Titlemax Loan Paperwork Required

Understanding the Titlemax Loan Paperwork Requirements

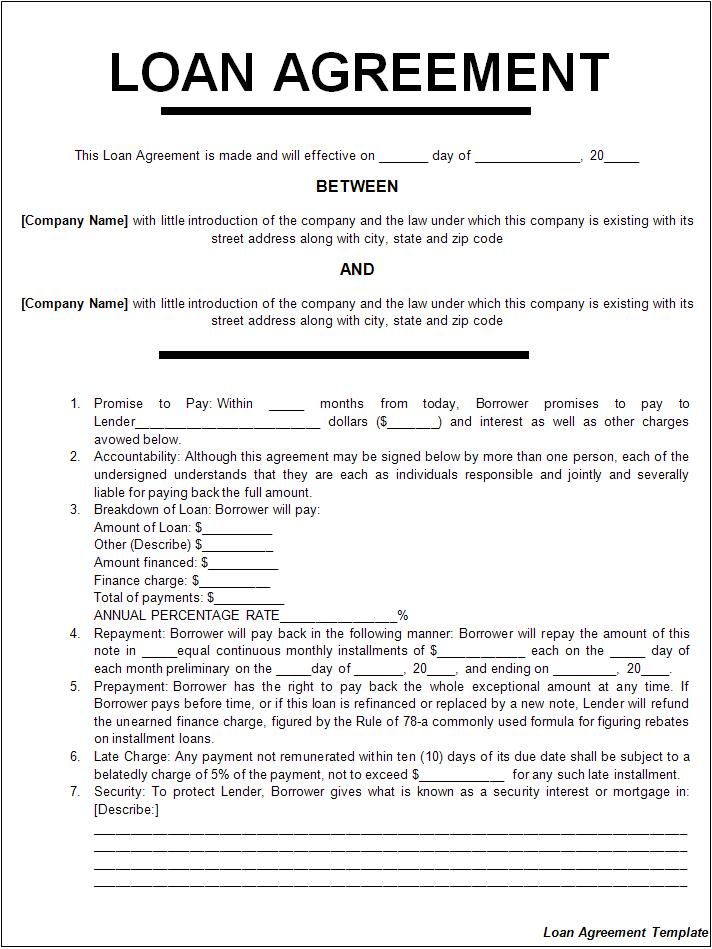

When considering a loan from Titlemax, it’s essential to understand the paperwork requirements to ensure a smooth and efficient application process. Titlemax is a lending company that offers title loans, allowing borrowers to use their vehicle’s title as collateral. The loan process typically involves submitting various documents to verify the borrower’s identity, income, and vehicle ownership. In this article, we will delve into the necessary paperwork required for a Titlemax loan, providing a comprehensive guide to help borrowers prepare and increase their chances of approval.

