Chase Business Account Paperwork Requirements

Introduction to Chase Business Account Paperwork Requirements

When it comes to opening a business account with Chase, one of the largest banks in the United States, there are specific paperwork requirements that must be met. These requirements are in place to ensure that the account is opened in compliance with all relevant laws and regulations, including those related to identity verification, business formation, and financial transparency. Understanding these requirements is crucial for businesses looking to establish a banking relationship with Chase.

Types of Businesses and Required Documents

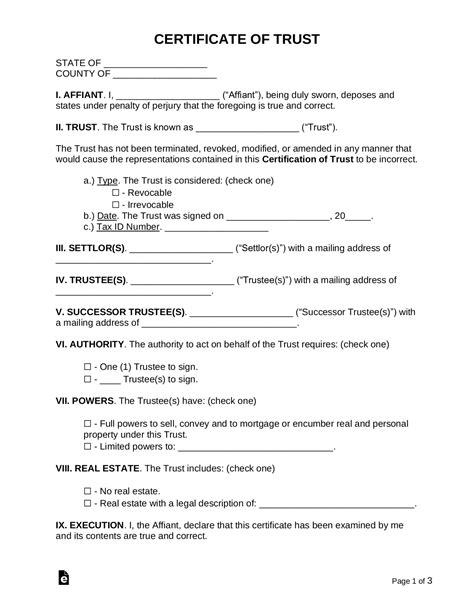

The type of business you own or represent will determine the specific paperwork requirements for opening a Chase business account. Generally, businesses can be categorized into sole proprietorships, partnerships, limited liability companies (LLCs), corporations, and non-profits. Each of these business types has its own set of required documents: - Sole Proprietorships: Typically require a valid government-issued ID, a Social Security number or Individual Taxpayer Identification Number (ITIN), and sometimes a fictitious business name statement (if the business operates under a name different from the owner’s name). - Partnerships: Need a partnership agreement, an Employer Identification Number (EIN), and identification for all partners. - LLCs and Corporations: Require articles of incorporation or articles of organization, an operating agreement (for LLCs), bylaws (for corporations), an EIN, and identification for all owners or shareholders. - Non-Profits: Must provide their non-profit certificate, bylaws, an EIN, and possibly other documentation specific to their non-profit status.

Generic Requirements for All Business Types

Regardless of the business type, there are generic requirements that apply across the board for opening a business account with Chase: - Business License: A valid business license issued by the state or local government where the business operates. - Proof of Business Address: This can be a utility bill, lease agreement, or other documents that verify the business’s physical location. - Identification for Signers: All individuals authorized to sign on the account must provide valid government-issued IDs. - Resolution or Agreement: For entities like corporations or LLCs, a resolution or operating agreement that outlines who has the authority to open and manage the bank account.

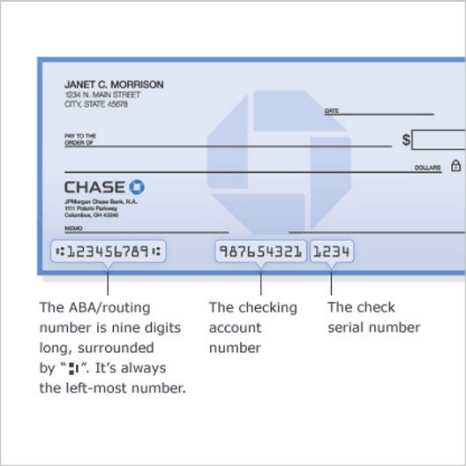

Understanding EIN and Its Importance

An Employer Identification Number (EIN), also known as a Federal Tax Identification Number, is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to business entities operating in the United States. It’s used to identify the business for tax purposes and is required for most businesses to open a bank account. Applying for an EIN is a straightforward process that can be completed online through the IRS website. It’s essential for businesses as it helps in separating personal and business finances and is necessary for filing tax returns and hiring employees.

Role of Business Formation Documents

Business formation documents, such as articles of incorporation for corporations or articles of organization for LLCs, are legal documents that formally establish a business’s existence. They provide essential information about the business, including its name, purpose, structure, and the names of its initial directors or members. These documents are filed with the state government where the business is located and are crucial for obtaining an EIN, opening a business bank account, and conducting other legal business activities.

