7 Tax Paper Tips

Understanding the Importance of Tax Papers

When it comes to managing your finances, one of the most crucial aspects is dealing with tax papers. Whether you’re an individual or a business, tax papers are essential for keeping track of your income, expenses, and tax obligations. In this article, we will provide you with 7 tax paper tips to help you navigate the complex world of taxation.

Tip 1: Keep Accurate Records

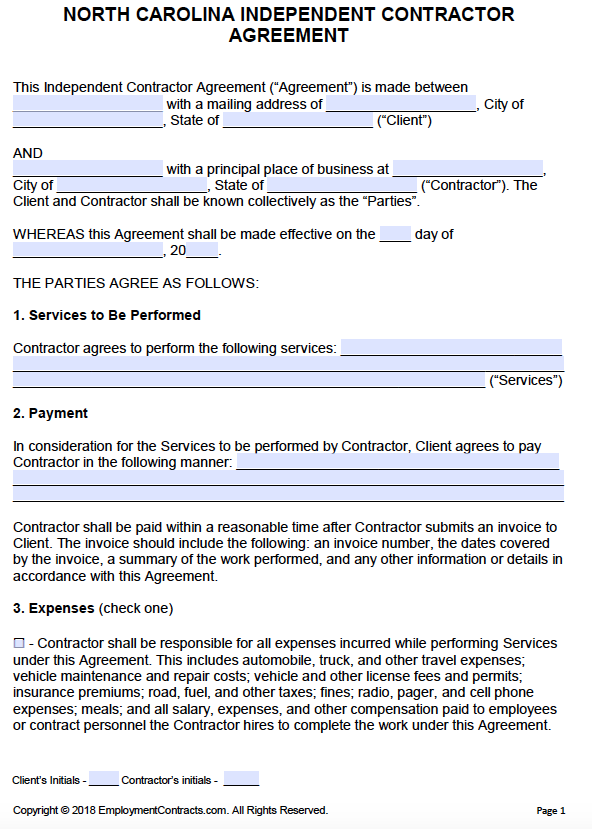

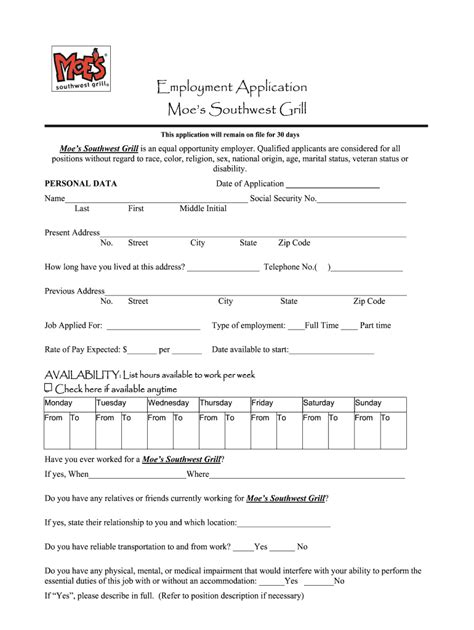

Keeping accurate records is the foundation of efficient tax paper management. This includes receipts, invoices, and bank statements. Make sure to store these documents in a safe and secure location, such as a filing cabinet or a digital storage system. It’s also essential to organize your records in a way that makes sense to you, so you can easily find the information you need when you need it.

