7 Tax Papers Needed

Introduction to Tax Papers

When it comes to managing your finances, one of the most crucial aspects is understanding and preparing your tax papers. Tax papers are essential documents that provide the necessary information for filing your taxes, and they play a significant role in ensuring you comply with tax laws and regulations. In this article, we will discuss the 7 tax papers needed for individuals and businesses to ensure a smooth tax filing process.

Understanding Tax Papers

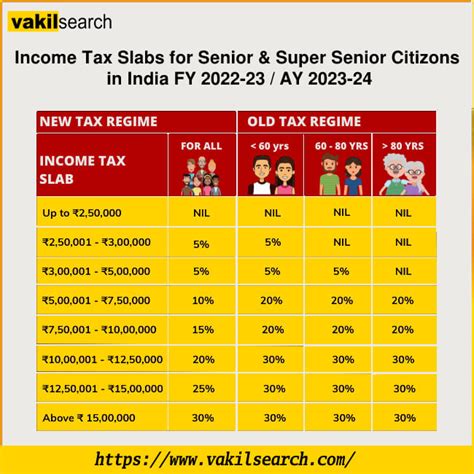

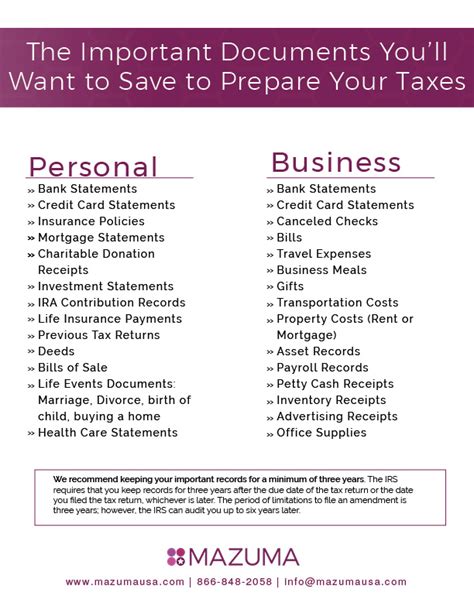

Tax papers can be categorized into two main types: personal tax papers and business tax papers. Personal tax papers are required for individuals to file their tax returns, while business tax papers are necessary for companies to report their income and expenses. The tax papers needed may vary depending on your filing status, income level, and business type. It is essential to understand which tax papers are required to avoid any penalties or fines.

