Paperwork

New Employee Paperwork Requirements

Introduction to New Employee Paperwork Requirements

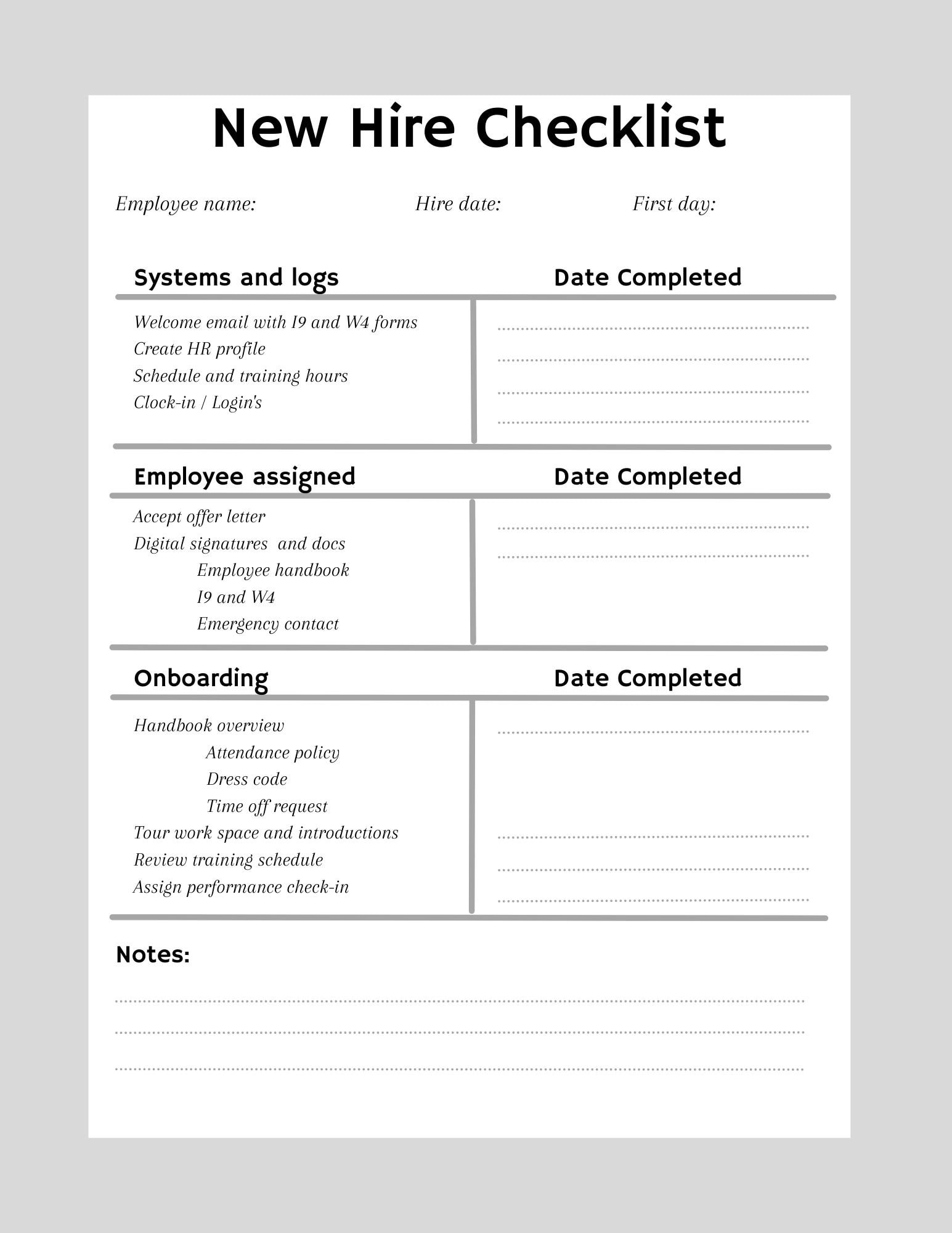

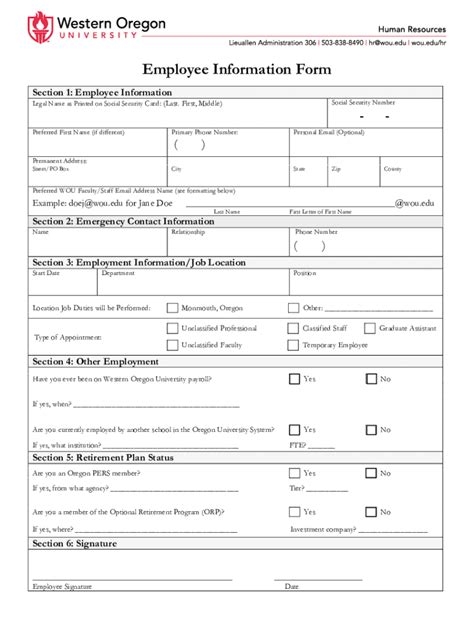

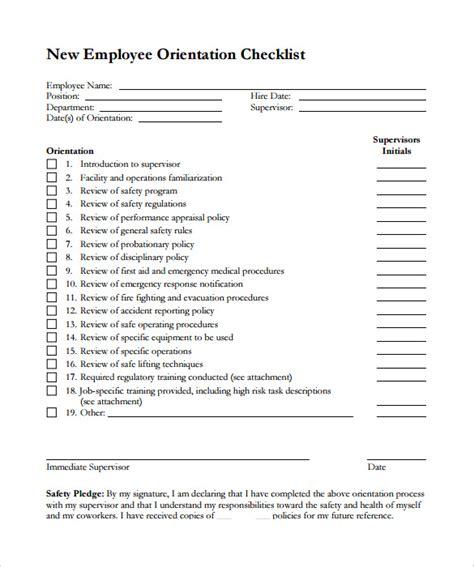

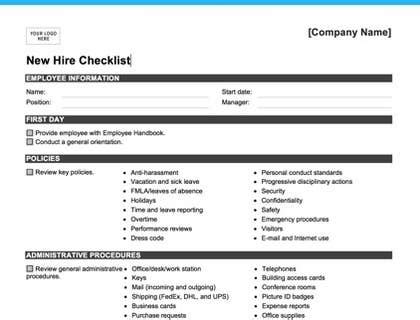

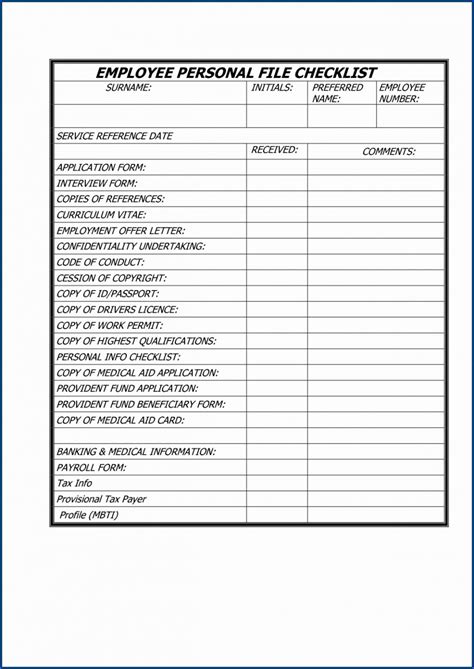

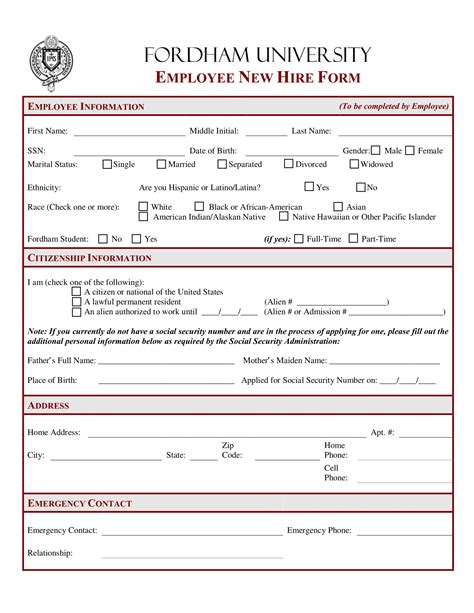

When a new employee joins an organization, there are various paperwork requirements that must be completed to ensure a smooth and compliant onboarding process. These requirements may vary depending on the country, state, or industry, but they generally include a range of documents that verify the employee’s identity, eligibility to work, and tax status. In this article, we will explore the common paperwork requirements for new employees and provide guidance on how to complete them efficiently.

