Paperwork

Self Employment Paperwork Requirements

Introduction to Self Employment Paperwork

When individuals decide to venture into self-employment, they often focus on the business aspects such as marketing, finance, and operations. However, one crucial aspect that can make or break a self-employed individual’s success is the paperwork requirements. Understanding and complying with these requirements is essential to avoid legal and financial issues. In this article, we will delve into the world of self-employment paperwork, exploring the necessary documents, registrations, and ongoing compliance needs.

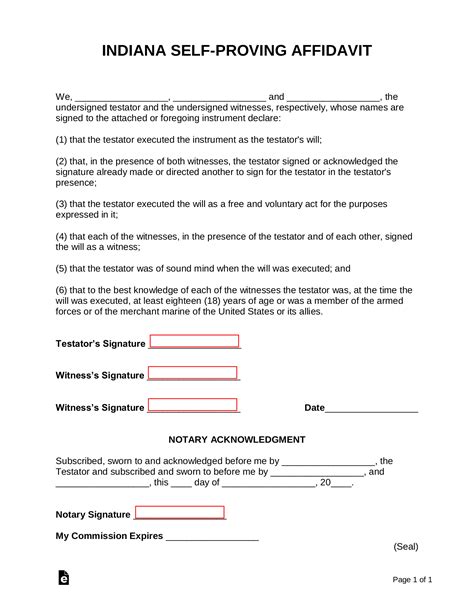

Business Structure and Registration

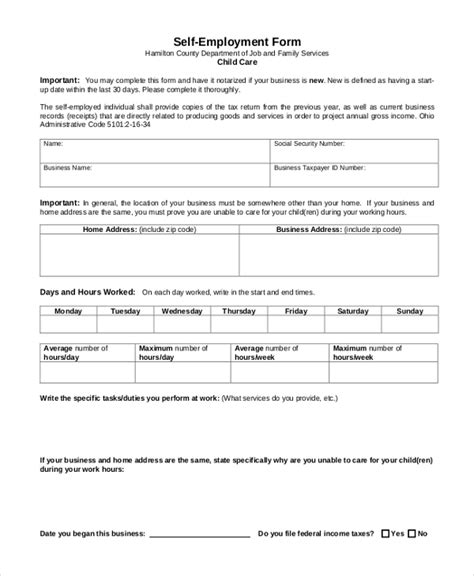

The first step in meeting self-employment paperwork requirements is to choose a business structure. This could be a sole proprietorship, partnership, limited liability company (LLC), or corporation. Each structure has its own set of paperwork and legal implications. For instance, a sole proprietorship requires less paperwork but offers no personal liability protection, whereas an LLC provides liability protection but involves more complex setup and ongoing compliance paperwork.

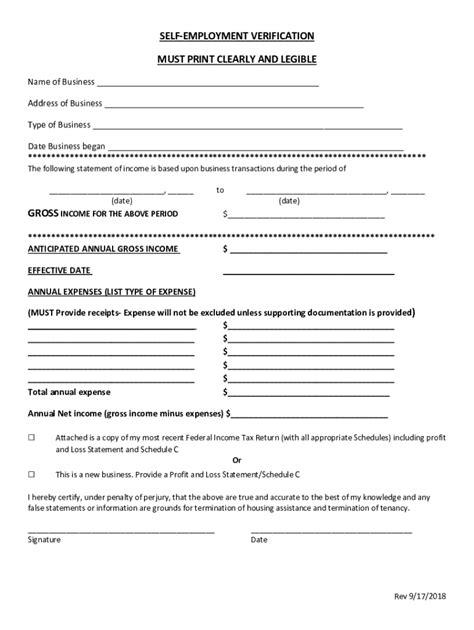

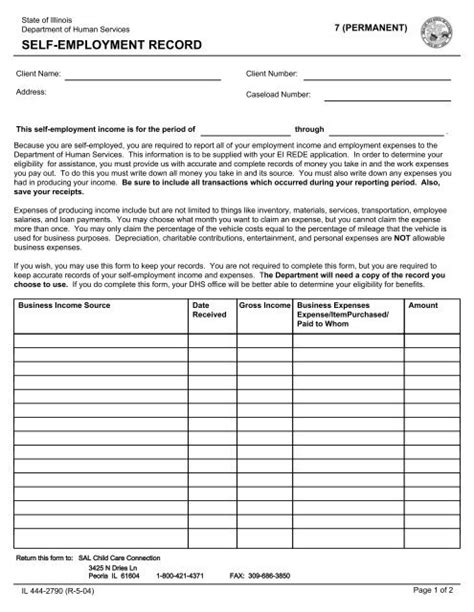

Taxation and Financial Paperwork

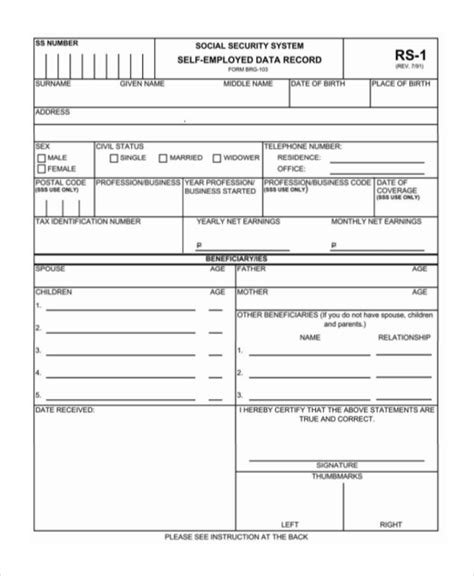

Self-employed individuals must understand their tax obligations, which include filing an annual tax return and potentially making quarterly estimated tax payments. The IRS Form 1040 and Schedule C are crucial for reporting business income and expenses. Additionally, self-employed individuals must pay self-employment taxes, which cover Social Security and Medicare taxes, using Schedule SE.

