5 Papers to Retire

Introduction to Retirement Planning

When it comes to planning for retirement, having a solid strategy in place is crucial. This involves not only saving money but also investing wisely and planning for the unexpected. One key aspect of retirement planning is understanding the various documents and papers that you will need to navigate. In this article, we will explore five essential papers that you should consider when planning for your retirement.

Understanding the Importance of Documentation

Having the right documents in order can make a significant difference in how smoothly your retirement plans unfold. From wills to insurance policies, each document plays a vital role in ensuring that your wishes are respected and your loved ones are protected. Let’s delve into the five papers you should retire with:

- Last Will and Testament: This document outlines how you want your assets to be distributed after you pass away. It’s a way to ensure that your wishes are carried out and can help avoid disputes among your heirs.

- Power of Attorney: A power of attorney gives someone you trust the authority to make decisions on your behalf if you become incapacitated. This can include financial, medical, and personal decisions.

- Advanced Healthcare Directive: This document specifies your preferences for medical treatment if you are unable to communicate for yourself. It includes a living will and a healthcare proxy.

- Insurance Policies: Having the right insurance policies, such as life insurance and long-term care insurance, can provide financial protection for you and your loved ones.

- Retirement Account Documents: These include documents related to your 401(k), IRA, or other retirement accounts. They outline the rules for withdrawals, contributions, and beneficiaries.

Creating a Last Will and Testament

Creating a last will and testament is a straightforward process that involves several key steps: 1. Determine Your Assets: Start by making a list of all your assets, including property, investments, and personal belongings. 2. Choose an Executor: Select someone you trust to carry out the instructions in your will. 3. Name Beneficiaries: Decide who will inherit your assets and in what proportions. 4. Consider a Trust: If you have complex assets or want to avoid probate, you may want to consider setting up a trust. 5. Review and Update: Regularly review your will to ensure it reflects any changes in your circumstances or wishes.

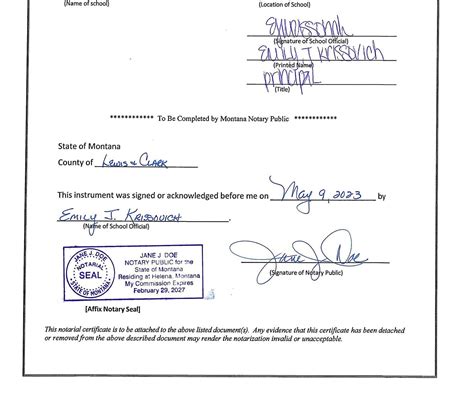

📝 Note: It's essential to have your will witnessed and notarized to ensure it is legally binding.

Understanding Power of Attorney

A power of attorney is a powerful document that allows someone else to act on your behalf. There are different types of power of attorney, including: - Financial Power of Attorney: Gives someone the authority to manage your financial affairs. - Medical Power of Attorney: Allows someone to make medical decisions for you. - Durable Power of Attorney: Remains in effect even if you become incapacitated.

Advanced Healthcare Directive

An advanced healthcare directive is a document that outlines your wishes for medical treatment if you are unable to communicate for yourself. It typically includes: - Living Will: Specifies the types of medical treatment you do or do not want to receive. - Healthcare Proxy: Names someone to make medical decisions for you.

Insurance Policies for Retirement

Having the right insurance policies in place can provide peace of mind and financial security. Consider the following: - Life Insurance: Provides a death benefit to your beneficiaries. - Long-Term Care Insurance: Helps cover the cost of long-term care, such as nursing home care or home health care.

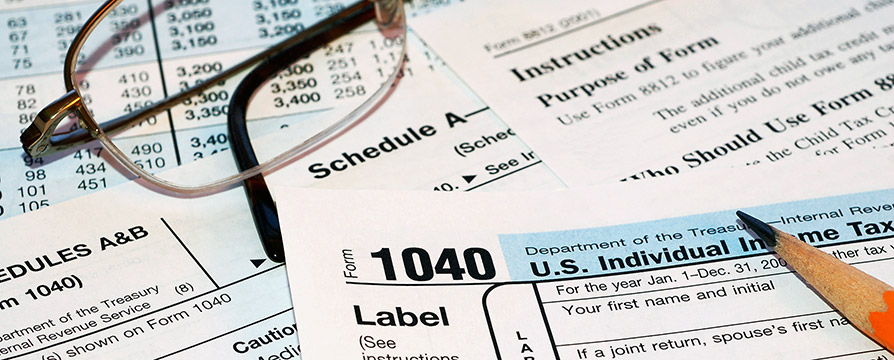

Retirement Account Documents

Your retirement account documents outline the rules for your retirement accounts, including: - 401(k) or IRA: Specifies the rules for contributions, withdrawals, and beneficiaries. - Required Minimum Distributions: Outlines the rules for required minimum distributions (RMDs) from your retirement accounts.

| Document | Purpose |

|---|---|

| Last Will and Testament | Outlines distribution of assets after death |

| Power of Attorney | Gives someone authority to act on your behalf |

| Advanced Healthcare Directive | Specifies medical treatment preferences |

| Insurance Policies | Provides financial protection |

| Retirement Account Documents | Outlines rules for retirement accounts |

As you prepare for retirement, it’s essential to have these five papers in order. By understanding the importance of each document and taking the time to create them, you can ensure a smoother transition into retirement and provide peace of mind for yourself and your loved ones. By planning ahead and being prepared, you can enjoy your retirement with confidence.

In the end, retirement planning is about more than just saving money; it’s about creating a comprehensive plan that includes all aspects of your life. By considering these five essential papers, you can take a significant step towards securing your financial future and ensuring that your wishes are respected.

What is the purpose of a last will and testament?

+

A last will and testament outlines how you want your assets to be distributed after you pass away, ensuring that your wishes are carried out and helping to avoid disputes among your heirs.

Why is it important to have a power of attorney?

+

A power of attorney gives someone you trust the authority to make decisions on your behalf if you become incapacitated, ensuring that your financial, medical, and personal affairs are managed according to your wishes.

What is an advanced healthcare directive?

+

An advanced healthcare directive is a document that specifies your preferences for medical treatment if you are unable to communicate for yourself, including a living will and a healthcare proxy.