Tax Paperwork Needed

Understanding the Tax Paperwork Requirements

When it comes to managing taxes, one of the most critical aspects is ensuring you have all the necessary paperwork in order. This can be a daunting task, especially for individuals who are not familiar with the process. Tax paperwork includes a variety of documents and forms that are required to file your taxes accurately and efficiently. In this article, we will delve into the details of the tax paperwork you need, how to obtain it, and tips for organizing it effectively.

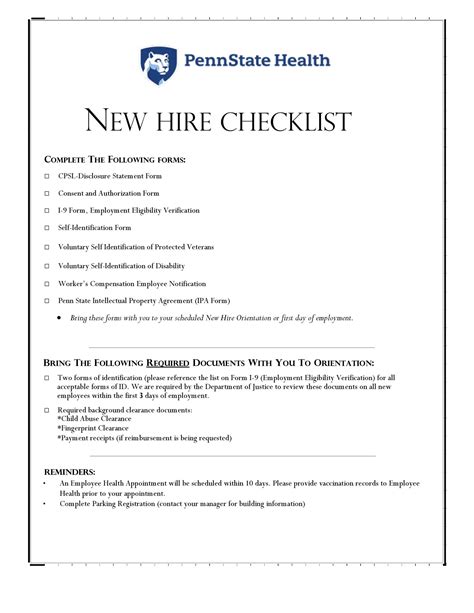

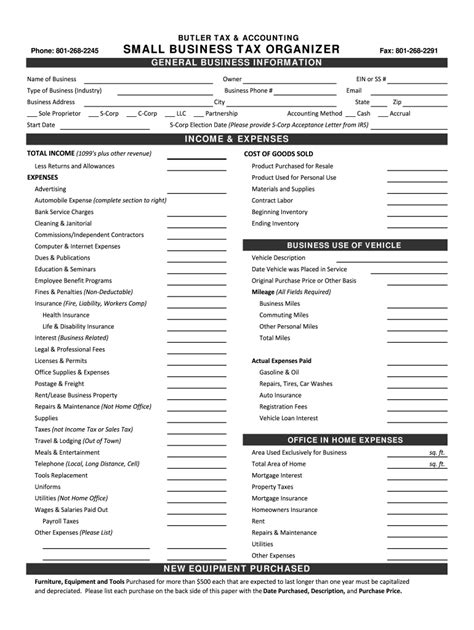

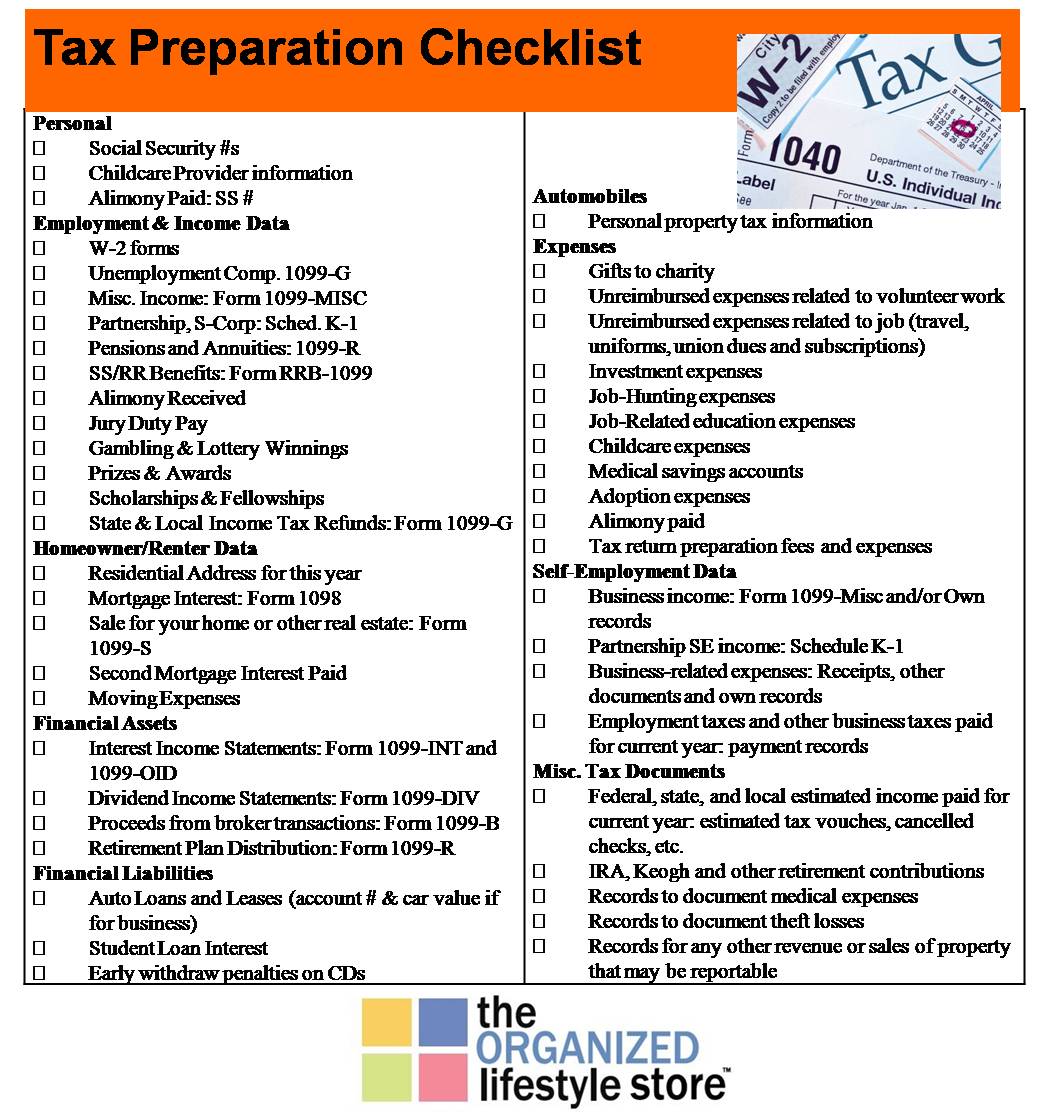

Types of Tax Paperwork

There are several types of tax paperwork that you may need to gather, depending on your income sources, deductions, and other factors. Some of the most common types include:

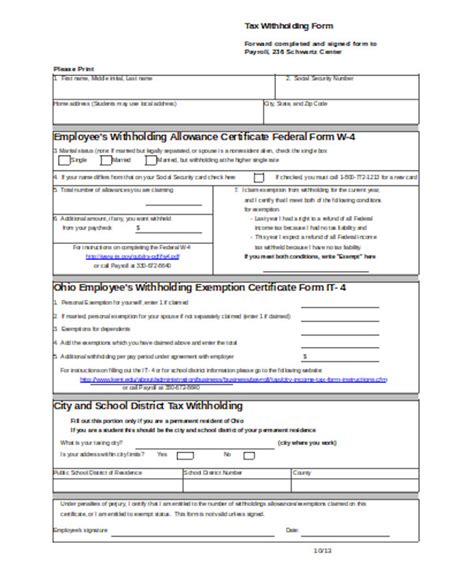

- W-2 forms: These are provided by your employer and show your income and the taxes withheld.

- 1099 forms: If you are self-employed or have income from freelance work, investments, or other sources, you will receive 1099 forms.

- Interest statements: Banks and other financial institutions will provide you with statements showing the interest you earned on your accounts.

- Dividend statements: If you own stocks, you will receive statements showing the dividends you earned.

- Charitable donation receipts: If you made donations to charity, you will need receipts to claim deductions.

- Medical expense receipts: If you have significant medical expenses, you may be able to claim deductions, and you will need receipts to support your claims.

Organizing Your Tax Paperwork

Organizing your tax paperwork is crucial to ensure that you do not miss any important documents and that you can easily find what you need when you need it. Here are some tips for organizing your tax paperwork:

- Create a folder or file: Designate a specific folder or file where you will keep all your tax-related documents.

- Label and categorize: Label each document clearly and categorize them (e.g., income, deductions, credits).

- Keep electronic copies: Scan your documents and save them electronically, in case the physical copies are lost or damaged.

- Review and update regularly: Regularly review your tax paperwork to ensure everything is in order and update as necessary.

Obtaining Missing Tax Paperwork

If you are missing any tax paperwork, there are steps you can take to obtain what you need:

