Freelance Paperwork Needed

Introduction to Freelance Paperwork

As a freelancer, it’s easy to get caught up in the creative aspects of your work and overlook the importance of paperwork. However, having the right documents in place is crucial for protecting your business, ensuring you get paid, and maintaining a professional reputation. In this article, we’ll explore the essential paperwork you need as a freelancer, including contracts, invoices, and tax documents.

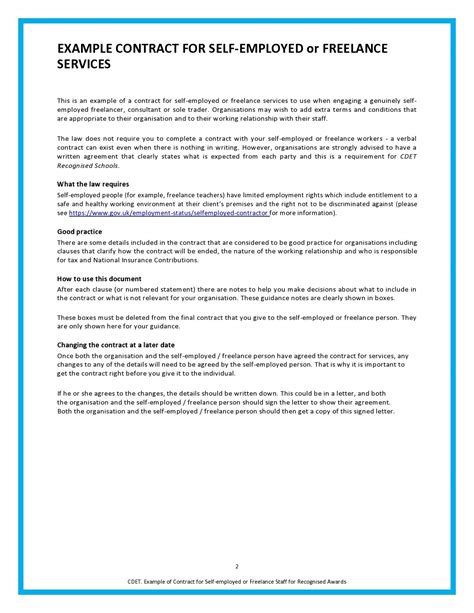

Contracts and Agreements

A freelance contract is a legally binding agreement between you and your client that outlines the scope of work, payment terms, and expectations. Having a contract in place helps prevent misunderstandings and protects both parties in case of disputes. A typical freelance contract should include: * Project description: A clear outline of the work to be done * Payment terms: The amount to be paid, payment schedule, and accepted payment methods * Deadline: The expected completion date of the project * Confidentiality: A clause ensuring that both parties will keep sensitive information confidential * Intellectual property: A statement outlining who owns the rights to the work created

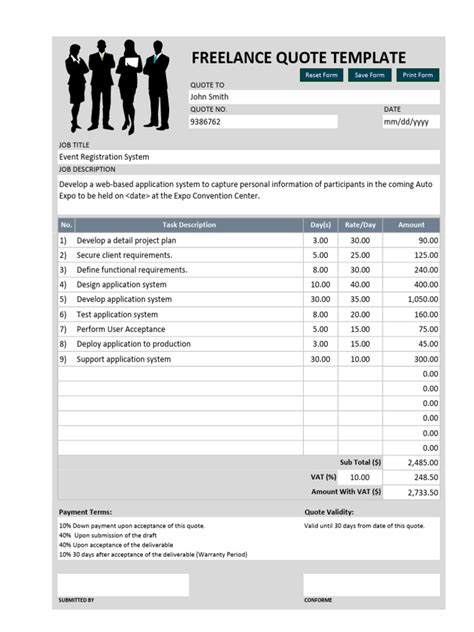

Invoices and Payment Terms

An invoice is a document that outlines the work completed, the amount due, and the payment terms. As a freelancer, you should send an invoice to your client upon completion of the project or at regular intervals, depending on the agreement. A professional invoice should include: * Your business information: Your name, address, and contact details * Client information: The client’s name, address, and contact details * Project description: A brief description of the work completed * Amount due: The total amount to be paid, including any taxes or fees * Payment terms: The accepted payment methods and deadline for payment

