Prove Successor Interest Paperwork Requirements

Introduction to Successor Interest

The concept of successor interest is crucial in various legal and financial contexts, including estate planning, business succession, and property transfers. Successor interest refers to the right or expectation of inheriting or acquiring assets, properties, or interests from a predecessor. This can occur through wills, trusts, inheritance laws, or other contractual agreements. Understanding the paperwork requirements for successor interest is essential for ensuring a smooth transfer of assets and minimizing potential disputes.

Types of Successor Interest

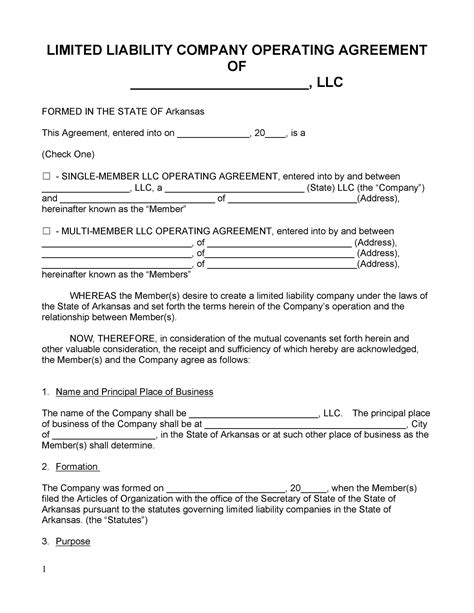

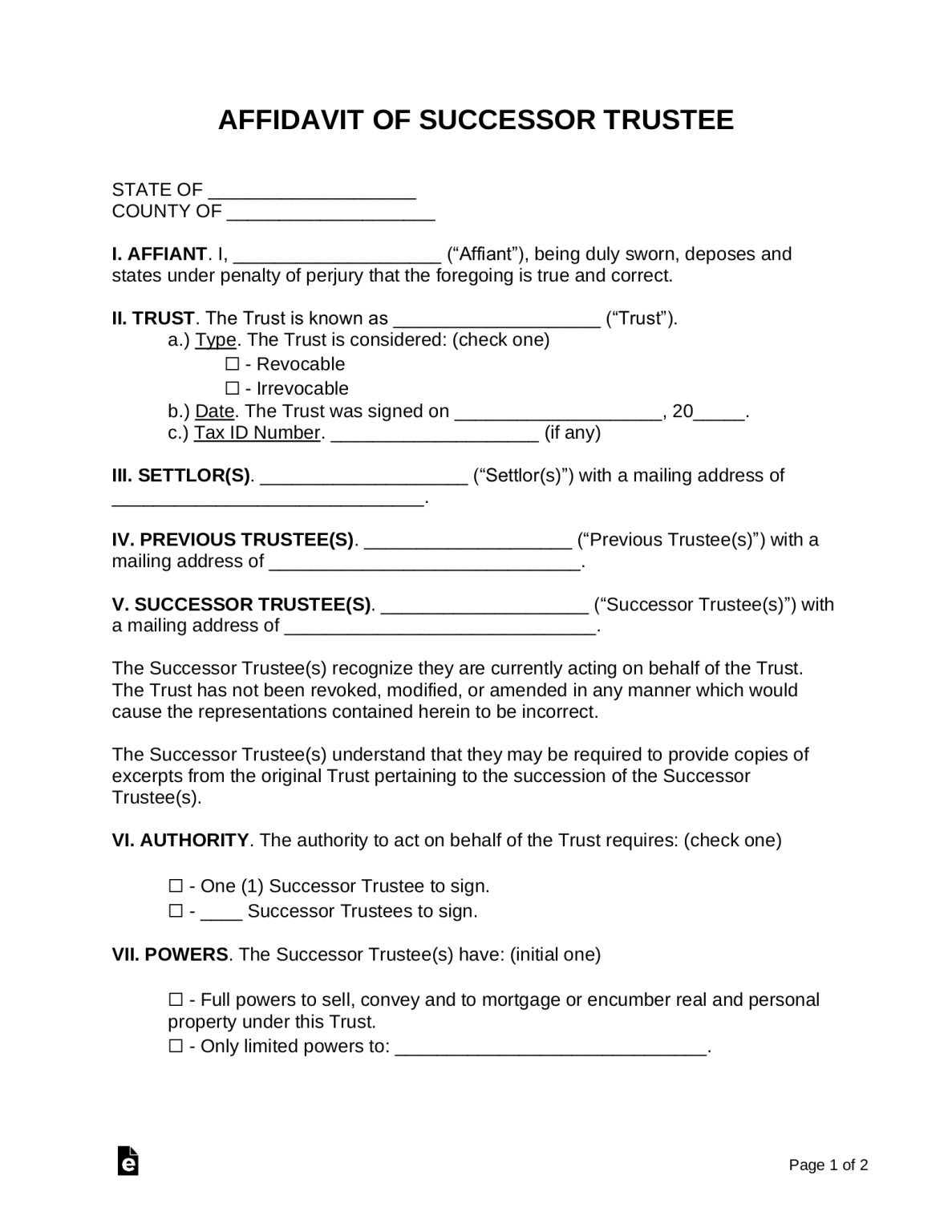

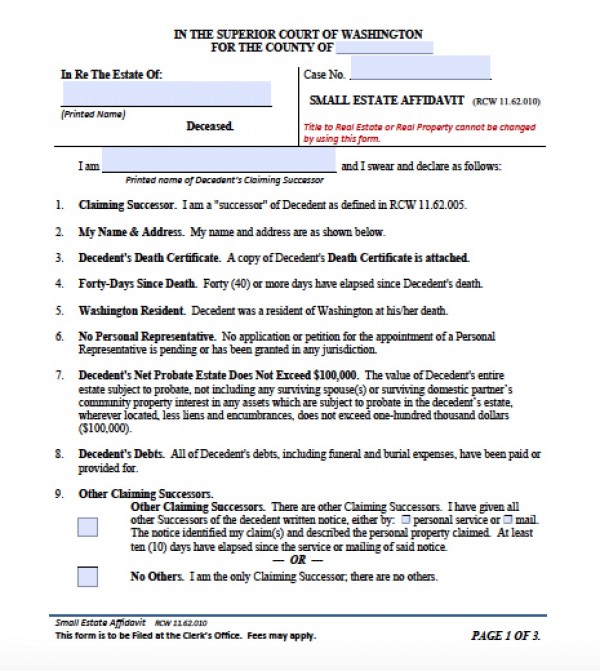

There are several types of successor interest, each with its own set of paperwork requirements: * Testamentary Successor Interest: This type of interest is created through a will, where the testator (the person making the will) designates a successor to inherit their assets. * Intestate Successor Interest: This occurs when a person dies without a will, and the successor interest is determined by intestate laws, which vary by jurisdiction. * Contractual Successor Interest: This type of interest is created through contractual agreements, such as partnership agreements or shareholder agreements. * Trust Successor Interest: This type of interest is created through trusts, where the trustor (the person creating the trust) designates a successor to inherit the trust assets.