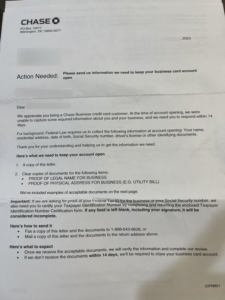

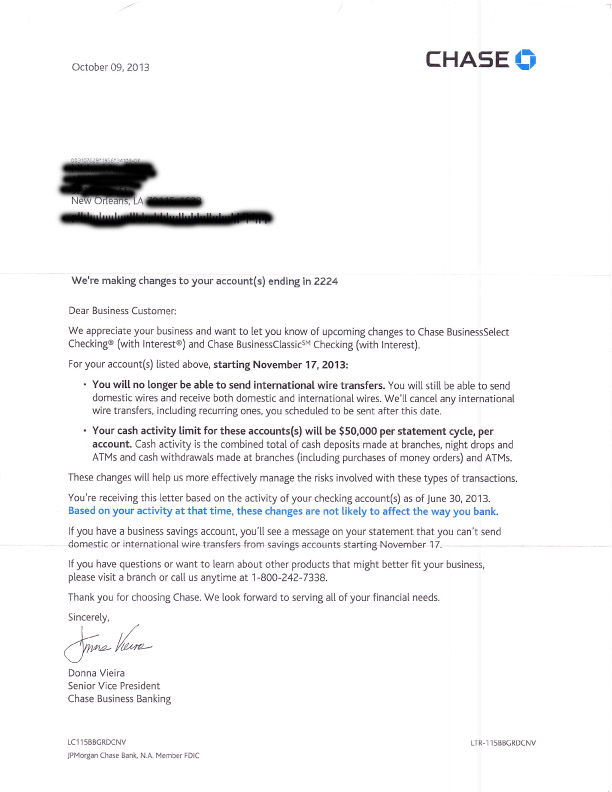

Identity Verification and Anti-Money Laundering (AML) Regulations

Chase, like all financial institutions, is subject to Anti-Money Laundering (AML) regulations and the Bank Secrecy Act (BSA). These laws require banks to verify the identity of their customers, monitor transactions for suspicious activity, and report certain transactions to the government. As part of the account opening process, Chase must collect information to verify the identity of the business and its beneficial owners. This includes understanding the nature of the business, its ownership structure, and the sources of its funds.

💡 Note: Beneficial owners are individuals who own or control 25% or more of the business. Identifying and verifying these individuals is a critical part of the AML compliance process.

