Buy House Paperwork Needed

Introduction to Buying a House

When it comes to buying a house, the process can be overwhelming, especially for first-time buyers. One of the most critical aspects of this process is the paperwork involved. Understanding what documents are required and when they are needed can make the experience less daunting. In this article, we will delve into the essential paperwork needed when buying a house, guiding you through the process from start to finish.

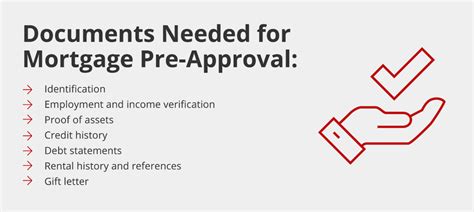

Pre-Purchase Paperwork

Before you even start looking for a house, there are several documents you should have ready. These include: - Identification Documents: A valid passport, driver’s license, or state ID. - Proof of Income: Pay stubs, W-2 forms, and tax returns to show your income stability. - Credit Reports: Your credit score plays a significant role in determining the interest rate you’ll qualify for and whether you’ll be approved for a mortgage. You can request a free credit report from each of the three major credit reporting agencies (Equifax, Experian, and TransUnion) once a year. - Bank Statements: To prove you have enough money for the down payment and closing costs. - Employment Verification: A letter from your employer confirming your employment status and salary.

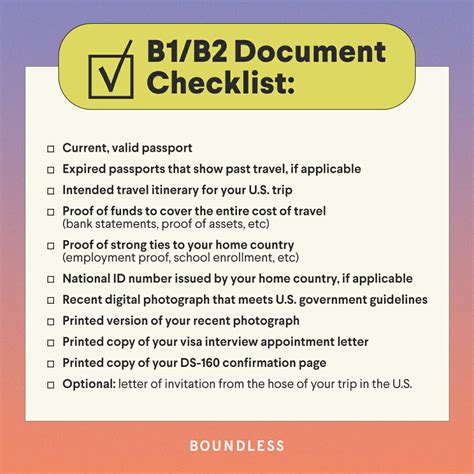

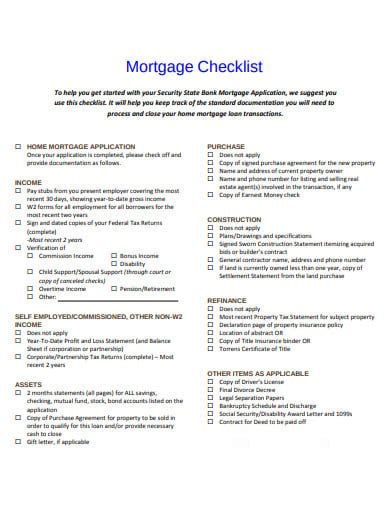

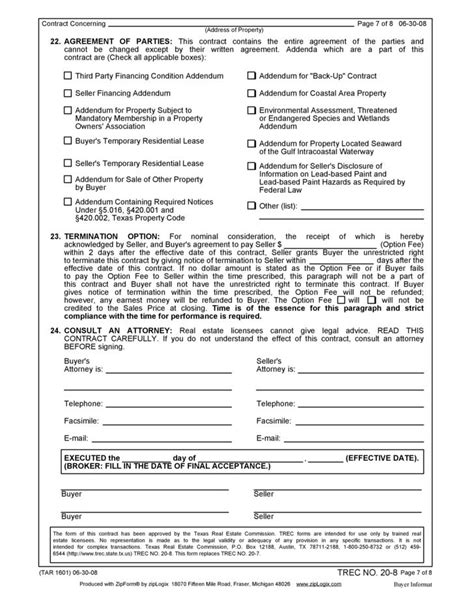

Mortgage Application Paperwork

Once you’ve found a house and your offer has been accepted, the next step is to apply for a mortgage. The paperwork required for a mortgage application includes: - Mortgage Application Form: This will ask for detailed financial information, employment history, and the property details. - Appraisal Report: Though not always required, an appraisal can be necessary to ensure the property’s value matches the sale price. - Title Report and Insurance: This ensures the seller has the right to sell the property and protects you from any unexpected ownership claims.

