House Buying Paperwork Explained

Introduction to House Buying Paperwork

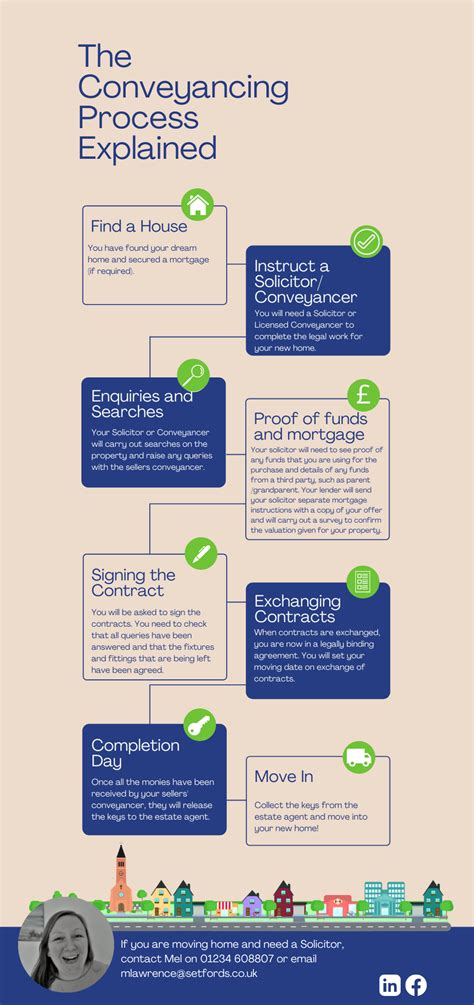

When purchasing a house, it’s essential to understand the various types of paperwork involved in the process. The paperwork can be overwhelming, but being familiar with the different documents and their purposes can help make the experience less stressful. In this article, we will delve into the world of house buying paperwork, exploring the key documents, their significance, and the steps involved in the process.

