New Jersey Hiring Paperwork Requirements

Introduction to New Jersey Hiring Paperwork Requirements

When hiring new employees in New Jersey, it is essential to understand the state’s specific requirements for paperwork and documentation. This process involves several steps and documents, all designed to ensure compliance with federal and state laws. Compliance is key to avoiding legal issues and penalties. In this article, we will guide you through the necessary paperwork and requirements for hiring in New Jersey, making the process smoother and more manageable for employers.

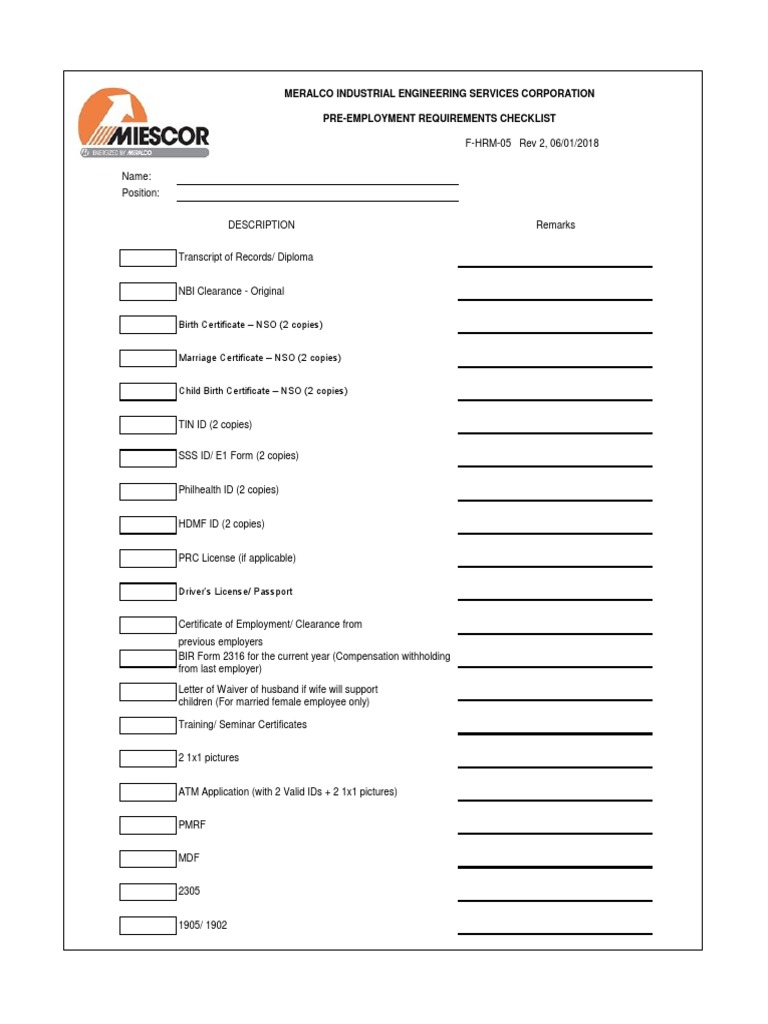

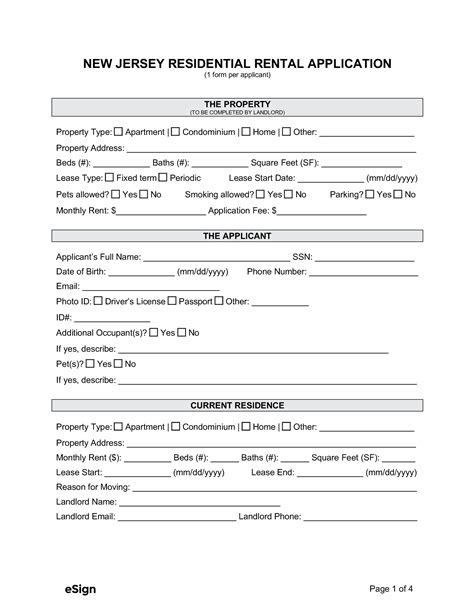

Pre-Hiring Process

Before the actual hiring, there are several steps employers must take. This includes: - Job Description: Creating a detailed job description that outlines the role, responsibilities, and requirements of the position. - Application Form: Developing an application form that requests necessary information from applicants without infringing on their rights or asking discriminatory questions. - Interview Process: Conducting interviews that are fair, unbiased, and focused on the applicant’s qualifications and fit for the role.

