Paperwork

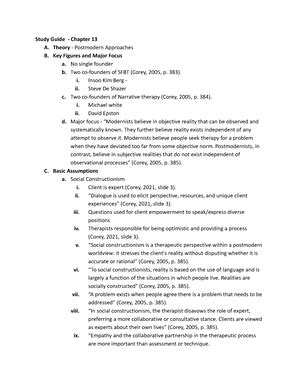

5 Tips Chapter 13

Introduction to Chapter 13

When it comes to managing debt, individuals often find themselves overwhelmed by the various options available. One such option is Chapter 13 bankruptcy, a legal process that allows individuals to reorganize their debts and pay them off over time. In this chapter, we will explore the ins and outs of Chapter 13 bankruptcy, including its benefits, drawbacks, and the steps involved in the process.

Understanding Chapter 13 Bankruptcy

Chapter 13 bankruptcy is a type of bankruptcy that allows individuals to create a repayment plan to pay off their debts over a period of three to five years. This type of bankruptcy is often referred to as a “wage earner’s plan” because it is designed for individuals who have a steady income and can afford to make monthly payments. During this time, creditors are prohibited from collecting debts, and the individual can focus on making payments and getting back on their feet.

Benefits of Chapter 13 Bankruptcy

There are several benefits to filing for Chapter 13 bankruptcy, including: * Stopping foreclosure: Chapter 13 bankruptcy can help individuals stop foreclosure proceedings and save their homes. * Reducing debt: Chapter 13 bankruptcy can help individuals reduce their debt burden and pay off a portion of their debts over time. * Protecting assets: Chapter 13 bankruptcy can help individuals protect their assets, such as their home and car, from creditors. * Improving credit score: By making regular payments and completing the repayment plan, individuals can improve their credit score over time. * Reducing stress: Chapter 13 bankruptcy can help individuals reduce stress and anxiety related to debt collection and financial uncertainty.

Drawbacks of Chapter 13 Bankruptcy

While Chapter 13 bankruptcy can be a useful tool for managing debt, there are also some drawbacks to consider: * Long repayment period: The repayment period for Chapter 13 bankruptcy can be three to five years, which can be a long time to be making payments. * Strict budgeting: Individuals who file for Chapter 13 bankruptcy must create a strict budget and stick to it, which can be challenging. * Public record: Chapter 13 bankruptcy is a public record, which can be embarrassing for some individuals. * Impact on credit score: Filing for Chapter 13 bankruptcy can have a negative impact on an individual’s credit score, at least in the short term. * Cost: Filing for Chapter 13 bankruptcy can be expensive, with court fees and attorney costs adding up quickly.

Steps Involved in Chapter 13 Bankruptcy

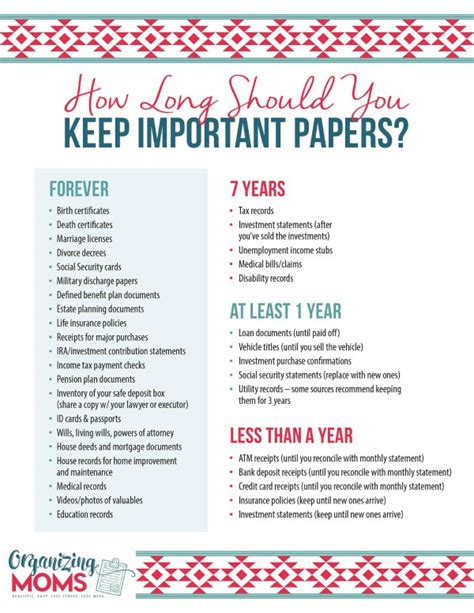

The steps involved in Chapter 13 bankruptcy are as follows: * Consult with an attorney: Individuals who are considering filing for Chapter 13 bankruptcy should consult with an attorney to determine if it is the right option for them. * Gather financial documents: Individuals will need to gather financial documents, such as income statements and expense reports, to create a budget and repayment plan. * Create a repayment plan: Individuals will need to create a repayment plan that outlines how they will pay off their debts over time. * File the petition: The individual will need to file a petition with the court to begin the Chapter 13 bankruptcy process. * Attend the meeting of creditors: The individual will need to attend a meeting of creditors, where they will answer questions about their financial situation and repayment plan.

📝 Note: It is essential to work with an experienced attorney when filing for Chapter 13 bankruptcy to ensure that the process is completed correctly and efficiently.

Conclusion and Final Thoughts

In conclusion, Chapter 13 bankruptcy can be a useful tool for individuals who are struggling with debt. By understanding the benefits and drawbacks of Chapter 13 bankruptcy, individuals can make informed decisions about their financial situation. It is essential to work with an experienced attorney and create a realistic repayment plan to ensure success. With the right guidance and support, individuals can use Chapter 13 bankruptcy to get back on their feet and achieve financial stability.

What is the difference between Chapter 7 and Chapter 13 bankruptcy?

+

Chapter 7 bankruptcy involves liquidating assets to pay off debts, while Chapter 13 bankruptcy involves creating a repayment plan to pay off debts over time.

How long does the Chapter 13 bankruptcy process take?

+

The Chapter 13 bankruptcy process typically takes three to five years to complete, depending on the individual’s repayment plan.

Can I file for Chapter 13 bankruptcy if I have already filed for bankruptcy in the past?

+

Yes, individuals can file for Chapter 13 bankruptcy even if they have already filed for bankruptcy in the past, but there may be certain restrictions or requirements that apply.