Tax Paperwork to Keep

Introduction to Tax Paperwork

When it comes to tax season, one of the most daunting tasks for many individuals and businesses is navigating the complex world of tax paperwork. With so many different forms, documents, and deadlines to keep track of, it can be easy to feel overwhelmed. However, keeping accurate and detailed records of your tax paperwork is crucial for ensuring you are in compliance with tax laws and regulations, and for maximizing your refund or minimizing your tax liability. In this article, we will explore the different types of tax paperwork you should keep, and provide tips for organizing and maintaining your records.

Types of Tax Paperwork to Keep

There are several types of tax paperwork that you should keep, including: * W-2 forms: These forms show your income and taxes withheld from your employer. * 1099 forms: These forms show income you earned from freelance work, investments, or other sources. * Receipts and invoices: These documents show expenses you incurred throughout the year, such as business expenses, medical expenses, or charitable donations. * Bank statements: These documents show your income and expenses, and can be used to verify your tax return. * Tax returns: You should keep a copy of your tax return, including any supporting documentation, for at least three years.

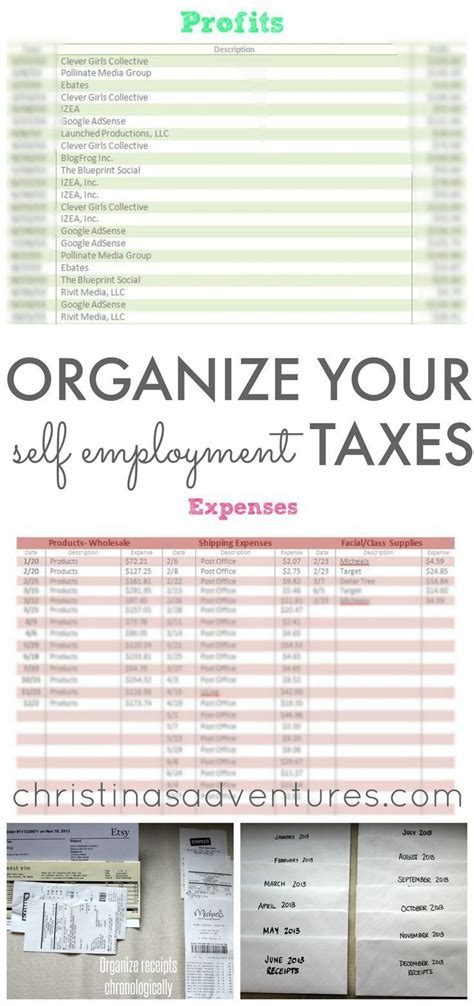

Organizing Your Tax Paperwork

Keeping your tax paperwork organized is crucial for ensuring you can easily access the documents you need when you need them. Here are some tips for organizing your tax paperwork: * Use a filing system: Set up a filing system that allows you to easily categorize and access your tax paperwork. * Label your files: Clearly label your files so you can easily identify what is inside. * Keep digital copies: Consider keeping digital copies of your tax paperwork, in addition to physical copies, to ensure you have a backup in case the physical copies are lost or destroyed. * Shred unnecessary documents: Shred any tax paperwork that is no longer needed, to protect your identity and prevent clutter.

Importance of Keeping Accurate Records

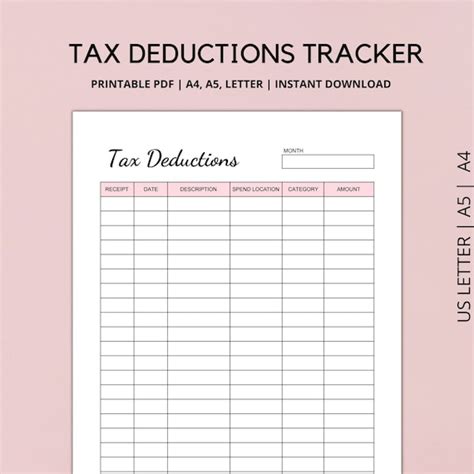

Keeping accurate and detailed records of your tax paperwork is crucial for ensuring you are in compliance with tax laws and regulations. Here are some reasons why: * Audit protection: If you are audited, having accurate and detailed records can help you prove your income and expenses, and avoid penalties and fines. * Maximize your refund: Keeping accurate records can help you maximize your refund, by ensuring you claim all the deductions and credits you are eligible for. * Minimize your tax liability: Keeping accurate records can also help you minimize your tax liability, by ensuring you take advantage of all the tax savings opportunities available to you.

📝 Note: It's also important to keep records of any tax-related correspondence, such as letters or notices from the IRS, as these can be important for resolving any issues or disputes.

Best Practices for Maintaining Tax Records

Here are some best practices for maintaining your tax records: * Keep records for at least three years: The IRS recommends keeping tax records for at least three years, in case of an audit. * Keep records in a secure location: Keep your tax records in a secure location, such as a safe or a locked file cabinet, to protect them from loss or theft. * Review and update your records regularly: Regularly review and update your tax records, to ensure they are accurate and complete. * Consider hiring a tax professional: If you are unsure about how to maintain your tax records, or need help with tax preparation, consider hiring a tax professional.

| Type of Tax Paperwork | Retention Period |

|---|---|

| W-2 forms | At least three years |

| 1099 forms | At least three years |

| Receipts and invoices | At least three years |

| Bank statements | At least one year |

| Tax returns | At least three years |

In summary, keeping accurate and detailed records of your tax paperwork is crucial for ensuring you are in compliance with tax laws and regulations, and for maximizing your refund or minimizing your tax liability. By following the tips and best practices outlined in this article, you can ensure you are keeping the right tax paperwork, and that you are prepared in case of an audit or other tax-related issue.

What types of tax paperwork should I keep?

+

You should keep W-2 forms, 1099 forms, receipts and invoices, bank statements, and tax returns.

How long should I keep my tax paperwork?

+

You should keep your tax paperwork for at least three years, in case of an audit.

What are the consequences of not keeping accurate tax records?

+

If you do not keep accurate tax records, you may be subject to penalties and fines, and may miss out on tax savings opportunities.