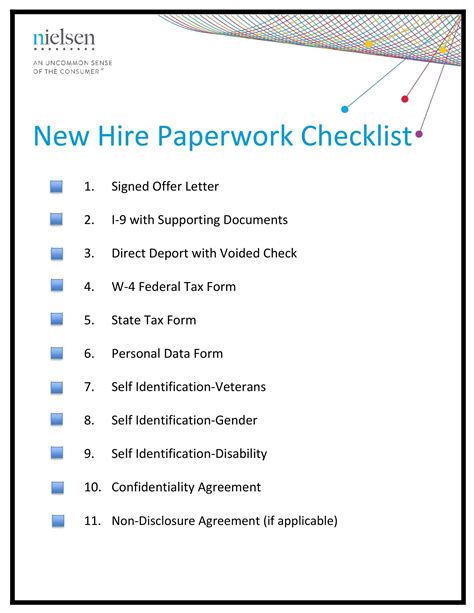

New Employee Paperwork Requirements

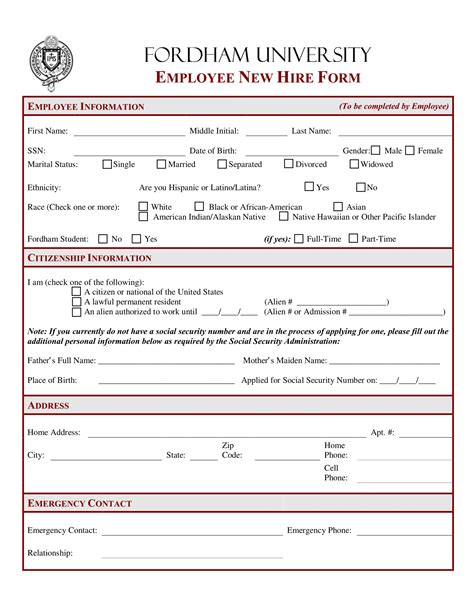

Introduction to New Employee Paperwork

When a new employee joins an organization, there are several paperwork requirements that must be completed to ensure a smooth transition and compliance with various laws and regulations. These requirements may vary depending on the country, state, or province, but there are some common documents that are typically required. In this article, we will explore the various paperwork requirements for new employees and provide guidance on how to complete them efficiently.

