Paperwork Needed After Death

Introduction to Handling Paperwork After a Death

When a loved one passes away, it can be a difficult and emotional time for those left behind. In addition to dealing with the emotional impact of the loss, there are also numerous practical tasks that need to be handled, including managing the deceased person’s estate and handling various paperwork requirements. The specific documents and tasks involved can vary depending on the jurisdiction, the deceased person’s assets, and other factors, but there are some common pieces of paperwork that are typically required.

Notifying Relevant Parties

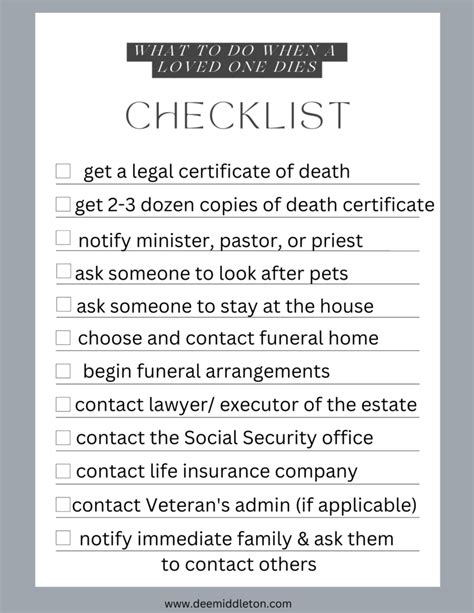

One of the first steps after a death is to notify relevant parties, including:

- Government agencies: Such as the Social Security Administration, if the deceased was receiving benefits.

- Banks and financial institutions: To freeze accounts and begin the process of managing the estate.

- Credit card companies: To inform them of the death and prevent unauthorized use.

- Insurance companies: For life insurance policies, health insurance, and any other relevant policies.

- Employer or pension fund: If the deceased was working or receiving a pension.

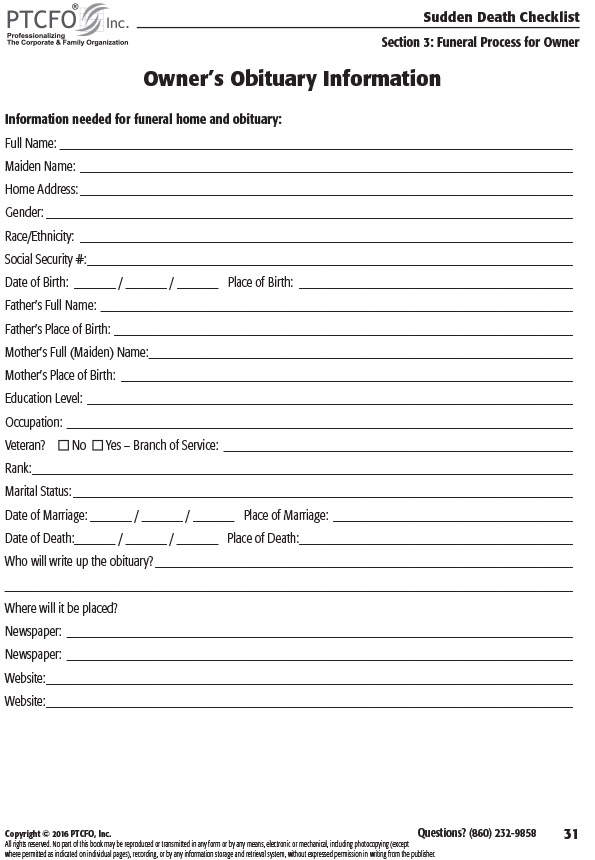

Gathering Necessary Documents

Several documents are essential for managing the estate and completing necessary paperwork. These may include:

- The will: If the deceased left a will, it outlines how they wanted their assets to be distributed.

- Death certificate: Officially proves the death and is required for various legal and administrative tasks.

- Birth certificate: May be needed for certain inheritances or benefits.

- Marriage certificate: If applicable, for spousal benefits or inheritances.

- Life insurance policies: To claim life insurance benefits.

- Titles and deeds: For vehicles, properties, and other assets.

- Bank statements and financial records: To understand the deceased’s financial situation and manage their estate.

Tax Considerations

After a death, there are also tax implications to consider. This may involve:

- Filing the deceased’s final tax return: To report income earned up to the date of death.

- Estate tax returns: If the estate’s value exceeds the threshold for estate taxes, a return must be filed.

- Income tax on inheritances: Beneficiaries may need to report income from inheritances, such as interest from inherited accounts.

Probate Process

If the deceased had assets that were not jointly owned or did not have a beneficiary designation (such as a will, trust, or certain types of accounts), the estate may need to go through probate. Probate is the legal process by which a court oversees the distribution of the deceased’s assets according to their will or state intestacy laws if there is no will. The probate process involves:

- Filing the will with the court: If there is a will, it must be submitted to the probate court.

- Appointing an executor or administrator: The court appoints someone to manage the estate, either as specified in the will (executor) or appointed by the court if there is no will (administrator).

- Inventorying the estate’s assets: The executor or administrator must list all assets and their values.

- Paying debts and taxes: Before distributing assets, the estate’s debts and taxes must be paid.

- Distributing assets: Finally, the remaining assets are distributed according to the will or state laws.

Other Considerations

There are several other tasks and considerations when handling paperwork after a death, including:

- Closing social media and email accounts: To protect the deceased’s privacy and prevent fraudulent use.

- Notifying clubs, organizations, and subscription services: To stop unwanted deliveries and membership fees.

- Managing the deceased’s digital legacy: This may include preserving or deleting online content and accounts.

- Seeking support: Handling the paperwork and emotional aftermath of a death can be overwhelming; seeking support from professionals, friends, and family can be crucial.

📝 Note: The specific steps and requirements can vary significantly depending on local laws and the individual circumstances of the deceased. It's often helpful to consult with a professional, such as an attorney or financial advisor, to ensure all necessary tasks are completed correctly and efficiently.

In the end, managing the paperwork after a death requires attention to detail, patience, and often professional guidance. By understanding the necessary steps and seeking help when needed, individuals can navigate this complex process with greater ease, ensuring that the deceased’s affairs are handled with dignity and respect. The process of handling a loved one’s estate is a significant responsibility, but with the right approach, it can be managed in a way that honors their memory and secures the well-being of their beneficiaries.

What are the first steps to take after a death in terms of paperwork?

+

The first steps include notifying relevant parties such as government agencies, banks, credit card companies, insurance providers, and the employer or pension fund. Gathering necessary documents like the will, death certificate, and financial records is also crucial.

What is the purpose of the probate process?

+

The probate process is used to validate the will (if there is one), appoint an executor or administrator to manage the estate, inventory the estate’s assets, pay debts and taxes, and finally distribute the remaining assets according to the will or state laws.

Why is it important to notify credit card companies and banks after a death?

+

Notifying these entities helps prevent identity theft and ensures that the deceased’s accounts are properly managed or closed, preventing unauthorized transactions and further complications for the estate and its beneficiaries.