Tax Return Paperwork Needed

Understanding the Tax Return Process

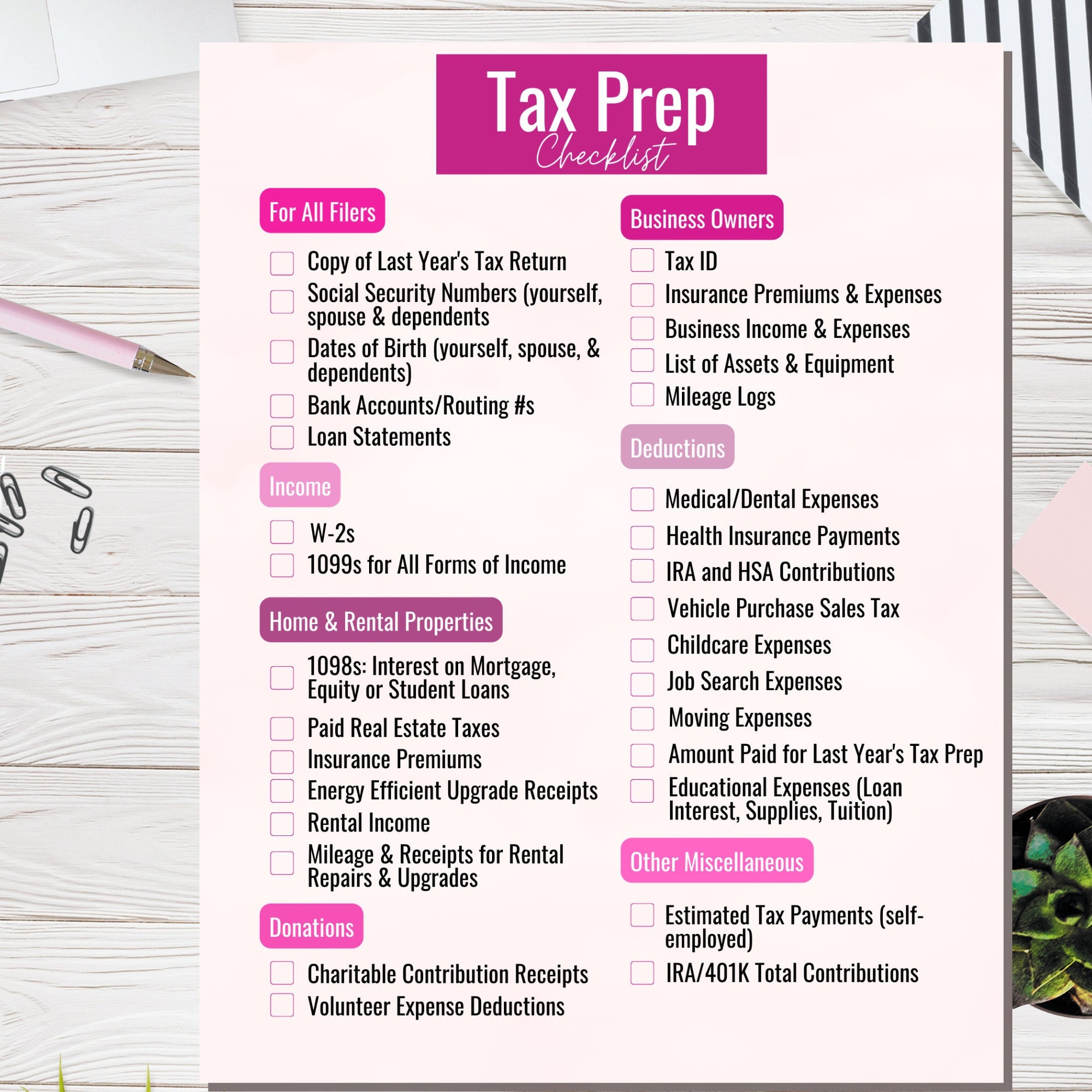

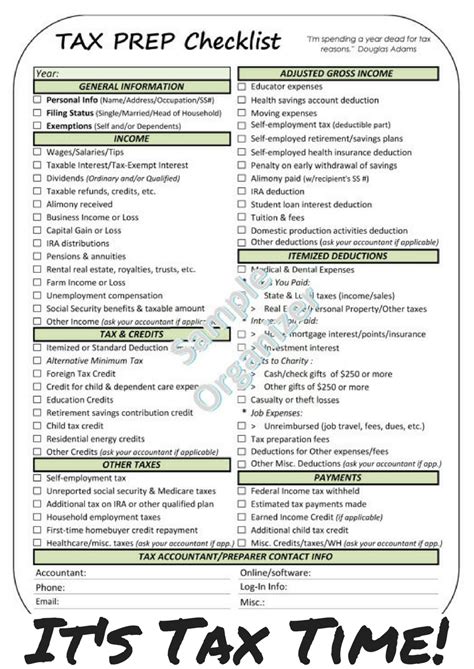

When it comes to filing your tax return, gathering all the necessary paperwork is crucial to ensure a smooth and efficient process. The tax return paperwork needed may vary depending on your individual circumstances, such as your income, expenses, and