5 LLC Paperwork Forms

Introduction to LLC Paperwork Forms

When forming a Limited Liability Company (LLC), it is essential to understand the various paperwork forms required to establish and maintain the business. These forms are crucial for registering the LLC, obtaining necessary licenses and permits, and ensuring compliance with state and federal regulations. In this article, we will discuss five essential LLC paperwork forms that entrepreneurs need to be familiar with.

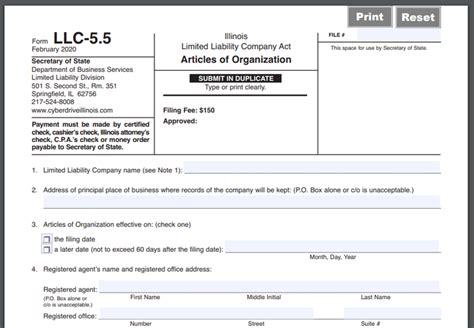

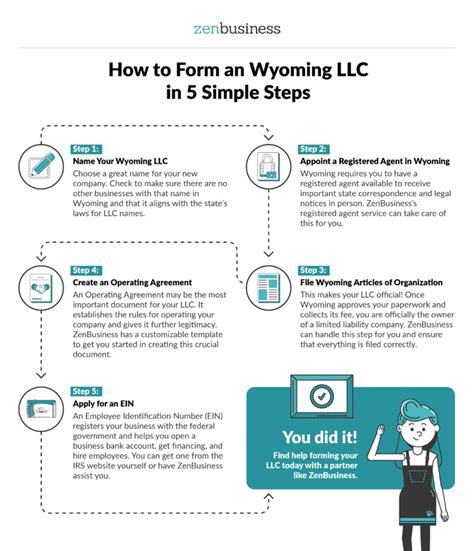

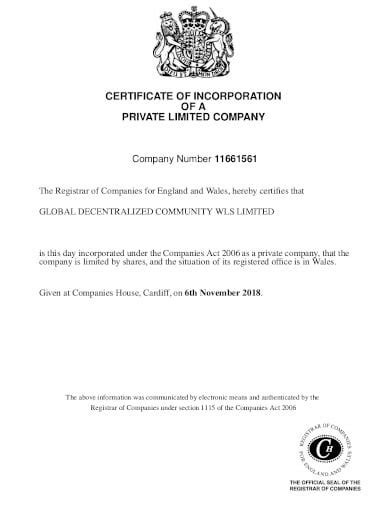

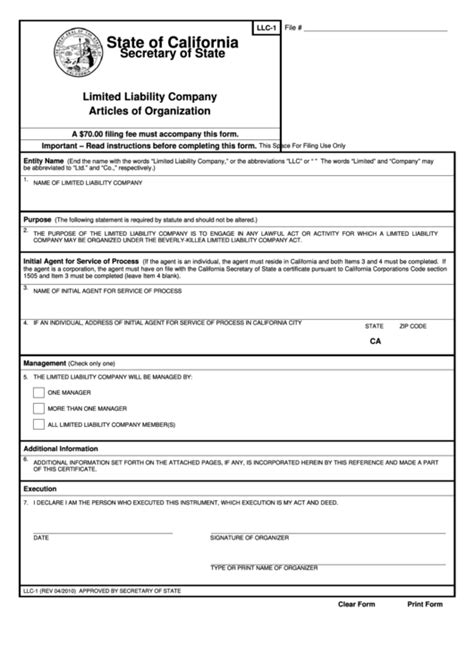

Form 1: Articles of Organization

The Articles of Organization is the primary document required to form an LLC. This form is filed with the state government and provides basic information about the business, such as its name, address, purpose, and ownership structure. The Articles of Organization typically include the following details: * Business name and address * Purpose of the business * Names and addresses of the owners (members) * Management structure (member-managed or manager-managed) * Duration of the business (perpetual or limited)

📝 Note: The specific requirements for the Articles of Organization may vary depending on the state where the LLC is being formed.

