Paperwork

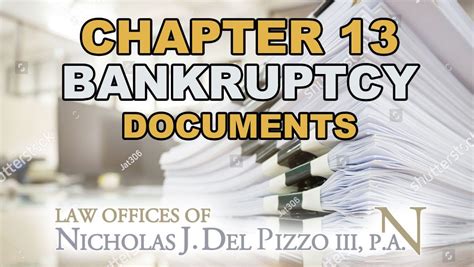

File Chapter 13 Bankruptcy Paperwork

Introduction to Chapter 13 Bankruptcy

Filing for Chapter 13 bankruptcy is a significant decision that can have a lasting impact on an individual’s financial situation. Also known as a wage earner’s plan, Chapter 13 bankruptcy allows individuals with a steady income to create a repayment plan to pay off a portion or all of their debts over time. This type of bankruptcy is often preferred by individuals who want to avoid foreclosure, repossession, or other severe financial consequences.

Understanding the Chapter 13 Bankruptcy Process

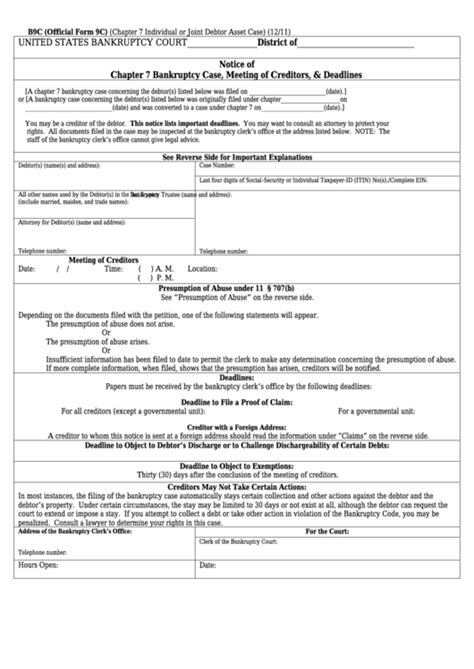

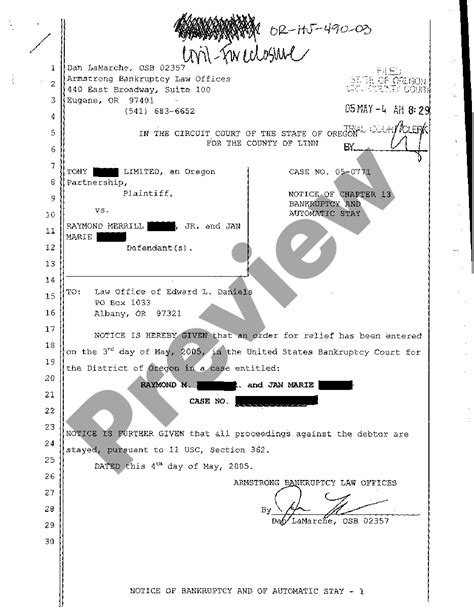

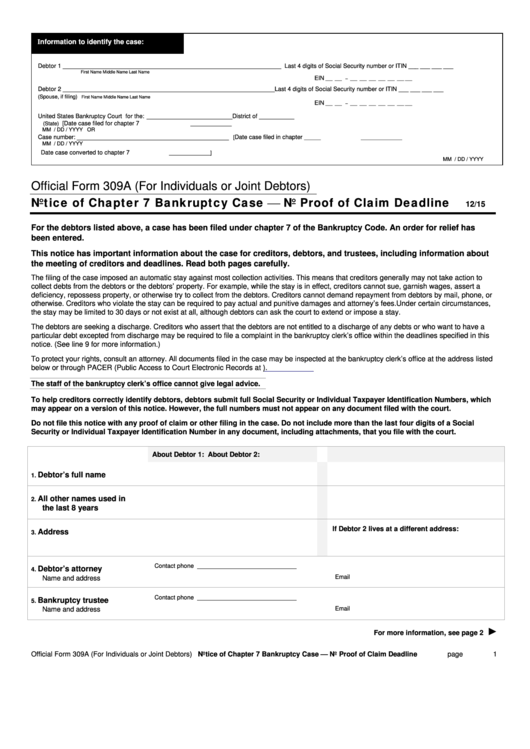

The Chapter 13 bankruptcy process involves several steps, including: * Financial counseling: Before filing for bankruptcy, individuals must undergo financial counseling to explore alternative debt relief options. * Filing paperwork: The individual must file a petition with the bankruptcy court, along with supporting documents, such as financial statements and tax returns. * Creating a repayment plan: The individual must propose a repayment plan, which outlines how they will pay off their debts over time. * Confirming the plan: The bankruptcy court must confirm the repayment plan, which involves reviewing the plan to ensure it is feasible and fair to creditors. * Making payments: The individual must make regular payments to the trustee, who distributes the funds to creditors.

