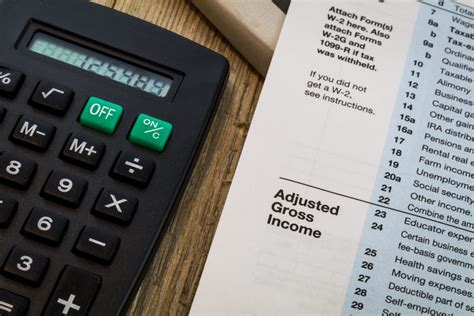

Find AGI on H&R Block

Understanding AGI and Its Importance

When filing taxes, one of the key terms you’ll encounter is Adjusted Gross Income (AGI). Your AGI is crucial because it determines your eligibility for certain tax deductions and credits, which can significantly impact your tax liability. AGI is essentially your total gross income from all sources, minus specific deductions allowed by the IRS. It’s a fundamental figure in calculating your taxable income.

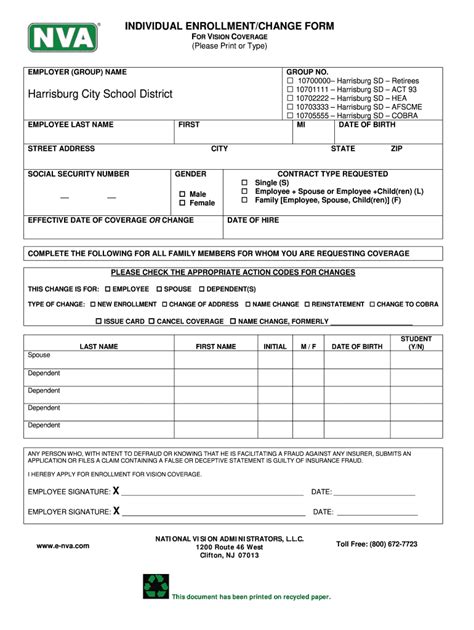

Locating AGI on H&R Block

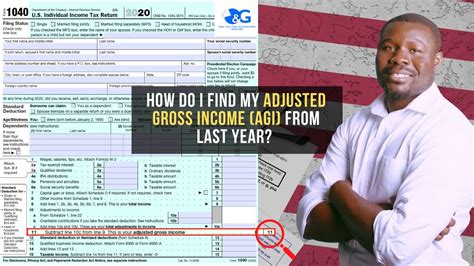

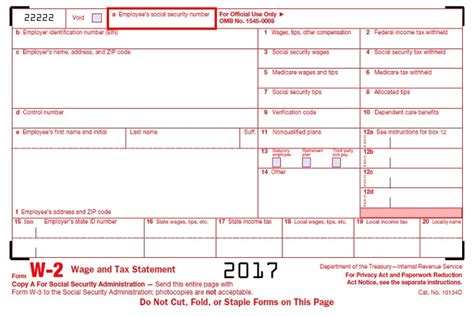

If you’re using H&R Block to prepare your taxes, finding your Adjusted Gross Income (AGI) is straightforward. Here’s a step-by-step guide: - First, ensure you have completed all the necessary sections related to your income. This includes wages, salaries, tips, interest, dividends, capital gains, and any other income sources. - After inputting all your income information, navigate to the review section of your tax return in H&R Block. - In the review section, look for a summary or overview of your tax return. This is usually where H&R Block provides a breakdown of your income, deductions, and credits. - Your AGI should be listed in this summary, often under a heading related to income or adjustments.

Why Your AGI Matters

Your Adjusted Gross Income is more than just a number on your tax return; it has significant implications for your financial situation. Here are a few reasons why your AGI matters: - Eligibility for Deductions and Credits: Many tax deductions and credits phase out at certain income levels. Your AGI determines whether you qualify for these deductions and credits, which can reduce your taxable income and lower your tax bill. - Tax Bracket: While your AGI itself doesn’t directly determine your tax bracket, it’s a key factor in calculating your taxable income, which does influence your tax bracket. - Health Insurance Subsidies: If you’re purchasing health insurance through the marketplace, your AGI can affect the amount of subsidy you’re eligible for.

Calculating AGI

To give you a better understanding, let’s break down how AGI is calculated: - Start with your gross income, which includes all the income you’ve earned from various sources. - From your gross income, subtract above-the-line deductions, also known as adjustments to income. These can include things like: - Alimony payments (for divorce agreements prior to 2019) - Student loan interest - Contributions to a traditional IRA - Moving expenses (for military personnel only, as of the last update) - Health savings account (HSA) contributions - The result after subtracting these deductions from your gross income is your Adjusted Gross Income (AGI).

Implications of AGI on Tax Planning

Understanding and managing your AGI can be a strategic part of tax planning. Here are some implications to consider: - Tax-Deferred Accounts: Contributions to certain tax-deferred accounts, like 401(k) or traditional IRAs, can reduce your AGI and, consequently, your taxable income. - Charitable Donations: While itemized deductions, including charitable donations, are reported after calculating AGI, planning your donations can still impact your overall tax situation. - Income Shift: In some cases, shifting income to a different year or using income-smoothing strategies can help manage your AGI and reduce your tax liability over time.

📝 Note: Tax laws and regulations are subject to change, so it's essential to consult the latest IRS guidelines or a tax professional for advice tailored to your specific situation.

Using H&R Block for Tax Filing

H&R Block is a popular choice for tax preparation due to its user-friendly interface and comprehensive guidance through the tax filing process. Whether you’re filing a simple return or have complex tax situations, H&R Block can help you navigate the process and ensure you’re taking advantage of all the deductions and credits you’re eligible for.

To make the most out of H&R Block, consider the following tips: - Accuracy is Key: Ensure all your income and deduction information is accurate and complete. - Maximize Deductions: Take advantage of all the deductions and credits you’re eligible for to minimize your taxable income. - Seek Professional Help: If you’re unsure about any part of the tax preparation process, don’t hesitate to seek help from a tax professional.

In summary, understanding your Adjusted Gross Income (AGI) and how it’s calculated is vital for effective tax planning. By managing your AGI and utilizing tools like H&R Block for tax preparation, you can optimize your tax strategy and potentially reduce your tax liability. Always stay informed about the latest tax laws and adjustments to make the most out of your tax filing experience.

What is Adjusted Gross Income (AGI)?

+

Adjusted Gross Income (AGI) is your total gross income minus specific deductions allowed by the IRS, playing a crucial role in determining your taxable income and eligibility for certain tax deductions and credits.

How do I find my AGI on H&R Block?

+

You can find your AGI in the review section of your tax return in H&R Block, typically under a summary or overview of your income, deductions, and credits.

Why is my AGI important for tax filing?

+

Your AGI is important because it determines your eligibility for certain tax deductions and credits, influences your tax bracket, and can affect subsidies for health insurance purchased through the marketplace.