Tax Documents and Accounting

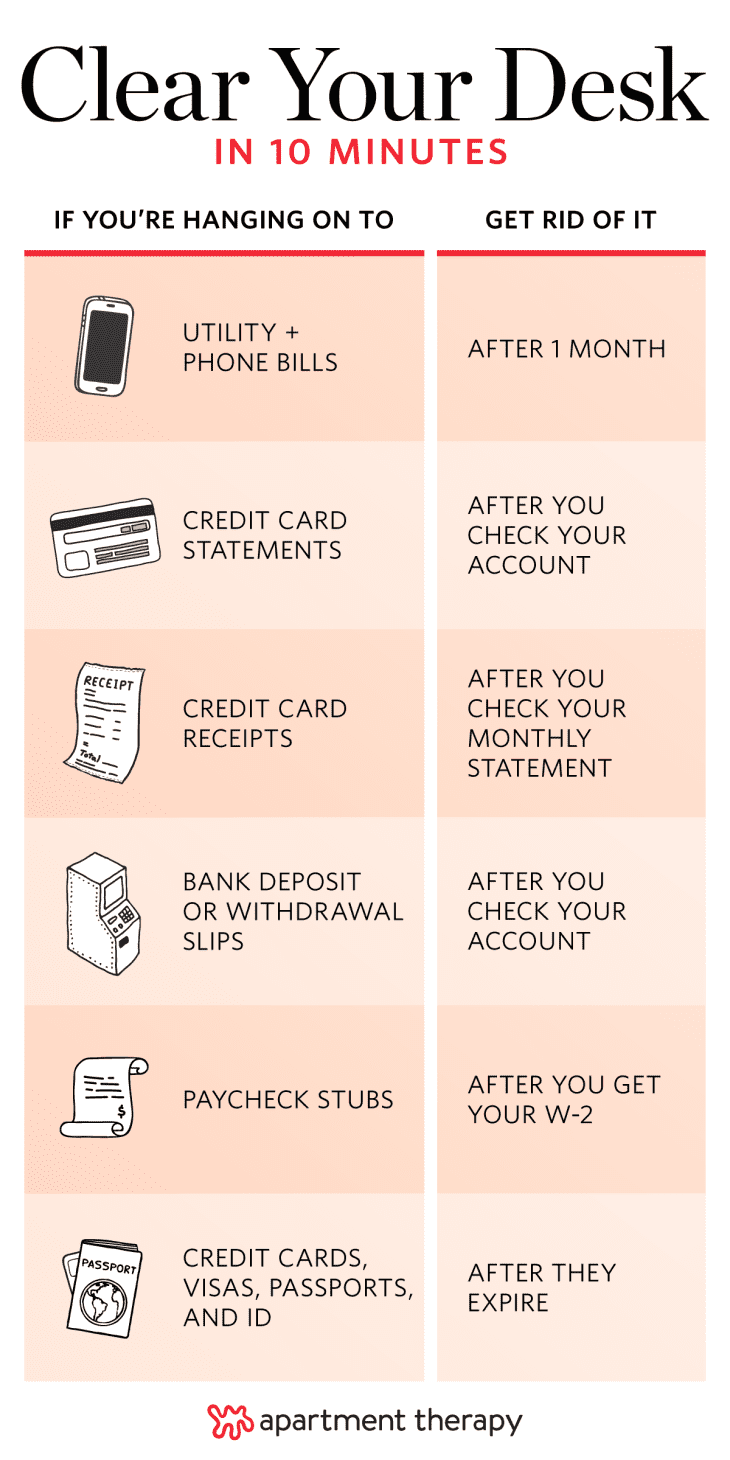

As a freelancer, you’re responsible for your own taxes and accounting. This includes keeping track of your income, expenses, and deductions. You’ll need to file tax returns with your government and may need to register for a business tax ID number. Some essential tax documents for freelancers include: * Tax returns: Annual tax returns outlining your income, expenses, and taxes owed * Business registration: Documentation of your business registration, including your business name and tax ID number * Expense records: Accurate records of your business expenses, including receipts and invoices

Additional Paperwork

Depending on your type of business and location, you may need additional paperwork, such as: * Business license: A license to operate a business in your state or country * Insurance: Liability insurance or other types of insurance to protect your business * Non-disclosure agreements: Agreements to protect sensitive information shared with clients or partners * Copyright or trademark registrations: Registrations to protect your intellectual property

| Document | Description |

|---|---|

| Contract | A legally binding agreement between you and your client |

| Invoice | A document outlining the work completed and amount due |

| Tax returns | Annual tax returns outlining your income, expenses, and taxes owed |

📝 Note: It's essential to keep accurate and detailed records of your paperwork, including contracts, invoices, and tax documents, to ensure you're protected in case of disputes or audits.

As you can see, having the right paperwork in place is crucial for freelancers. By understanding the essential documents you need, you can protect your business, ensure you get paid, and maintain a professional reputation. Whether you’re just starting out or have been freelancing for years, taking the time to get your paperwork in order will pay off in the long run.

In the end, being a successful freelancer requires more than just creative talent – it requires a solid understanding of the business side of things. By prioritizing your paperwork and staying organized, you can focus on what you do best: delivering high-quality work to your clients and growing your business.

What is a freelance contract, and why do I need one?

+

A freelance contract is a legally binding agreement between you and your client that outlines the scope of work, payment terms, and expectations. Having a contract in place helps prevent misunderstandings and protects both parties in case of disputes.

How do I create a professional invoice?

+

A professional invoice should include your business information, client information, project description, amount due, and payment terms. You can use a template or create your own using a word processor or spreadsheet software.

What tax documents do I need to file as a freelancer?

+

As a freelancer, you’ll need to file tax returns with your government, which may include forms for business income, expenses, and taxes owed. You may also need to register for a business tax ID number and obtain other tax documents, such as a W-9 form.