Paperwork

7 Years To Keep Papers

Introduction to Document Retention

When it comes to keeping papers and documents, many individuals and businesses are unsure about how long they should retain them. The general rule of thumb is to keep papers for at least 7 years to ensure compliance with legal and financial requirements. However, this timeframe may vary depending on the type of document, its significance, and the industry or jurisdiction in question.

Understanding the 7-Year Rule

The 7-year rule is a common guideline for retaining financial documents, tax returns, and other important papers. This period allows individuals and businesses to maintain a record of their financial transactions, income, and expenses, which can be useful for audits, tax purposes, and other financial inquiries. During this time, it is essential to keep documents organized, easily accessible, and secure to prevent loss, damage, or unauthorized access.

Types of Documents to Keep

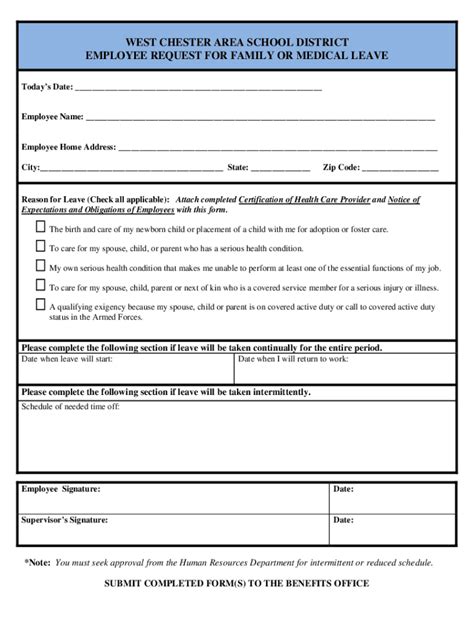

There are various types of documents that should be kept for at least 7 years, including: * Tax returns: Keep copies of tax returns, including W-2 forms, 1099 forms, and other supporting documents. * Financial statements: Retain financial statements, such as bank statements, investment accounts, and loan documents. * Receipts and invoices: Keep receipts and invoices for major purchases, business expenses, and tax-deductible items. * Contracts and agreements: Store contracts, agreements, and other legal documents related to business, employment, or personal matters. * Insurance policies: Maintain records of insurance policies, including health, life, and property insurance.

Best Practices for Document Retention

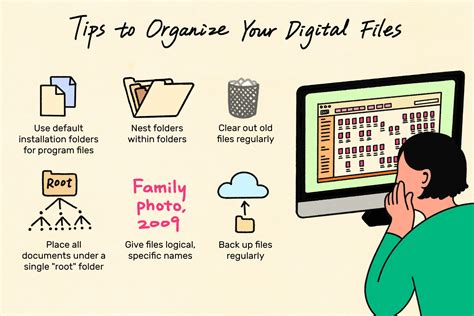

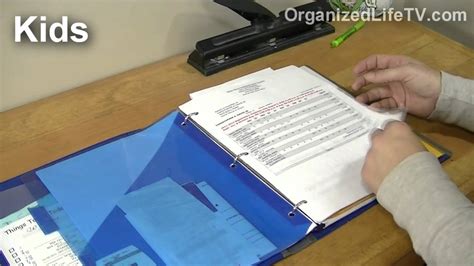

To ensure effective document retention, follow these best practices: * Create a centralized filing system: Designate a specific area or digital platform for storing documents. * Use secure storage: Keep documents in a secure, fireproof safe or a locked cabinet to prevent unauthorized access. * Label and categorize documents: Organize documents using clear labels and categories to facilitate easy retrieval. * Consider digital storage: Scan and store documents electronically to reduce physical storage space and enhance accessibility. * Regularly review and update documents: Periodically review documents to ensure they are up-to-date, accurate, and still relevant.

Electronic Document Storage

With the advancement of technology, electronic document storage has become a popular option for individuals and businesses. Digital storage offers several benefits, including: * Convenience: Easily access and retrieve documents from any location. * Space-saving: Reduce physical storage space and minimize clutter. * Security: Enhance document security with encryption, passwords, and access controls. * Cost-effective: Reduce costs associated with physical storage, printing, and maintenance.

| Document Type | Retention Period |

|---|---|

| Tax returns | 7 years |

| Financial statements | 7 years |

| Receipts and invoices | 3-7 years |

| Contracts and agreements | 7-10 years |

| Insurance policies | 永久 |

📝 Note: The retention periods listed in the table are general guidelines and may vary depending on the specific document, industry, or jurisdiction.

Conclusion and Key Takeaways

In summary, keeping papers and documents for at least 7 years is a good rule of thumb to ensure compliance with legal and financial requirements. By understanding the types of documents to keep, following best practices for document retention, and considering electronic storage options, individuals and businesses can maintain accurate, organized, and secure records. Remember to regularly review and update documents to ensure they remain relevant and useful.

What types of documents should I keep for 7 years?

+

You should keep tax returns, financial statements, receipts and invoices, contracts and agreements, and insurance policies for at least 7 years.

Can I store documents electronically?

+

Yes, electronic document storage is a convenient and secure option for storing documents. Consider using cloud storage or digital filing systems to reduce physical storage space and enhance accessibility.

How long should I keep insurance policies?

+

You should keep insurance policies permanently, as they provide important information about your coverage and benefits.