5 Tips Replace EIN Paperwork

Introduction to EIN Paperwork Replacement

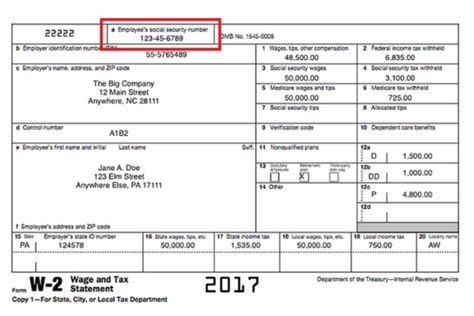

When it comes to managing business operations, one of the most crucial aspects is ensuring that all paperwork and legal requirements are met. For businesses in the United States, obtaining an Employer Identification Number (EIN) is a fundamental step. The EIN is used by the Internal Revenue Service (IRS) to identify businesses for tax purposes. However, managing EIN paperwork can be cumbersome, especially for small businesses or startups with limited administrative resources. This article will explore five tips on how to replace or manage EIN paperwork more efficiently, leveraging technology and best practices to streamline business operations.

Understanding EIN Paperwork

Before diving into the tips for replacing EIN paperwork, it’s essential to understand what EIN paperwork entails. The process typically starts with applying for an EIN, which can be done online through the IRS website, by phone, or by mail using Form SS-4. Once an EIN is assigned, businesses must use it on all tax returns, statements, and other documents submitted to the IRS. The paperwork involved includes not just the application but also subsequent documentation and reporting required for tax compliance.

Tips for Replacing EIN Paperwork

Given the importance of EIN paperwork, finding efficient ways to manage and replace traditional paperwork methods can significantly benefit businesses. Here are five tips to consider:

- Digital Applications: The IRS offers an online application process for obtaining an EIN, which is faster and more convenient than mail or phone applications. This digital approach reduces paperwork and expedites the process, allowing businesses to receive their EIN immediately after applying.

- Electronic Tax Filing: Utilizing electronic tax filing (e-filing) for tax returns and other submissions can significantly reduce the need for physical paperwork. The IRS and tax software providers offer secure and efficient e-filing options, making it easier to manage tax compliance digitally.

- Cloud-Based Document Management: Implementing a cloud-based document management system can help businesses organize and store their EIN paperwork and other critical documents securely. This approach enables easy access, sharing, and collaboration, reducing the reliance on physical files.

- Automated Compliance Tools: Leveraging automated compliance tools and software can help streamline the process of managing EIN paperwork and ensuring tax compliance. These tools can remind businesses of filing deadlines, assist with form preparation, and even submit documents electronically.

- Professional Assistance: For businesses struggling to manage their EIN paperwork or seeking to ensure full compliance with IRS regulations, consulting with a tax professional or accountant can be beneficial. These experts can provide guidance on the best practices for managing paperwork and can assist with the application and filing processes.

Benefits of Efficient EIN Paperwork Management

Efficiently managing EIN paperwork offers several benefits to businesses, including: * Reduced Administrative Burden: By automating and digitizing paperwork processes, businesses can free up administrative resources for more strategic activities. * Improved Compliance: Utilizing digital tools and professional assistance can reduce the risk of non-compliance with IRS regulations, minimizing the likelihood of penalties and fines. * Enhanced Security: Digital storage and transmission of sensitive documents can be more secure than traditional paper methods, reducing the risk of data breaches and loss.

📝 Note: Ensuring the security and integrity of business documents is crucial. Always use reputable and secure platforms for digital document management and transmission.

Conclusion and Future Directions

In conclusion, managing EIN paperwork efficiently is crucial for businesses aiming to streamline their operations and ensure compliance with IRS regulations. By embracing digital solutions, leveraging technology, and seeking professional assistance when needed, businesses can replace traditional paperwork methods with more efficient and secure alternatives. As technology continues to evolve, it’s likely that even more innovative solutions will emerge, further simplifying the process of managing EIN paperwork and enhancing business operations.

What is an EIN, and why is it necessary for businesses?

+

An Employer Identification Number (EIN) is a unique number assigned to a business by the IRS for tax purposes. It’s necessary for businesses to open bank accounts, file tax returns, and manage payroll among other functions.

How can businesses apply for an EIN?

+

Businesses can apply for an EIN through the IRS website, by phone, or by mail using Form SS-4. The online application process is the fastest method, providing an EIN immediately after application.

What are the benefits of using digital tools for EIN paperwork management?

+

The benefits include reduced administrative burden, improved compliance, enhanced security, and faster access to critical documents. Digital tools can automate tasks, remind businesses of deadlines, and securely store documents.