5 Tips 1099 Texas

Understanding 1099 Tax Forms in Texas: A Comprehensive Guide

As a freelancer or independent contractor in Texas, receiving a 1099 tax form is a crucial part of your tax obligations. The 1099 form is used to report income earned from sources other than employment, such as freelancing, consulting, or contract work. In this article, we will delve into the world of 1099 tax forms in Texas, exploring what they are, how to handle them, and providing valuable tips for navigating the tax landscape as a freelancer or independent contractor.

What is a 1099 Tax Form?

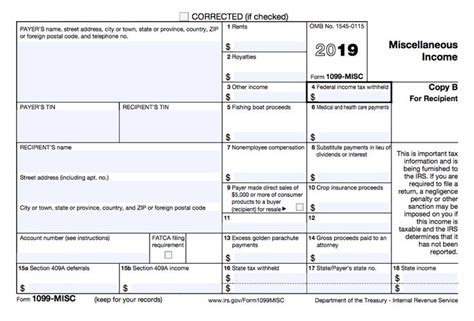

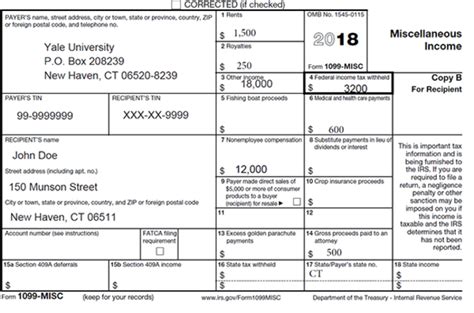

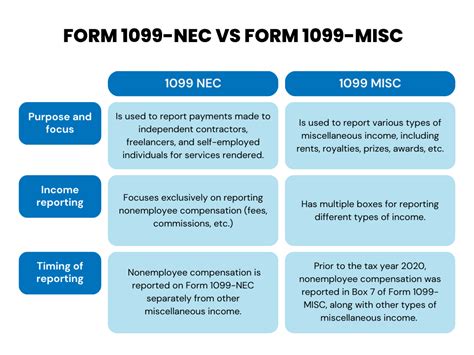

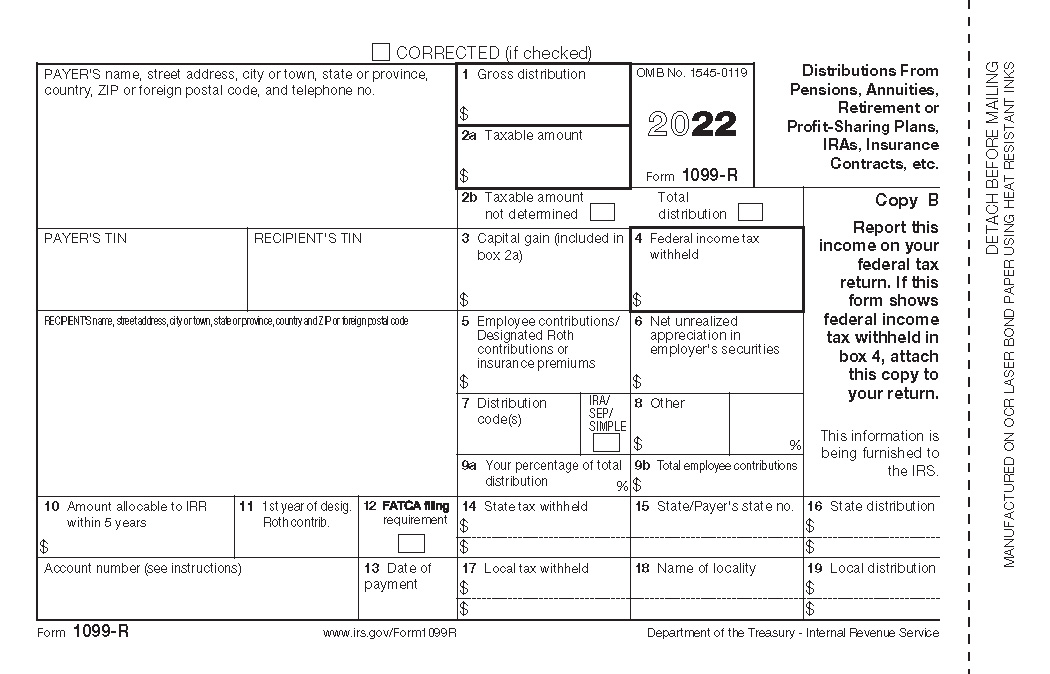

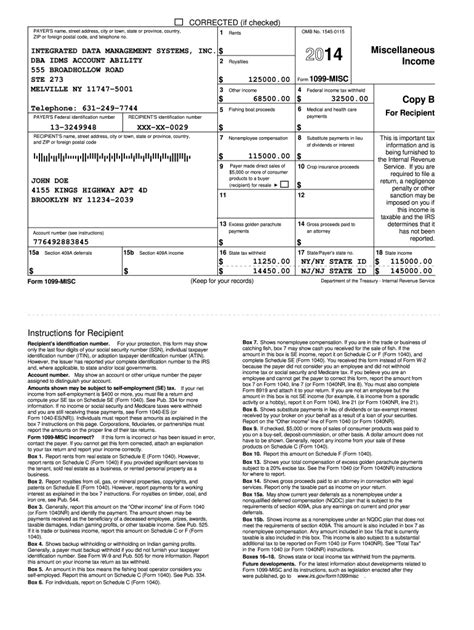

A 1099 tax form is a series of documents used to report various types of income earned by individuals who are not considered employees. The most common types of 1099 forms include: * 1099-MISC: Used to report miscellaneous income, such as freelance work, consulting fees, and rent. * 1099-INT: Used to report interest income, such as interest earned from savings accounts or investments. * 1099-DIV: Used to report dividend income, such as dividends earned from stock ownership. In Texas, as in other states, the IRS requires businesses to issue 1099 forms to individuals who have earned $600 or more in a calendar year.

5 Tips for Handling 1099 Tax Forms in Texas

As a freelancer or independent contractor in Texas, it’s essential to understand how to handle 1099 tax forms to ensure you’re meeting your tax obligations. Here are five valuable tips: * Tip 1: Keep Accurate Records: Keep detailed records of your income and expenses throughout the year. This will help you accurately report your income on your tax return and ensure you’re taking advantage of all eligible deductions. * Tip 2: Understand Your Tax Obligations: As a freelancer or independent contractor, you’re considered self-employed and are required to pay self-employment taxes. This means you’ll need to report your income and expenses on your tax return and pay taxes on your net earnings from self-employment. * Tip 3: Take Advantage of Deductions: As a freelancer or independent contractor, you may be eligible for various deductions, such as home office deductions, business use of your car, and equipment expenses. Keep accurate