Paperwork

Chapter 7 Bankruptcy Paperwork Requirements

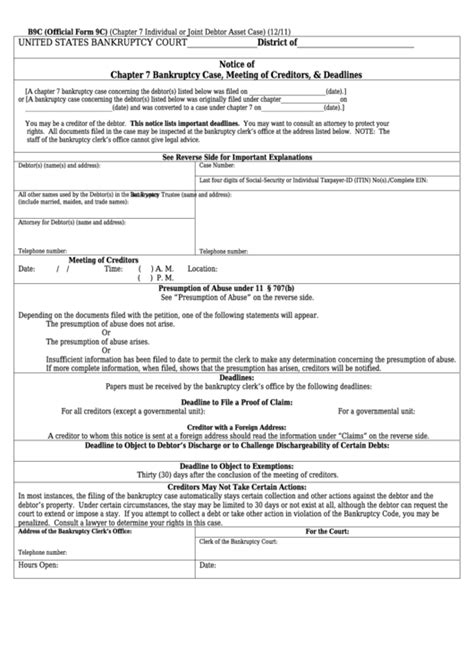

Introduction to Chapter 7 Bankruptcy

Filing for Chapter 7 bankruptcy can be a complex and overwhelming process, especially when it comes to understanding the required paperwork. Chapter 7 bankruptcy, also known as liquidation bankruptcy, is a type of bankruptcy that involves the sale of a debtor’s non-exempt assets to pay off creditors. In this chapter, we will delve into the necessary paperwork required to file for Chapter 7 bankruptcy.