Home Inspection and Testing Reports

While not always mandatory, home inspections and testing can provide valuable insights into the property’s condition. These reports can include: - Home Inspection Report: Identifies any issues with the property, such as structural damage or needed repairs. - Pest Inspection Report: Checks for signs of pest infestation. - Environmental Testing Reports: Such as tests for lead, mold, or asbestos.

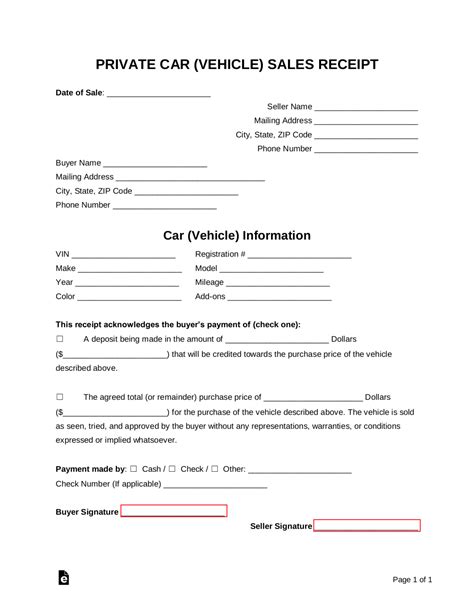

Closing Paperwork

The final stage of buying a house involves closing, where you sign all the documents to transfer the ownership of the property. Key documents at this stage include: - Deed: Transfers the ownership of the property from the seller to the buyer. - Mortgage Note: Promises to repay the mortgage. - Mortgage Deed or Deed of Trust: Puts the property up as collateral for the loan. - Closing Disclosure: Outlines all the costs associated with the home purchase and mortgage.

| Document | Description |

|---|---|

| Identification Documents | Proof of identity |

| Proof of Income | Shows income stability |

| Credit Reports | Determines creditworthiness |

| Bank Statements | Proof of funds for down payment and closing costs |

| Employment Verification | Confirms employment status and salary |

| Mortgage Application Form | Applies for a mortgage |

| Appraisal Report | Ensures property value |

| Title Report and Insurance | Ensures seller has the right to sell and protects buyer |

| Home Inspection Report | Identifies property issues |

| Pest Inspection Report | Checks for pest infestation |

| Environmental Testing Reports | Checks for environmental hazards |

| Deed | Transfers property ownership |

| Mortgage Note | Promises to repay mortgage |

| Mortgage Deed or Deed of Trust | Puts property up as collateral |

| Closing Disclosure | Outlines home purchase and mortgage costs |

📝 Note: The specific documents required may vary depending on your location and the type of property you're buying. It's essential to work closely with your real estate agent and lender to ensure you have all the necessary paperwork.

As you navigate the process of buying a house, understanding and preparing the necessary paperwork in advance can significantly reduce stress and make the experience more manageable. From pre-purchase documents to closing paperwork, each step requires careful attention to detail to ensure a smooth transaction. By being informed and prepared, you can make your dream of homeownership a reality.

In wrapping up the discussion on the paperwork needed to buy a house, it’s clear that the process involves a multitude of documents, each serving a critical purpose in the home buying journey. Whether you’re a seasoned buyer or a first-time homeowner, grasping the importance of these documents and their roles can make all the difference in achieving your goal of owning a home.

What is the first step in preparing to buy a house?

+

The first step in preparing to buy a house is to check your credit score and history, as this will determine the interest rate you qualify for and whether you’ll be approved for a mortgage.

Why is a home inspection important?

+

A home inspection is important because it identifies any potential issues with the property, such as structural damage or needed repairs, allowing you to make an informed decision about your purchase.

What is the purpose of a closing disclosure?

+

The closing disclosure outlines all the costs associated with the home purchase and mortgage, providing transparency and ensuring you understand all the financial obligations involved in buying a house.