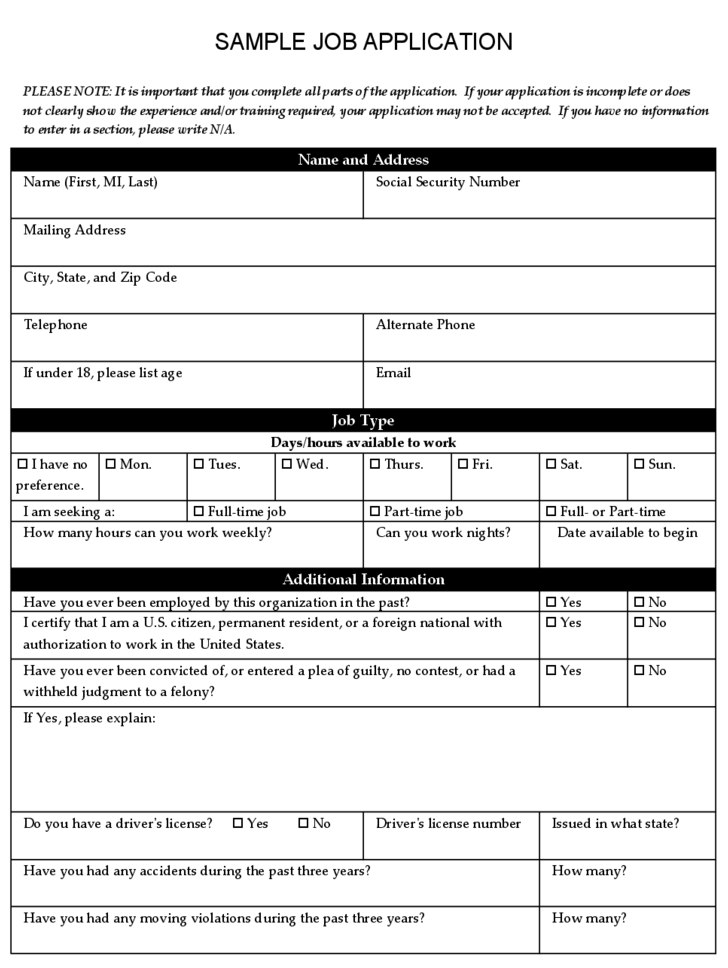

Licenses and Permits

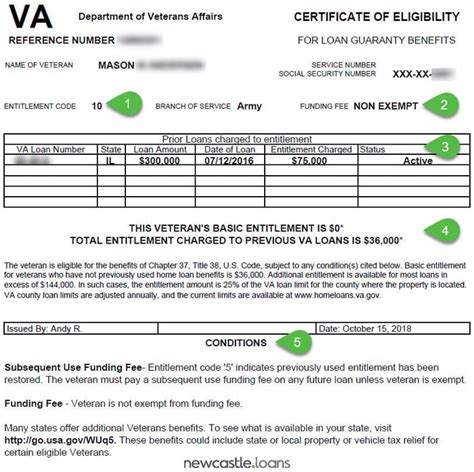

Depending on the nature of the business and its location, self-employed individuals may need to obtain licenses and permits. These can range from a general business license to specific professional licenses or permits related to the type of business being conducted. Researching local, state, and federal requirements is vital to ensure compliance.

Insurance and Benefits

Self-employed individuals are responsible for their own health insurance and may need to consider liability insurance to protect their business. Additionally, they must plan for their own retirement benefits, as they will not have access to an employer-sponsored plan. Understanding the options available, such as SEP-IRAs or Solo 401(k) plans, is essential for securing financial stability in retirement.

Record Keeping and Accounting

Maintaining accurate and detailed financial records is crucial for self-employed individuals. This includes tracking income, expenses, invoices, and payments. Investing in accounting software can simplify this process and help in preparing for tax season. A well-organized record-keeping system also aids in making informed business decisions and identifying areas for cost savings or investment.

Compliance and Ongoing Requirements

Beyond the initial setup, self-employed individuals must comply with ongoing requirements, such as filing annual reports, updating business registrations, and adhering to tax filing deadlines. Staying informed about changes in laws and regulations is also important to avoid unintentional non-compliance.

📝 Note: It's essential to consult with a financial advisor or accountant to ensure all paperwork requirements are met and to receive guidance tailored to the specific business needs.

Conclusion and Future Planning

Navigating the world of self-employment paperwork requires dedication, organization, and a willingness to learn and adapt. By understanding the initial and ongoing requirements, self-employed individuals can focus on growing their business, knowing they have a solid foundation to build upon. Whether it’s registering the business, managing taxes, or maintaining records, each piece of paperwork plays a vital role in the success and legality of the venture. As the business evolves, so too will the paperwork requirements, making it essential to stay vigilant and seek professional advice when needed.

What is the most critical paperwork requirement for self-employed individuals?

+

The most critical paperwork requirement is likely filing an annual tax return, which includes reporting business income and expenses and paying self-employment taxes.

Do all self-employed individuals need to register their business?

+

Yes, all self-employed individuals need to register their business, but the type of registration can vary depending on the business structure chosen, such as a sole proprietorship, LLC, or corporation.

How often do self-employed individuals need to file taxes?

+

Self-employed individuals typically need to file taxes annually but may also need to make quarterly estimated tax payments to avoid penalties.