New Job Paperwork Requirements

Introduction to New Job Paperwork Requirements

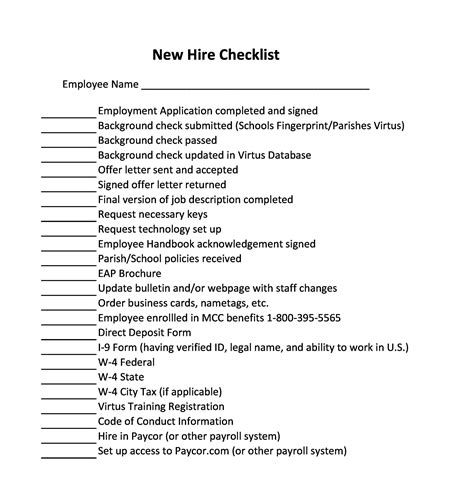

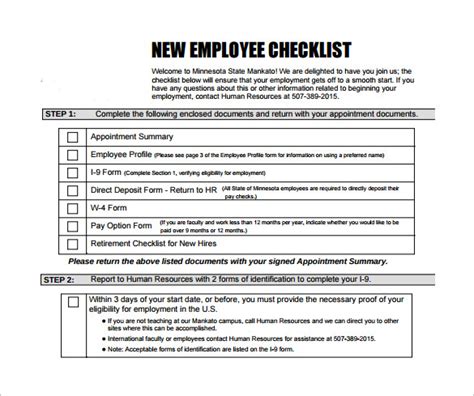

When starting a new job, there are several paperwork requirements that must be completed. These requirements can vary depending on the employer, the type of job, and the location. In this article, we will explore the common paperwork requirements for new jobs, including tax forms, benefit enrollment, and contract agreements. We will also discuss the importance of completing these forms accurately and on time.

