Paperwork

Tax Paperwork to Save

Introduction to Tax Paperwork

When it comes to dealing with tax paperwork, many individuals and businesses feel overwhelmed. The process of sorting through numerous documents, understanding complex tax laws, and meeting deadlines can be daunting. However, it is essential to stay on top of tax paperwork to avoid penalties, audits, and lost refunds. In this article, we will explore the importance of organizing and saving tax paperwork, provide tips on how to manage it efficiently, and discuss the benefits of doing so.

Why Save Tax Paperwork?

Saving tax paperwork is crucial for several reasons. Firstly, it helps to ensure that you are taking advantage of all the deductions and credits you are eligible for, which can result in a lower tax bill. Secondly, having a well-organized system in place can make it easier to prepare and file your tax return, reducing the risk of errors and missed deadlines. Finally, in the event of an audit, having all the necessary documents readily available can help to resolve the issue quickly and efficiently.

Types of Tax Paperwork to Save

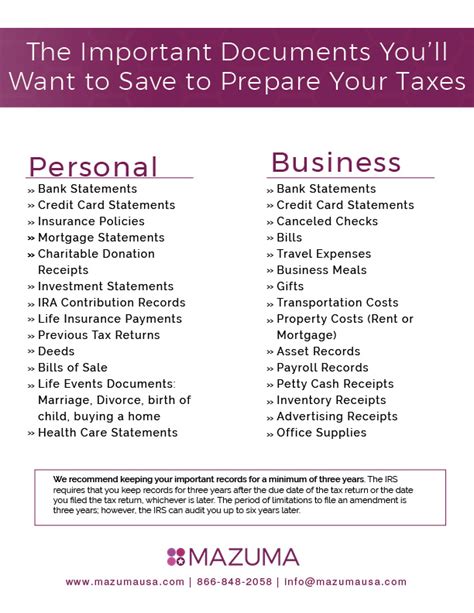

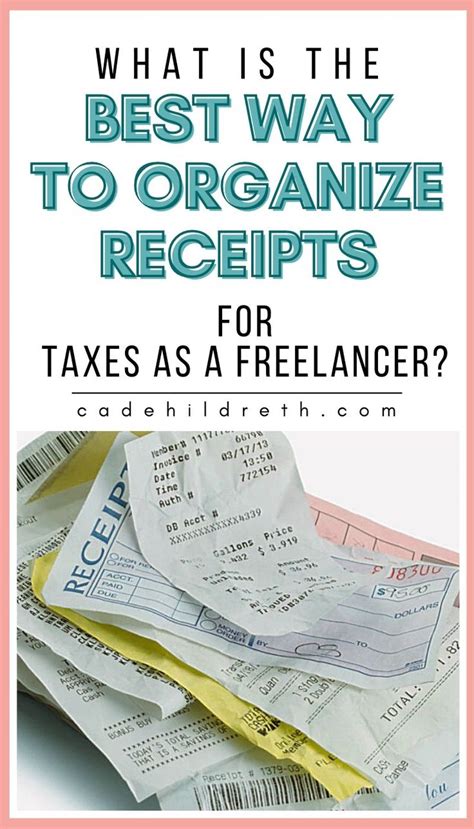

There are several types of tax paperwork that you should save, including: * W-2 forms: These forms show your income and taxes withheld from your employer. * 1099 forms: These forms show income earned from freelance work, investments, and other sources. * Receipts and invoices: These documents can be used to support deductions and credits, such as charitable donations and business expenses. * Bank statements: These statements can be used to verify income and expenses. * Tax returns: It is essential to save a copy of your tax return, including any supporting documentation.

How to Organize Tax Paperwork

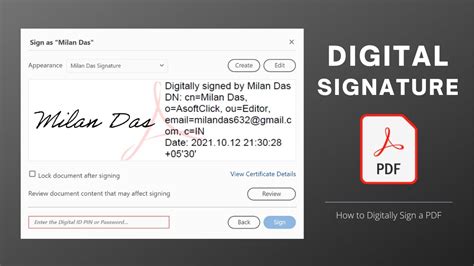

Organizing tax paperwork can be a challenge, but there are several strategies that can help. Here are a few tips: * Use a file folder or binder to keep all your tax documents in one place. * Label and categorize your documents, such as income, deductions, and credits. * Scan and digitize your documents to create a backup and free up physical storage space. * Set up a system for tracking and managing your tax paperwork throughout the year, such as setting reminders for deadlines and using a spreadsheet to track income and expenses.

Benefits of Saving Tax Paperwork

Saving tax paperwork can have several benefits, including: * Reduced stress: Having a well-organized system in place can reduce the stress and anxiety associated with tax season. * Increased efficiency: Saving tax paperwork can make it easier to prepare and file your tax return, reducing the time and effort required. * Improved accuracy: Having all the necessary documents readily available can help to reduce errors and ensure that you are taking advantage of all the deductions and credits you are eligible for. * Better financial management: Saving tax paperwork can help you to better understand your financial situation and make informed decisions about your money.

Tips for Managing Tax Paperwork

Here are a few additional tips for managing tax paperwork: * Start early: Begin gathering and organizing your tax documents as soon as possible to avoid last-minute rush. * Seek professional help: If you are unsure about how to manage your tax paperwork or need help with tax preparation, consider seeking the help of a professional. * Stay up-to-date: Stay informed about changes to tax laws and regulations to ensure that you are taking advantage of all the deductions and credits you are eligible for.

📝 Note: It is essential to keep your tax paperwork for at least three years in case of an audit.

Conclusion and Next Steps

In conclusion, saving tax paperwork is an essential part of managing your finances and reducing stress during tax season. By understanding the importance of saving tax paperwork, knowing what types of documents to save, and using strategies to organize and manage your paperwork, you can make the tax preparation process easier and more efficient. Remember to start early, seek professional help when needed, and stay up-to-date on changes to tax laws and regulations.

What types of tax paperwork should I save?

+

You should save W-2 forms, 1099 forms, receipts and invoices, bank statements, and tax returns.

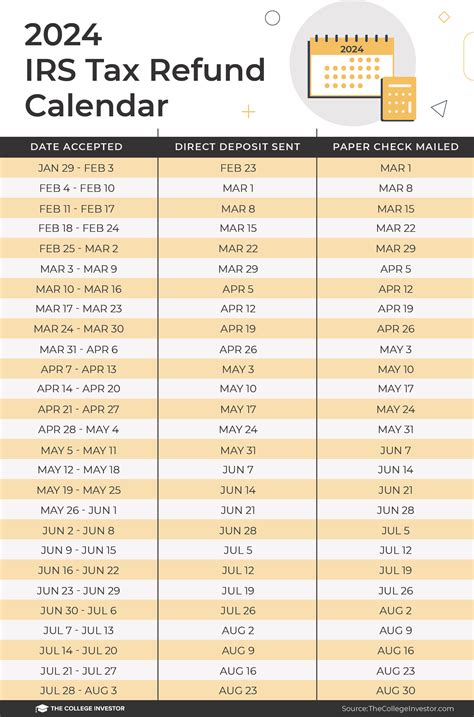

How long should I keep my tax paperwork?

+

You should keep your tax paperwork for at least three years in case of an audit.

Can I digitize my tax paperwork?

+