- Contact your employer or financial institution: Reach out to your employer or financial institution to request a duplicate copy of the missing document.

- Check online: Many financial institutions and employers provide online access to tax documents.

- Contact the IRS: If you are unable to obtain a document from the issuer, you may be able to get it from the IRS.

💡 Note: It's essential to act promptly if you are missing tax paperwork, as delays can impact your ability to file your taxes on time.

Tips for Filing Your Taxes

Once you have all your tax paperwork in order, it’s time to file your taxes. Here are some tips to make the process smoother:

- E-file: Consider e-filing your taxes, as it is generally faster and more accurate than paper filing.

- Use tax software: Utilize tax software to help guide you through the filing process and ensure you are taking advantage of all eligible deductions and credits.

- Seek professional help: If you are unsure about any aspect of the tax filing process, consider seeking help from a tax professional.

| Document Type | Purpose |

|---|---|

| W-2 | Reports income and taxes withheld |

| 1099 | Reports income from self-employment, freelance work, investments, etc. |

| Interest Statement | Reports interest earned on bank accounts |

As you finalize your tax filing, remember that accuracy and completeness are key. Ensure you have all the necessary tax paperwork and that it is accurately reflected in your tax return. This will help you avoid any potential issues with the IRS and ensure you receive the refund you are entitled to.

In summary, having the right tax paperwork is essential for filing your taxes efficiently and accurately. By understanding what documents you need, organizing them effectively, and seeking help when necessary, you can navigate the tax filing process with confidence. Remember to stay organized, and don’t hesitate to reach out for help if you need it. With the right approach, you can ensure a smooth and successful tax filing experience.

What is the deadline for filing taxes?

+

The deadline for filing taxes varies by year, but it is typically April 15th.

Can I file my taxes electronically?

+

Yes, you can file your taxes electronically, which is generally faster and more accurate than paper filing.

What happens if I miss the tax filing deadline?

+

If you miss the tax filing deadline, you may be subject to penalties and interest on any taxes owed. It’s essential to file as soon as possible to minimize these charges.