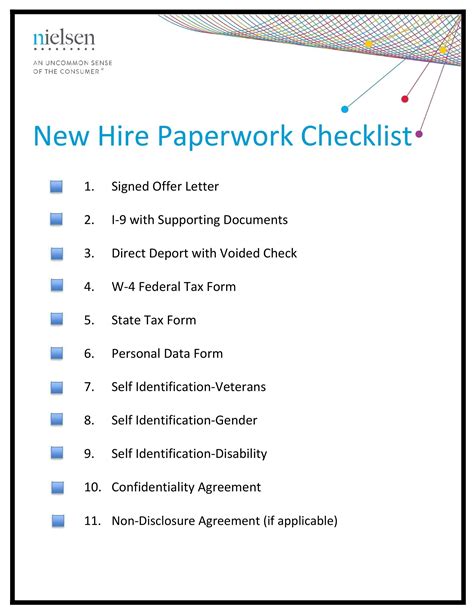

Pre-Employment Paperwork

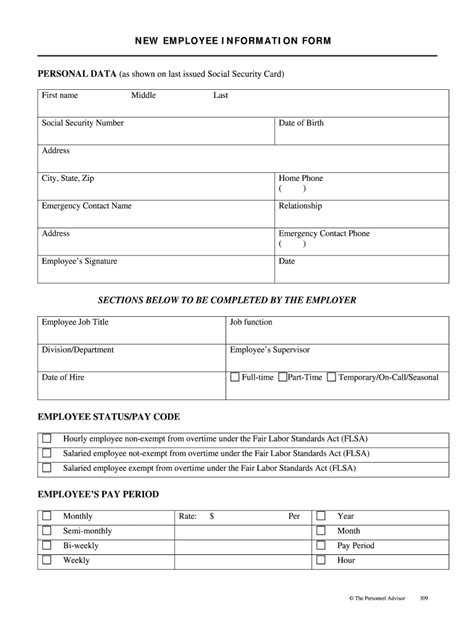

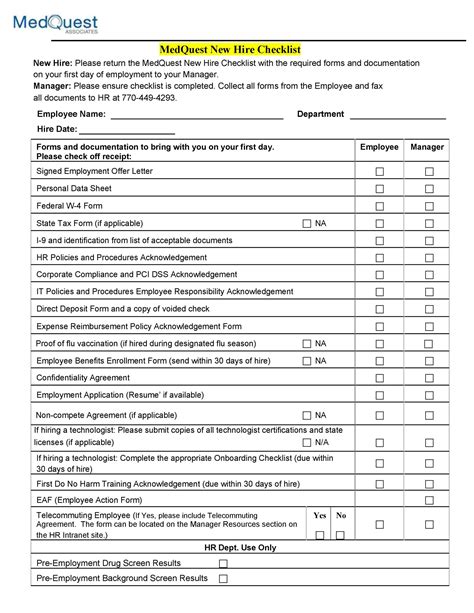

Before a new employee starts work, there are several documents that must be completed. These include: * Job application form: This is the initial document that the employee completes to apply for the job. * Resume and cover letter: These documents provide more information about the employee’s qualifications and experience. * Reference checks: The employer may contact the employee’s previous employers to verify their employment history and performance. * Background check: Depending on the type of job, a background check may be required to ensure the employee is eligible to work in the position.

Employment Contract

The employment contract is a critical document that outlines the terms and conditions of employment. It should include: * Job title and description: A clear description of the job duties and responsibilities. * Salary and benefits: The employee’s salary, benefits, and any other forms of compensation. * Working hours and vacation time: The employee’s working hours, vacation time, and any other leave entitlements. * Termination clause: The circumstances under which the employment contract can be terminated.

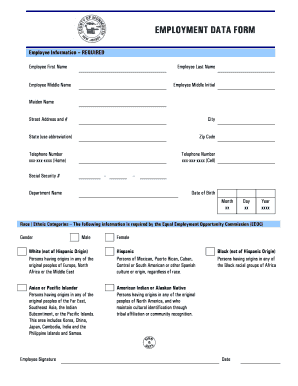

Tax-Related Paperwork

New employees must complete tax-related paperwork to ensure they are taxed correctly. This includes: * W-4 form: This form is used to determine the employee’s tax withholding. * State and local tax forms: Depending on the state or province, additional tax forms may be required. * Social Security number or Individual Taxpayer Identification Number (ITIN): The employee must provide their Social Security number or ITIN to ensure accurate tax reporting.

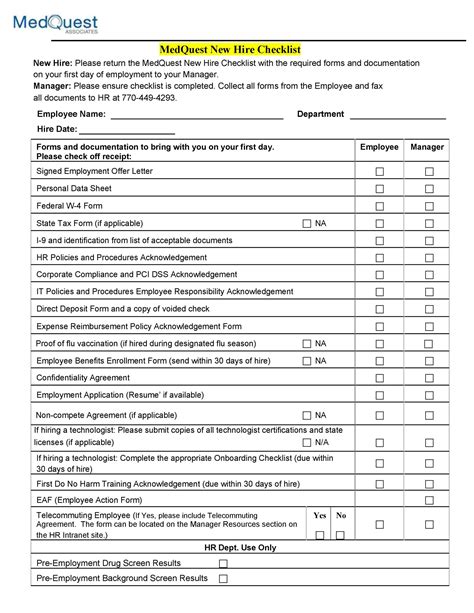

Benefits Enrollment

Many employers offer benefits to their employees, such as health insurance, retirement plans, and life insurance. New employees must complete benefits enrollment paperwork to participate in these programs. This may include: * Health insurance enrollment form: The employee must complete this form to enroll in the company’s health insurance plan. * Retirement plan enrollment form: The employee must complete this form to enroll in the company’s retirement plan. * Life insurance enrollment form: The employee must complete this form to enroll in the company’s life insurance plan.