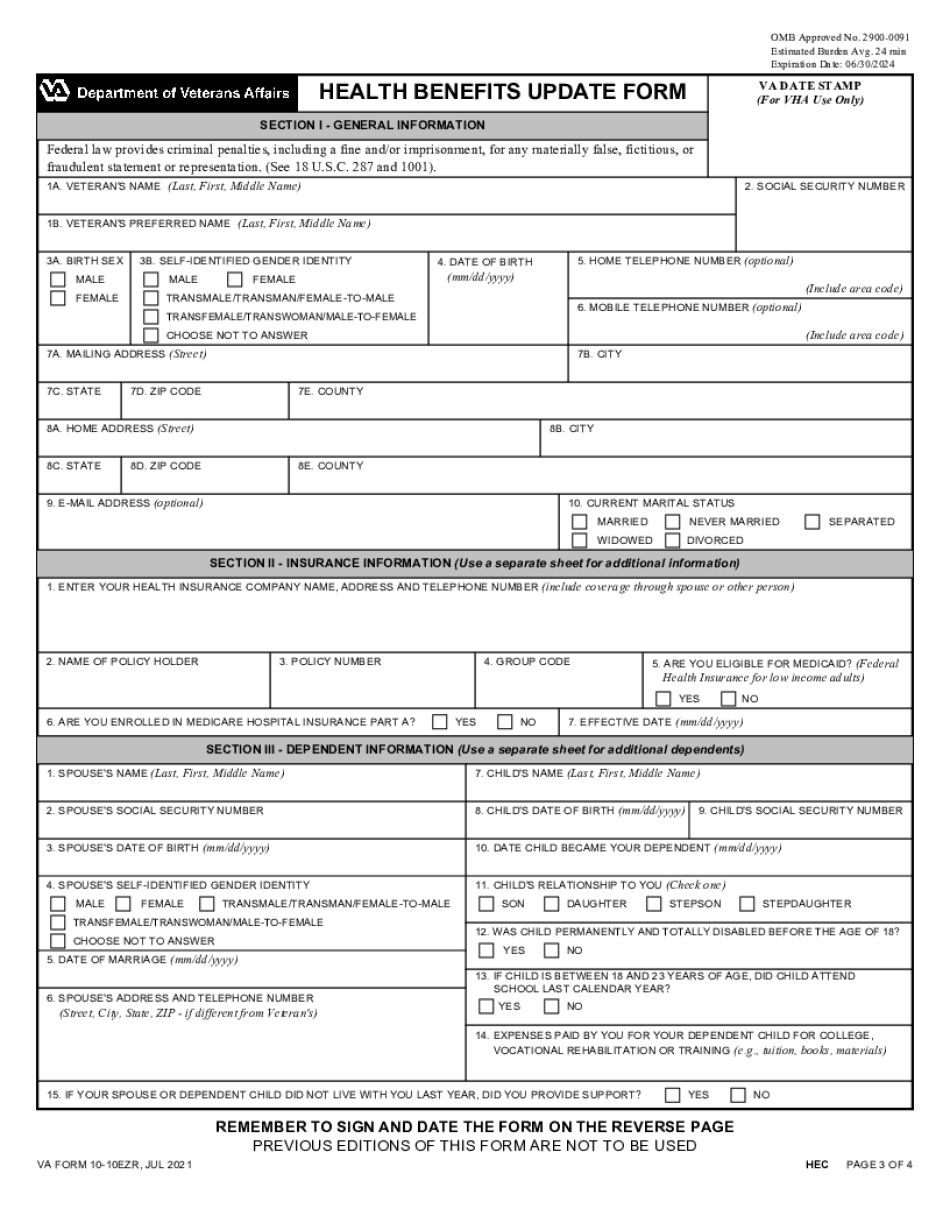

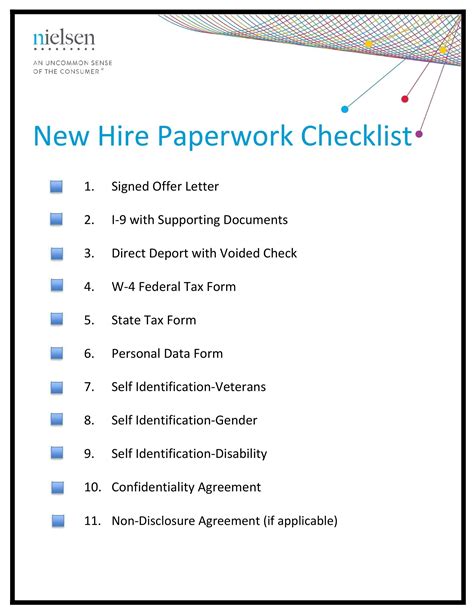

Necessary Documents for Hiring

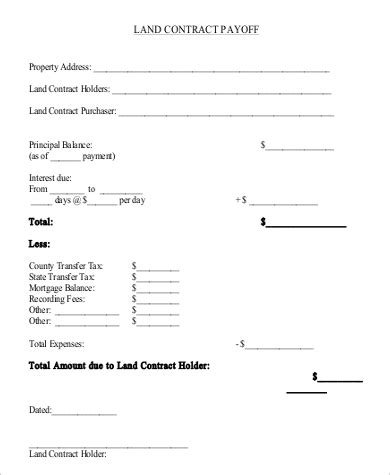

Once an employer decides to hire an applicant, several documents must be completed and retained. These include: - W-4 Form: For tax withholding purposes. - I-9 Form: To verify the employee’s identity and eligibility to work in the United States. - Employee Handbook Acknowledgement: Confirming that the employee has received and understood the company’s policies and procedures. - Benefits Enrollment Forms: If the company offers health insurance, retirement plans, or other benefits, employees must be given the opportunity to enroll.

