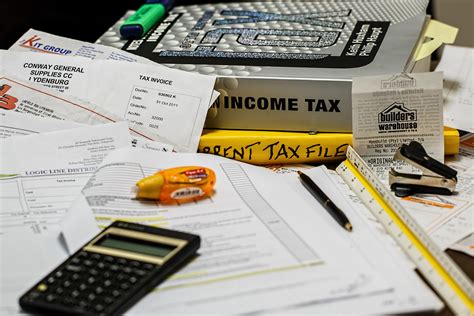

5 Tax Papers Needed

Introduction to Tax Papers

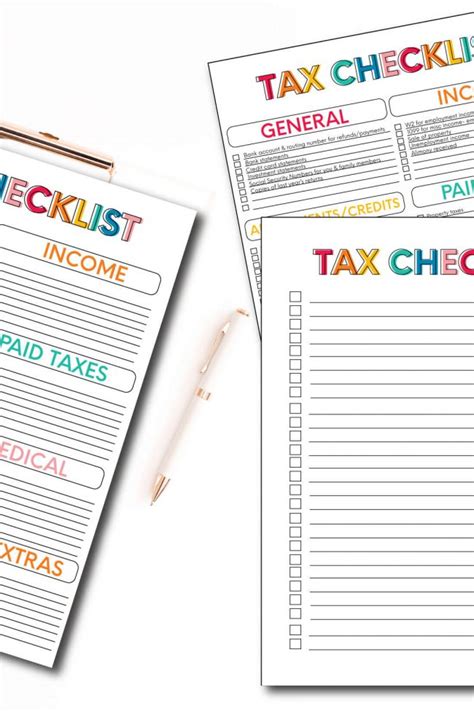

When it comes to filing taxes, having the right documents is crucial to ensure a smooth and accurate process. Among the numerous forms and papers required, there are five key tax papers that individuals and businesses must be aware of. These documents are essential for reporting income, claiming deductions, and complying with tax regulations. In this article, we will explore the five tax papers needed, their purposes, and the importance of maintaining accurate and organized records.

1. W-2 Form: Wage and Tax Statement

The W-2 form is a critical tax paper that employers must provide to their employees by January 31st of each year. This document reports an employee’s annual wages, taxes withheld, and other relevant information. The W-2 form is used to calculate an individual’s tax liability and determine their eligibility for tax credits and deductions. It is essential to review the W-2 form carefully, as errors or discrepancies can lead to delays or issues with tax returns.

2. 1099 Form: Miscellaneous Income

The 1099 form is used to report various types of income, such as freelance work, consulting fees, and rental income. This tax paper is typically provided by payers to recipients by January 31st of each year. The 1099 form is essential for reporting income that is not subject to withholding, and it helps individuals and businesses accurately report their income and claim deductions.

