HELOC Paperwork Requirements

Introduction to HELOC Paperwork Requirements

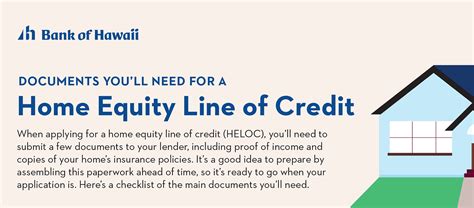

When considering a Home Equity Line of Credit (HELOC), it’s essential to understand the paperwork requirements involved in the application process. A HELOC allows homeowners to borrow money using the equity in their home as collateral, providing a flexible and often lower-interest alternative to other forms of credit. The paperwork required for a HELOC application can vary depending on the lender and the borrower’s financial situation, but there are common documents and information that lenders typically request.

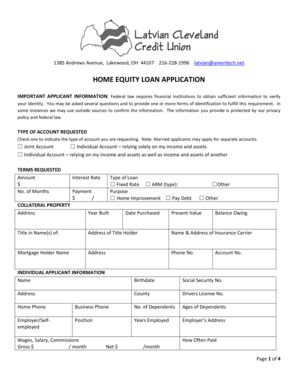

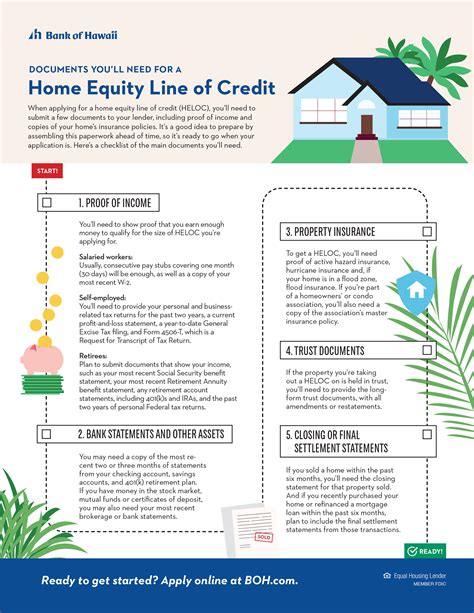

Common Documents Required for HELOC Application

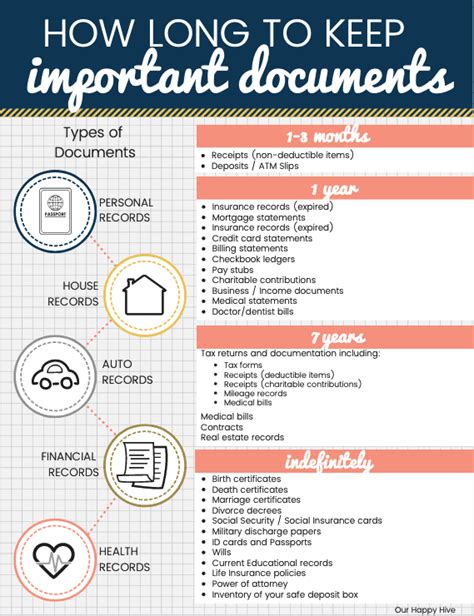

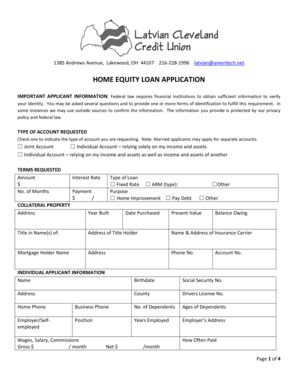

The following documents are commonly required when applying for a HELOC: * Identification Documents: A valid government-issued ID, such as a driver’s license or passport, is necessary to verify the borrower’s identity. * Income Verification: Pay stubs, W-2 forms, or tax returns are used to confirm the borrower’s income and employment status. * Credit Reports: Lenders will check the borrower’s credit history to determine their creditworthiness. A good credit score can lead to better interest rates and terms. * Property Deed and Mortgage Statement: These documents prove ownership of the property and show the outstanding mortgage balance. * Appraisal Report: In some cases, lenders may require an appraisal to determine the current value of the property. * Financial Statements: For self-employed individuals or those with complex financial situations, additional financial statements may be required to assess their ability to repay the loan.

