Paperwork

Keep Papers 7 Years

Understanding the Importance of Keeping Financial Records

When it comes to managing personal finances, one of the most critical aspects is maintaining accurate and detailed records. This not only helps in keeping track of income and expenses but also proves to be invaluable during tax seasons and audits. A common recommendation is to keep papers for 7 years, but what does this really mean, and why is it so important?

The 7-Year Rule: What Does It Entail?

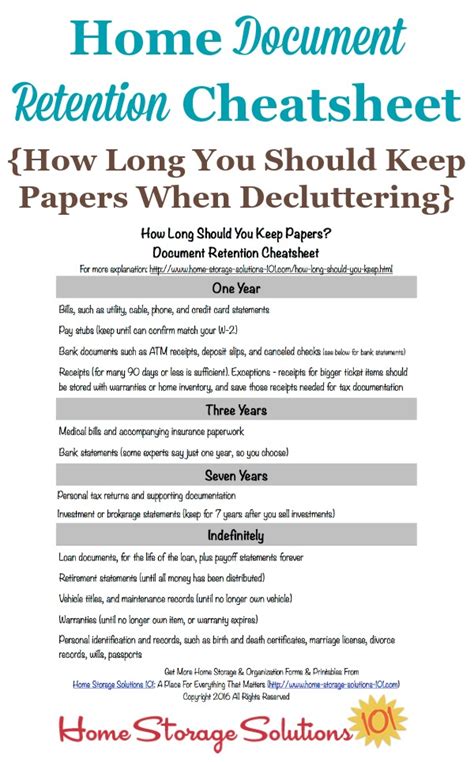

The 7-year rule is a guideline that suggests individuals should keep their financial documents, including tax returns, receipts, bank statements, and investment records, for at least seven years. This period is recommended because the Internal Revenue Service (IRS) has up to seven years to initiate an audit, and having these records can provide evidence of income, deductions, and credits claimed.

