File Taxes 2015 Paperwork Needed

Introduction to Filing Taxes for 2015

Filing taxes can be a daunting task, especially when it comes to gathering all the necessary paperwork. For the 2015 tax year, it’s essential to have all the required documents to ensure a smooth and accurate filing process. In this article, we will guide you through the paperwork needed to file your taxes for 2015.

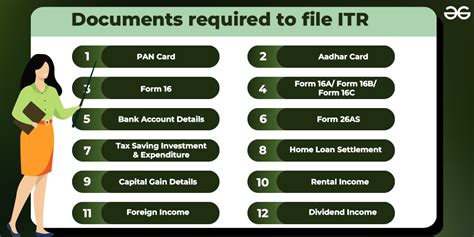

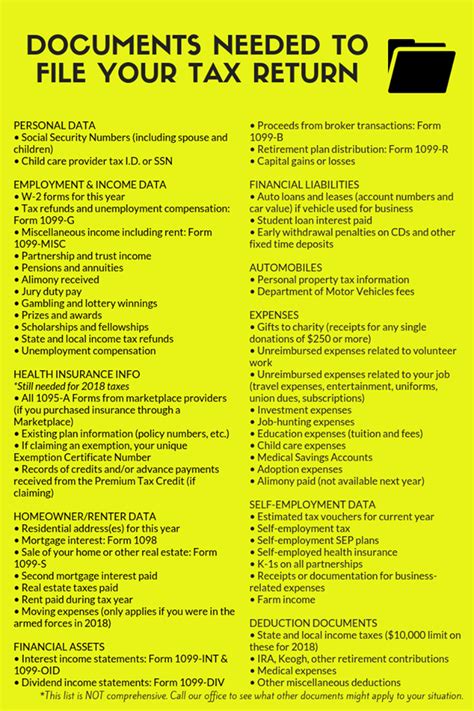

Understanding Tax Forms and Documents

To file your taxes, you will need to gather various forms and documents that provide information about your income, deductions, and credits. The most common tax forms include the W-2 form, which shows your income and taxes withheld from your employer, and the 1099 form, which reports income from self-employment, freelancing, or contract work. You may also receive 1098 forms for mortgage interest, 1099-INT forms for interest income, and 1099-DIV forms for dividend income.

Gathering Paperwork for Income

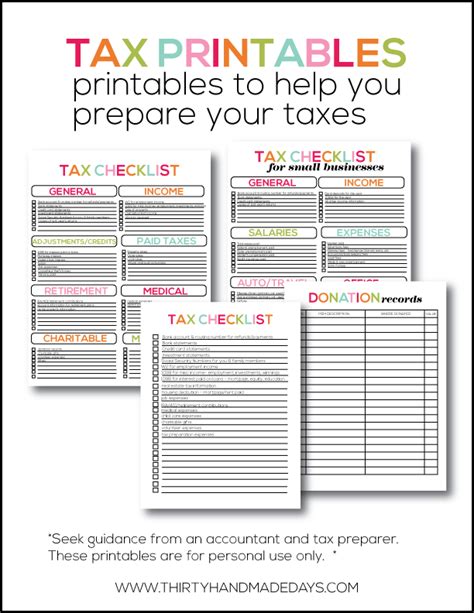

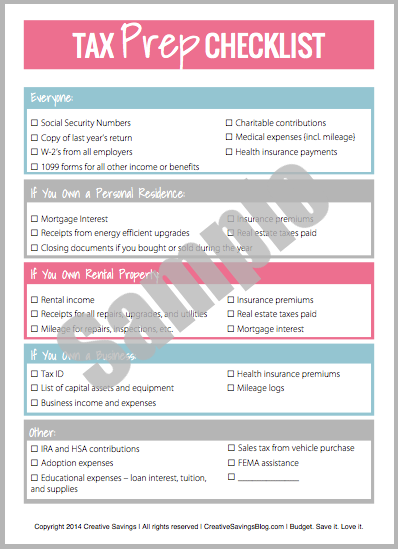

To report your income accurately, you will need to gather the following paperwork: * W-2 forms from your employer(s) * 1099 forms for self-employment, freelancing, or contract work * 1099-INT forms for interest income * 1099-DIV forms for dividend income * K-1 forms for partnership or S corporation income * Schedule C forms for business income and expenses

Gathering Paperwork for Deductions

To claim deductions, you will need to gather the following paperwork: * Medical expense receipts * Charitable donation receipts * Mortgage interest statements (1098 forms) * Property tax statements * Business expense receipts (for self-employed individuals)

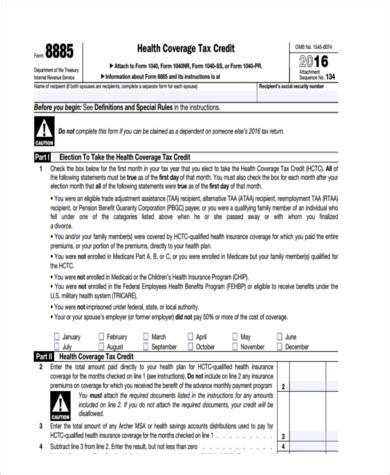

Gathering Paperwork for Credits

To claim credits, you will need to gather the following paperwork: * Dependent care receipts * Education expense receipts * Child tax credit documentation * Earned Income Tax Credit (EITC) documentation

