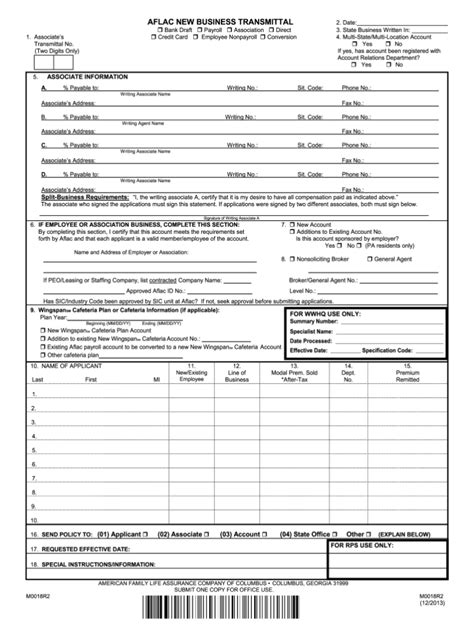

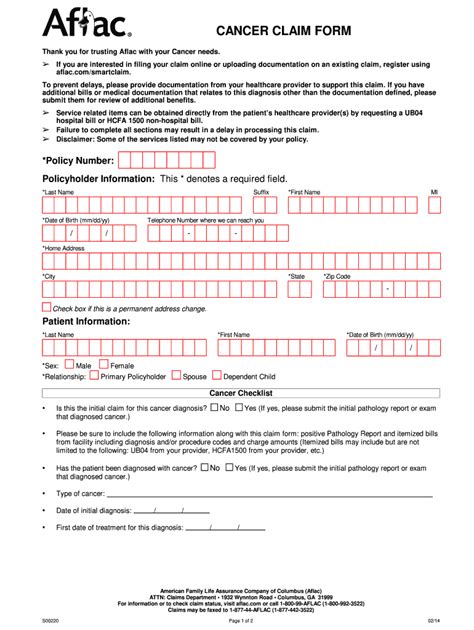

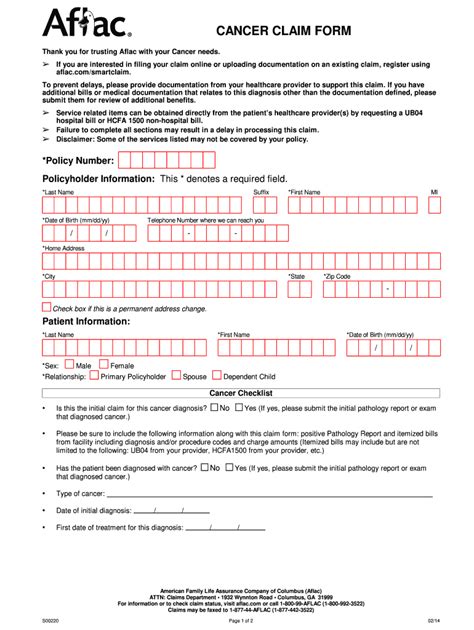

Different types of claims have different paperwork requirements. Here are some common types of claims and the essential documents typically needed for each: - Hospital Indemnity Claims: For claims related to hospital stays, policyholders usually need to provide admission and discharge records, itemized hospital bills, and sometimes, a statement from the hospital confirming the stay. - Disability or Income Protection Claims: These claims require proof of disability, such as a doctor’s statement, medical records, and sometimes, proof of income to determine benefit amounts. - Life Insurance Claims: Beneficiaries will need to provide the policyholder’s death certificate, proof of their relationship to the policyholder, and possibly other documents depending on the policy’s specifics. - Accident or Critical Illness Claims: Claims for accidents or critical illnesses may require medical records detailing the diagnosis and treatment, along with any relevant test results or physician statements.

