5 Refinance Papers

Understanding Refinance Papers

Refinancing a mortgage involves replacing an existing loan with a new one, often to take advantage of lower interest rates, switch from an adjustable-rate to a fixed-rate loan, or tap into home equity. The process requires a series of documents, collectively known as refinance papers, which are essential for completing the transaction. These papers serve as legal agreements and provide detailed information about the loan terms, borrower obligations, and lender requirements.

Types of Refinance Papers

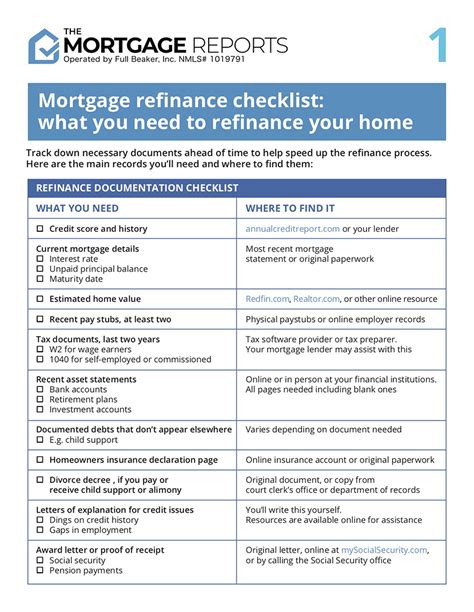

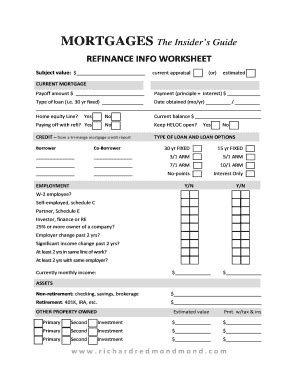

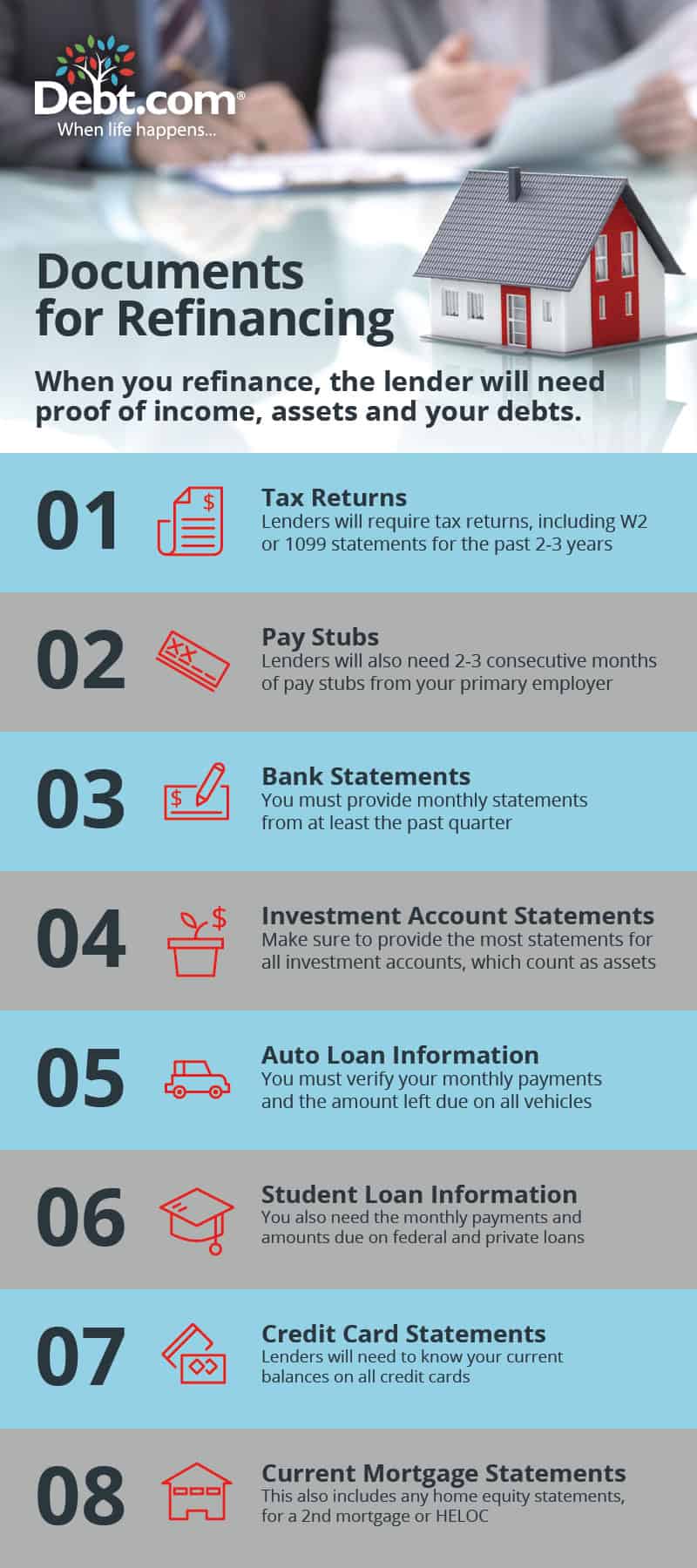

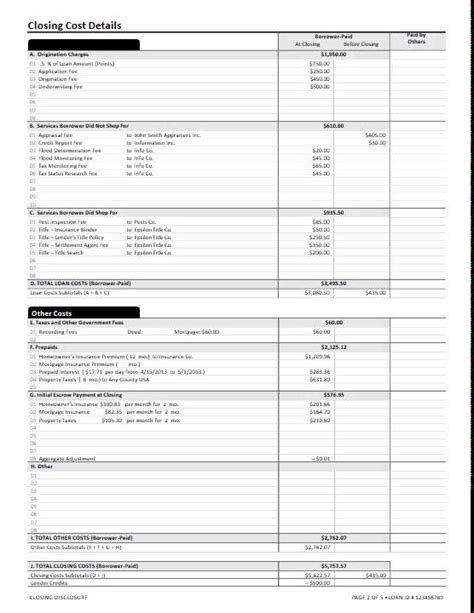

There are several types of refinance papers that borrowers must review and sign during the refinancing process. These include: * Loan Application: The initial document that starts the refinancing process, where borrowers provide personal and financial information to the lender. * Good Faith Estimate (GFE): A document that outlines the estimated costs associated with the loan, including interest rates, fees, and closing costs. * Truth-in-Lending (TIL) Disclosure: A document that provides a detailed breakdown of the loan terms, including the annual percentage rate (APR), finance charges, and total payments. * Loan Estimate: A document that replaces the GFE and TIL, providing a detailed estimate of the loan terms and costs. * Closing Disclosure: A document that outlines the final loan terms, including the interest rate, monthly payments, and closing costs.

Refinancing Process

The refinancing process typically involves the following steps: * Pre-approval: Borrowers submit a loan application and provide financial information to the lender, who then issues a pre-approval letter stating the loan amount and interest rate. * Loan Processing: The lender reviews the loan application, orders an appraisal, and verifies the borrower’s credit and income. * Underwriting: The lender evaluates the loan application and makes a final decision on the loan approval. * Closing: The borrower signs the refinance papers, and the loan is funded.

Key Components of Refinance Papers

Refinance papers typically include the following key components: * Loan Terms: The interest rate, loan amount, repayment term, and monthly payments. * Fees and Charges: The costs associated with the loan, including origination fees, discount points, and closing costs. * Collateral: The property being used as security for the loan. * Default and Acceleration: The consequences of failing to make payments, including late fees and foreclosure.

📝 Note: Borrowers should carefully review the refinance papers to ensure they understand the loan terms and conditions before signing.

Benefits of Refinancing