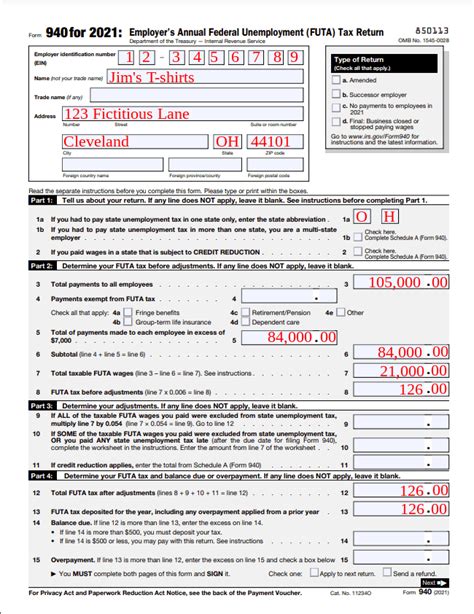

Tip 2: Understand Your Tax Obligations

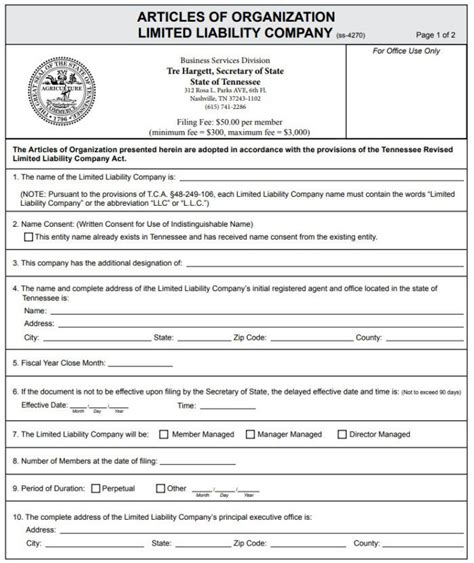

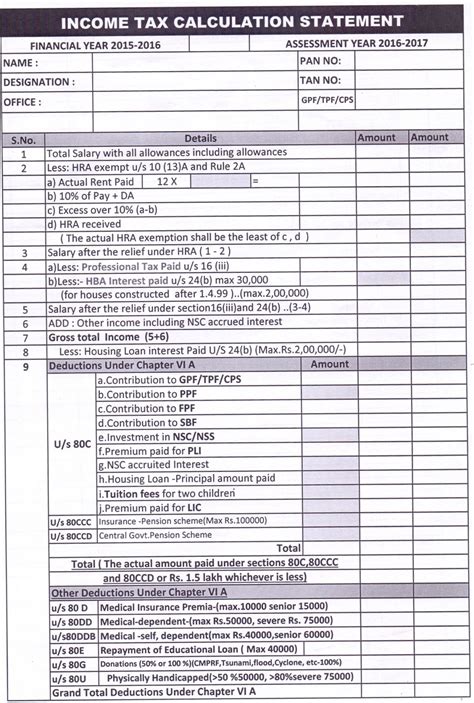

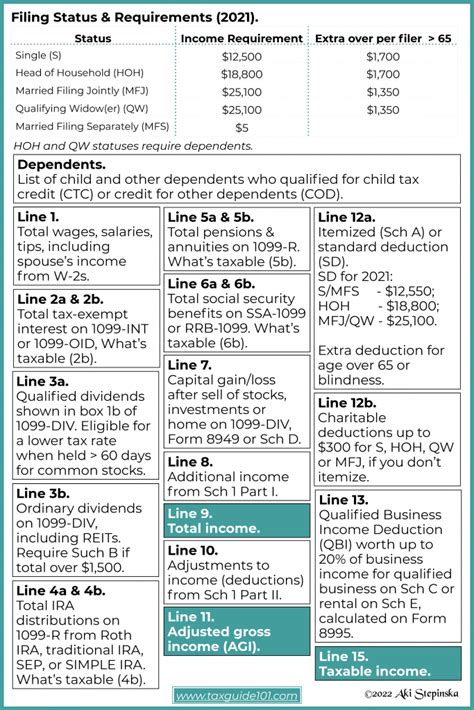

It’s crucial to understand your tax obligations, including tax deadlines, tax rates, and tax deductions. You can find this information on the official website of your country’s tax authority or by consulting with a tax professional. Staying informed about changes to tax laws and regulations can also help you avoid penalties and take advantage of available tax credits.

Tip 3: Take Advantage of Tax Deductions

Tax deductions can help reduce your taxable income, which can result in a lower tax bill. Some common tax deductions include: * Charitable donations * Medical expenses * Home office expenses * Business expenses Make sure to keep receipts and records of these expenses, as you will need to provide proof of them when filing your tax return.

Tip 4: Use Tax Software

Tax software can make it easier to prepare and file your tax return. Some popular tax software options include TurboTax, H&R Block, and TaxAct. These programs can help you: * Prepare your tax return * Calculate your tax liability * File your tax return electronically * Track your refund

Tip 5: Seek Professional Help

If you’re unsure about any aspect of tax paper management, it’s a good idea to seek professional help. A tax professional can provide you with personalized advice and guidance, help you navigate complex tax laws, and ensure you’re taking advantage of all available tax credits and deductions.

Tip 6: Stay Organized Throughout the Year

Tax paper management is an ongoing process that requires regular attention throughout the year. Make sure to: * Set reminders for tax deadlines and important dates * Keep track of expenses and income * Review and update your tax records regularly By staying organized, you can avoid last-minute rushes and reduce the stress associated with tax season.

Tip 7: Review and Learn from Last Year’s Return

Finally, it’s essential to review and learn from last year’s return. This can help you: * Identify areas for improvement * Take advantage of new tax credits and deductions * Avoid making the same mistakes By reviewing your previous return, you can gain valuable insights and make informed decisions about your tax strategy.

📝 Note: Always keep a copy of your tax return and supporting documents for at least three years in case of an audit.

In summary, managing tax papers requires attention to detail, organization, and a willingness to learn and adapt. By following these 7 tax paper tips, you can simplify the tax preparation process, reduce stress, and ensure you’re taking advantage of all available tax credits and deductions.

What is the deadline for filing my tax return?

+

The deadline for filing your tax return varies depending on your location and the type of return you’re filing. Check with your local tax authority for specific deadlines and requirements.

Can I file my tax return electronically?

+

Yes, you can file your tax return electronically using tax software or by visiting the website of your local tax authority. Electronic filing is faster, more secure, and often less prone to errors than paper filing.

What happens if I miss the tax filing deadline?

+

If you miss the tax filing deadline, you may be subject to penalties and interest on any unpaid taxes. It’s essential to file your return as soon as possible and pay any outstanding taxes to minimize these penalties.