dependents. In this article, we will guide you through the essential documents and information required to complete your tax return.

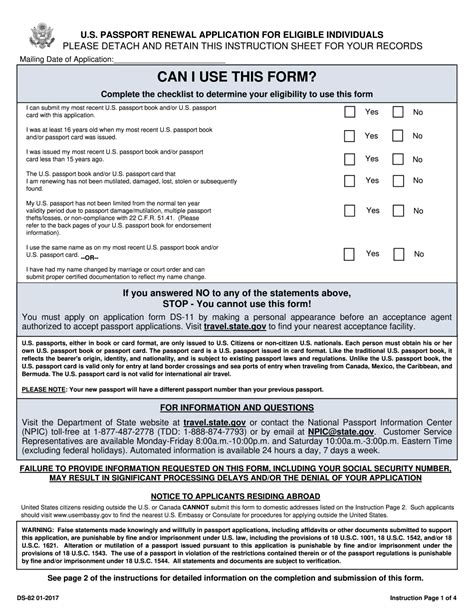

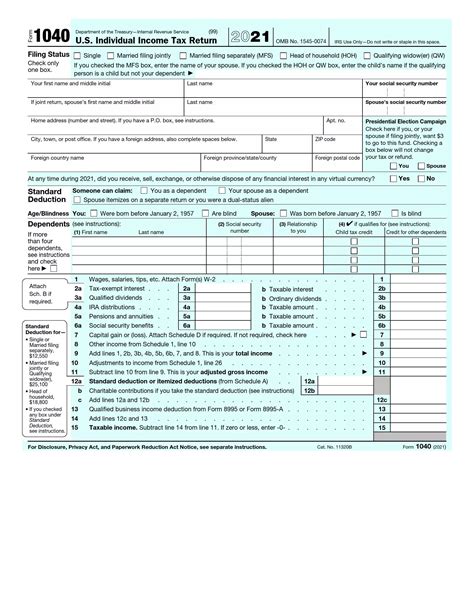

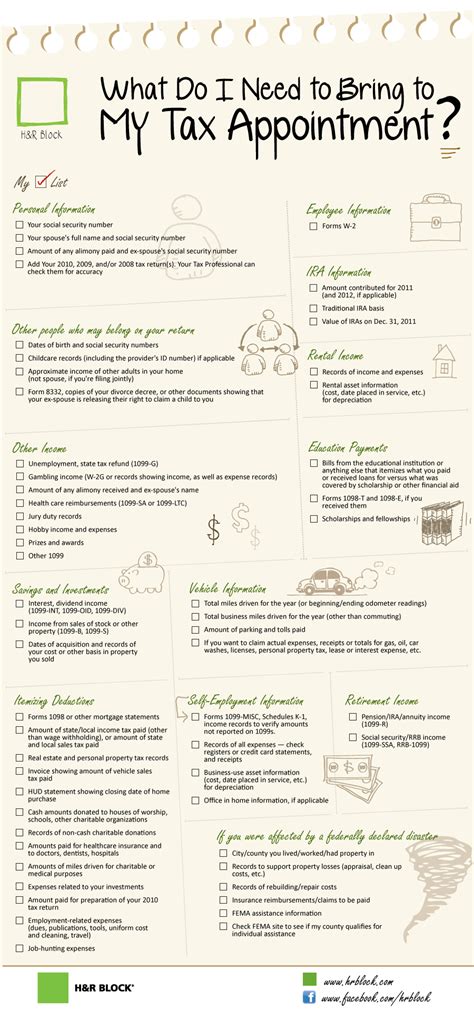

Personal Details and Identification

To start your tax return, you will need to provide your personal details and identification. This includes:

