Paperwork

5 Tips Florida Title

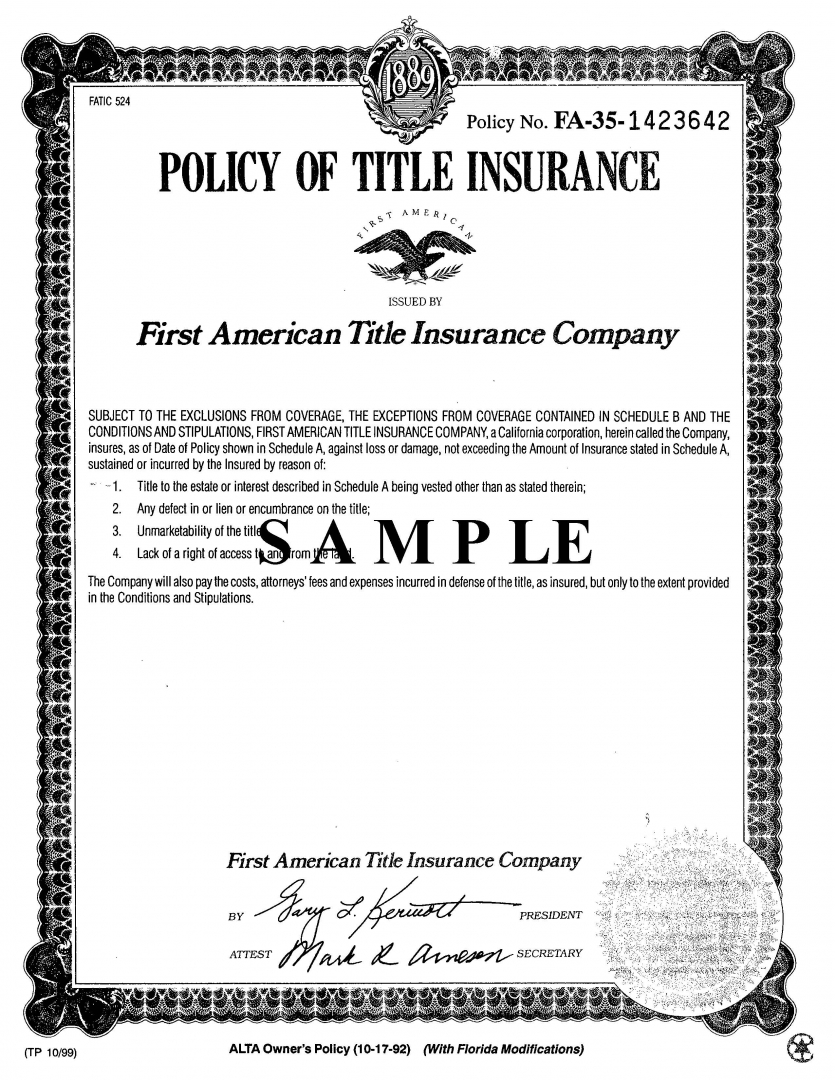

Introduction to Florida Title Loans

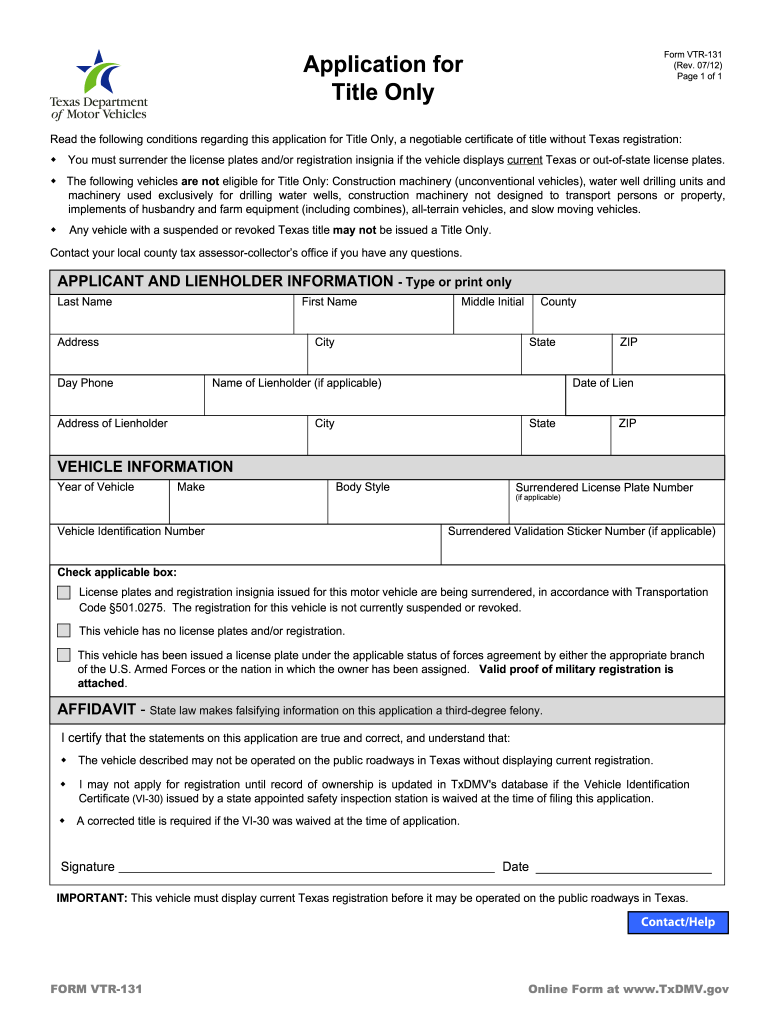

Florida title loans are a type of short-term loan that allows borrowers to use their vehicle’s title as collateral. These loans are often used by individuals who need quick access to cash and may not have the best credit score. However, before taking out a title loan, it’s essential to understand the process and the potential risks involved. In this article, we will discuss five tips for navigating Florida title loans and making informed decisions.

Understanding How Florida Title Loans Work

Florida title loans work by allowing borrowers to use their vehicle’s title as collateral in exchange for a loan. The lender will assess the value of the vehicle and offer a loan amount based on that value. The borrower will then receive the loan amount and must repay the loan, plus interest and fees, within a specified period. If the borrower fails to repay the loan, the lender can repossess the vehicle and sell it to recover the loan amount.

Tips for Navigating Florida Title Loans

Here are five tips for navigating Florida title loans: * Research the lender: Before taking out a title loan, research the lender to ensure they are reputable and licensed to operate in Florida. Check online reviews and ask for referrals from friends or family members. * Understand the terms: Carefully review the loan terms, including the interest rate, fees, and repayment period. Make sure you understand the total cost of the loan and the consequences of defaulting. * Know the risks: Title loans can be risky, as you are using your vehicle as collateral. If you default on the loan, you could lose your vehicle. Make sure you have a plan in place to repay the loan and avoid default. * Consider alternatives: Before taking out a title loan, consider alternative options, such as a personal loan or credit card. These options may have lower interest rates and fewer risks. * Read the fine print: Carefully review the loan agreement and ensure you understand all the terms and conditions. Pay attention to any hidden fees or penalties.