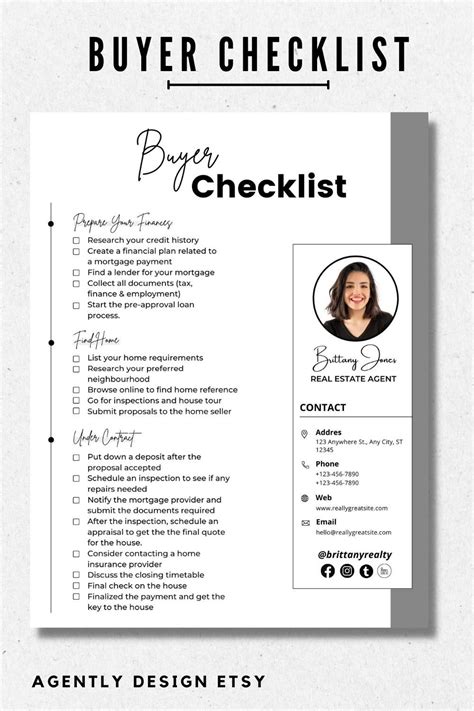

Pre-Purchase Paperwork

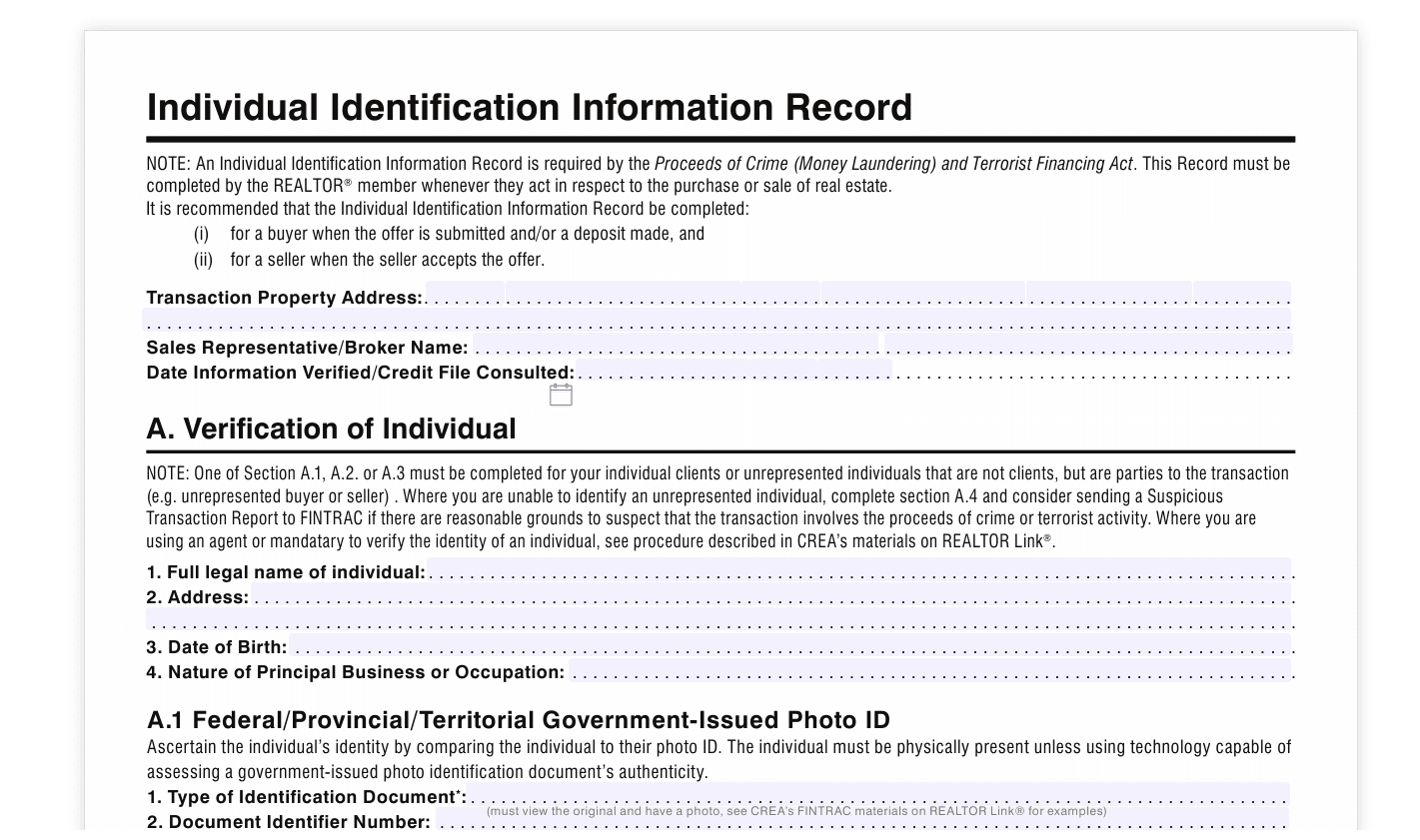

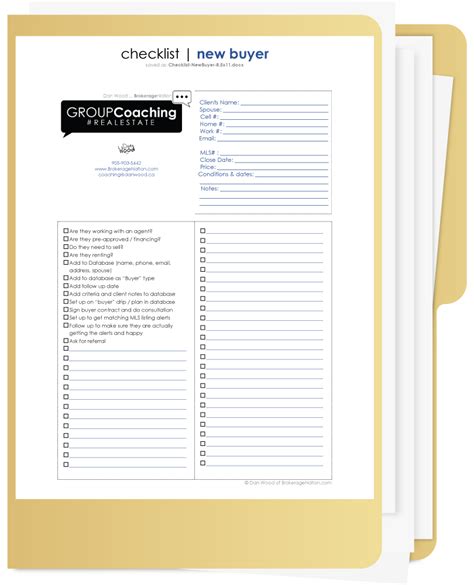

Before starting the house hunting process, it’s crucial to get your finances in order. This involves gathering the necessary paperwork to secure a mortgage. The pre-purchase paperwork includes: * Identification documents: Passport, driver’s license, or state ID * Proof of income: Pay stubs, W-2 forms, or tax returns * Proof of employment: Letter from employer or business registration documents * Credit reports: Obtain a copy of your credit report to check for any errors or issues * Bank statements: Provide statements for the past few months to demonstrate your financial stability

📝 Note: It's essential to review your credit report and address any errors or issues before applying for a mortgage, as this can impact your credit score and ability to secure a loan.

