Paperwork

5 Docs for Home Equity Loan

Introduction to Home Equity Loans

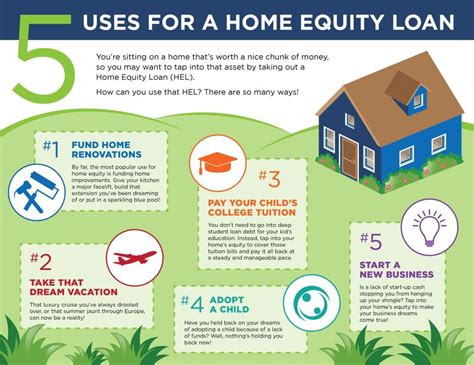

A home equity loan is a type of loan that allows homeowners to borrow money using the equity in their home as collateral. The equity in a home refers to the difference between the home’s current market value and the outstanding balance on the mortgage. Home equity loans are often used to finance major expenses, such as home repairs, debt consolidation, or large purchases. In this article, we will discuss the 5 key documents required for a home equity loan.

Understanding the Documents Required

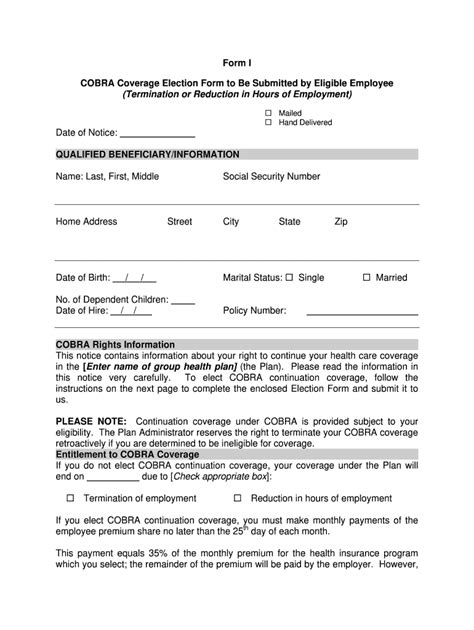

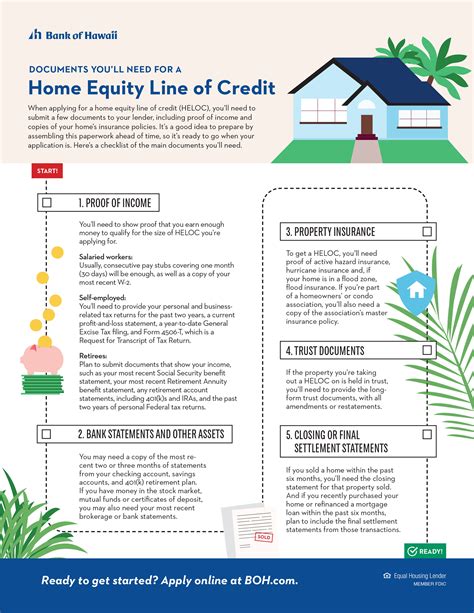

To apply for a home equity loan, you will need to provide various documents to the lender. These documents help the lender assess your creditworthiness and the value of your property. The 5 key documents required for a home equity loan are: * Identification documents: This includes a valid government-issued ID, such as a driver’s license or passport. * Income verification documents: You will need to provide proof of income, such as pay stubs, W-2 forms, or tax returns. * Property deeds and titles: The lender will require proof of ownership, which includes the property deed and title. * Mortgage statements and balances: You will need to provide current mortgage statements and balances to demonstrate the outstanding balance on your mortgage. * Credit reports and scores: The lender will typically require a credit report and score to assess your creditworthiness.

Importance of Accurate Documentation

It is essential to ensure that all documents are accurate and up-to-date. Incomplete or inaccurate documentation can lead to delays or even rejection of the loan application. It is crucial to review and verify all documents before submitting them to the lender.

Steps to Apply for a Home Equity Loan

To apply for a home equity loan, follow these steps: * Research and compare lenders to find the best rates and terms. * Gather all required documents and review them for accuracy. * Submit the application and supporting documents to the lender. * Wait for the lender to review and process the application. * Receive the loan funds and repay the loan according to the agreed-upon terms.

Key Considerations

Before applying for a home equity loan, consider the following: * Interest rates and fees: Compare rates and fees among lenders to find the best option. * Repayment terms: Understand the repayment terms, including the loan term, monthly payments, and any prepayment penalties. * Risk of foreclosure: If you default on the loan, you risk losing your home to foreclosure.

📝 Note: It is essential to carefully review and understand the loan terms and conditions before signing the agreement.

Conclusion and Final Thoughts

In conclusion, a home equity loan can be a useful financial tool for homeowners who need to borrow money. By understanding the 5 key documents required and following the application process, you can increase your chances of approval. Remember to carefully review and compare lenders, and consider the key considerations before making a decision. With the right lender and loan terms, a home equity loan can help you achieve your financial goals.

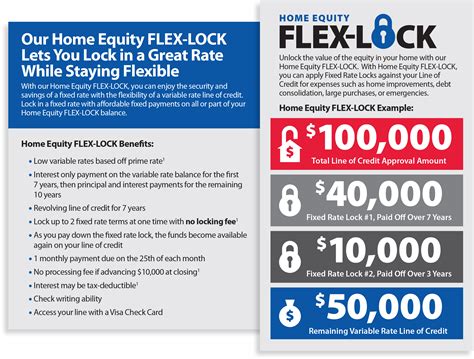

What is the difference between a home equity loan and a home equity line of credit?

+

A home equity loan provides a lump sum of money, while a home equity line of credit provides a revolving line of credit that can be borrowed and repaid as needed.

How long does it take to process a home equity loan application?

+

The processing time for a home equity loan application can vary depending on the lender and the complexity of the application, but it typically takes 2-6 weeks.

Can I use a home equity loan to consolidate debt?

+

Yes, a home equity loan can be used to consolidate debt, such as credit card balances or personal loans, into a single loan with a lower interest rate and monthly payment.