- Your full name and address

- Your social security number or tax identification number

- Your date of birth

- Your marital status

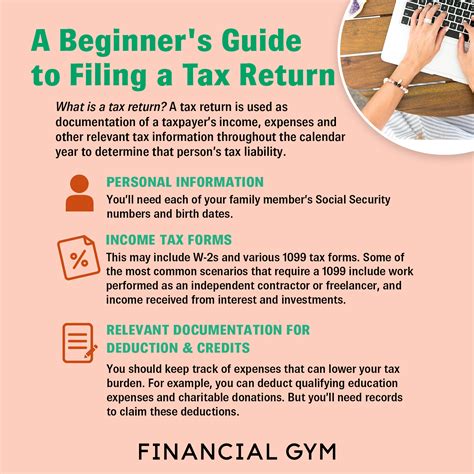

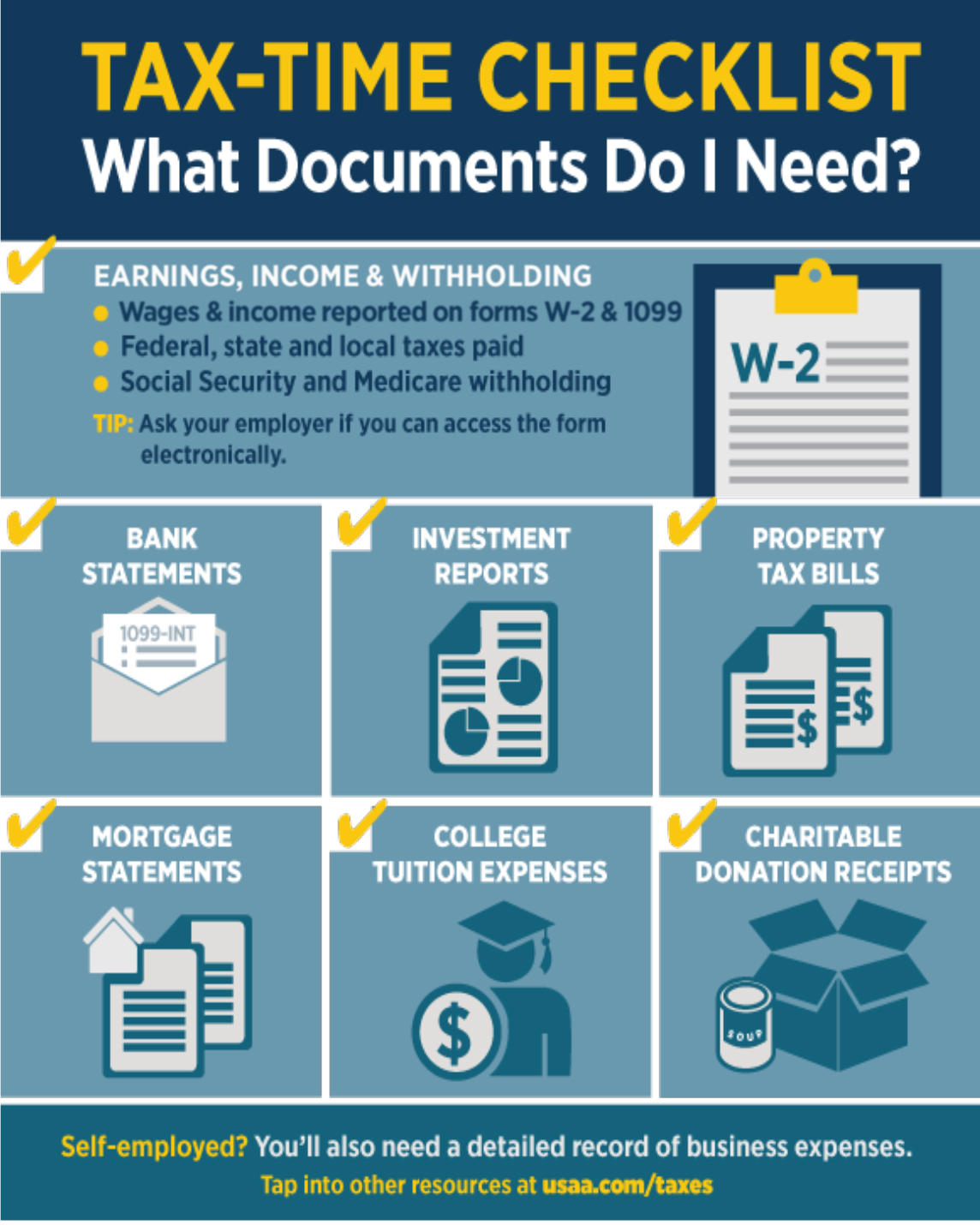

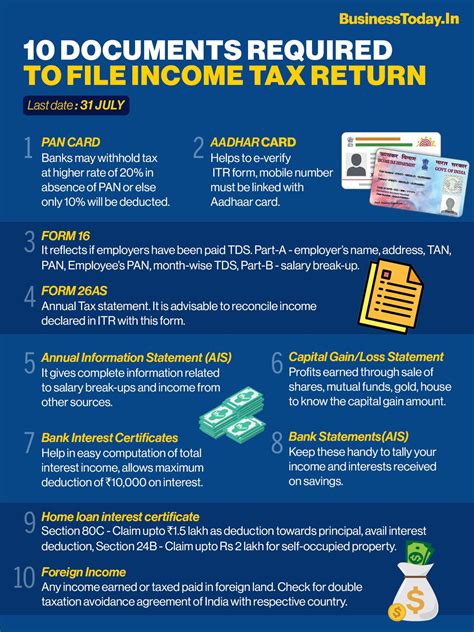

Income-Related Documents

The next step is to gather all the necessary income-related documents. These may include:

- W-2 forms from your employer, showing your income and taxes withheld

- 1099 forms for any freelance or contract work, interest, dividends, or capital gains

- Pay stubs to verify your income and taxes withheld

- Investment statements, such as brokerage accounts or retirement accounts

Expense-Related Documents

To claim deductions and credits, you will need to gather expense-related documents. These may include:

- Receipts for charitable donations, medical expenses, or business expenses

- Invoices for home improvements, such as energy-efficient upgrades or repairs

- Bank statements to verify mortgage interest, property taxes, or other expenses

- Records of business use of your car, home, or other assets

Dependent-Related Documents

If you have dependents, such as children or elderly parents, you will need to gather dependent-related documents. These may include:

- Birth certificates or adoption papers for children

- Social security numbers or tax identification numbers for dependents

- Records of childcare expenses, such as daycare or after-school programs

- Records of medical expenses for dependents

Other Essential Documents

In addition to the above documents, you may need to gather other essential documents, such as:

- Previous year’s tax return, to ensure accuracy and completeness

- Records of tax payments, such as quarterly estimated tax payments

- Records of tax credits, such as the earned income tax credit (EITC)

📝 Note: It is essential to keep all your tax-related documents organized and easily accessible, in case you need to refer to them during the tax return process.