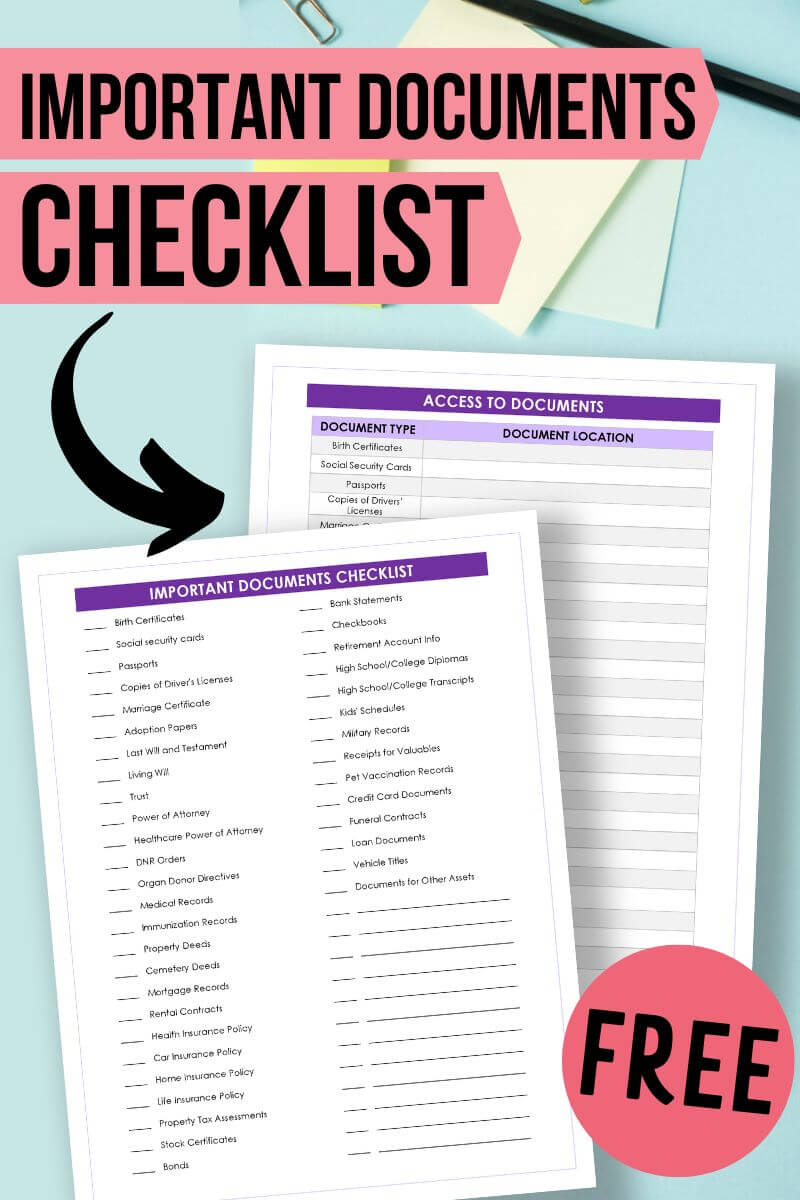

Other Important Documents

In addition to the above paperwork, you may also need to gather: * Social Security number or Individual Taxpayer Identification Number (ITIN) * Birth dates for yourself, spouse, and dependents * Bank account information for direct deposit or electronic payment

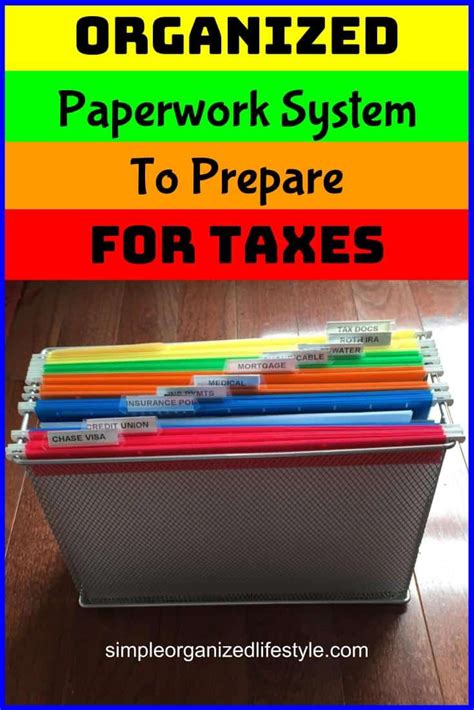

📝 Note: Make sure to keep all your paperwork organized and easily accessible to ensure a smooth filing process.

Using Tax Software or Consulting a Tax Professional

If you’re unsure about the paperwork needed or the filing process, consider using tax software or consulting a tax professional. They can guide you through the process and ensure you’re taking advantage of all the deductions and credits you’re eligible for.

Table of Common Tax Forms and Documents

| Form | Purpose |

|---|---|

| W-2 | Reports income and taxes withheld from employer |

| 1099 | Reports income from self-employment, freelancing, or contract work |

| 1098 | Reports mortgage interest |

| 1099-INT | Reports interest income |

| 1099-DIV | Reports dividend income |

In summary, filing taxes for 2015 requires gathering various forms and documents that provide information about your income, deductions, and credits. By understanding the different types of tax forms and documents, gathering the necessary paperwork, and considering the use of tax software or consulting a tax professional, you can ensure a smooth and accurate filing process.

What is the deadline for filing taxes for 2015?

+

The deadline for filing taxes for 2015 was April 15, 2016. However, if you need to file an amended return or have other tax-related issues, you should consult the IRS website or contact a tax professional for guidance.

Can I file my taxes electronically?

+

What if I’m missing some paperwork or documents?

+

If you’re missing paperwork or documents, you should contact the issuer or provider to obtain a copy. If you’re unable to obtain a copy, you may need to file an amended return or consult a tax professional for guidance.