Benefits and Drawbacks of Florida Title Loans

Florida title loans can be beneficial for individuals who need quick access to cash and have a vehicle to use as collateral. However, there are also some drawbacks to consider:

| Benefits | Drawbacks |

|---|---|

| Quick access to cash | High interest rates and fees |

| No credit check required | Risk of losing your vehicle |

| Flexible repayment terms | Hidden fees and penalties |

💡 Note: Before taking out a title loan, make sure you understand the benefits and drawbacks and have a plan in place to repay the loan.

Conclusion and Final Thoughts

In conclusion, Florida title loans can be a viable option for individuals who need quick access to cash and have a vehicle to use as collateral. However, it’s essential to understand the process and the potential risks involved. By following the five tips outlined in this article, you can make informed decisions and avoid common pitfalls. Remember to research the lender, understand the terms, know the risks, consider alternatives, and read the fine print. With careful planning and consideration, you can navigate Florida title loans and achieve your financial goals.

What is a Florida title loan?

+

A Florida title loan is a type of short-term loan that allows borrowers to use their vehicle’s title as collateral in exchange for a loan.

How do I apply for a Florida title loan?

+

To apply for a Florida title loan, you will need to provide the lender with your vehicle’s title, proof of income, and identification. You can apply online or in-person at a licensed lender.

What are the risks of taking out a Florida title loan?

+

The risks of taking out a Florida title loan include high interest rates and fees, the risk of losing your vehicle, and hidden fees and penalties. It’s essential to carefully review the loan terms and understand the risks before taking out a loan.