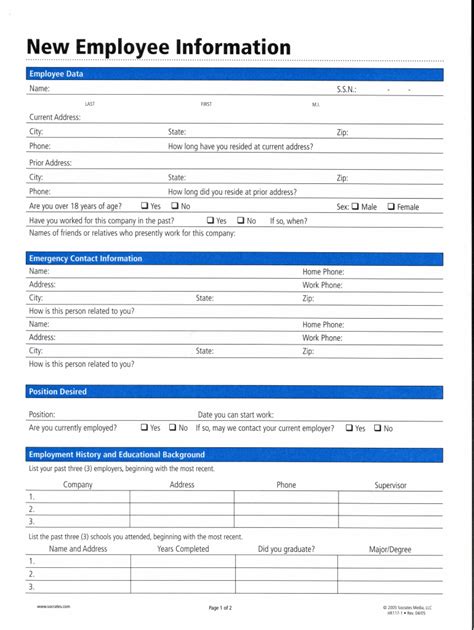

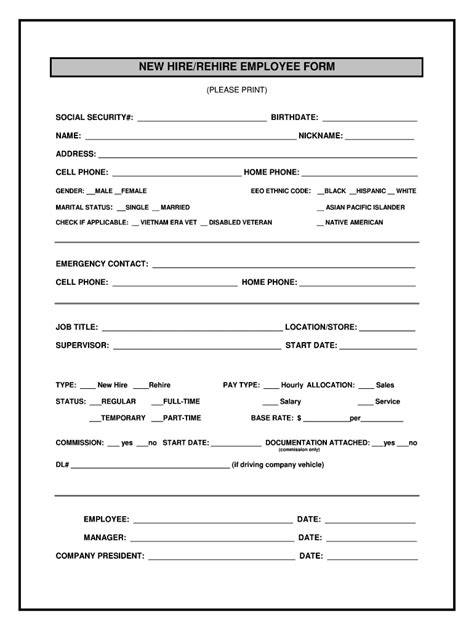

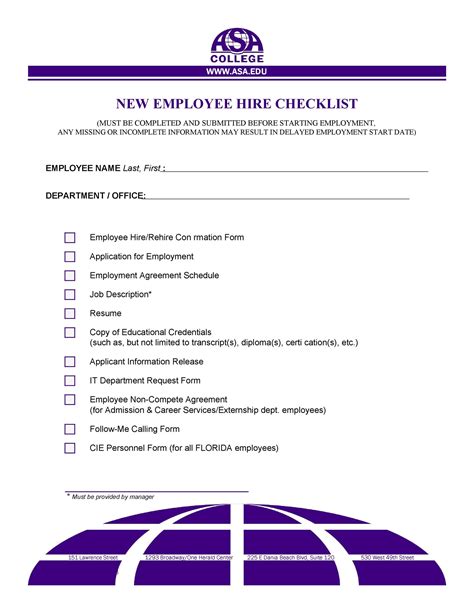

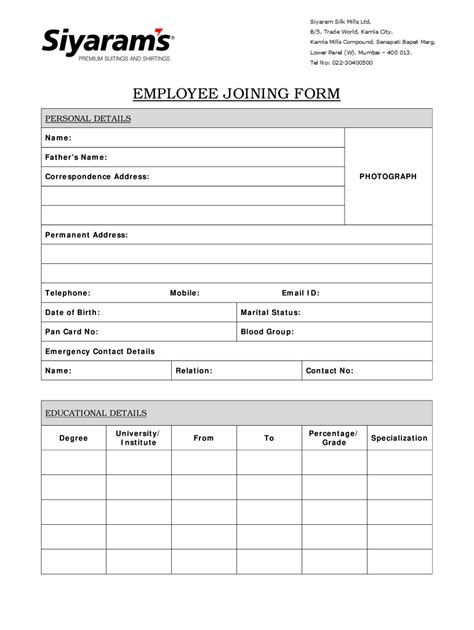

Pre-Employment Paperwork

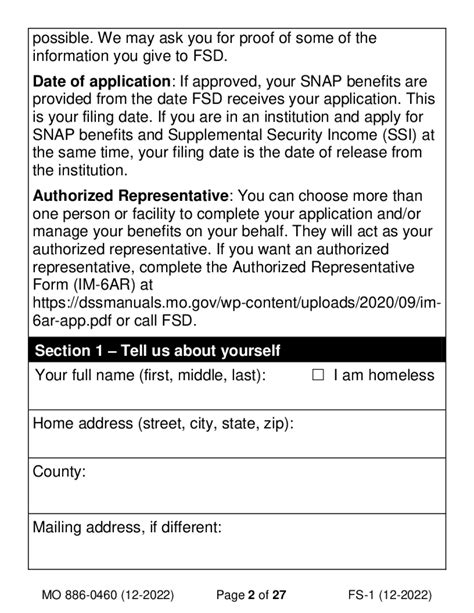

Before starting a new job, employees are typically required to complete pre-employment paperwork. This can include: * Job application: The initial application for the job, which may be submitted online or in person. * Resume and cover letter: A summary of the employee’s education, work experience, and skills. * References: Contact information for previous employers or colleagues who can vouch for the employee’s skills and work ethic. * Background check: A review of the employee’s criminal history, credit report, and other public records. * Drug test: A screening for illicit substances, which may be required for certain jobs or industries.

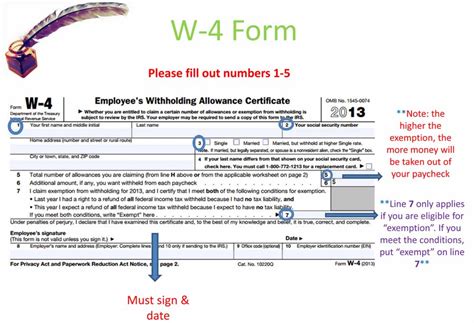

Tax Forms and Withholding

When starting a new job, employees are required to complete tax forms, including: * W-4 form: The Employee’s Withholding Certificate, which determines the amount of federal income tax withheld from the employee’s paycheck. * State and local tax forms: Depending on the location, employees may need to complete additional tax forms for state and local income tax withholding. * Social Security number: Employees must provide their Social Security number for tax reporting purposes.

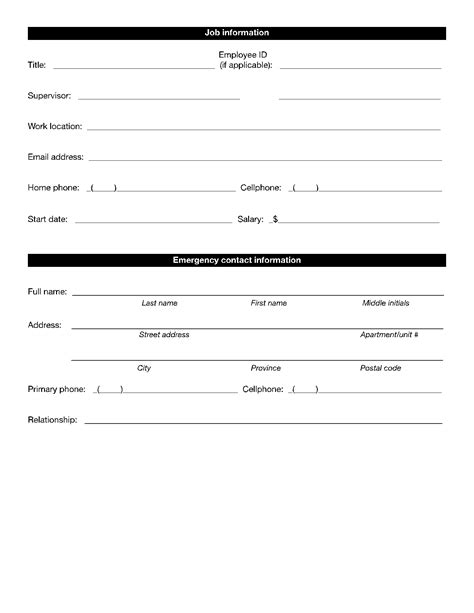

Benefit Enrollment

Many employers offer benefits, such as health insurance, retirement plans, and paid time off. To enroll in these benefits, employees must complete the necessary paperwork, including: * Benefit enrollment forms: Employees must select the benefits they wish to enroll in and provide any required information, such as dependents or beneficiaries. * Benefit waivers: If an employee declines a benefit, they must sign a waiver indicating their decision.