General Requirements for All Claims

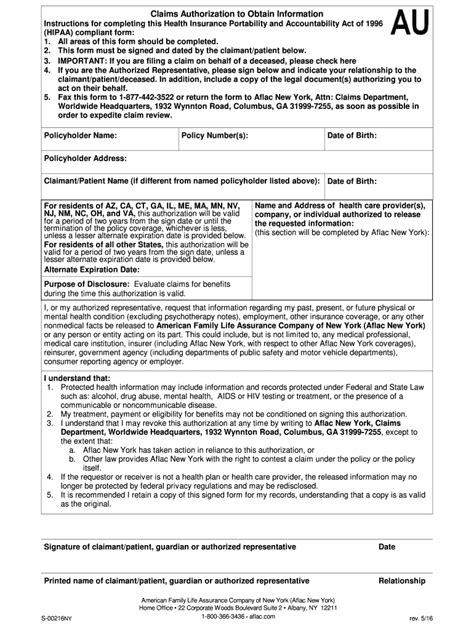

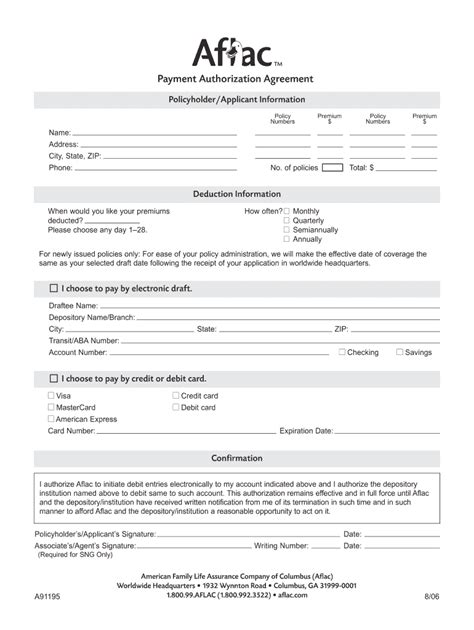

Regardless of the claim type, there are some general requirements that apply across the board: - Policy Information: The policy number and a copy of the policy document are essential for identifying the coverage and benefits. - Claim Form: Aflac provides claim forms that must be completed by the policyholder or their representative. These forms ask for detailed information about the claim, including the reason for the claim, dates of relevant events, and other supporting details. - Identification: Proof of identity for the policyholder and sometimes for the beneficiary or claimant may be required. - Medical Records: For health-related claims, comprehensive medical records are crucial. These may include diagnoses, treatment plans, and prognosis.

Submiting Aflac Paperwork

Once all the necessary paperwork is gathered, the next step is submission. Aflac offers several methods for submitting claims, including: - Online Portal: Many claims can be initiated and supporting documents uploaded through Aflac’s online platform. - Mail: Claim forms and documents can be mailed to the address specified by Aflac. - Fax: In some cases, documents can be faxed, though this method is less common due to security and privacy concerns. - Mobile App: For convenience, Aflac’s mobile app may allow policyholders to initiate claims and upload necessary documents directly from their devices.

Tips for Efficient Claim Processing

To ensure that claims are processed efficiently, consider the following tips: - Double-check Requirements: Before submitting, review all requirements to ensure everything needed is included. - Use Official Channels: Always use Aflac’s official channels for claim submission to avoid delays or loss of documents. - Follow Up: If there’s been no update on the claim status after a reasonable period, it may be necessary to follow up with Aflac’s customer service.

📝 Note: It's essential to keep a copy of all submitted documents for personal records and in case additional information is requested during the claim review process.

Conclusion and Final Thoughts

Navigating the process of filing a claim with Aflac can seem daunting, especially during stressful times. However, by understanding the specific paperwork requirements for the claim type and following the submission guidelines carefully, policyholders can help ensure a smoother, more efficient experience. Remember, preparation and attention to detail are key to a successful claim process.

What is the typical timeframe for Aflac to process a claim?

+

The processing time can vary, but Aflac often processes claims within a few days to a couple of weeks, depending on the complexity of the claim and how quickly all necessary documents are received.

Can I submit my claim online?

+

Yes, Aflac provides an online portal where you can initiate your claim and upload the necessary documents. This is often the quickest and most convenient method.

What if I’m missing some of the required documents for my claim?

+

If you’re missing documents, you should still submit your claim with the information you have. Aflac will review your claim and notify you of any additional documents needed to complete the process.