Paperwork

Mortgage Lender Paperwork Requirements

Introduction to Mortgage Lender Paperwork Requirements

When applying for a mortgage, one of the most critical aspects of the process is gathering and submitting the required paperwork. Mortgage lenders need various documents to assess the borrower’s creditworthiness and ensure that they can afford the loan. The paperwork requirements may vary depending on the lender, loan type, and borrower’s circumstances. In this article, we will delve into the common mortgage lender paperwork requirements, providing an overview of the necessary documents and the reasons behind their necessity.

Understanding the Importance of Paperwork in Mortgage Applications

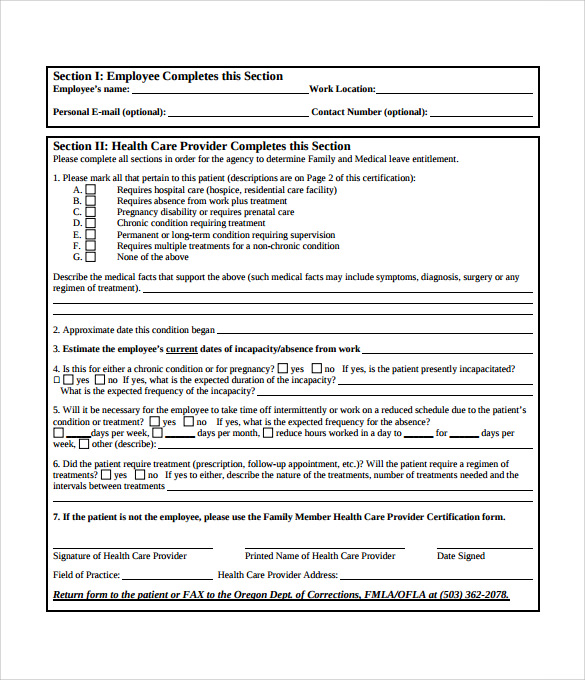