Key Paperwork Requirements

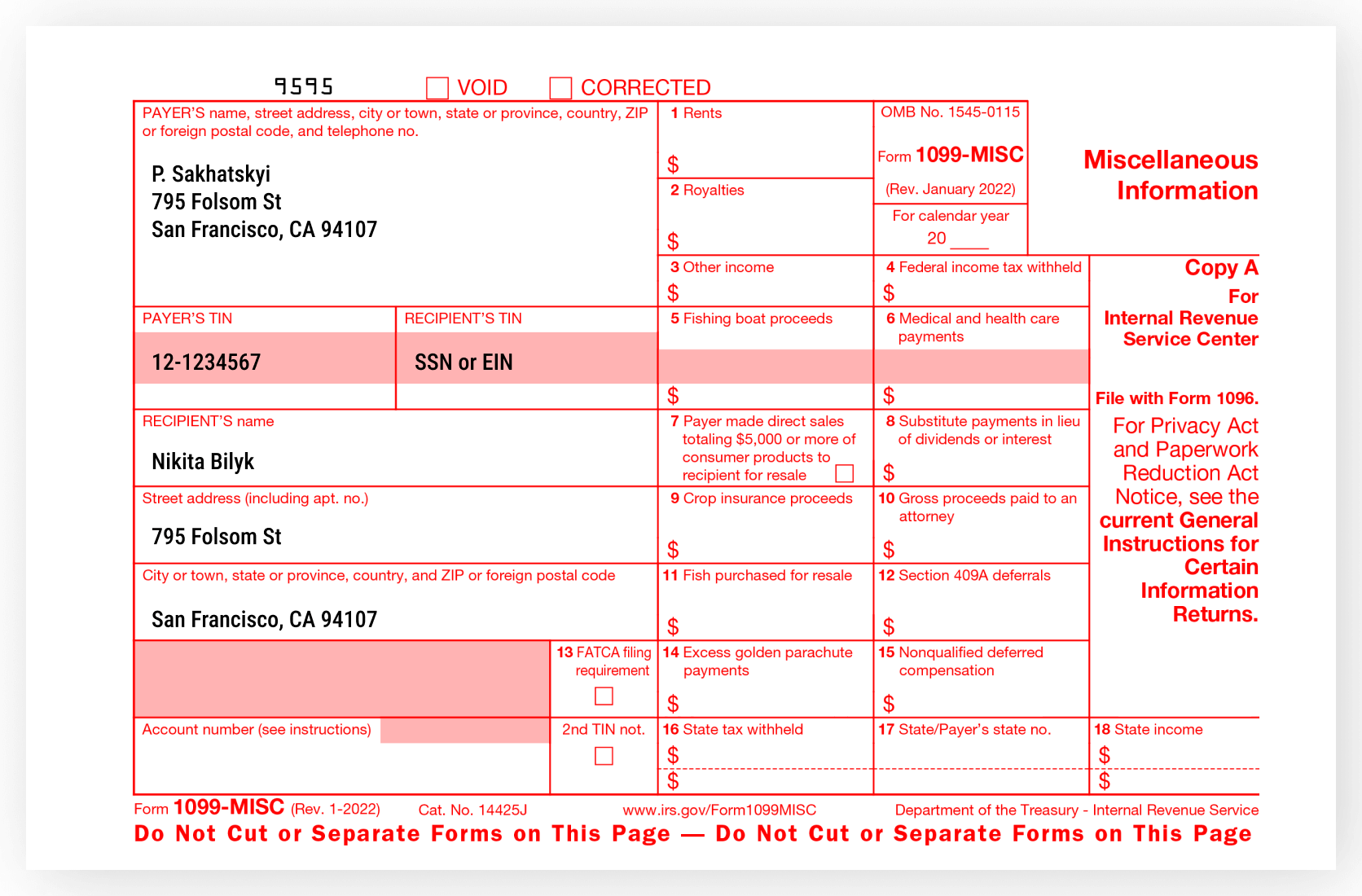

The paperwork requirements for successor interest vary depending on the type of interest and the jurisdiction. However, some common documents and paperwork requirements include: * Wills: A will is a crucial document for establishing testamentary successor interest. It should be signed, witnessed, and notarized to be valid. * Trust Agreements: A trust agreement is a document that outlines the terms of a trust, including the successor interest. It should be signed and notarized to be valid. * Partnership Agreements: A partnership agreement is a document that outlines the terms of a partnership, including the successor interest. It should be signed and notarized to be valid. * Shareholder Agreements: A shareholder agreement is a document that outlines the terms of a corporation, including the successor interest. It should be signed and notarized to be valid. * Beneficiary Designations: Beneficiary designations are used to designate a successor interest in life insurance policies, retirement accounts, and other benefit plans. * Letters of Administration: Letters of administration are court documents that appoint a personal representative to manage the estate of a deceased person.