Required Documents for a Titlemax Loan

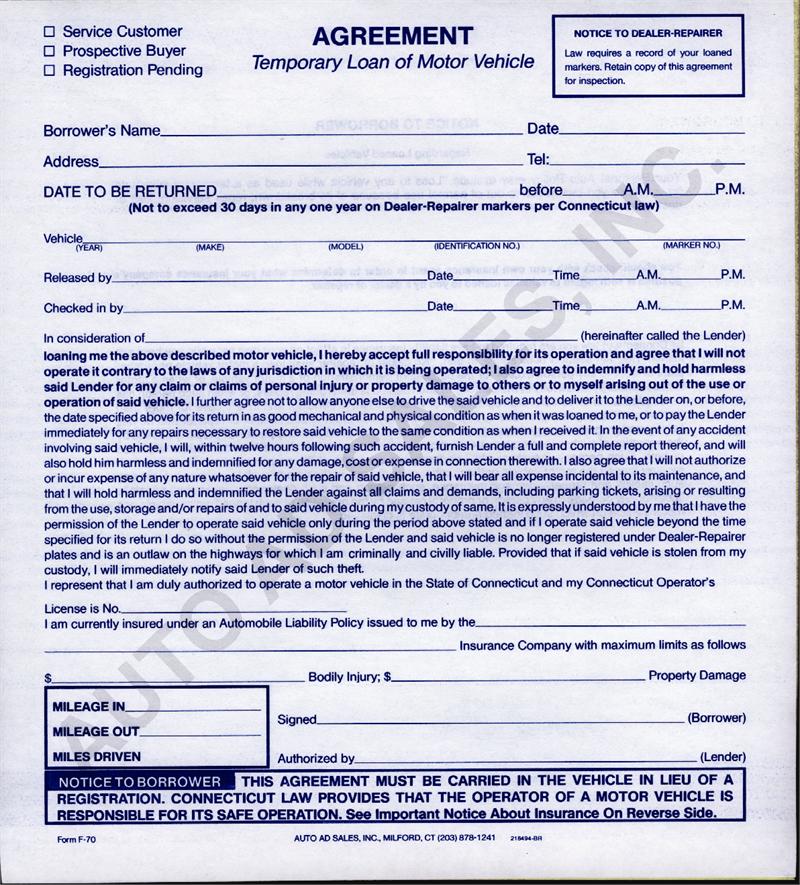

To apply for a Titlemax loan, borrowers will need to provide the following documents: * A valid government-issued ID, such as a driver’s license or state ID * Proof of income, including pay stubs, bank statements, or tax returns * Vehicle title, which must be free of any liens or outstanding loans * Vehicle registration, which must be current and up-to-date * Proof of residency, such as a utility bill or lease agreement * Social Security number or Individual Taxpayer Identification Number (ITIN)

📝 Note: The specific documents required may vary depending on the borrower's state of residence and the type of loan being applied for.

Additional Requirements for Certain Borrowers

In some cases, Titlemax may require additional documentation from certain borrowers, such as: * Self-employed individuals, who may need to provide business financial statements or tax returns * Retirees, who may need to provide proof of retirement income or social security benefits * Active military personnel, who may need to provide military ID or leave and earnings statements

How to Submit the Required Paperwork

Borrowers can submit the required paperwork in person at a Titlemax location or online through the company’s website. Electronic signatures are accepted, making it convenient for borrowers to apply from the comfort of their own homes. Once the application is submitted, a Titlemax representative will review the paperwork and contact the borrower to discuss the loan terms and conditions.

Benefits of Choosing Titlemax

Titlemax offers several benefits to borrowers, including: * Fast approval process, with loans often approved in as little as 30 minutes * Competitive interest rates, which can help borrowers save money on interest payments * Flexible repayment terms, which can be tailored to fit the borrower’s budget and financial situation * No prepayment penalties, which allows borrowers to pay off their loan early without incurring additional fees

Common Mistakes to Avoid When Applying for a Titlemax Loan

To increase their chances of approval, borrowers should avoid the following common mistakes: * Inaccurate or incomplete paperwork, which can delay the application process or result in denial * Insufficient income, which can make it difficult to repay the loan * Poor credit history, which can affect the interest rate or loan terms * Inadequate vehicle value, which can reduce the loan amount or increase the interest rate

| Document | Description |

|---|---|

| Valid government-issued ID | Driver's license or state ID |

| Proof of income | Pay stubs, bank statements, or tax returns |

| Vehicle title | Free of any liens or outstanding loans |

| Vehicle registration | Current and up-to-date |

As borrowers prepare to apply for a Titlemax loan, it’s essential to remember that the required paperwork is in place to protect both the borrower and the lender. By providing accurate and complete documentation, borrowers can increase their chances of approval and enjoy the benefits of a Titlemax loan. In the end, understanding the Titlemax loan paperwork requirements is crucial for a successful application process, and borrowers should take the time to carefully review and prepare the necessary documents to ensure a smooth and efficient experience.

What is the minimum credit score required for a Titlemax loan?

+

Titlemax does not require a minimum credit score, as the loan is secured by the vehicle’s title.

How long does the Titlemax loan application process typically take?

+

The Titlemax loan application process can take as little as 30 minutes, but may take longer in some cases.

Can I apply for a Titlemax loan online or do I need to visit a store location?

+

Borrowers can apply for a Titlemax loan online or in person at a store location.