File Bankruptcy Paperwork Requirements

Introduction to Bankruptcy Paperwork Requirements

Filing for bankruptcy can be a daunting and complex process, especially when it comes to understanding the necessary paperwork requirements. Bankruptcy laws are designed to help individuals and businesses restructure or eliminate debts, but the process involves a significant amount of documentation. The goal of this article is to provide a comprehensive overview of the paperwork requirements for filing bankruptcy, helping to navigate this challenging process with clarity and confidence.

Types of Bankruptcy and Their Paperwork Requirements

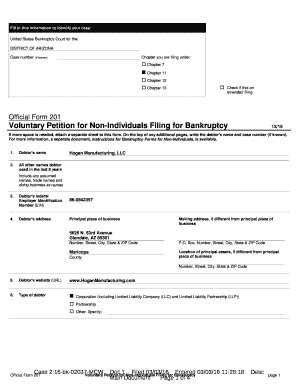

There are several types of bankruptcy, each with its own set of paperwork requirements. The most common types for individuals are Chapter 7 and Chapter 13, while businesses might file under Chapter 11. Understanding the differences between these chapters is crucial for determining the specific paperwork needed.

Chapter 7 Bankruptcy: This type of bankruptcy involves the liquidation of assets to pay off creditors. The paperwork for Chapter 7 includes:

- Petition for Chapter 7 bankruptcy

- Schedules of assets and liabilities

- Statement of financial affairs

- Means test calculation

Chapter 13 Bankruptcy: This chapter focuses on restructuring debts and creating a repayment plan. The necessary paperwork includes:

- Petition for Chapter 13 bankruptcy

- Plan for repayment

- Schedules of assets and liabilities

- Statement of financial affairs

- Means test calculation

Chapter 11 Bankruptcy: Designed for businesses, Chapter 11 involves reorganizing debts while continuing operations. The paperwork requirements are more complex and include:

- Petition for Chapter 11 bankruptcy

- Disclosure statement

- Reorganization plan

- Schedules of assets and liabilities

- Statement of financial affairs

Preparing the Bankruptcy Paperwork

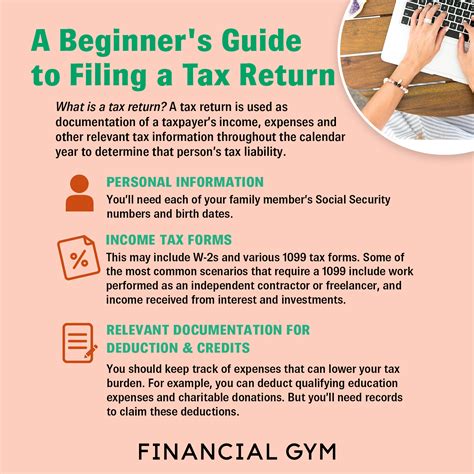

Preparing the necessary bankruptcy paperwork requires meticulous attention to detail and a thorough understanding of the bankruptcy laws and procedures. It is essential to gather all required documents and information before filing. This includes: * Financial records: Income statements, expense reports, asset valuations, and debt listings. * Identification documents: Driver’s license, passport, or state ID. * Tax returns: Recent tax returns to verify income. * Credit reports: To ensure all debts are accounted for.

📝 Note: It is highly recommended to seek the assistance of a bankruptcy attorney to ensure all paperwork is correctly prepared and filed.

Filing the Bankruptcy Paperwork

Once all the necessary paperwork is prepared, the next step is to file it with the appropriate bankruptcy court. This involves submitting the petition and supporting documents to the court clerk’s office. There is a filing fee associated with bankruptcy petitions, which can vary depending on the chapter filed under.

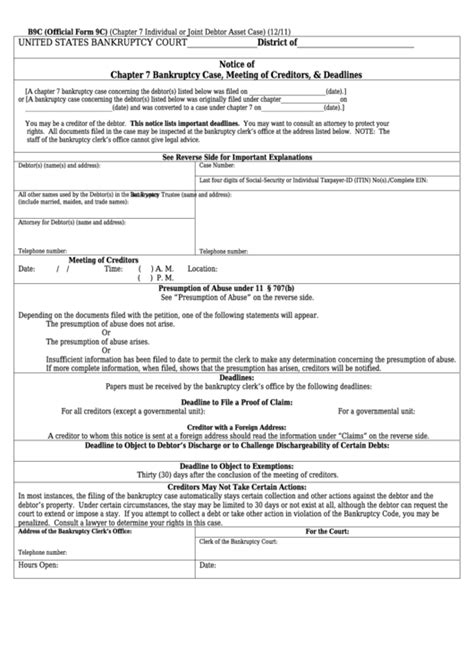

Post-Filing Procedures

After the bankruptcy paperwork is filed, several procedures must be followed: * Meeting of creditors: A meeting where the debtor answers questions about their financial situation under oath. * Confirmation of the plan (for Chapter 13 and Chapter 11): The court reviews and approves the repayment or reorganization plan. * Discharge of debts: After completing the requirements of the bankruptcy plan, the court issues an order discharging the debts.

Challenges and Considerations

Filing bankruptcy paperwork comes with its own set of challenges and considerations. Accuracy and completeness are key to avoiding delays or complications in the process. Additionally, understanding the impact on credit scores and the potential for asset loss (in the case of Chapter 7) are important considerations.

| Chapter | Paperwork Requirements | Filing Fee |

|---|---|---|

| Chapter 7 | Petition, Schedules, Statement of Financial Affairs, Means Test | $335 |

| Chapter 13 | Petition, Plan, Schedules, Statement of Financial Affairs, Means Test | $310 |

| Chapter 11 | Petition, Disclosure Statement, Reorganization Plan, Schedules, Statement of Financial Affairs | $1,717 |

In summary, the process of filing bankruptcy involves a significant amount of paperwork and procedural steps. Understanding the specific requirements for the type of bankruptcy being filed is crucial for navigating this complex process successfully. With the right approach and possibly the assistance of a bankruptcy attorney, individuals and businesses can work through their debt challenges and move towards a more financially stable future.

What are the main types of bankruptcy for individuals?

+

The main types of bankruptcy for individuals are Chapter 7 and Chapter 13. Chapter 7 involves the liquidation of assets to pay off debts, while Chapter 13 focuses on creating a repayment plan to restructure debts.

Do I need a lawyer to file bankruptcy paperwork?

+

While it is possible to file bankruptcy paperwork without a lawyer, it is highly recommended to seek legal assistance. Bankruptcy laws are complex, and a lawyer can help ensure all paperwork is correctly prepared and filed, reducing the risk of errors or omissions that could delay or complicate the process.

How long does the bankruptcy process take?

+

The duration of the bankruptcy process varies depending on the type of bankruptcy filed. Chapter 7 bankruptcies are typically quicker, often taking a few months to complete, while Chapter 13 bankruptcies involve a repayment plan that can last several years, usually three to five years.