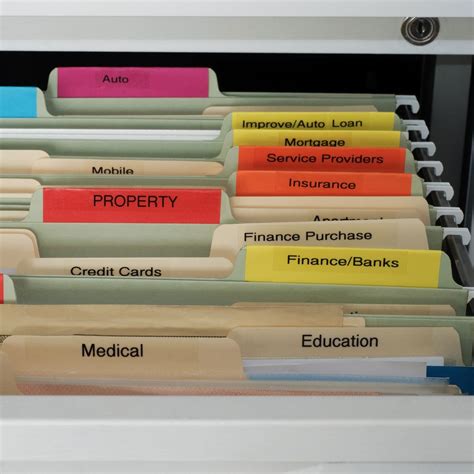

Required Documents for Chapter 13 Bankruptcy

To file for Chapter 13 bankruptcy, individuals must submit the following documents: * Petition: The petition is the initial document filed with the bankruptcy court, which starts the bankruptcy process. * Schedules: The individual must file schedules, which provide detailed information about their income, expenses, assets, and debts. * Statement of financial affairs: This document provides a comprehensive overview of the individual’s financial situation, including income, expenses, and debt payments. * Means test: The means test is used to determine whether the individual is eligible for Chapter 13 bankruptcy and to calculate their disposable income. * Repayment plan: The individual must propose a repayment plan, which outlines how they will pay off their debts over time.

| Document | Description |

|---|---|

| Petition | Initial document filed with the bankruptcy court |

| Schedules | Provide detailed information about income, expenses, assets, and debts |

| Statement of financial affairs | Comprehensive overview of financial situation |

| Means test | Determines eligibility for Chapter 13 bankruptcy and calculates disposable income |

| Repayment plan | Outlines how debts will be paid off over time |

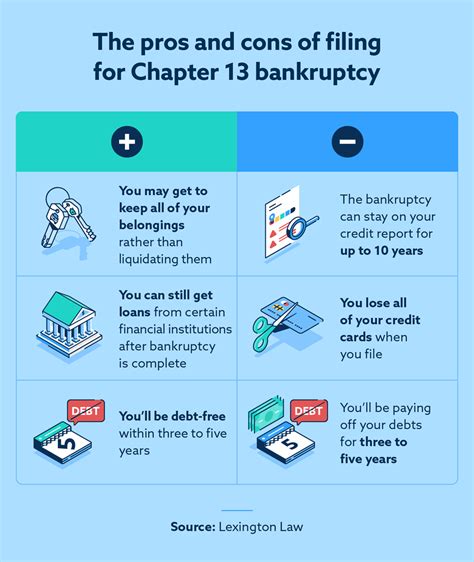

Benefits of Chapter 13 Bankruptcy

Chapter 13 bankruptcy offers several benefits, including: * Stop foreclosure: Chapter 13 bankruptcy can stop foreclosure proceedings, allowing individuals to catch up on mortgage payments. * Prevent repossession: Chapter 13 bankruptcy can prevent repossession of vehicles and other assets. * Consolidate debts: Chapter 13 bankruptcy allows individuals to consolidate debts into a single monthly payment. * Reduce debt payments: Chapter 13 bankruptcy can reduce debt payments, making it easier for individuals to manage their finances.

💡 Note: Chapter 13 bankruptcy can have a significant impact on an individual's credit score, and it is essential to carefully consider the consequences before filing.

Conclusion and Final Thoughts

In conclusion, filing for Chapter 13 bankruptcy is a complex process that requires careful consideration and planning. By understanding the process, required documents, and benefits of Chapter 13 bankruptcy, individuals can make informed decisions about their financial situation. It is essential to seek the advice of a qualified bankruptcy attorney to ensure the best possible outcome.

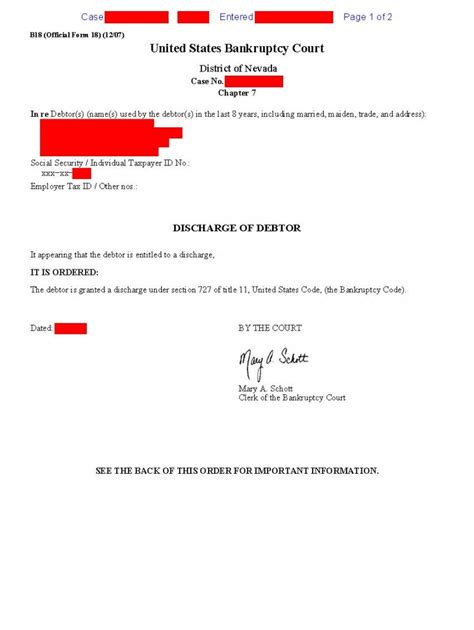

What is the difference between Chapter 13 and Chapter 7 bankruptcy?

+

Chapter 13 bankruptcy is a wage earner’s plan, which allows individuals to create a repayment plan to pay off debts over time. Chapter 7 bankruptcy, on the other hand, is a liquidation plan, which involves selling assets to pay off debts.

How long does the Chapter 13 bankruptcy process take?

+

The Chapter 13 bankruptcy process typically takes 3-5 years to complete, although this can vary depending on the individual’s circumstances and the complexity of the case.

Can I file for Chapter 13 bankruptcy if I have a high income?

+

Yes, individuals with a high income can file for Chapter 13 bankruptcy, although they may be required to pay a larger portion of their debts over time.