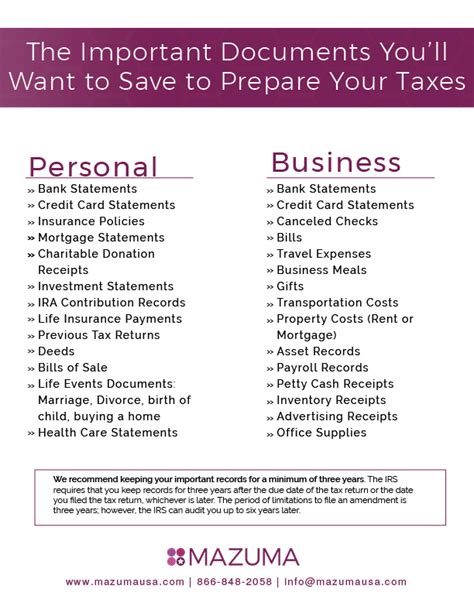

Types of Documents to Keep

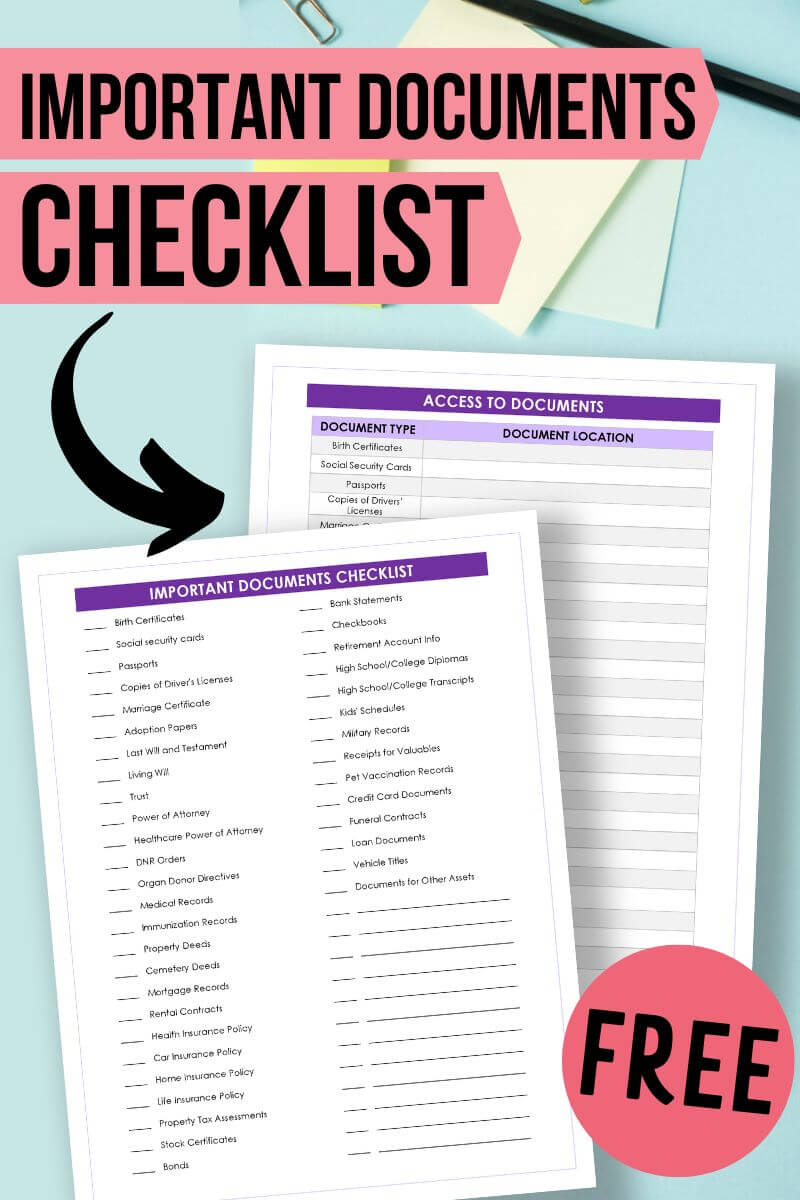

There are several types of financial documents that should be kept for the recommended 7-year period. These include: - Tax Returns: Both personal and business tax returns, along with supporting documentation like W-2s, 1099s, and receipts for deductions. - Bank Statements: Monthly statements from checking and savings accounts, as well as investment accounts. - Receipts and Invoices: For large purchases, business expenses, and any item that might be claimed as a deduction on tax returns. - Investment Records: Statements from brokerage accounts, mutual funds, and retirement accounts. - Loan Documents: Records of loans, including car loans, mortgages, and personal loans, along with payment schedules and receipts.

Why Keeping These Records Matters

Keeping financial records for 7 years is crucial for several reasons: - Audit Protection: In the event of an IRS audit, having detailed records can help prove the accuracy of tax returns and prevent additional taxes, penalties, and interest. - Financial Planning: Accurate records help in tracking financial progress over time, making it easier to set and achieve financial goals. - Identity Theft Protection: Detailed financial records can help identify and correct instances of identity theft or financial fraud. - Credit History: Keeping records of payments and credit inquiries can be helpful in maintaining a good credit score.

How to Store Financial Records

With the importance of keeping financial records established, the next question is how to store them safely and efficiently. Consider the following options: - Digital Storage: Scanning documents and storing them digitally on a secure external hard drive or cloud storage service. Encryption and password protection are musts for digital storage. - Physical Storage: Keeping original documents in a fireproof safe or a safe deposit box at a bank. - Hybrid Approach: Combining digital and physical storage methods for added security and accessibility.

📝 Note: Always ensure that digital storage solutions are secure and compliant with data protection regulations to prevent data breaches.

Best Practices for Record Keeping

To make the most out of keeping financial records, adopt the following best practices: - Organize Documents: Use folders, labels, and categorization to keep documents organized and easily accessible. - Update Regularly: Set a schedule to regularly update and review financial records. - Secure Disposal: When disposing of financial documents, use a shredder to protect against identity theft.

Technology and Financial Record Keeping

Technology has made it easier than ever to manage and keep track of financial records. Utilize: - Financial Management Apps: Apps like Mint, Personal Capital, and YNAB (You Need a Budget) can help track expenses, create budgets, and set financial goals. - Digital Scanners: For quickly scanning and digitizing paper documents. - Cloud Services: For secure and accessible storage of digital documents.

Conclusion Summary

In summary, keeping financial records for 7 years is a prudent practice that offers protection during audits, aids in financial planning, and helps in maintaining good credit. By understanding what documents to keep, how to store them securely, and adopting best practices, individuals can better manage their financial health and security. Whether through digital, physical, or a combination of storage methods, the key is to ensure that these records are safe, accessible, and organized.

What types of financial documents should I keep for 7 years?

+

You should keep tax returns, bank statements, receipts for large purchases and business expenses, investment records, and loan documents for at least 7 years.

Why is it important to keep financial records for such a long time?

+

Keeping financial records for 7 years is important for audit protection, financial planning, identity theft protection, and maintaining a good credit score.

How should I store my financial records to keep them safe?

+

You can store your financial records digitally using secure cloud storage, physically in a fireproof safe, or use a combination of both methods for added security and accessibility.