Refinancing a mortgage can provide several benefits, including: * Lower Monthly Payments: By reducing the interest rate or extending the repayment term, borrowers can lower their monthly payments. * Lower Interest Rates: Borrowers can take advantage of lower interest rates to reduce their monthly payments and save on interest charges. * Cash-Out Refinancing: Borrowers can tap into their home equity to access cash for home improvements, debt consolidation, or other expenses. * Debt Consolidation: Borrowers can consolidate multiple debts into a single loan with a lower interest rate and a single monthly payment.

Common Refinancing Mistakes

Borrowers should avoid the following common mistakes when refinancing a mortgage: * Failing to Shop Around: Borrowers should compare rates and terms from multiple lenders to find the best deal. * Not Reviewing the Fine Print: Borrowers should carefully review the refinance papers to ensure they understand the loan terms and conditions. * Not Considering the Fees: Borrowers should factor in the costs associated with refinancing, including origination fees, discount points, and closing costs.

| Refinancing Option | Benefits | Risks |

|---|---|---|

| Cash-Out Refinancing | Access to cash, lower interest rates | Risk of foreclosure, increased debt |

| Debt Consolidation | Lower interest rates, single monthly payment | Risk of accumulating new debt, longer repayment term |

The refinancing process can be complex and time-consuming, but it can also provide significant benefits for borrowers who are looking to reduce their monthly payments, tap into their home equity, or consolidate their debt. By understanding the types of refinance papers, the refinancing process, and the key components of refinance papers, borrowers can make informed decisions and avoid common mistakes.

As borrowers navigate the refinancing process, they should keep in mind the importance of carefully reviewing the refinance papers, shopping around for the best rates and terms, and considering the fees and risks associated with refinancing. By doing so, they can ensure a smooth and successful refinancing experience.

In the end, refinancing a mortgage can be a savvy financial move for borrowers who are looking to improve their financial situation. By understanding the ins and outs of refinance papers and the refinancing process, borrowers can make the most of this opportunity and achieve their financial goals.

What is the difference between a refinance and a second mortgage?

+

A refinance replaces an existing mortgage with a new one, while a second mortgage is an additional loan taken out on top of the existing mortgage.

Can I refinance my mortgage if I have bad credit?

+

It may be more challenging to refinance a mortgage with bad credit, but it’s not impossible. Borrowers with bad credit may need to consider alternative lenders or loan programs.

How long does the refinancing process typically take?

+

The refinancing process can take anywhere from 30 to 60 days, depending on the lender and the complexity of the loan.