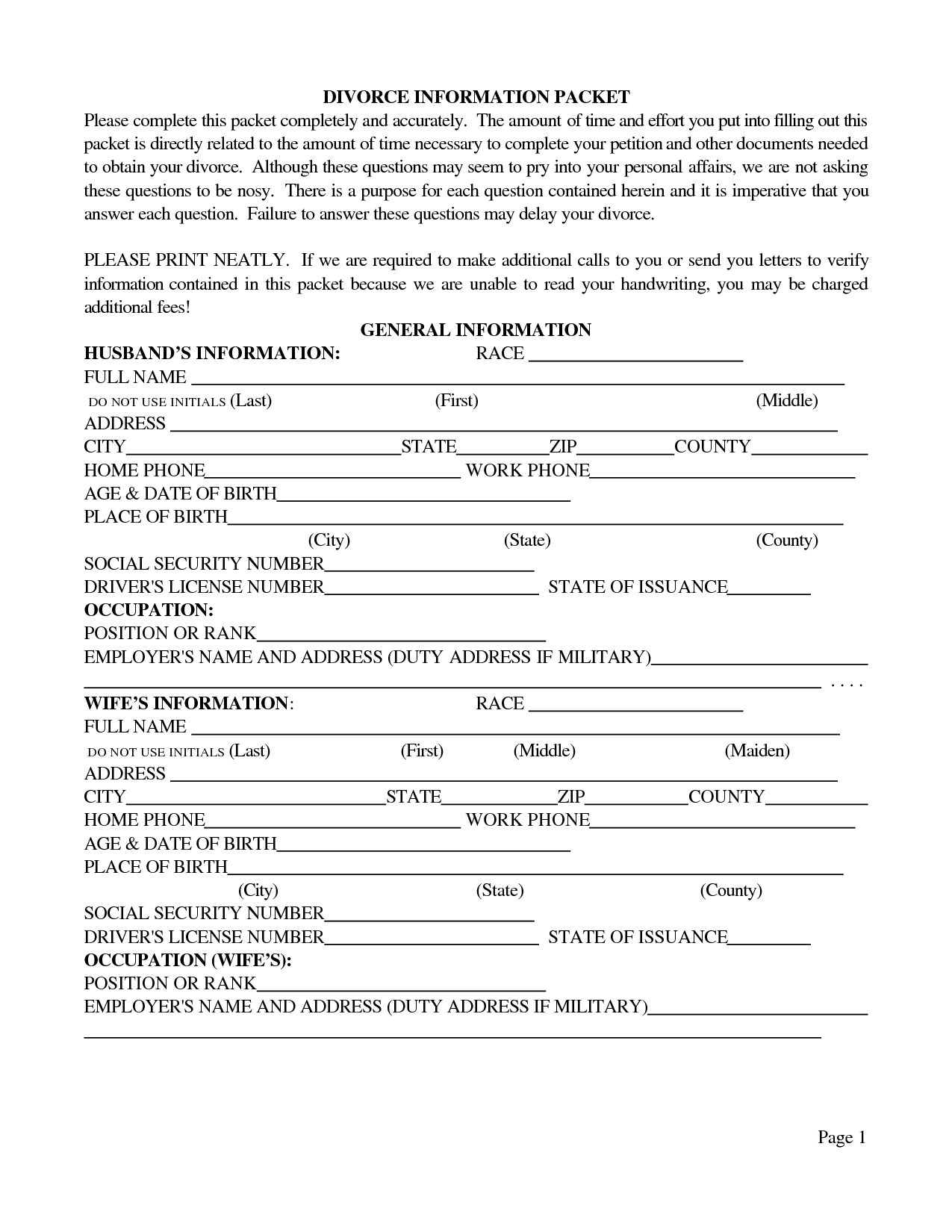

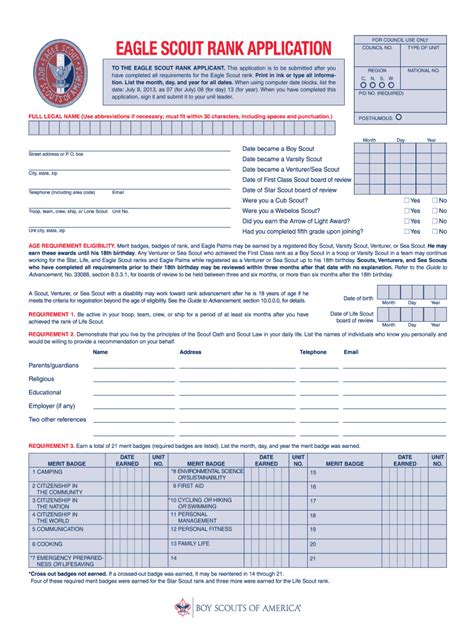

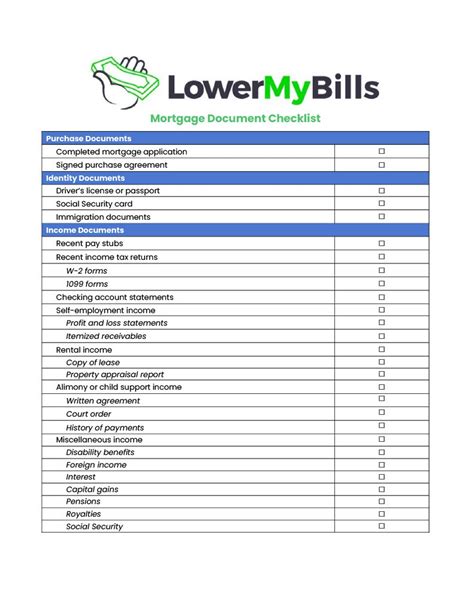

The primary purpose of the paperwork is to provide the lender with a comprehensive understanding of the borrower’s financial situation, including their income, credit history, employment status, and assets. This information enables the lender to evaluate the risk associated with lending and make an informed decision about the loan application. The required documents may include: * Identification documents (e.g., passport, driver’s license) * Proof of income (e.g., pay stubs, tax returns) * Bank statements * Credit reports * Employment verification * Asset documentation (e.g., investment accounts, retirement accounts)

