Mortgage Paperwork Requirements

Introduction to Mortgage Paperwork

When applying for a mortgage, it’s essential to understand the various paperwork requirements involved in the process. The mortgage application process can be complex and time-consuming, but being prepared with the necessary documents can help streamline the procedure. In this article, we will delve into the world of mortgage paperwork, exploring the different types of documents required and providing tips on how to navigate the process.

Pre-Approval Documents

Before starting your mortgage application, you’ll need to gather several documents to secure pre-approval. These documents typically include:

- Identification: A valid government-issued ID, such as a driver’s license or passport

- Income verification: Pay stubs, W-2 forms, and tax returns to demonstrate your income stability

- Credit reports: Your credit score and history will be reviewed to determine your creditworthiness

- Bank statements: To verify your savings and assets

- Employment verification: A letter from your employer confirming your employment status

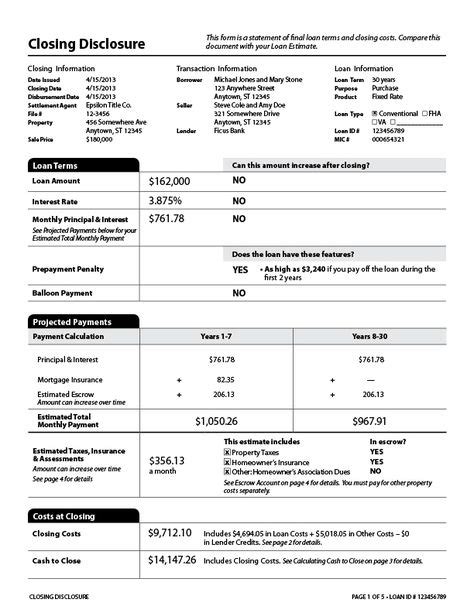

Mortgage Application Documents

Once you’ve found a property and are ready to apply for a mortgage, you’ll need to provide additional documentation. This may include:

- Property details: The property’s address, value, and any relevant inspections or appraisals

- Loan application: A completed mortgage application form, which will require information about your income, employment, and credit history

- Title report: A document that outlines the property’s ownership history and any outstanding liens

- Insurance information: Details about your homeowner’s insurance policy, including the provider and premium

Supporting Documents

Depending on your individual circumstances, you may need to provide supporting documents to accompany your mortgage application. These could include:

- Divorce or separation documents: If you’re recently divorced or separated, you may need to provide documentation related to your marital status

- Bankruptcy or foreclosure documents: If you’ve experienced financial difficulties in the past, you may need to provide documentation related to these events

- Gift letter: If you’re receiving a gift from a family member or friend to help with your down payment, you’ll need to provide a gift letter to explain the source of the funds

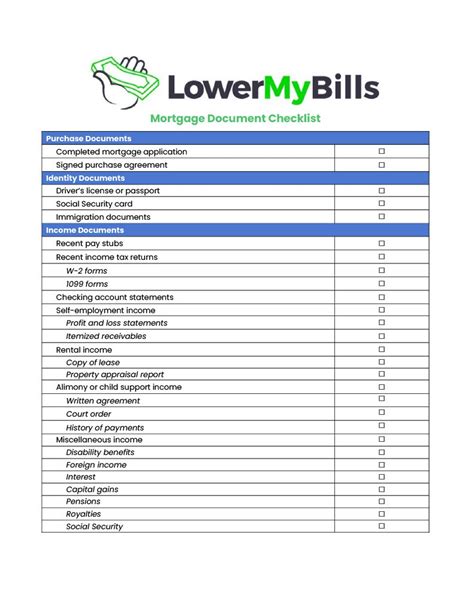

Table of Common Mortgage Documents

The following table summarizes some of the common documents required for a mortgage application:

| Document | Description |

|---|---|

| Identification | Valid government-issued ID |

| Income verification | Pay stubs, W-2 forms, and tax returns |

| Credit reports | Credit score and history |

| Bank statements | Verification of savings and assets |

| Employment verification | Letter from employer confirming employment status |

This is not an exhaustive list, and your lender may require additional documents depending on your specific situation.

📝 Note: It's essential to keep detailed records of all your mortgage paperwork, including receipts, invoices, and correspondence with your lender. This will help you stay organized and ensure a smooth application process.

Tips for Navigating the Mortgage Paperwork Process

To make the mortgage application process as efficient as possible, consider the following tips:

- Stay organized: Keep all your documents in a secure, easily accessible location

- Be proactive: Provide documents as soon as possible to avoid delays in the application process

- Communicate with your lender: If you’re unsure about any aspect of the application process, don’t hesitate to reach out to your lender for guidance

- Review your documents carefully: Ensure all information is accurate and complete to avoid any issues down the line

In summary, the mortgage paperwork process can be complex, but being prepared and understanding the requirements can make all the difference. By gathering the necessary documents, staying organized, and communicating with your lender, you can navigate the process with confidence and secure the mortgage that’s right for you.

What is the typical timeframe for a mortgage application?

+

The timeframe for a mortgage application can vary depending on the lender and the complexity of the application. On average, it can take anywhere from 30 to 60 days to complete the process.

What is the minimum credit score required for a mortgage?

+

The minimum credit score required for a mortgage varies depending on the lender and the type of mortgage. However, a credit score of 620 or higher is typically considered good for a conventional mortgage.

Can I apply for a mortgage online?

+

Yes, many lenders offer online mortgage applications. However, you may still need to provide documentation and communicate with your lender via phone or email to complete the process.