Table of Tax Return Paperwork Needed

The following table summarizes the tax return paperwork needed:

| Document Type | Description |

|---|---|

| W-2 forms | Income and taxes withheld from employer |

| 1099 forms | Freelance or contract work, interest, dividends, or capital gains |

| Pay stubs | Income and taxes withheld from employer |

| Investment statements | Brokerage accounts or retirement accounts |

| Receipts | Charitable donations, medical expenses, or business expenses |

| Invoices | Home improvements, such as energy-efficient upgrades or repairs |

| Bank statements | Mortgage interest, property taxes, or other expenses |

| Records of business use | Car, home, or other assets used for business purposes |

In summary, gathering all the necessary tax return paperwork is crucial to ensure a smooth and efficient process. By understanding the types of documents needed, you can ensure that your tax return is accurate and complete, and that you receive any refunds or credits you are eligible for. As you complete your tax return, remember to stay organized and keep all your documents easily accessible, in case you need to refer to them during the process.

What is the deadline for filing my tax return?

+

The deadline for filing your tax return is typically April 15th of each year, but it may vary depending on your location and individual circumstances.

What happens if I miss the deadline for filing my tax return?

+

If you miss the deadline for filing your tax return, you may be subject to penalties and interest on any taxes owed. It is essential to file your tax return as soon as possible to avoid these penalties.

Can I file my tax return electronically?

+

Yes, you can file your tax return electronically using tax software or by working with a tax professional. Electronic filing is faster and more accurate than paper filing, and it can also help you receive your refund more quickly.