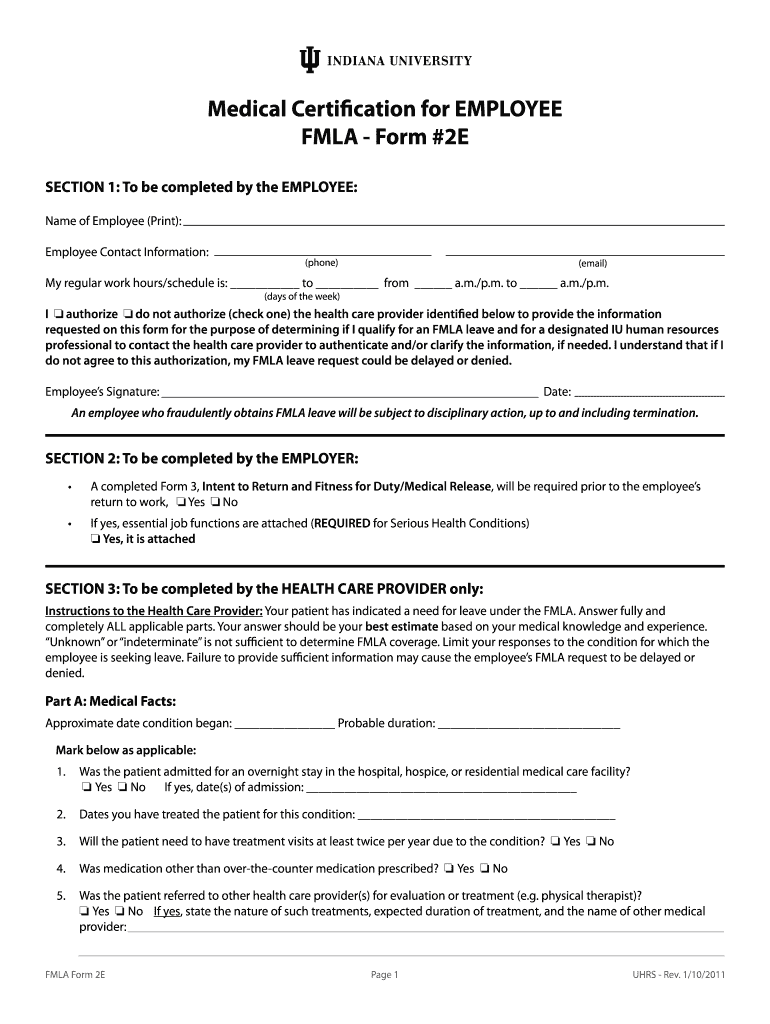

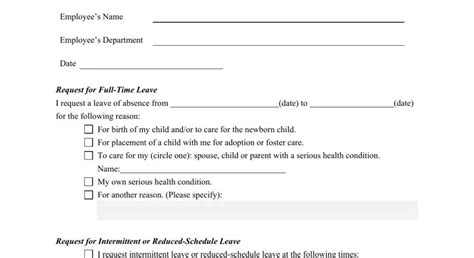

Compliance-Related Paperwork

There are several compliance-related documents that new employees must complete. These include: * I-9 form: This form is used to verify the employee’s eligibility to work in the United States. * OSHA training: The employee must complete OSHA training to ensure they understand workplace safety procedures. * Confidentiality agreement: The employee must sign a confidentiality agreement to protect the company’s confidential information.

💡 Note: The specific paperwork requirements may vary depending on the company, industry, and location. It's essential to consult with HR or the relevant authorities to ensure compliance with all applicable laws and regulations.