Pre-Employment Documents

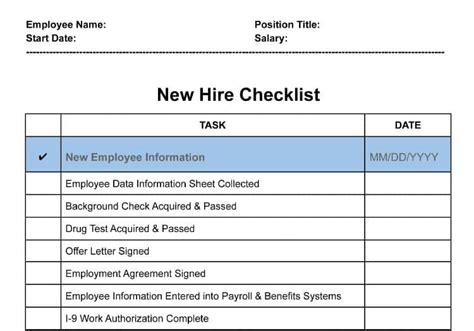

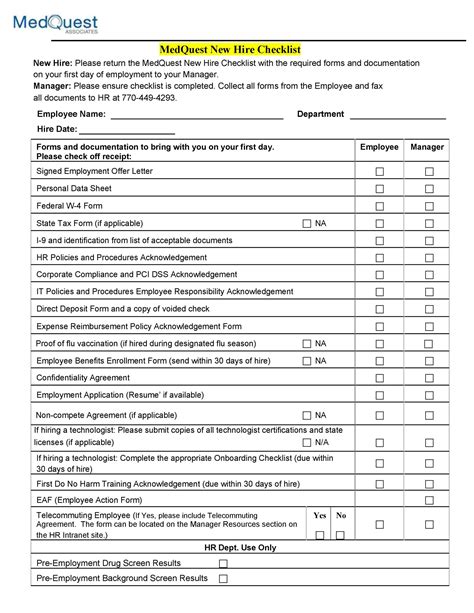

Before a new employee starts work, they are typically required to complete a range of pre-employment documents. These may include: * Job application form: This is usually the first document that a new employee completes, and it provides basic information about their qualifications, experience, and contact details. * Resume and cover letter: Many employers require new employees to submit a resume and cover letter as part of the application process. * Reference checks: Some employers may require new employees to provide professional references, which can be contacted to verify their previous work experience and qualifications. * Background checks: Depending on the industry or job role, new employees may be required to undergo background checks, which can include criminal history checks, credit checks, or other types of screening.

Employment Eligibility Verification

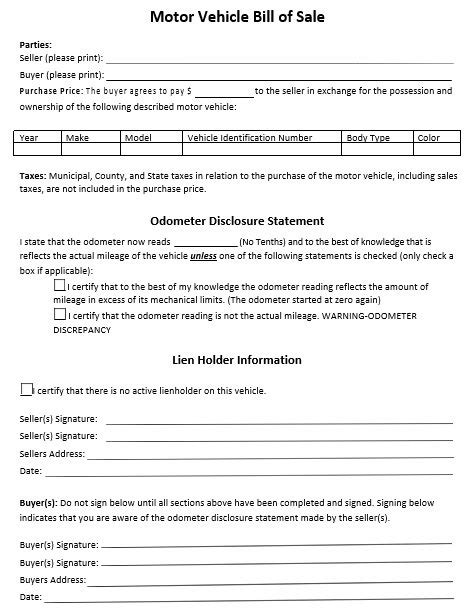

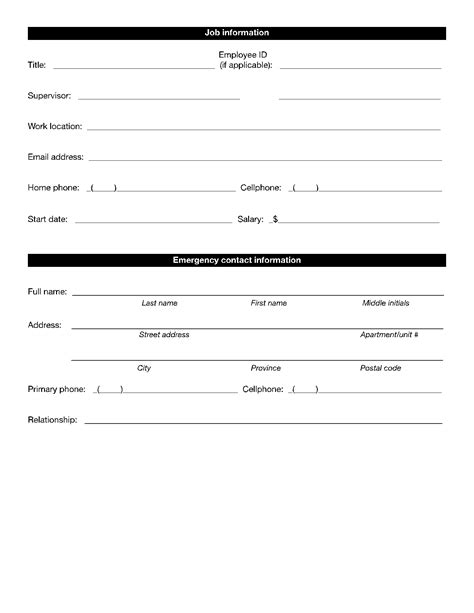

One of the most important paperwork requirements for new employees is the employment eligibility verification process. This involves completing a form, usually a Form I-9, which verifies the employee’s identity and eligibility to work in the country. The Form I-9 requires new employees to provide documentation, such as a passport, driver’s license, or social security card, to prove their identity and work authorization.