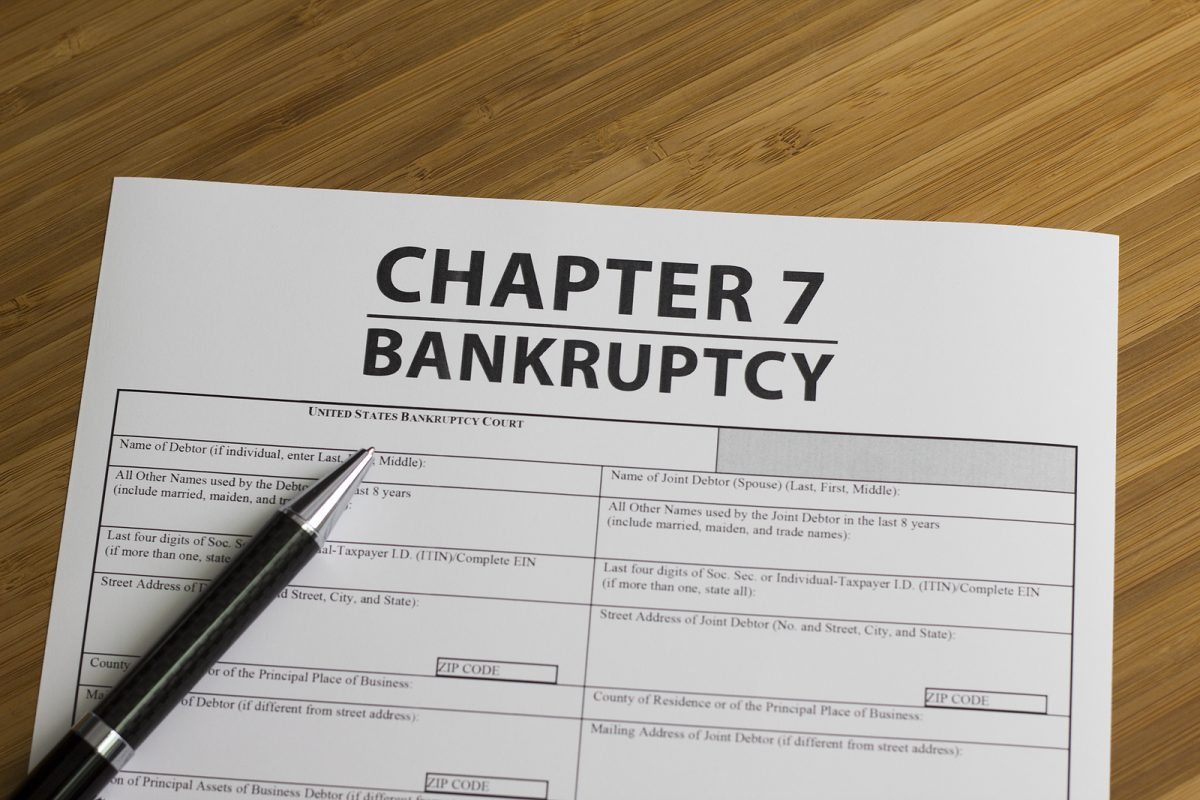

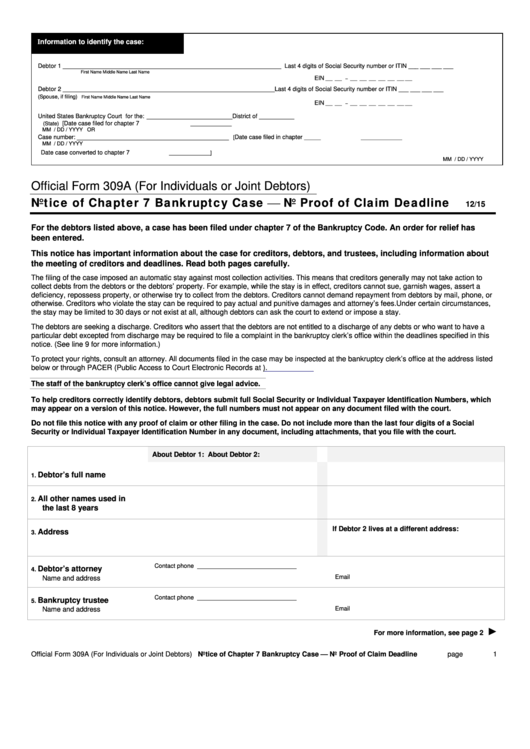

Required Paperwork for Chapter 7 Bankruptcy

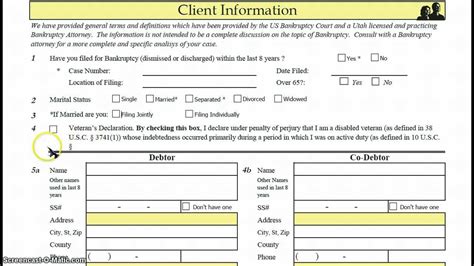

To initiate the Chapter 7 bankruptcy process, debtors must submit a petition and several supporting documents to the bankruptcy court. The required paperwork includes: * Voluntary Petition for Individuals Filing for Bankruptcy: This is the primary document that starts the bankruptcy process. * Schedules A-J: These schedules provide detailed information about the debtor’s assets, liabilities, income, and expenses. * Statement of Financial Affairs: This document outlines the debtor’s financial transactions, including income, expenses, and debt payments, over the past two years. * Means Test Calculation: This form determines whether the debtor’s income is below the state’s median income, making them eligible for Chapter 7 bankruptcy. * Certificate of Credit Counseling: Debtors must complete a credit counseling course from an approved agency before filing for bankruptcy. * Copy of Tax Return: Debtors must provide a copy of their most recent tax return, as well as any pending tax returns.

Additional Requirements

In addition to the required paperwork, debtors must also: * Pay a filing fee, which currently stands at $335 for Chapter 7 bankruptcy. * Provide identification and social security number verification. * Complete a means test to determine eligibility for Chapter 7 bankruptcy. * Attend a meeting of creditors, also known as a 341 meeting, where the debtor will be questioned by the trustee and creditors.

Consequences of Incomplete or Inaccurate Paperwork

It is essential to ensure that all required paperwork is complete and accurate, as incomplete or inaccurate paperwork can lead to: * Dismissal of the bankruptcy case * Delay in the bankruptcy process * Additional fees and penalties

💡 Note: Debtors should consult with a bankruptcy attorney to ensure that all required paperwork is complete and accurate, and to guide them through the complex bankruptcy process.

Table of Required Paperwork

| Document | Description |

|---|---|

| Voluntary Petition | Initiates the bankruptcy process |

| Schedules A-J | Provides detailed information about assets, liabilities, income, and expenses |

| Statement of Financial Affairs | Outlines financial transactions over the past two years |

| Means Test Calculation | Determines eligibility for Chapter 7 bankruptcy |

| Certificate of Credit Counseling | Verifies completion of credit counseling course |

| Copy of Tax Return | Provides financial information for the past year |

Conclusion and Final Thoughts

In conclusion, filing for Chapter 7 bankruptcy requires a significant amount of paperwork and documentation. It is crucial to ensure that all required paperwork is complete and accurate to avoid any delays or complications in the bankruptcy process. Debtors should consult with a bankruptcy attorney to guide them through the complex process and ensure a smooth transition.

What is the purpose of the means test in Chapter 7 bankruptcy?

+

The means test determines whether the debtor’s income is below the state’s median income, making them eligible for Chapter 7 bankruptcy.

What happens if the debtor’s paperwork is incomplete or inaccurate?

+

Incomplete or inaccurate paperwork can lead to dismissal of the bankruptcy case, delay in the bankruptcy process, or additional fees and penalties.

Do debtors need to attend a meeting of creditors?

+

Yes, debtors must attend a meeting of creditors, also known as a 341 meeting, where they will be questioned by the trustee and creditors.