Partnership Paperwork Requirements

Introduction to Partnership Paperwork Requirements

When establishing a partnership, whether it’s a general partnership, limited partnership, or limited liability partnership, there are several legal and regulatory requirements that must be met. One of the most critical aspects of forming a partnership is the paperwork involved. In this article, we will delve into the world of partnership paperwork requirements, exploring the necessary documents, filings, and registrations that partners must complete to ensure their business is legally recognized and operational.

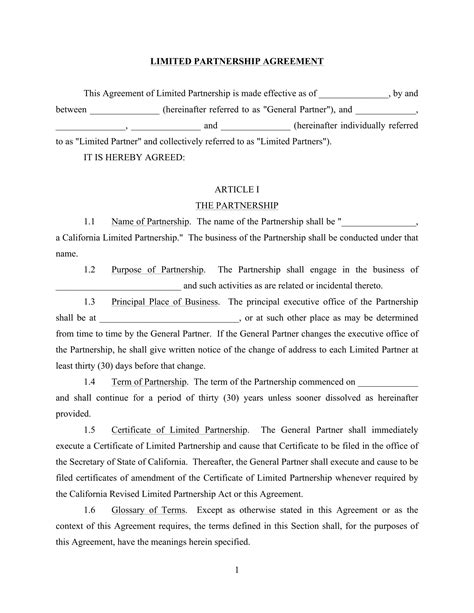

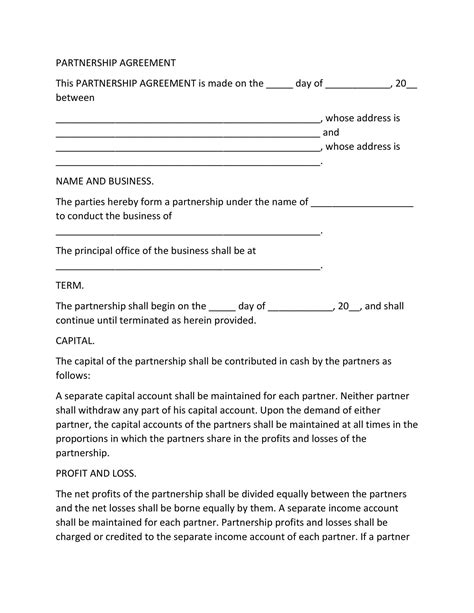

Partnership Agreement

The partnership agreement is the foundation of any partnership. This document outlines the terms and conditions of the partnership, including the roles and responsibilities of each partner, the distribution of profits and losses, and the procedure for resolving disputes. A well-drafted partnership agreement is essential to prevent misunderstandings and ensure a smooth operation of the business. The agreement should include details such as: * The name and purpose of the partnership * The names and addresses of all partners * The capital contributions of each partner * The ownership percentage of each partner * The management structure and decision-making process * The distribution of profits and losses * The procedure for admitting new partners or withdrawing from the partnership

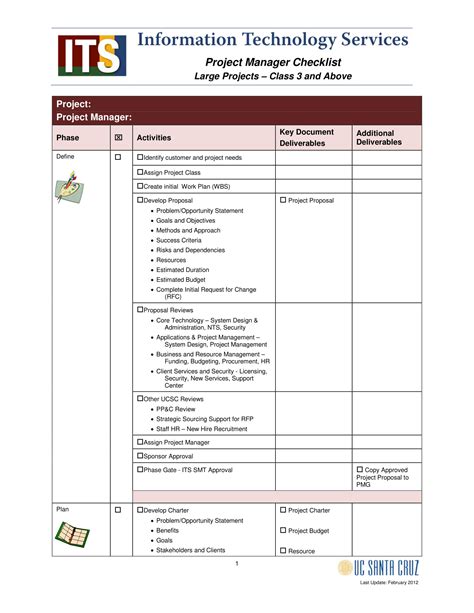

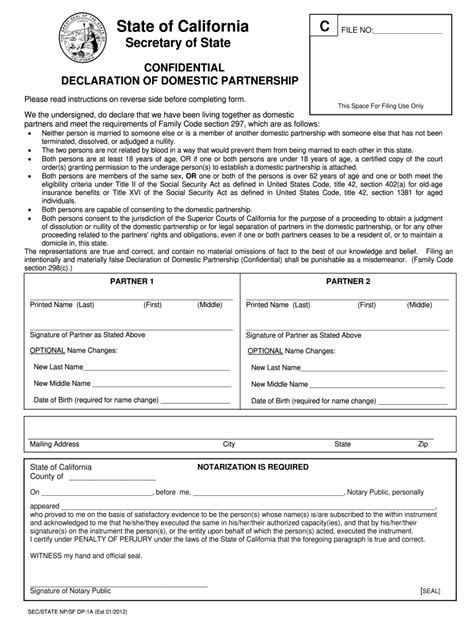

Registration Requirements

In addition to the partnership agreement, partners must also comply with various registration requirements. These may include: * Business registration: Partners must register their business with the relevant state or local authorities. This typically involves filing a certificate of partnership or articles of partnership with the state’s business registration office. * Obtaining an Employer Identification Number (EIN): Partnerships must obtain an EIN from the IRS, which is used to identify the business for tax purposes. * Registering for state and local taxes: Partnerships must register for state and local taxes, such as sales tax and employment tax. * Obtaining necessary licenses and permits: Depending on the type of business, partners may need to obtain special licenses or permits to operate.

Tax Filings

Partnerships are pass-through entities, meaning that the partnership itself is not subject to income tax. Instead, the partners report their share of the partnership’s income and expenses on their individual tax returns. The partnership must file an annual information return (Form 1065) with the IRS, which reports the partnership’s income, deductions, and credits. Partners will also receive a Schedule K-1, which shows their share of the partnership’s income and expenses.

Other Requirements

In addition to the partnership agreement, registration requirements, and tax filings, partners may need to comply with other regulations, such as: * Maintaining accurate records: Partnerships must maintain accurate and detailed records of their financial transactions, including income, expenses, and capital contributions. * Holding annual meetings: Partnerships should hold annual meetings to discuss the business’s operations, financial performance, and future plans. * Complying with employment laws: If the partnership has employees, partners must comply with employment laws, such as minimum wage and overtime requirements, and provide workers’ compensation insurance.

📝 Note: Partnerships must also comply with any industry-specific regulations, such as health and safety standards or environmental regulations.

Conclusion and Future Planning

In conclusion, forming a partnership requires careful planning and attention to detail. By understanding the necessary paperwork requirements, partners can ensure their business is legally recognized and operational. It’s essential to consult with an attorney or accountant to ensure compliance with all regulatory requirements. With the right planning and documentation, partners can focus on growing their business and achieving their goals.

What is the purpose of a partnership agreement?

+

The partnership agreement outlines the terms and conditions of the partnership, including the roles and responsibilities of each partner, the distribution of profits and losses, and the procedure for resolving disputes.

What are the registration requirements for a partnership?

+

Partners must register their business with the relevant state or local authorities, obtain an Employer Identification Number (EIN), register for state and local taxes, and obtain necessary licenses and permits.

How do partnerships file taxes?

+

Partnerships are pass-through entities, meaning that the partnership itself is not subject to income tax. Instead, the partners report their share of the partnership’s income and expenses on their individual tax returns. The partnership must file an annual information return (Form 1065) with the IRS.