Customs Paperwork Needed

Understanding the Complexity of Customs Paperwork

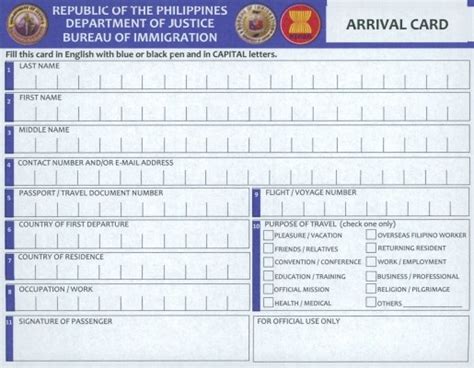

When dealing with international trade, one of the most critical aspects is customs paperwork. The process of importing and exporting goods across borders involves a plethora of documents, each serving a specific purpose. The complexity of customs paperwork can be overwhelming, especially for those new to the industry. However, understanding the different types of documents required and their significance can simplify the process and ensure compliance with regulations.

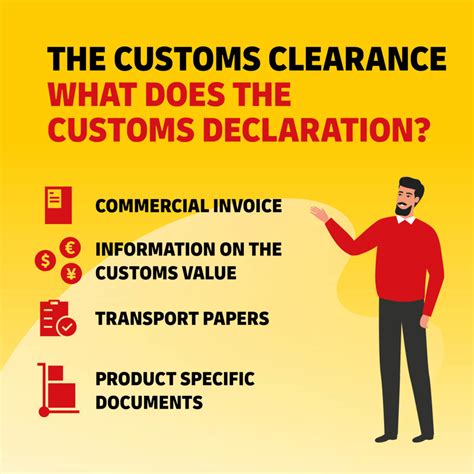

Types of Customs Paperwork

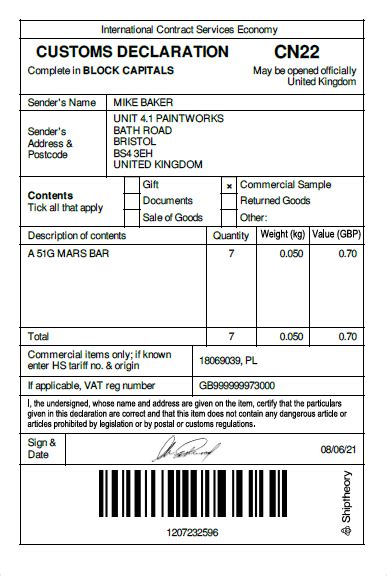

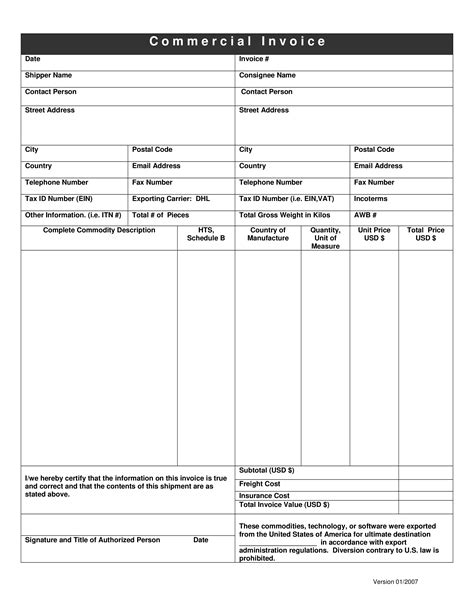

Several documents are essential for customs clearance. These include: * Commercial Invoice: A document provided by the seller to the buyer, detailing the type, quantity, and value of goods being sold. It is used to determine the value of goods for customs purposes. * Bill of Lading: A document issued by the carrier to the shipper, acknowledging receipt of cargo for transportation. It serves as a contract between the shipper and the carrier and provides details about the shipment. * Certificate of Origin: A document that certifies the country of origin of the goods being imported. It is often required for customs clearance and can affect the duty rates applied to the goods. * Shipper’s Export Declaration (SED): A document required for all exports from the United States, providing detailed information about the shipment, including the type of goods, their value, and their destination.

Importance of Accurate Customs Paperwork

Accurate and complete customs paperwork is crucial for several reasons: * Compliance with Regulations: Incorrect or missing documents can lead to delays, fines, or even the seizure of goods. Ensuring all paperwork is accurate and complete helps avoid these issues. * Smooth Clearance Process: Proper documentation facilitates a smooth clearance process, reducing the time goods spend in customs and allowing them to reach their destination faster. * Tariff and Tax Calculation: Customs paperwork is used to determine the tariffs and taxes applicable to imported goods. Accurate documentation ensures that the correct duties are applied, avoiding potential disputes or additional costs.

Challenges in Customs Paperwork

Despite its importance, managing customs paperwork can be challenging due to: * Complexity of Regulations: Customs regulations vary by country and are subject to change, making it difficult to stay compliant. * Volume of Documents: The sheer number of documents required for each shipment can be overwhelming, especially for small to medium-sized businesses. * Time Sensitivity: Delays in submitting customs paperwork can lead to shipment delays, affecting delivery times and customer satisfaction.

Streamlining Customs Paperwork Processes

To overcome these challenges, businesses can: * Invest in Automation: Utilizing software solutions can automate the generation and submission of customs paperwork, reducing errors and increasing efficiency. * Outsource to Experts: Partnering with customs brokers or freight forwarders can provide access to expertise in managing customs paperwork, ensuring compliance and facilitating smooth customs clearance. * Stay Informed: Regularly updating knowledge on customs regulations and changes can help businesses anticipate and prepare for potential issues, minimizing delays and additional costs.

📝 Note: Keeping detailed records of all customs paperwork is essential for auditing purposes and to resolve any potential disputes that may arise.

Future of Customs Paperwork

The future of customs paperwork is likely to be shaped by technology, with a move towards digitalization and automation. Electronic data interchange (EDI) and blockchain technology are expected to play significant roles in streamlining customs processes, enhancing security, and reducing paperwork. As international trade continues to evolve, the importance of efficient and accurate customs paperwork will only continue to grow.

In summary, customs paperwork is a critical component of international trade, requiring accuracy, completeness, and compliance with regulations. By understanding the different types of documents required, the challenges associated with customs paperwork, and the strategies for streamlining processes, businesses can navigate the complexities of customs clearance more effectively. As the trade landscape continues to evolve, embracing technology and expertise will be key to managing customs paperwork efficiently and ensuring the smooth movement of goods across borders.

What is the purpose of a commercial invoice in customs paperwork?

+

The commercial invoice is used to determine the value of goods for customs purposes, providing details about the type, quantity, and value of the goods being imported or exported.

Why is accurate customs paperwork important?

+

Accurate customs paperwork is crucial for compliance with regulations, smooth customs clearance, and the correct application of tariffs and taxes. It helps avoid delays, fines, and potential disputes.

How can businesses streamline their customs paperwork processes?

+

Businesses can streamline customs paperwork by investing in automation software, outsourcing to customs experts, and staying informed about changes in customs regulations.