| Document | Purpose |

|---|---|

| W-4 Form | Tax Withholding |

| I-9 Form | Identity and Work Eligibility Verification |

| Employee Handbook Acknowledgement | Acknowledgement of Company Policies |

| Benefits Enrollment Forms | Enrollment in Company Benefits |

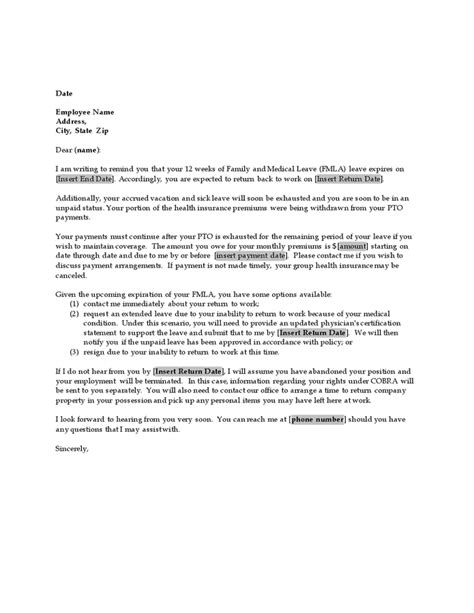

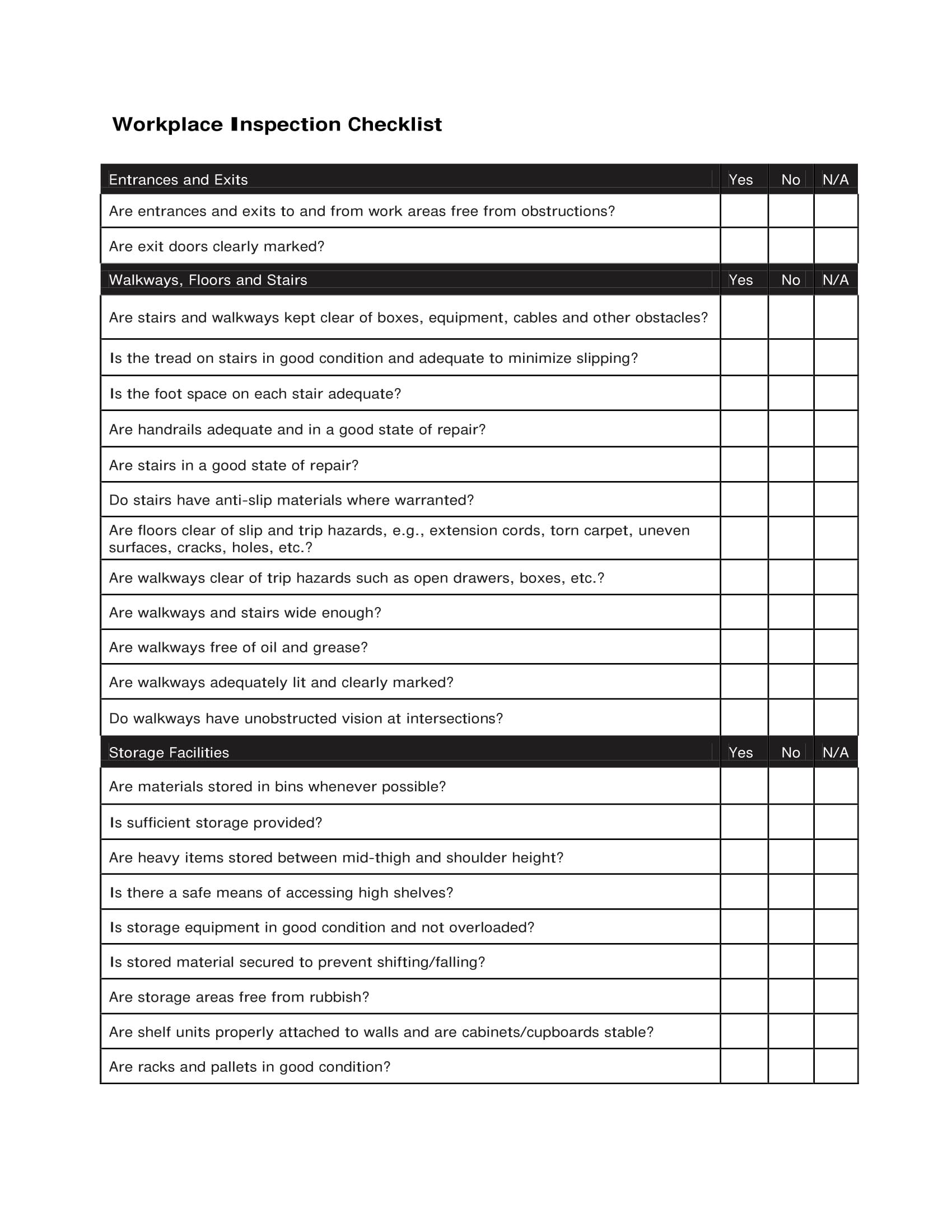

Post-Hiring Requirements

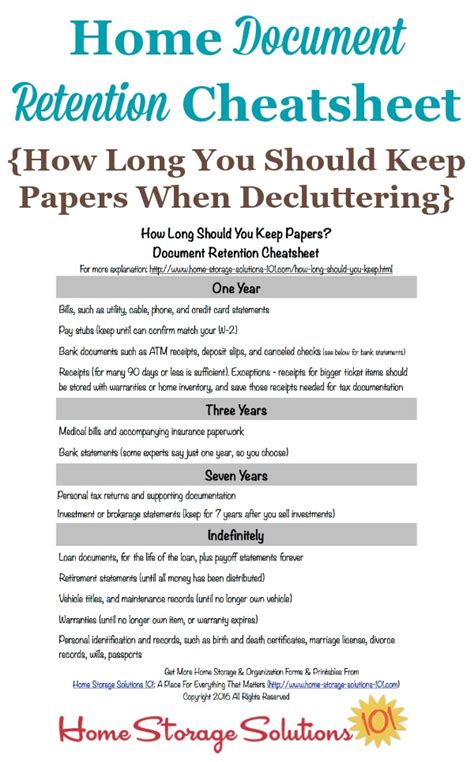

After hiring, employers have ongoing obligations, including: - Reporting New Hires: Employers must report new hires to the state within 20 days of hire. - Maintaining Records: Keeping accurate and detailed records of employee information, including personnel files and payroll records. - Compliance with Labor Laws: Ensuring adherence to all federal and state labor laws, including those related to minimum wage, overtime, and workplace safety.

📝 Note: Employers must be aware of and comply with all applicable laws and regulations, including anti-discrimination laws and laws related to employee privacy.

Benefits and Compensation

Employers in New Jersey must also consider the benefits and compensation they offer, ensuring they meet state requirements. This includes: - Minimum Wage: Paying at least the minimum wage set by the state. - Paid Sick Leave: Providing paid sick leave as required by state law. - Family Leave Insurance: Offering family leave insurance to eligible employees.

Conclusion and Final Thoughts

In summary, hiring in New Jersey involves a series of steps and requirements designed to protect both employers and employees. By understanding and complying with these regulations, businesses can ensure a smooth hiring process and maintain a positive, lawful work environment. Compliance with state and federal laws is not only a legal necessity but also contributes to the overall well-being of the company and its employees.

What is the minimum wage in New Jersey?

+

The minimum wage in New Jersey is subject to change, so it’s essential to check the current rate. As of my last update, the minimum wage was increasing annually until it reaches $15 per hour for most employees.

Do all employers in New Jersey need to provide paid sick leave?

+

Yes, most employers in New Jersey are required to provide paid sick leave to their employees, with certain exceptions. The law requires employers with 10 or fewer employees to provide up to 40 hours of unpaid sick leave, while those with more than 10 employees must provide up to 40 hours of paid sick leave per year.

How do I report new hires in New Jersey?

+

Employers can report new hires to the New Jersey Department of Human Services, Division of Family Development, through their online portal or by mailing a completed form. This must be done within 20 days of the hire date.