5 Dividend Paperwork Tips

Introduction to Dividend Paperwork

When it comes to managing investments, one of the most critical aspects is handling the paperwork associated with dividend payments. Dividend paperwork can be overwhelming, especially for those who are new to investing. However, understanding the process and having the right strategies in place can make a significant difference in ensuring that investors receive their dividends without any issues. In this article, we will delve into the world of dividend paperwork and provide five essential tips to help investors navigate this complex process.

Understanding Dividend Paperwork

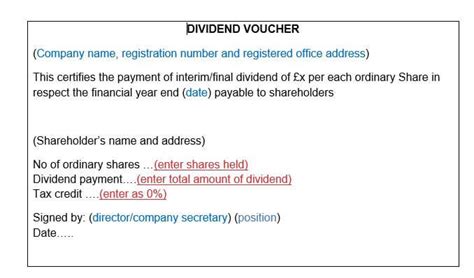

Before we dive into the tips, it’s essential to understand what dividend paperwork entails. Dividend paperwork refers to the documentation and procedures required to process and receive dividend payments from investments. This can include everything from registering for dividend payments to submitting tax forms. The process can vary depending on the type of investment, the jurisdiction, and the brokerage firm or financial institution involved.

Tip 1: Keep Accurate Records

One of the most critical aspects of managing dividend paperwork is keeping accurate records. This includes: * Keeping track of investment accounts and statements * Recording dividend payments and dates * Maintaining a record of tax-related documents * Storing documents securely, such as in a fireproof safe or a secure online storage service By keeping accurate records, investors can ensure that they receive their dividend payments on time and avoid any potential issues with their investments.

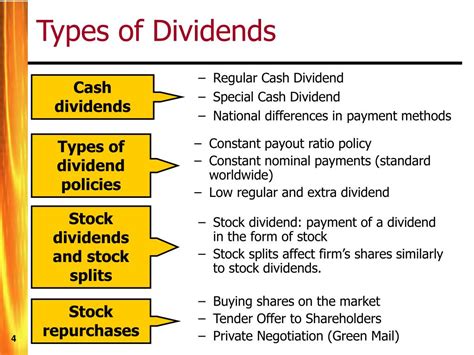

Tip 2: Understand Tax Implications

Dividend payments are subject to taxes, and understanding the tax implications is crucial to avoiding any unexpected surprises. Tax rates can vary depending on the jurisdiction, and investors may be required to submit tax forms to report their dividend income. It’s essential to: * Understand the tax rates applicable to dividend income * Keep track of tax-related documents, such as W-8BEN forms * Consult with a tax professional to ensure compliance with tax regulations By understanding the tax implications, investors can plan their investments more effectively and avoid any potential tax liabilities.

Tip 3: Choose the Right Brokerage Firm

The brokerage firm or financial institution used to manage investments can significantly impact the dividend paperwork process. Brokerage firms may offer different services, such as dividend reinvestment plans or tax reporting, that can simplify the process. When choosing a brokerage firm, investors should consider: * The range of services offered * The fees associated with dividend payments * The level of customer support By choosing the right brokerage firm, investors can minimize the complexity of dividend paperwork and ensure that they receive their dividend payments efficiently.

Tip 4: Take Advantage of Dividend Reinvestment Plans

Dividend reinvestment plans (DRIPs) can be an excellent way to simplify the dividend paperwork process. DRIPs allow investors to automatically reinvest their dividend payments into additional shares of the same investment, eliminating the need for manual processing. By taking advantage of DRIPs, investors can: * Reduce the complexity of dividend paperwork * Increase their investment returns over time * Benefit from the power of compounding It’s essential to understand the terms and conditions of DRIPs and to choose a brokerage firm that offers this service.

Tip 5: Stay Organized and Up-to-Date

Finally, staying organized and up-to-date is critical to managing dividend paperwork effectively. Investors should: * Regularly review investment statements and dividend payments * Update records and documents as necessary * Stay informed about changes in tax regulations or brokerage firm policies By staying organized and up-to-date, investors can ensure that they receive their dividend payments on time and avoid any potential issues with their investments.

| Tip | Description |

|---|---|

| Keep Accurate Records | Keep track of investment accounts, statements, and tax-related documents |

| Understand Tax Implications | Understand tax rates, keep track of tax-related documents, and consult with a tax professional |

| Choose the Right Brokerage Firm | Consider the range of services, fees, and customer support when choosing a brokerage firm |

| Take Advantage of Dividend Reinvestment Plans | Automatically reinvest dividend payments into additional shares to simplify the process |

| Stay Organized and Up-to-Date | Regularly review investment statements, update records, and stay informed about changes in tax regulations or brokerage firm policies |

📝 Note: It's essential to consult with a financial advisor or tax professional to ensure compliance with tax regulations and to receive personalized advice on managing dividend paperwork.

In summary, managing dividend paperwork requires attention to detail, organization, and a thorough understanding of the process. By following these five tips, investors can simplify the process, minimize potential issues, and ensure that they receive their dividend payments on time. With the right strategies in place, investors can focus on growing their investments and achieving their financial goals.

What is dividend paperwork?

+

Dividend paperwork refers to the documentation and procedures required to process and receive dividend payments from investments.

Why is it essential to keep accurate records?

+

Keeping accurate records is essential to ensure that investors receive their dividend payments on time and avoid any potential issues with their investments.

What are dividend reinvestment plans?

+

Dividend reinvestment plans (DRIPs) allow investors to automatically reinvest their dividend payments into additional shares of the same investment, eliminating the need for manual processing.