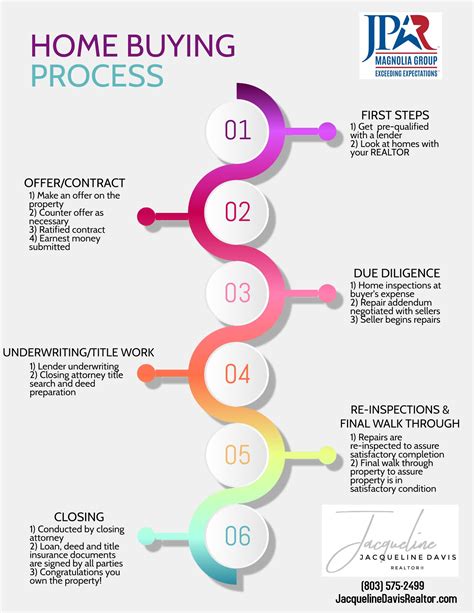

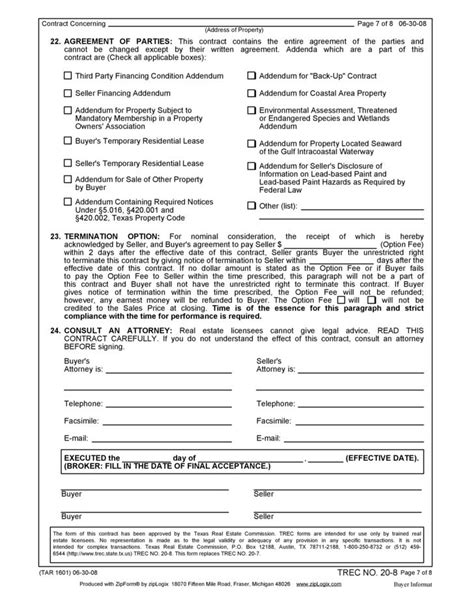

Offer and Acceptance Paperwork

Once you’ve found a house you’d like to purchase, it’s time to make an offer. The offer and acceptance paperwork includes: * Offer letter: A formal letter outlining the terms of your offer, including the price, contingencies, and closing date * Acceptance letter: A response from the seller indicating their acceptance of your offer * Counteroffer: A revised offer from the seller, which may include changes to the price or terms

Inspection and Due Diligence Paperwork

After your offer has been accepted, it’s essential to conduct inspections and due diligence to ensure the property is in good condition. The inspection and due diligence paperwork includes: * Inspection reports: Reports from licensed inspectors highlighting any issues with the property * Appraisal report: An independent assessment of the property’s value * Title search: A review of the property’s title to ensure there are no unexpected liens or encumbrances

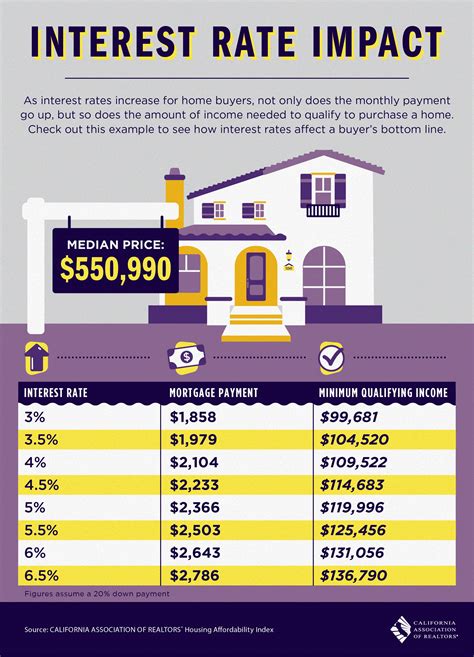

Mortgage Paperwork

The mortgage paperwork is a critical component of the house buying process. The key documents include: * Mortgage application: A formal application for a mortgage, which includes personal and financial information * Loan estimate: A document outlining the terms of the loan, including the interest rate, fees, and repayment terms * Closing disclosure: A final document summarizing the terms of the loan and the closing costs

Closing Paperwork

The closing paperwork is the final step in the house buying process. The key documents include: * Deed: A document transferring ownership of the property from the seller to the buyer * Mortgage note: A document outlining the terms of the loan and the borrower’s obligations * Title insurance: A policy protecting the buyer from any unexpected title issues

| Document | Purpose |

|---|---|

| Offer letter | Outlines the terms of the offer |

| Acceptance letter | Indicates the seller's acceptance of the offer |

| Inspection reports | Highlights any issues with the property |

| Mortgage application | Formal application for a mortgage |

| Closing disclosure | Summarizes the terms of the loan and closing costs |

The house buying paperwork process can be complex and time-consuming. However, by understanding the different documents and their purposes, you can navigate the process with confidence. It’s essential to work with a reputable real estate agent and attorney to ensure that all the necessary paperwork is completed accurately and efficiently.

In the end, the key to a successful house buying experience is being prepared and informed. By taking the time to understand the paperwork involved, you can avoid any unexpected surprises and ensure a smooth transaction. With the right guidance and support, you can navigate the complex world of house buying paperwork and achieve your dream of owning a home.

What is the purpose of the offer letter?

+

The offer letter outlines the terms of the offer, including the price, contingencies, and closing date.

What is the difference between a mortgage note and a deed?

+

A mortgage note outlines the terms of the loan and the borrower’s obligations, while a deed transfers ownership of the property from the seller to the buyer.

What is the purpose of the inspection reports?

+

The inspection reports highlight any issues with the property, providing the buyer with a comprehensive understanding of the property’s condition.