5 Must-Have Papers

Introduction to Essential Documents

When it comes to organizing personal affairs, having the right documents in place can make a significant difference in times of need. These documents not only ensure that one’s wishes are respected but also provide a sense of security and clarity for loved ones. In this article, we will explore the 5 must-have papers that everyone should consider having.

1. Last Will and Testament

A Last Will and Testament is a document that outlines how a person wants their assets to be distributed after they pass away. It is a crucial document that ensures one’s wishes are carried out and can help avoid conflicts among family members. Some key points to consider when creating a Will include: * Appointing an Executor: The person responsible for carrying out the instructions in the Will. * Naming Beneficiaries: The individuals who will inherit the assets. * Specifying Funeral Arrangements: Outlining the type of funeral service and burial preferred.

2. Power of Attorney

A Power of Attorney (POA) is a document that grants someone the authority to act on another person’s behalf in financial and legal matters. This document is essential in case someone becomes incapacitated and cannot make decisions for themselves. There are different types of POA, including: * General POA: Grants broad powers to the appointed individual. * Special POA: Limits the powers to specific areas, such as financial transactions. * Healthcare POA: Focuses on medical decisions and healthcare-related matters.

3. Advance Directive

An Advance Directive is a document that outlines a person’s medical wishes if they become unable to communicate. This document is also known as a

4. Insurance Policies

Having the right insurance policies in place can provide financial protection for loved ones in case of unexpected events. Some essential insurance policies to consider include: * Life Insurance: Provides a death benefit to beneficiaries. * Disability Insurance: Offers financial support in case of illness or injury. * Health Insurance: Covers medical expenses and provides access to healthcare services.

5. Trusts

A Trust is a document that allows a person to manage and distribute assets according to their wishes. Trusts can be used to: * Avoid Probate: Bypass the court process of distributing assets after passing away. * Minimize Taxes: Reduce tax liabilities for beneficiaries. * Protect Assets: Safeguard assets from creditors or lawsuits.

📝 Note: It is essential to review and update these documents regularly to ensure they remain relevant and effective.

In the event of incapacity or death, having these 5 must-have papers in place can make a significant difference for loved ones. They provide clarity, security, and peace of mind, knowing that one’s wishes will be respected.

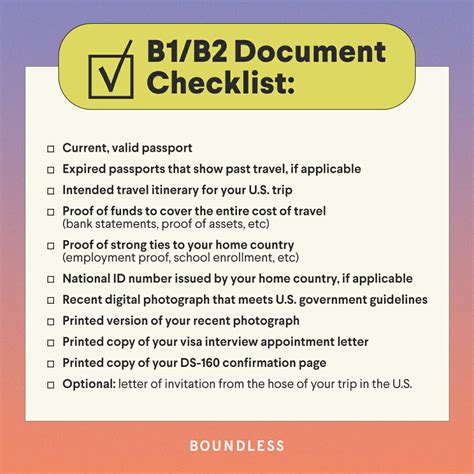

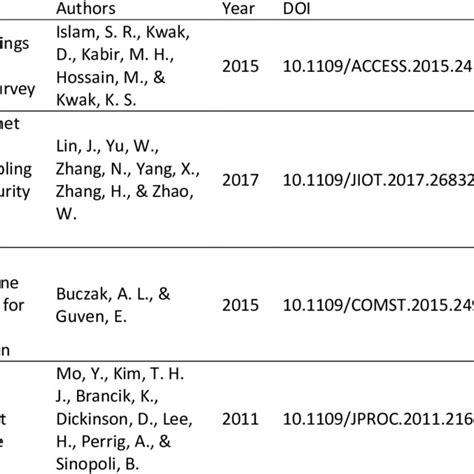

To further illustrate the importance of these documents, consider the following table:

| Document | Purpose |

|---|---|

| Last Will and Testament | Outlines asset distribution after passing away |

| Power of Attorney | Grants authority to act on someone's behalf |

| Advance Directive | Outlines medical wishes if incapacitated |

| Insurance Policies | Provides financial protection for loved ones |

| Trusts | Manages and distributes assets according to one's wishes |

Having these essential documents in place can provide peace of mind and ensure that one’s wishes are respected. It is crucial to review and update these documents regularly to ensure they remain relevant and effective.

In final thoughts, it is essential to prioritize the creation and maintenance of these 5 must-have papers. By doing so, individuals can ensure that their wishes are carried out, and their loved ones are protected and provided for.

What is the purpose of a Last Will and Testament?

+

A Last Will and Testament outlines how a person wants their assets to be distributed after they pass away.

What is the difference between a Power of Attorney and an Advance Directive?

+

A Power of Attorney grants someone the authority to act on another person’s behalf in financial and legal matters, while an Advance Directive outlines a person’s medical wishes if they become incapacitated.

Why is it essential to have insurance policies in place?

+

Insurance policies provide financial protection for loved ones in case of unexpected events, such as illness, injury, or death.