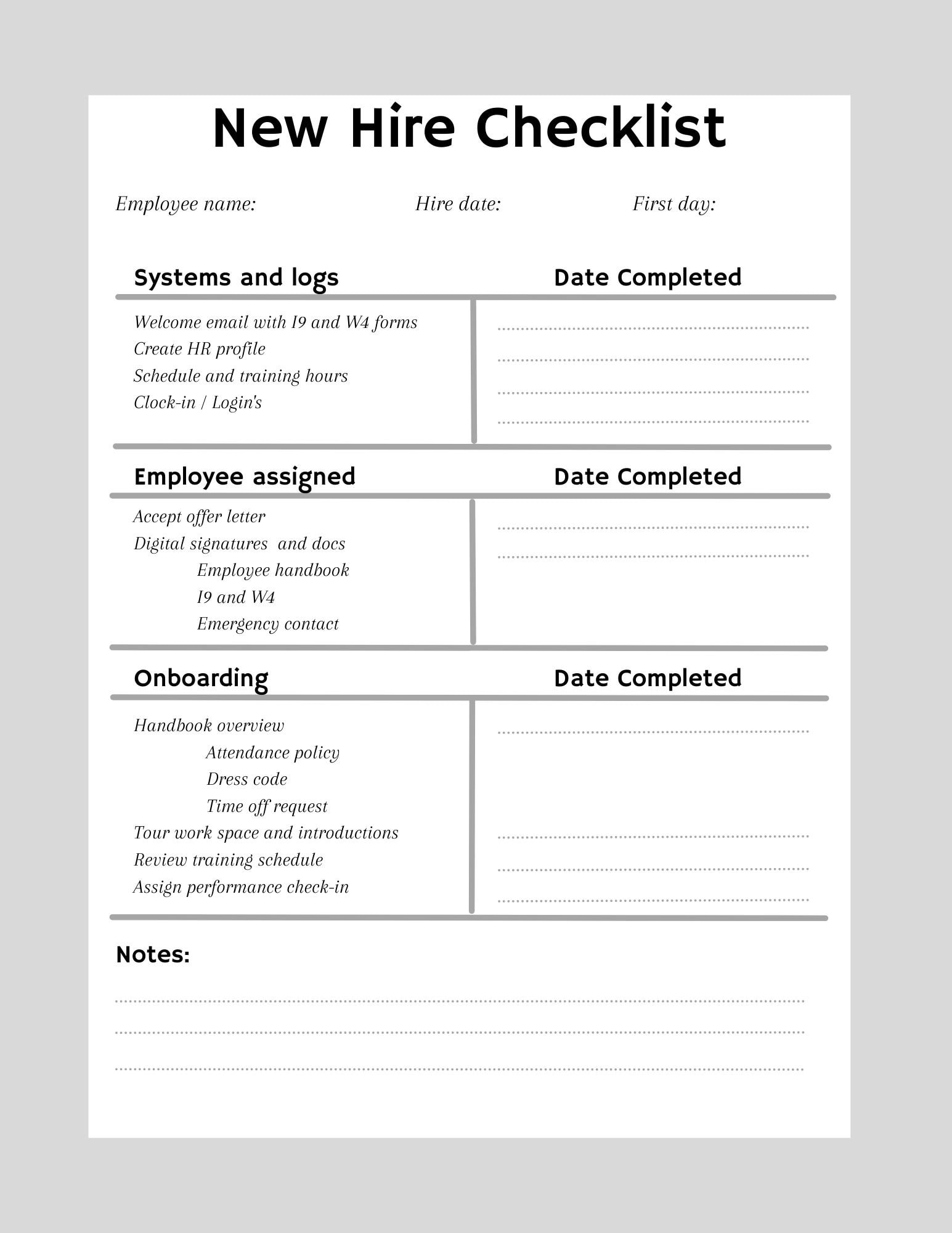

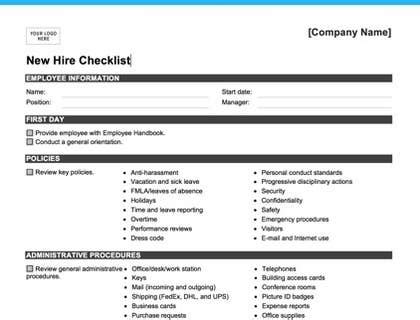

Best Practices for Managing New Employee Paperwork

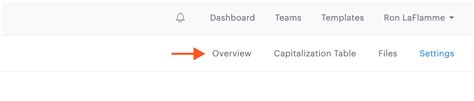

To manage new employee paperwork efficiently, consider the following best practices: * Use digital paperwork: Consider using digital paperwork to streamline the process and reduce errors. * Provide clear instructions: Ensure the new employee understands what paperwork is required and how to complete it. * Set deadlines: Establish deadlines for completing the paperwork to ensure the new employee is fully onboarded and compliant with company policies. * Store paperwork securely: Ensure all paperwork is stored securely and in accordance with company policies and applicable laws.

| Document | Purpose | Deadline |

|---|---|---|

| Job application form | To apply for the job | Before the interview |

| Employment contract | To outline the terms and conditions of employment | Before the first day of work |

| W-4 form | To determine tax withholding | Before the first day of work |

| I-9 form | To verify eligibility to work in the United States | Before the first day of work |

In summary, new employee paperwork is a critical aspect of the onboarding process. It’s essential to ensure that all required documents are completed accurately and efficiently to comply with applicable laws and regulations. By following best practices and using digital paperwork, companies can streamline the process and ensure a smooth transition for new employees.

What is the purpose of the I-9 form?

+

The I-9 form is used to verify the eligibility of new employees to work in the United States.

What is the deadline for completing the W-4 form?

+

The W-4 form must be completed before the first day of work.

What is the purpose of the employment contract?

+

The employment contract outlines the terms and conditions of employment, including job duties, salary, benefits, and termination clause.