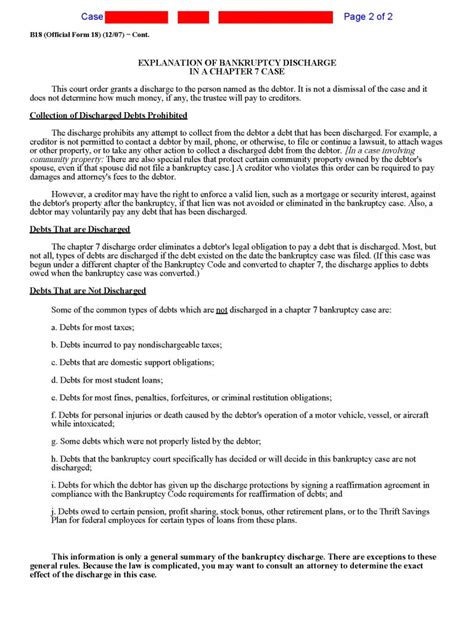

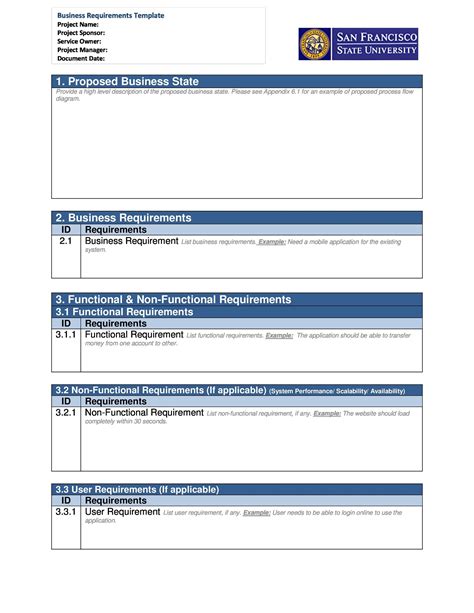

Contract Agreements

Some jobs require contract agreements, which outline the terms and conditions of employment. These agreements may include: * Employment contract: A written agreement between the employer and employee that outlines the job duties, salary, and benefits. * Non-disclosure agreement: A contract that prohibits the employee from sharing confidential information or trade secrets. * Non-compete agreement: A contract that restricts the employee from working for a competitor or starting a similar business.

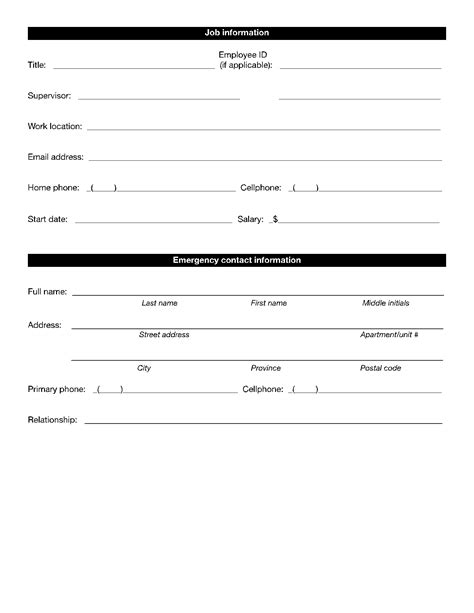

Other Paperwork Requirements

In addition to the above requirements, employees may need to complete other paperwork, such as: * Direct deposit form: A form that authorizes the employer to deposit the employee’s paycheck directly into their bank account. * Emergency contact form: A form that provides contact information for the employee’s emergency contacts. * Employee handbook acknowledgement: A form that acknowledges the employee has received and read the employee handbook.

📝 Note: It is essential to carefully review and complete all paperwork requirements to ensure a smooth transition into the new job.

Completing Paperwork Requirements

To complete the paperwork requirements, employees should: * Carefully review each form and ask questions if they are unsure about any information. * Complete all forms accurately and thoroughly. * Submit the completed forms to the employer by the designated deadline. * Keep a copy of the completed forms for their records.

Importance of Accurate and Timely Completion

Completing the paperwork requirements accurately and on time is crucial for several reasons: * Tax compliance: Accurate completion of tax forms ensures compliance with tax laws and regulations. * Benefit enrollment: Timely completion of benefit enrollment forms ensures that employees receive the benefits they are eligible for. * Contract agreements: Accurate completion of contract agreements ensures that both the employer and employee understand the terms and conditions of employment.

| Form | Description |

|---|---|

| W-4 form | Employee's Withholding Certificate |

| Benefit enrollment form | Selection of benefits and provision of required information |

| Contract agreement | Written agreement outlining the terms and conditions of employment |

In summary, new job paperwork requirements can vary depending on the employer and the type of job. It is essential to carefully review and complete all forms accurately and on time to ensure a smooth transition into the new job. By understanding the common paperwork requirements and their importance, employees can ensure compliance with tax laws and regulations, receive the benefits they are eligible for, and understand the terms and conditions of employment.

What is the purpose of the W-4 form?

+

The W-4 form is used to determine the amount of federal income tax withheld from an employee’s paycheck.

What benefits are typically offered by employers?

+

Common benefits offered by employers include health insurance, retirement plans, and paid time off.

What is the importance of completing paperwork requirements accurately and on time?

+

Accurate and timely completion of paperwork requirements ensures compliance with tax laws and regulations, receipt of eligible benefits, and understanding of the terms and conditions of employment.