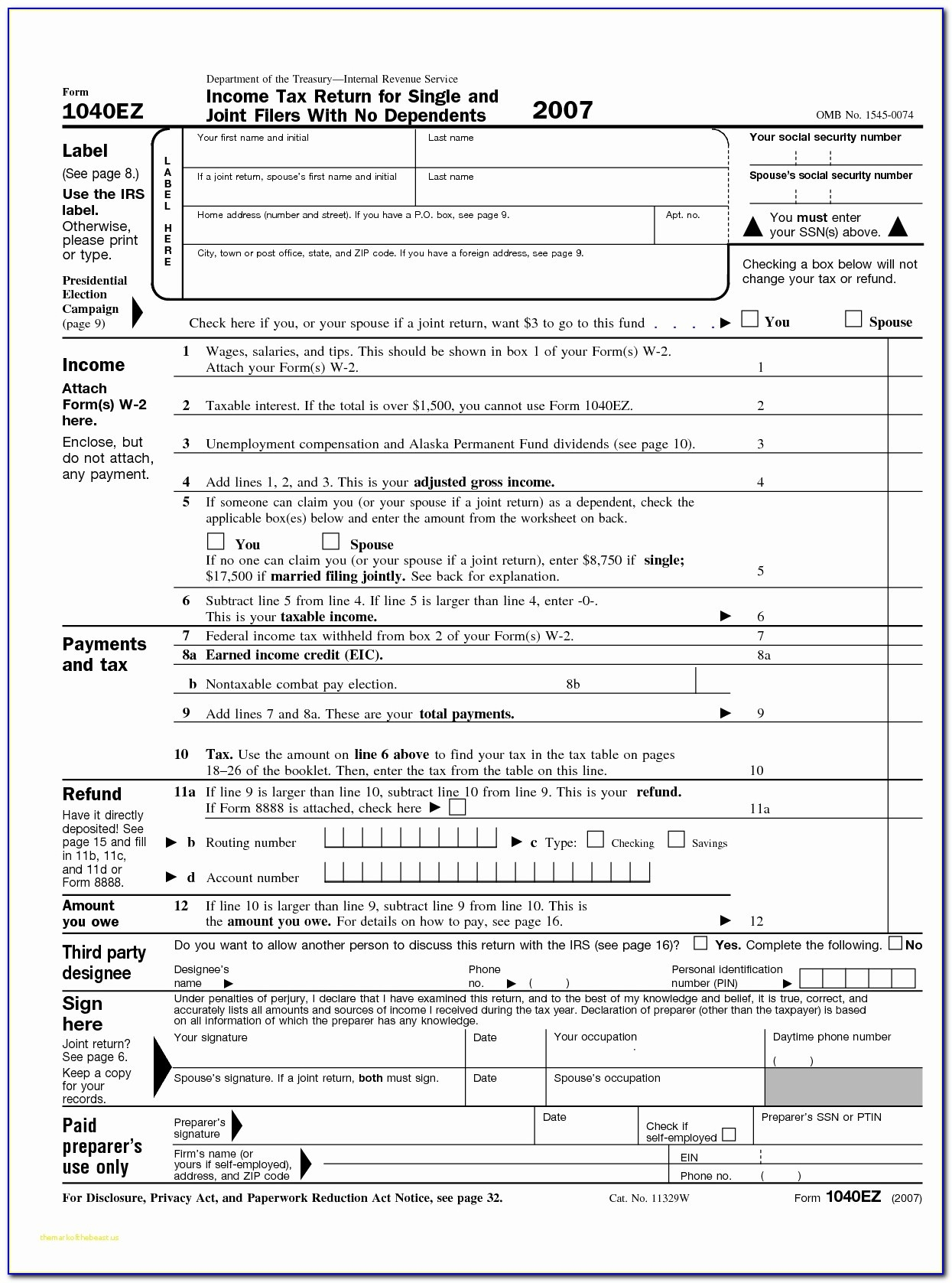

3. Form 1040: Individual Income Tax Return

The Form 1040 is the standard form used for personal income tax returns. This tax paper is used to report an individual’s income, deductions, and credits, as well as calculate their tax liability. The Form 1040 is typically due on April 15th of each year, and it is essential to submit accurate and complete information to avoid delays or penalties.

4. Form 1098: Mortgage Interest Statement

The Form 1098 is a tax paper provided by lenders to borrowers, reporting the amount of mortgage interest paid during the tax year. This document is essential for claiming the mortgage interest deduction, which can significantly reduce an individual’s tax liability. The Form 1098 is typically provided by January 31st of each year, and it is crucial to review the form carefully to ensure accuracy.

5. Form 8829: Expenses for Business Use of Your Home

The Form 8829 is a tax paper used to calculate the business use percentage of a home, which is essential for claiming the home office deduction. This form is typically used by self-employed individuals and businesses that use a home office for business purposes. The Form 8829 is used to calculate the business use percentage, which can be used to deduct a portion of rent or mortgage interest, utilities, and other expenses related to the home office.

📝 Note: It is essential to maintain accurate and organized records of these tax papers, as well as other relevant documents, to ensure a smooth and efficient tax filing process.

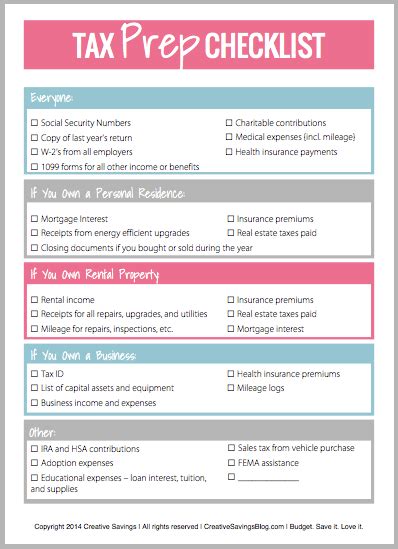

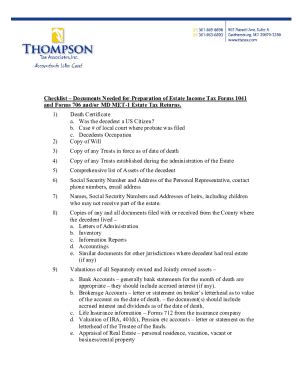

In addition to these five tax papers, there are other documents that may be required, depending on individual circumstances. For example, individuals with dependents may need to provide Form 2441: Child and Dependent Care Expenses, while businesses may need to provide Form 1120: Corporation Income Tax Return. It is crucial to consult with a tax professional or accountant to ensure that all necessary tax papers are completed and submitted accurately.

To further illustrate the importance of these tax papers, consider the following table:

| Tax Paper | Purpose | Due Date |

|---|---|---|

| W-2 Form | Reports annual wages and taxes withheld | January 31st |

| 1099 Form | Reports miscellaneous income | January 31st |

| Form 1040 | Reports individual income and calculates tax liability | April 15th |

| Form 1098 | Reports mortgage interest paid | January 31st |

| Form 8829 | Calculates business use percentage of a home | April 15th |

In summary, the five tax papers needed for filing taxes are the W-2 form, 1099 form, Form 1040, Form 1098, and Form 8829. These documents are essential for reporting income, claiming deductions, and complying with tax regulations. By maintaining accurate and organized records, individuals and businesses can ensure a smooth and efficient tax filing process.

What is the purpose of the W-2 form?

+

The W-2 form reports an employee’s annual wages, taxes withheld, and other relevant information, which is used to calculate an individual’s tax liability and determine their eligibility for tax credits and deductions.

What is the difference between a 1099 form and a W-2 form?

+

A 1099 form reports miscellaneous income, such as freelance work or consulting fees, while a W-2 form reports wages and taxes withheld from an employer.

Can I file my taxes without these five tax papers?

+

No, these five tax papers are essential for filing taxes accurately and efficiently. Without them, you may experience delays or issues with your tax return.