5 Retirement Forms

Introduction to Retirement Forms

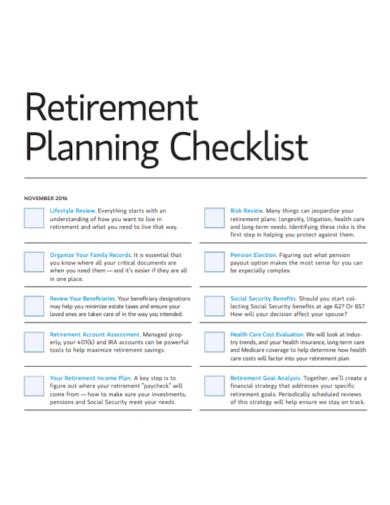

When planning for retirement, it’s essential to understand the various forms involved in the process. These forms help individuals apply for retirement benefits, manage their retirement accounts, and make informed decisions about their post-work life. In this article, we’ll explore five key retirement forms that you should be familiar with.

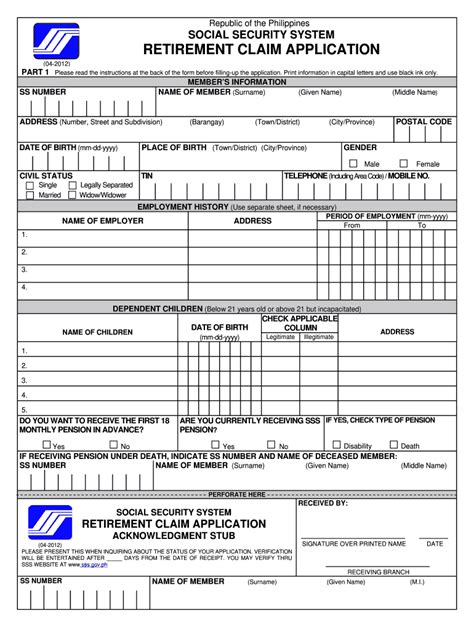

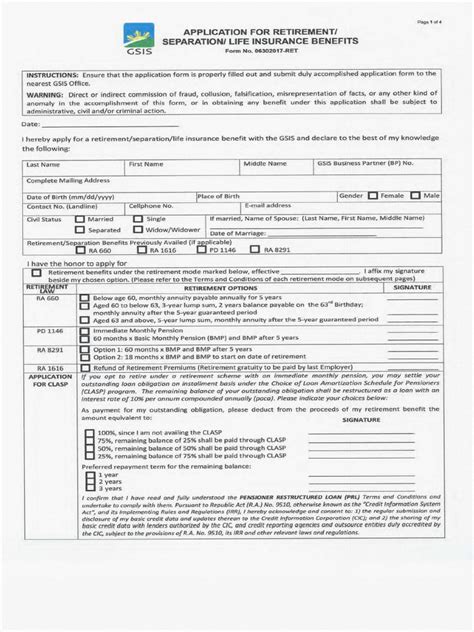

1. Application for Retirement Benefits (SSA-1)

The SSA-1 form is used to apply for retirement benefits from the Social Security Administration (SSA). This form is typically completed online or by phone, but you can also download and print it from the SSA website. To complete the SSA-1 form, you’ll need to provide personal and employment information, including your: * Social Security number * Birth certificate * Proof of citizenship or lawful alien status * W-2 forms or self-employment tax returns * Military discharge papers (if applicable)

2. Annual Benefit Statement (SSA-1099)

The SSA-1099 form is an annual statement that shows the total amount of Social Security benefits you received in a given year. You’ll receive this form by mail or online if you’re receiving benefits. The SSA-1099 form is essential for tax purposes, as it helps you report your benefits on your tax return. You can use this form to: * Report your benefits on your tax return * Calculate your taxable benefits * Verify your benefits for other government programs

3. Request for Reconsideration (SSA-561)

If you’re not satisfied with the SSA’s decision regarding your retirement benefits, you can file a Request for Reconsideration using the SSA-561 form. This form allows you to appeal the decision and provide additional information to support your claim. To complete the SSA-561 form, you’ll need to: * Explain why you disagree with the SSA’s decision * Provide new or additional evidence to support your claim * Sign and date the form

4. Voluntary Income Tax Withholding Request (W-4V)

The W-4V form is used to request voluntary income tax withholding from your Social Security benefits. This form allows you to choose the amount of federal income tax you want withheld from your benefits. To complete the W-4V form, you’ll need to: * Choose the percentage of benefits you want withheld (7%, 10%, 12%, or 22%) * Sign and date the form * Return the form to the SSA

5. Application for a Replacement Medicare Card (CMS-200)

The CMS-200 form is used to apply for a replacement Medicare card. This form is essential if you’ve lost, damaged, or never received your Medicare card. To complete the CMS-200 form, you’ll need to: * Provide your Medicare number * Explain why you need a replacement card * Sign and date the form

📝 Note: It's essential to keep your retirement forms organized and easily accessible, as you may need to refer to them throughout the retirement process.

In summary, these five retirement forms play a crucial role in helping individuals apply for retirement benefits, manage their accounts, and make informed decisions about their post-work life. By understanding the purpose and requirements of each form, you can ensure a smooth and successful retirement planning process.

To further illustrate the importance of these forms, consider the following table:

| Form | Purpose |

|---|---|

| SSA-1 | Apply for retirement benefits |

| SSA-1099 | Annual benefit statement |

| SSA-561 | Request for reconsideration |

| W-4V | Voluntary income tax withholding request |

| CMS-200 | Application for a replacement Medicare card |

The retirement planning process involves various forms and documents, and it’s essential to understand the purpose and requirements of each one. By doing so, you can ensure a smooth and successful transition into retirement.

As we conclude our discussion on retirement forms, it’s essential to remember that planning for retirement requires careful consideration and attention to detail. By understanding the various forms involved, you can make informed decisions about your post-work life and ensure a secure and comfortable retirement.

What is the purpose of the SSA-1 form?

+

The SSA-1 form is used to apply for retirement benefits from the Social Security Administration (SSA).

How do I obtain a replacement Medicare card?

+

You can apply for a replacement Medicare card by completing the CMS-200 form and returning it to the SSA.

What is the purpose of the W-4V form?

+

The W-4V form is used to request voluntary income tax withholding from your Social Security benefits.