records of your expenses to ensure you’re taking advantage of all eligible deductions. * Tip 4: Make Quarterly Estimated Tax Payments: As a freelancer or independent contractor, you’re required to make quarterly estimated tax payments to the IRS. This will help you avoid penalties and interest on your tax bill. * Tip 5: Consult a Tax Professional: If you’re unsure about how to handle your 1099 tax forms or have questions about your tax obligations, consider consulting a tax professional. They can provide valuable guidance and help you navigate the complex tax landscape.

Additional Resources

For more information on 1099 tax forms in Texas, you can visit the IRS website or consult with a tax professional. Additionally, you can use the following resources to help you navigate the tax landscape:

| Resource | Description |

|---|---|

| IRS Website | The official website of the Internal Revenue Service, providing information on tax forms, tax obligations, and more. |

| Texas Comptroller Website | The official website of the Texas Comptroller, providing information on state taxes, tax forms, and more. |

| Tax Professional | A professional who can provide guidance on tax obligations, tax planning, and more. |

📝 Note: It's essential to keep accurate records of your income and expenses throughout the year to ensure you're meeting your tax obligations and taking advantage of all eligible deductions.

As you navigate the complex world of 1099 tax forms in Texas, remember to keep accurate records, understand your tax obligations, and take advantage of deductions. By following these tips and seeking guidance from a tax professional when needed, you’ll be well on your way to ensuring you’re meeting your tax obligations and maximizing your earnings as a freelancer or independent contractor. In the end, it’s all about being proactive and taking control of your finances to achieve success in your career.

What is a 1099 tax form?

+

A 1099 tax form is a series of documents used to report various types of income earned by individuals who are not considered employees.

Who is required to receive a 1099 tax form?

+

Individuals who have earned $600 or more in a calendar year from a business are required to receive a 1099 tax form.

What are the different types of 1099 tax forms?

+

The most common types of 1099 tax forms include 1099-MISC, 1099-INT, and 1099-DIV.