Form 2: Operating Agreement

An Operating Agreement is a document that outlines the internal operations of the LLC, including the rights and responsibilities of its members. This form is not typically filed with the state government but is essential for establishing the rules and procedures of the business. An Operating Agreement usually covers: * Ownership percentages and voting rights * Management structure and decision-making processes * Distribution of profits and losses * Conflict resolution procedures * Buy-sell agreements and exit strategies

Form 3: Employer Identification Number (EIN) Application

An Employer Identification Number (EIN) is a unique identifier assigned to the LLC by the Internal Revenue Service (IRS). This number is required for tax purposes, such as opening a business bank account, hiring employees, and filing tax returns. The EIN application form (SS-4) requires the following information: * Business name and address * Type of business entity (LLC) * Purpose of the business * Names and addresses of the owners (members) * Contact information for the business

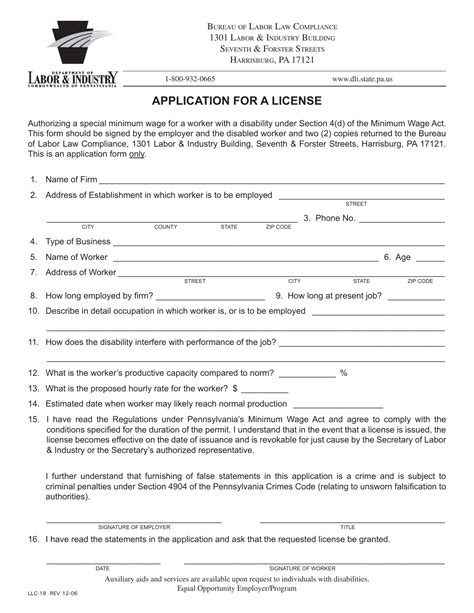

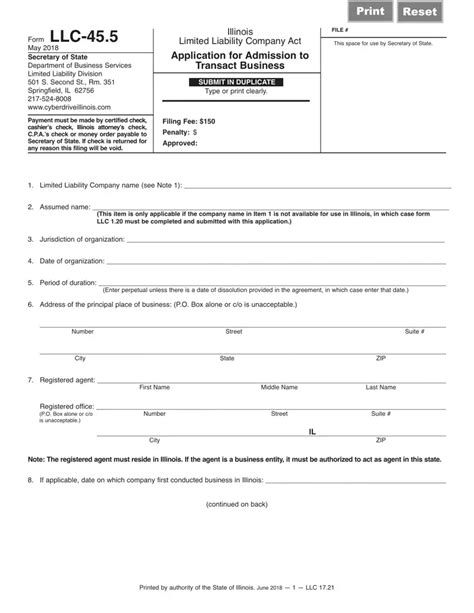

Form 4: Business License and Permit Applications

Depending on the type of business and its location, the LLC may need to obtain various licenses and permits to operate legally. These forms typically require information about the business, such as its name, address, and purpose, as well as details about the owners and their qualifications. Some common licenses and permits required for LLCs include: * Business license * Sales tax permit * Employer tax permit * Professional license (e.g., law, medicine, engineering) * Environmental permit (e.g., air, water, waste management)

Form 5: Annual Report

Most states require LLCs to file an Annual Report, which provides updated information about the business and its owners. This form is usually filed with the state government and may require the following details: * Business name and address * Names and addresses of the owners (members) * Management structure and contact information * Business activity and purpose * Financial information (e.g., revenue, expenses, assets)

| Form | Purpose | Requirements |

|---|---|---|

| Articles of Organization | Forming an LLC | Business name, address, purpose, ownership structure |

| Operating Agreement | Establishing internal operations | Ownership percentages, management structure, distribution of profits and losses |

| EIN Application | Obtaining an Employer Identification Number | Business name, address, type of entity, purpose, owner information |

| Business License and Permit Applications | Obtaining necessary licenses and permits | Business name, address, purpose, owner information, qualifications |

| Annual Report | Providing updated information about the business | Business name, address, owner information, management structure, financial information |

In summary, forming and maintaining an LLC requires various paperwork forms, including the Articles of Organization, Operating Agreement, EIN Application, Business License and Permit Applications, and Annual Report. Each form serves a specific purpose and requires accurate and complete information to ensure compliance with state and federal regulations. By understanding these essential forms, entrepreneurs can navigate the LLC formation process with confidence and establish a strong foundation for their business.

What is the purpose of the Articles of Organization?

+

The Articles of Organization is the primary document required to form an LLC, providing basic information about the business, such as its name, address, purpose, and ownership structure.

Do I need to file the Operating Agreement with the state government?

+

No, the Operating Agreement is not typically filed with the state government. However, it is essential for establishing the internal operations of the LLC and should be kept on record.

What is the purpose of the EIN Application?

+

The EIN Application is used to obtain a unique identifier for the LLC, which is required for tax purposes, such as opening a business bank account, hiring employees, and filing tax returns.

What licenses and permits are required for an LLC?

+

The licenses and permits required for an LLC vary depending on the type of business and its location. Common licenses and permits include business licenses, sales tax permits, employer tax permits, professional licenses, and environmental permits.

How often do I need to file the Annual Report?

+

The frequency of filing the Annual Report varies depending on the state where the LLC is registered. Most states require LLCs to file an Annual Report on a yearly basis, while some states may require biennial or triennial filings.