Application Process and Timeline

The application process for a HELOC typically involves the following steps: * Pre-approval: The lender provides a pre-approval letter stating the amount they are willing to lend based on a preliminary review of the borrower’s creditworthiness and property value. * Application Submission: The borrower submits the application along with the required documents. * Processing and Underwriting: The lender reviews the application, orders an appraisal if necessary, and makes a final decision on the loan. * Closing: Once approved, the borrower signs the loan documents, and the HELOC is opened.

The timeline for the application process can vary but generally takes several weeks to a few months. Prompt submission of required documents and a clear understanding of the lender’s requirements can help expedite the process.

Understanding HELOC Terms and Conditions

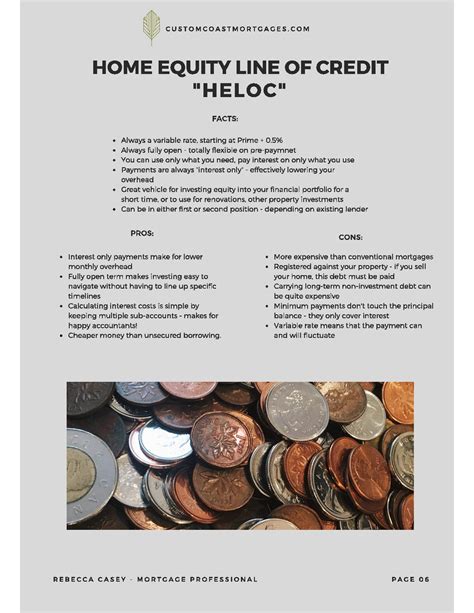

Before finalizing a HELOC, it’s crucial to understand the terms and conditions of the loan, including: * Interest Rate: The rate at which interest is charged on the borrowed amount. Rates can be fixed or variable. * Repayment Terms: The schedule for repaying the loan, including the minimum payment due each month. * Fees: Origination fees, annual fees, and late payment fees associated with the HELOC. * Draw Period: The time during which the borrower can draw funds from the line of credit. * Repayment Period: The period after the draw period ends, during which the borrower must repay the loan.

Benefits and Risks of HELOCs

HELOCs offer several benefits, including: * Flexibility: Borrowers can draw and repay funds as needed during the draw period. * Lower Interest Rates: Compared to other forms of credit, such as credit cards. * Tax Deductibility: Interest paid on a HELOC may be tax-deductible, though this can depend on the borrower’s situation and changes in tax laws.

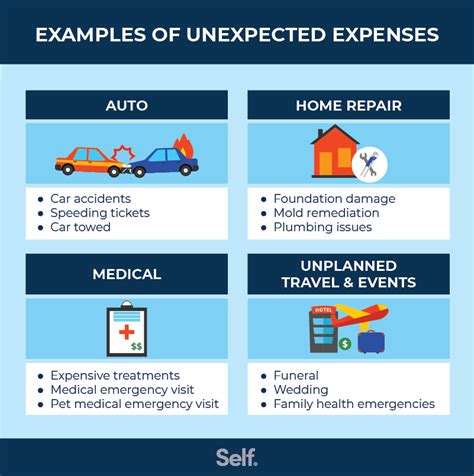

However, there are also risks to consider: * Risk of Foreclosure: If the borrower fails to repay the loan, they risk losing their home. * Variable Interest Rates: Rates can increase over time, making monthly payments larger. * Fees and Charges: Borrowers should be aware of all fees associated with the HELOC to avoid unexpected costs.

💡 Note: It's essential for borrowers to carefully review the terms and conditions of a HELOC and consider their financial situation before applying.

Conclusion and Final Thoughts

In summary, applying for a HELOC involves gathering and submitting various documents to verify the borrower’s identity, income, creditworthiness, and property value. Understanding the application process, terms, and conditions of the loan is crucial for making an informed decision. By weighing the benefits and risks and carefully reviewing the loan agreement, homeowners can use a HELOC as a valuable financial tool to achieve their goals.

What is the primary advantage of a HELOC over other forms of credit?

+

The primary advantage of a HELOC is its flexibility and potentially lower interest rates compared to other forms of credit, such as credit cards.

Can I use a HELOC for any purpose?

+

While HELOCs can be used for various purposes, such as home renovations, debt consolidation, or large purchases, it’s essential to use them responsibly and consider the potential impact on your financial situation.

How long does the HELOC application process typically take?

+

The application process for a HELOC can take several weeks to a few months, depending on the lender and the complexity of the application.