Tax Paperwork Needed

Introduction to Tax Paperwork

When it comes to handling taxes, one of the most daunting tasks for individuals and businesses alike is navigating the complex world of tax paperwork. The process involves gathering, organizing, and submitting various documents to the relevant tax authorities. This not only ensures compliance with tax laws but also helps in avoiding penalties and fines. In this comprehensive guide, we will delve into the essential tax paperwork needed for both personal and business tax purposes, exploring the types of forms, deadlines, and best practices for managing tax documentation.

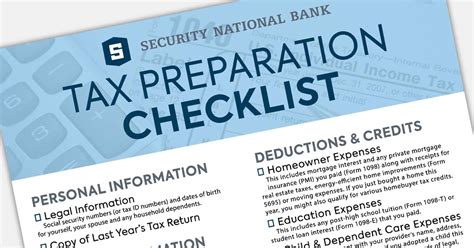

Personal Tax Paperwork

For individuals, the tax paperwork process typically begins with the W-2 form, which is provided by employers to detail the employee’s income and the taxes withheld. Other crucial documents include: - 1099 forms for freelance or contract work, dividends, and interest income. - Receipts for deductions, such as charitable donations, medical expenses, and home office deductions. - 1098 form for mortgage interest paid, which can be deductible. - Student loan interest statements, which may qualify for a tax deduction.

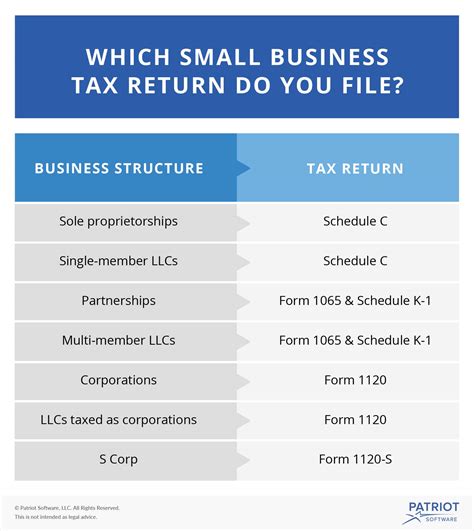

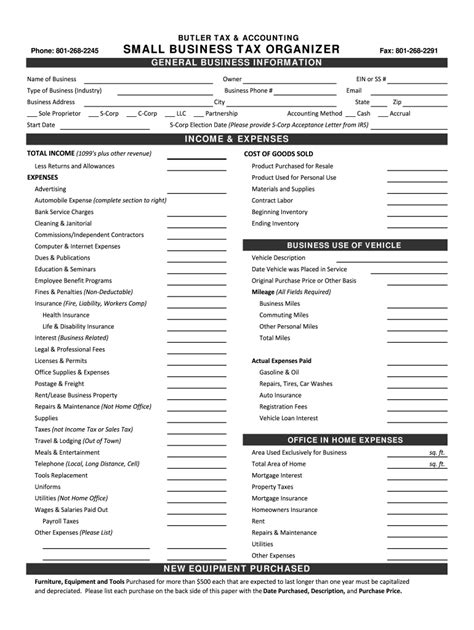

Business Tax Paperwork

Businesses face a more complex landscape when it comes to tax paperwork. Key documents include: - W-2 and W-3 forms for employee income and taxes withheld. - 1099-MISC forms for payments to independent contractors. - Form 941, the Employer’s Quarterly Federal Tax Return, to report employment taxes. - Business expense receipts for deductions, including office supplies, travel, and equipment purchases.

Deadlines and Penalties

Understanding the deadlines for filing tax paperwork is critical. For personal taxes, the deadline is typically April 15th of each year, though this can vary. Businesses have different deadlines based on their structure and the type of tax return they are filing. Missing these deadlines can result in penalties and fines, emphasizing the importance of timely and accurate filing.

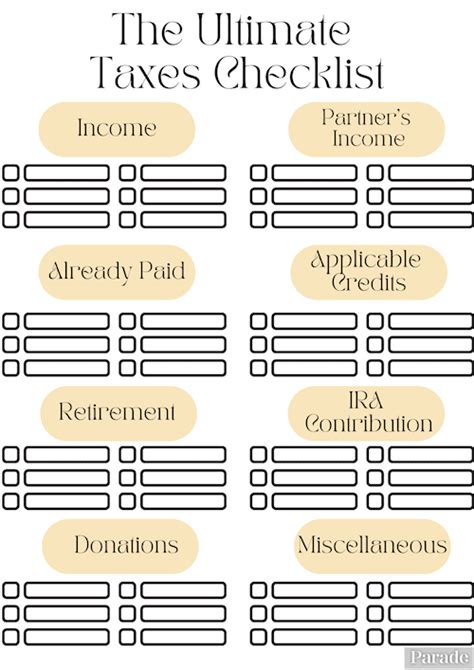

Best Practices for Managing Tax Paperwork

To manage tax paperwork effectively, consider the following best practices: - Keep detailed records of income and expenses throughout the year. - Organize documents in a secure and accessible manner, whether physically or digitally. - Seek professional help if unsure about any aspect of the tax filing process. - Stay informed about changes in tax laws and regulations that may affect your situation.

| Document Type | Description | Deadline |

|---|---|---|

| W-2 | Employee income and taxes withheld | January 31st |

| 1099-MISC | Payments to independent contractors | January 31st |

| Form 1040 | Personal income tax return | April 15th |

| Form 941 | Employer's quarterly federal tax return | Varies by quarter |

📝 Note: Always check the official tax authority website for the most current deadlines and requirements, as these can change.

As the tax season approaches, it’s essential to be prepared by gathering all necessary paperwork and understanding the filing process. Whether you’re handling personal or business taxes, staying organized and seeking professional advice when needed can make a significant difference in ensuring compliance and maximizing your refund.

In summary, managing tax paperwork is a critical task that requires attention to detail, organization, and knowledge of tax laws and deadlines. By following best practices and staying informed, individuals and businesses can navigate the complex world of taxes with greater ease and confidence.

What is the deadline for filing personal tax returns?

+

The deadline for filing personal tax returns is typically April 15th of each year, though this can vary.

What documents do I need to file my business taxes?

+

You will need documents such as W-2 and W-3 forms for employees, 1099-MISC forms for independent contractors, and receipts for business expenses, among others.

What happens if I miss the deadline for filing my taxes?

+

Missing the deadline can result in penalties and fines. It’s essential to file for an extension if you cannot meet the deadline or to consult with a tax professional.