7 Tax Papers Needed

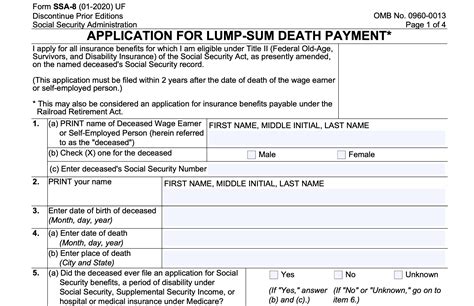

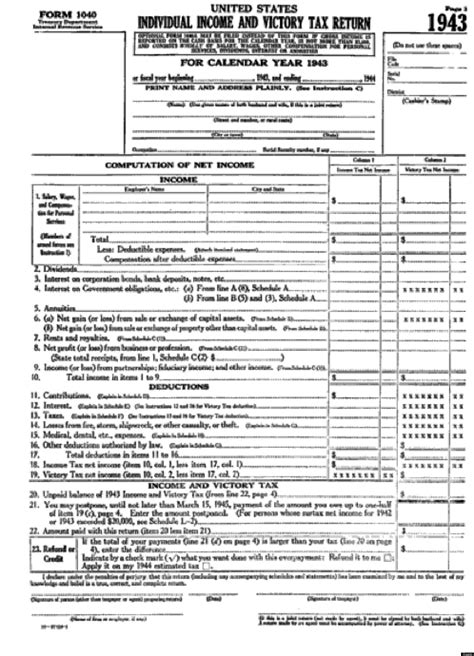

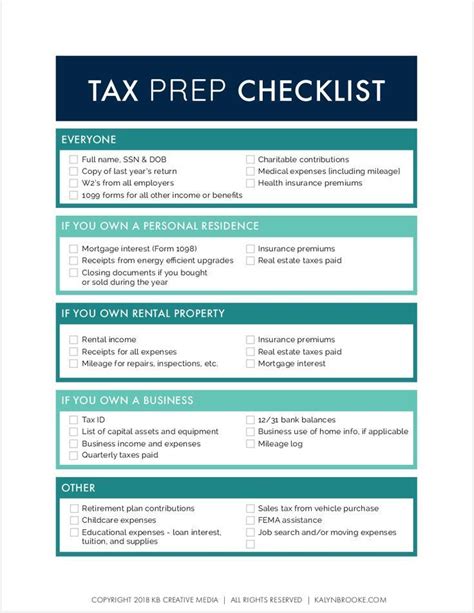

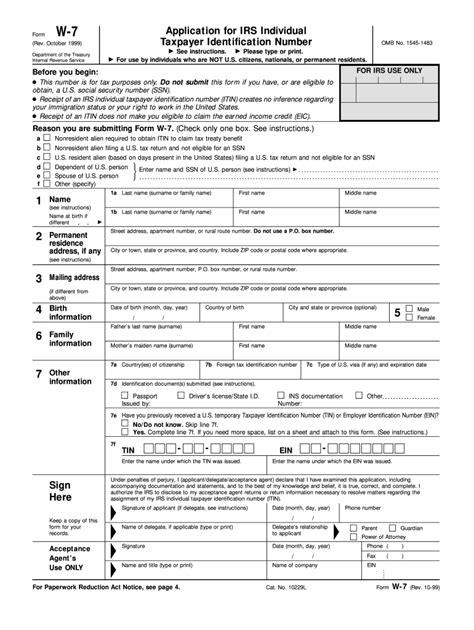

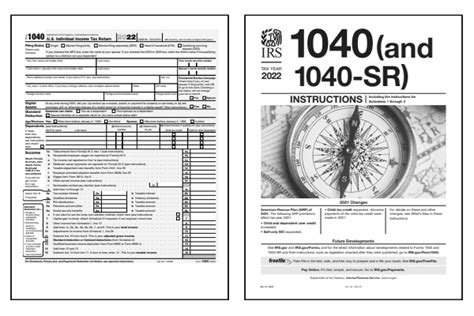

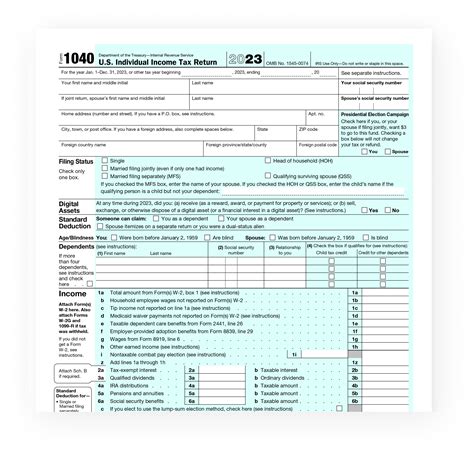

Here are the 7 tax papers needed for individuals and businesses: * Form W-2: This form is used to report your income and taxes withheld from your employer. * Form 1099: This form is used to report income from freelance work, investments, or other sources. * Form 1040: This is the standard form used for personal tax returns. * Schedule C: This form is used to report business income and expenses for sole proprietors. * Form 1120: This form is used for corporate tax returns. * Form 8949: This form is used to report sales and other dispositions of capital assets. * Form 4868: This form is used to apply for an automatic extension of time to file your tax return.

Importance of Tax Papers

Tax papers are essential for ensuring you comply with tax laws and regulations. They provide the necessary information for filing your taxes, and they help you claim deductions and credits. Without the required tax papers, you may face penalties, fines, or even audits. It is crucial to keep accurate and up-to-date records of your tax papers to avoid any issues during the tax filing process.

How to Obtain Tax Papers

You can obtain tax papers from various sources, including: * Your employer * The IRS website * Tax preparation software * A tax professional It is essential to ensure you receive the correct tax papers and that they are accurate and complete.

💡 Note: Always keep a copy of your tax papers for your records, and ensure you understand what each form is used for to avoid any mistakes or errors.

Tax Paper Organization

Organizing your tax papers is crucial to ensure a smooth tax filing process. You can use a tax organizer or a spreadsheet to keep track of your tax papers and deadlines. It is also essential to keep your tax papers up-to-date and to review them regularly to ensure accuracy and completeness.

| Tax Paper | Purpose |

|---|---|

| Form W-2 | Report income and taxes withheld |

| Form 1099 | Report income from freelance work or investments |

| Form 1040 | Personal tax return |

| Schedule C | Report business income and expenses |

| Form 1120 | Corporate tax return |

| Form 8949 | Report sales and other dispositions of capital assets |

| Form 4868 | Apply for an automatic extension of time to file tax return |

In summary, understanding and preparing the necessary tax papers is essential for a smooth tax filing process. The 7 tax papers needed, including Form W-2, Form 1099, Form 1040, Schedule C, Form 1120, Form 8949, and Form 4868, provide the necessary information for filing your taxes and claiming deductions and credits. It is crucial to keep accurate and up-to-date records of your tax papers and to organize them effectively to avoid any issues during the tax filing process.

What is the purpose of Form W-2?

+

Form W-2 is used to report your income and taxes withheld from your employer.

What is the difference between Form 1099 and Form W-2?

+

Form 1099 is used to report income from freelance work or investments, while Form W-2 is used to report income and taxes withheld from an employer.

How do I obtain tax papers?

+

You can obtain tax papers from various sources, including your employer, the IRS website, tax preparation software, or a tax professional.