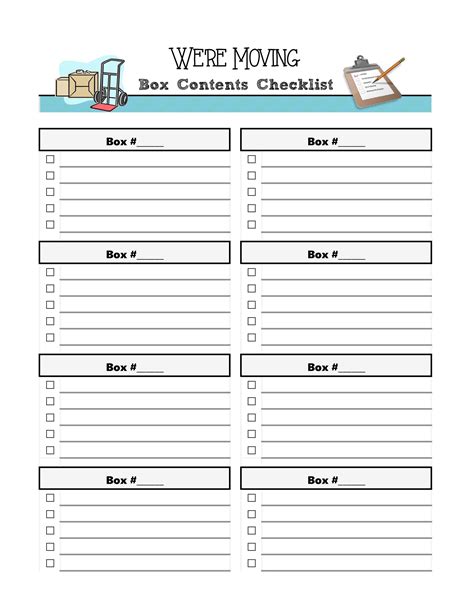

Successor Interest Paperwork Checklist

To ensure that all necessary paperwork is completed, the following checklist can be used: * Gather all relevant documents, including wills, trust agreements, partnership agreements, and shareholder agreements. * Review and update beneficiary designations to ensure that they are current and accurate. * Obtain letters of administration from the court, if necessary. * File all necessary paperwork with the relevant authorities, such as the court or the county recorder’s office. * Keep all paperwork organized and easily accessible, in case it is needed in the future.

| Document | Description |

|---|---|

| Will | A document that outlines the distribution of assets after death |

| Trust Agreement | A document that outlines the terms of a trust |

| Partnership Agreement | A document that outlines the terms of a partnership |

| Shareholder Agreement | A document that outlines the terms of a corporation |

| Beneficiary Designation | A document that designates a successor interest in a life insurance policy, retirement account, or other benefit plan |

📝 Note: It is essential to consult with an attorney or other qualified professional to ensure that all necessary paperwork is completed accurately and in accordance with the relevant laws and regulations.

Best Practices for Managing Successor Interest Paperwork

To ensure that successor interest paperwork is managed effectively, the following best practices can be followed: * Keep all paperwork organized and easily accessible, in case it is needed in the future. * Review and update paperwork regularly, to ensure that it is current and accurate. * Use a secure and reliable storage system, such as a safe or a secure online storage service, to store all paperwork. * Provide copies of paperwork to all relevant parties, such as beneficiaries or successor trustees. * Seek professional advice, if necessary, to ensure that all paperwork is completed accurately and in accordance with the relevant laws and regulations.

In summary, successor interest paperwork requirements vary depending on the type of interest and the jurisdiction. It is essential to understand the key paperwork requirements and to follow best practices for managing successor interest paperwork to ensure a smooth transfer of assets and minimize potential disputes.

The key points to remember are that successor interest can be created through various means, including wills, trusts, and contractual agreements, and that it is crucial to complete all necessary paperwork accurately and in accordance with the relevant laws and regulations. By following these guidelines and seeking professional advice when necessary, individuals can ensure that their successor interest is properly established and that their assets are transferred smoothly to their successors.

What is successor interest?

+

Successor interest refers to the right or expectation of inheriting or acquiring assets, properties, or interests from a predecessor.

What are the types of successor interest?

+

There are several types of successor interest, including testamentary successor interest, intestate successor interest, contractual successor interest, and trust successor interest.

What are the key paperwork requirements for successor interest?

+

The key paperwork requirements for successor interest include wills, trust agreements, partnership agreements, shareholder agreements, beneficiary designations, and letters of administration.