Refinance Paperwork Needed

Understanding the Refinance Paperwork Needed

When considering refinancing a mortgage, it’s essential to understand the paperwork involved in the process. Refinancing can be a great way to lower monthly payments, switch from an adjustable-rate to a fixed-rate loan, or tap into home equity. However, the process can be complex and requires a significant amount of documentation. In this article, we will explore the refinance paperwork needed to help you navigate the process smoothly.

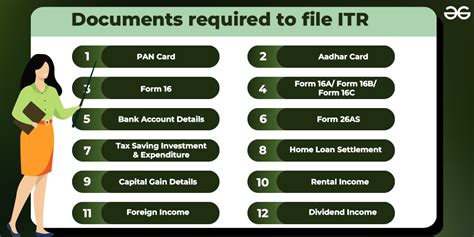

Pre-Refinance Checklist

Before starting the refinance process, it’s crucial to gather all the necessary documents. The following is a list of paperwork typically required for a refinance: * Identification documents: Driver’s license, state ID, or passport * Income verification: Pay stubs, W-2 forms, and tax returns * Employment verification: Letter from employer or recent pay stub * Credit reports: Permission to access credit reports * Property documents: Deed, title report, and appraisal (if required) * Loan documents: Current loan statement and note * Insurance documents: Proof of homeowners insurance

Refinance Application Process

The refinance application process typically involves the following steps: * Pre-approval: The lender reviews credit and income to determine eligibility * Application submission: The borrower submits the refinance application and supporting documents * Processing and underwriting: The lender reviews the application and orders an appraisal (if required) * Approval and closing: The lender approves the refinance and schedules a closing meeting

📝 Note: The refinance process can vary depending on the lender and the borrower's circumstances. It's essential to work with a reputable lender and ask questions throughout the process.

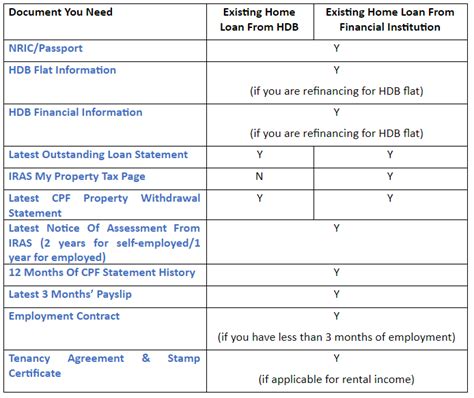

Types of Refinance Loans

There are several types of refinance loans available, each with its own set of requirements and benefits. The following are some common types of refinance loans: * Cash-out refinance: Allows borrowers to tap into home equity and receive cash at closing * Rate-and-term refinance: Involves changing the interest rate or loan term, but not borrowing additional funds * Streamline refinance: A simplified refinance process for borrowers with a VA or FHA loan * Home equity loan: A separate loan that allows borrowers to tap into home equity

| Loan Type | Benefits | Requirements |

|---|---|---|

| Cash-out Refinance | Tap into home equity, consolidate debt | Eligible credit score, sufficient equity |

| Rate-and-Term Refinance | Lower monthly payments, change loan term | Eligible credit score, sufficient income |

| Streamline Refinance | Simplified process, reduced documentation | VA or FHA loan, eligible credit score |

Refinance Paperwork Tips

To ensure a smooth refinance process, consider the following tips: * Gather documents early: Avoid delays by collecting required documents ahead of time * Review credit reports: Check for errors and work to improve credit scores * Shop around: Compare rates and terms from multiple lenders * Ask questions: Clarify any concerns or questions with the lender

In summary, refinancing a mortgage requires a significant amount of paperwork and documentation. By understanding the refinance paperwork needed and following the tips outlined above, borrowers can navigate the process with confidence. Whether looking to lower monthly payments, tap into home equity, or switch to a fixed-rate loan, refinancing can be a great option for homeowners. With the right preparation and knowledge, borrowers can make informed decisions and achieve their financial goals.

What is the difference between a cash-out refinance and a rate-and-term refinance?

+

A cash-out refinance allows borrowers to tap into home equity and receive cash at closing, while a rate-and-term refinance involves changing the interest rate or loan term without borrowing additional funds.

What are the benefits of a streamline refinance?

+

A streamline refinance offers a simplified process, reduced documentation, and faster closing times for borrowers with a VA or FHA loan.

How long does the refinance process typically take?

+

The refinance process can take anywhere from 30 to 60 days, depending on the lender, borrower, and complexity of the loan.