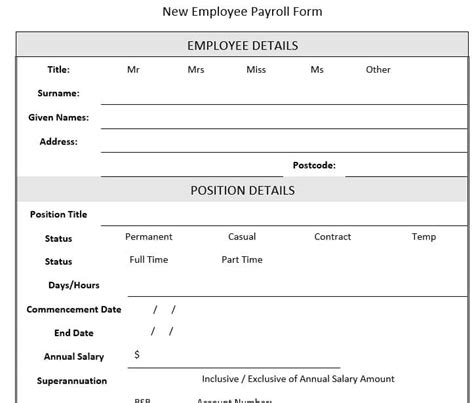

Tax-Related Documents

New employees are also required to complete tax-related documents, which include: * W-4 form: This form is used to determine the amount of federal income tax to be withheld from the employee’s wages. * State tax withholding form: Depending on the state, new employees may be required to complete a state tax withholding form, which determines the amount of state income tax to be withheld. * Benefits enrollment forms: Many employers offer benefits, such as health insurance, retirement plans, or life insurance, which require new employees to complete enrollment forms.

Other Paperwork Requirements

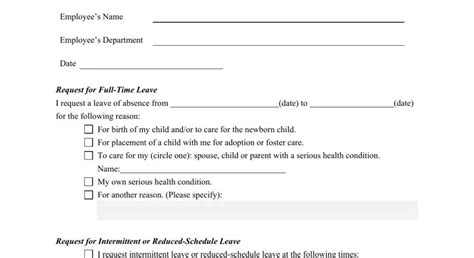

In addition to the above documents, new employees may be required to complete other paperwork, such as: * Employee handbook acknowledgement: This document acknowledges that the new employee has received and read the employee handbook, which outlines the company’s policies and procedures. * Confidentiality agreement: Some employers may require new employees to sign a confidentiality agreement, which protects the company’s confidential information and trade secrets. * Non-compete agreement: Depending on the industry or job role, new employees may be required to sign a non-compete agreement, which restricts their ability to work for a competitor or start a similar business.

📝 Note: The specific paperwork requirements may vary depending on the country, state, or industry, so it's essential to check with the relevant authorities or consult with an HR expert to ensure compliance.

Best Practices for Completing New Employee Paperwork

To ensure a smooth and efficient onboarding process, employers should follow best practices when completing new employee paperwork. These include: * Using electronic forms: Electronic forms can streamline the paperwork process and reduce errors. * Providing clear instructions: Employers should provide clear instructions and guidance on how to complete the paperwork requirements. * Allowing sufficient time: New employees should be given sufficient time to complete the paperwork requirements, and employers should be flexible and accommodating if issues arise. * Verifying documentation: Employers should verify the documentation provided by new employees to ensure compliance with relevant laws and regulations.

| Document | Purpose | Required By |

|---|---|---|

| Form I-9 | Employment eligibility verification | U.S. Citizenship and Immigration Services |

| W-4 form | Federal income tax withholding | Internal Revenue Service |

| State tax withholding form | State income tax withholding | State tax authority |

Conclusion and Next Steps

In conclusion, new employee paperwork requirements are an essential part of the onboarding process, and employers must ensure that they comply with relevant laws and regulations. By following best practices and using electronic forms, employers can streamline the paperwork process and reduce errors. New employees should be given sufficient time to complete the paperwork requirements, and employers should be flexible and accommodating if issues arise. By prioritizing compliance and efficiency, employers can ensure a smooth and successful onboarding process for their new employees.

What is the purpose of the Form I-9?

+

The Form I-9 is used to verify the identity and employment eligibility of new employees in the United States.

What documents are required for tax-related paperwork?

+

The W-4 form and state tax withholding form are typically required for tax-related paperwork, although the specific requirements may vary depending on the state or industry.

How can employers ensure compliance with new employee paperwork requirements?

+

Employers can ensure compliance by using electronic forms, providing clear instructions, and verifying documentation, as well as consulting with HR experts or relevant authorities if necessary.