Breaking Down the Common Paperwork Requirements

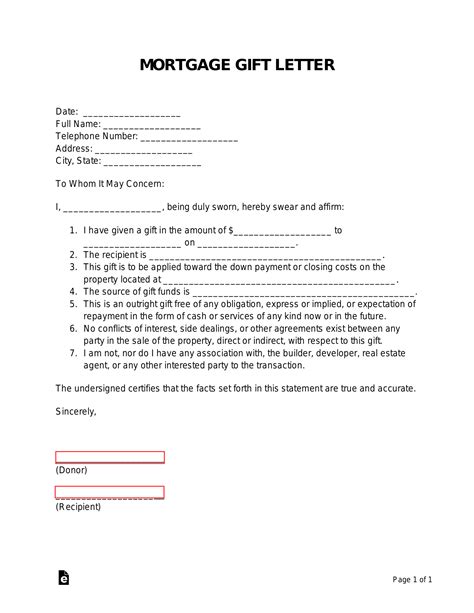

Here is a more detailed look at the common paperwork requirements for mortgage applications: * Identification documents: These documents are used to verify the borrower’s identity and may include a passport, driver’s license, or state ID. * Proof of income: Lenders require proof of income to ensure that the borrower can afford the monthly mortgage payments. This may include pay stubs, tax returns, or letters from employers. * Bank statements: Bank statements provide an overview of the borrower’s financial situation, including their account balances, transactions, and credit history. * Credit reports: Credit reports are used to evaluate the borrower’s creditworthiness and may include information about their credit score, payment history, and outstanding debts. * Employment verification: Lenders may require verification of the borrower’s employment status, including their job title, salary, and length of employment. * Asset documentation: Asset documentation, such as investment accounts or retirement accounts, may be required to demonstrate the borrower’s financial stability and ability to afford the loan.

Additional Paperwork Requirements for Specific Loan Types

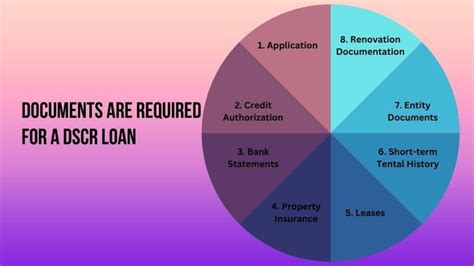

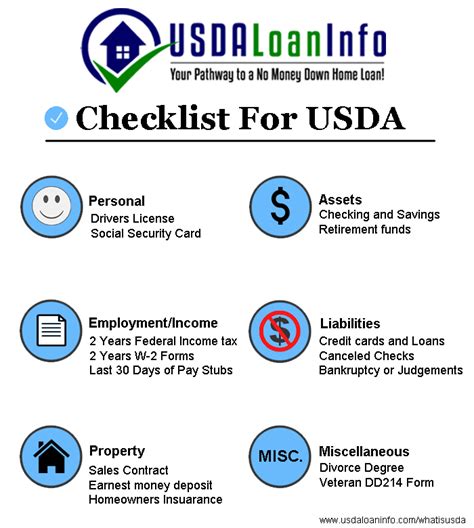

Some loan types may require additional paperwork, such as: * FHA loans: FHA loans may require additional documentation, including a Uniform Residential Loan Application and a credit report. * VA loans: VA loans may require a Certificate of Eligibility and a DD Form 214 (discharge paperwork). * USDA loans: USDA loans may require additional documentation, including a rural area eligibility determination and a credit report.

Streamlining the Paperwork Process

To streamline the paperwork process, borrowers can take several steps: * Gather all necessary documents before submitting the loan application * Review and understand the required paperwork and the reasons behind their necessity * Use online platforms to submit and track the paperwork * Communicate effectively with the lender and other parties involved in the process

💡 Note: Borrowers should ensure that they understand the paperwork requirements and the reasons behind their necessity to avoid delays or complications in the loan application process.

Conclusion and Final Thoughts

In conclusion, the mortgage lender paperwork requirements are a critical aspect of the loan application process. By understanding the necessary documents and the reasons behind their necessity, borrowers can streamline the process and increase their chances of approval. It is essential to gather all required documents, review and understand the paperwork, and communicate effectively with the lender to ensure a smooth and successful loan application process.

What are the common paperwork requirements for mortgage applications?

+

The common paperwork requirements for mortgage applications include identification documents, proof of income, bank statements, credit reports, employment verification, and asset documentation.

Why are credit reports necessary for mortgage applications?

+

Credit reports are necessary for mortgage applications to evaluate the borrower’s creditworthiness and assess the risk associated with lending.

Can I apply for a mortgage online and submit the required paperwork electronically?

+

Yes, many lenders offer online mortgage applications and allow borrowers to submit the required paperwork electronically, streamlining the process and reducing paperwork.