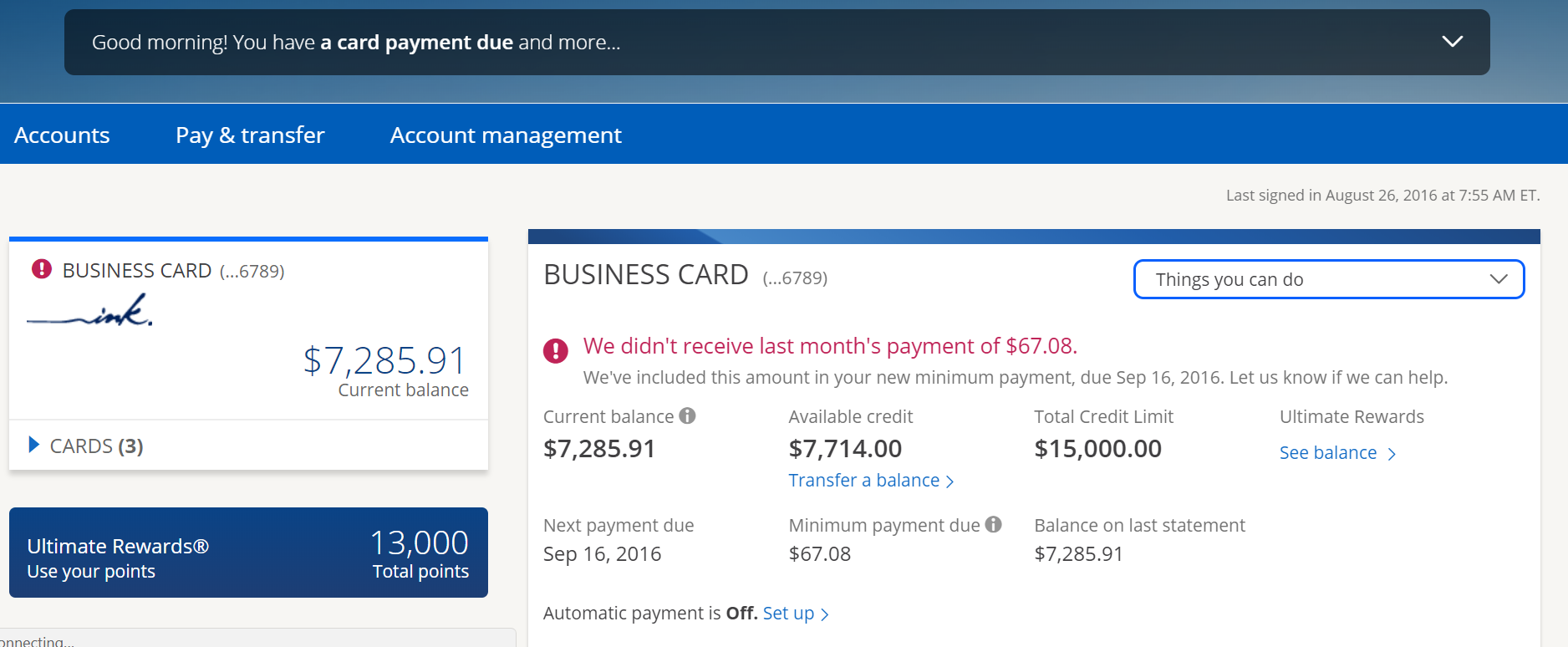

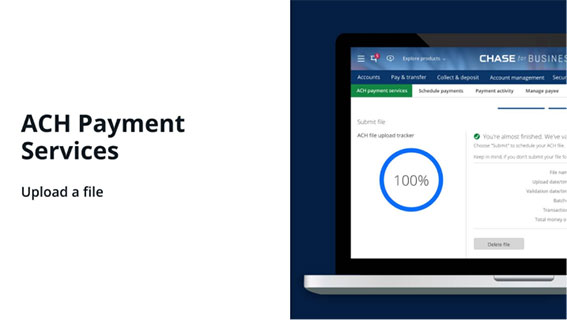

Streamlining the Account Opening Process

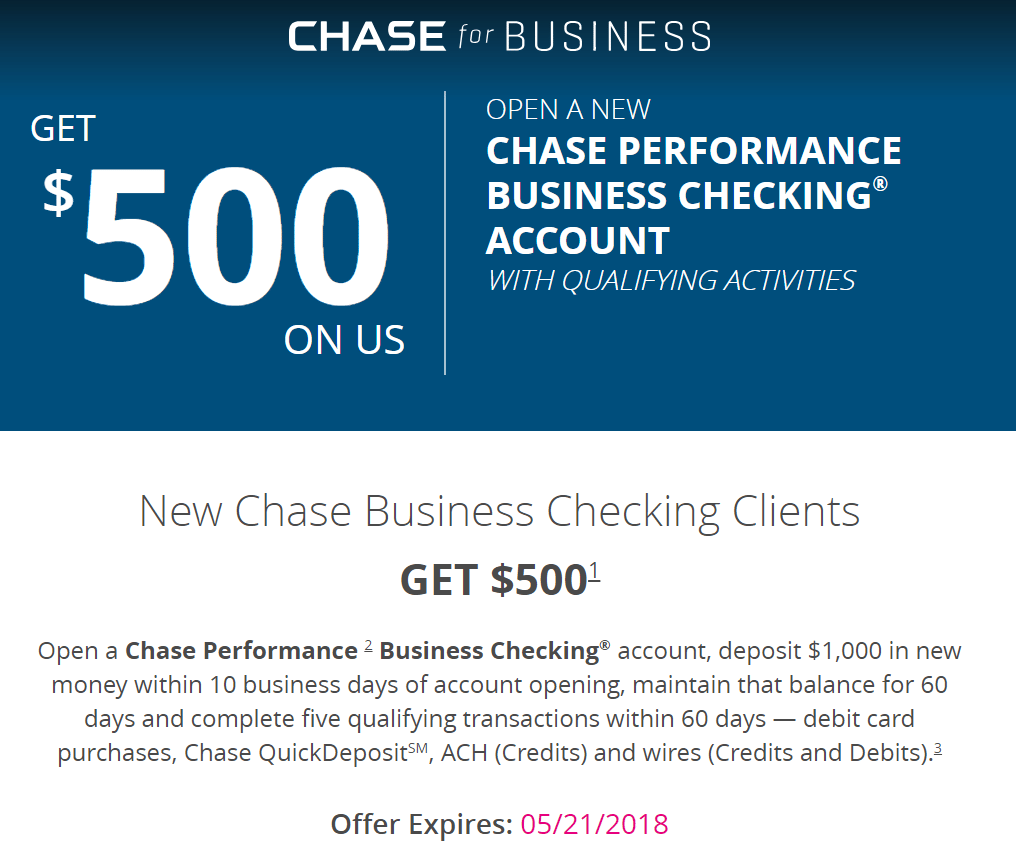

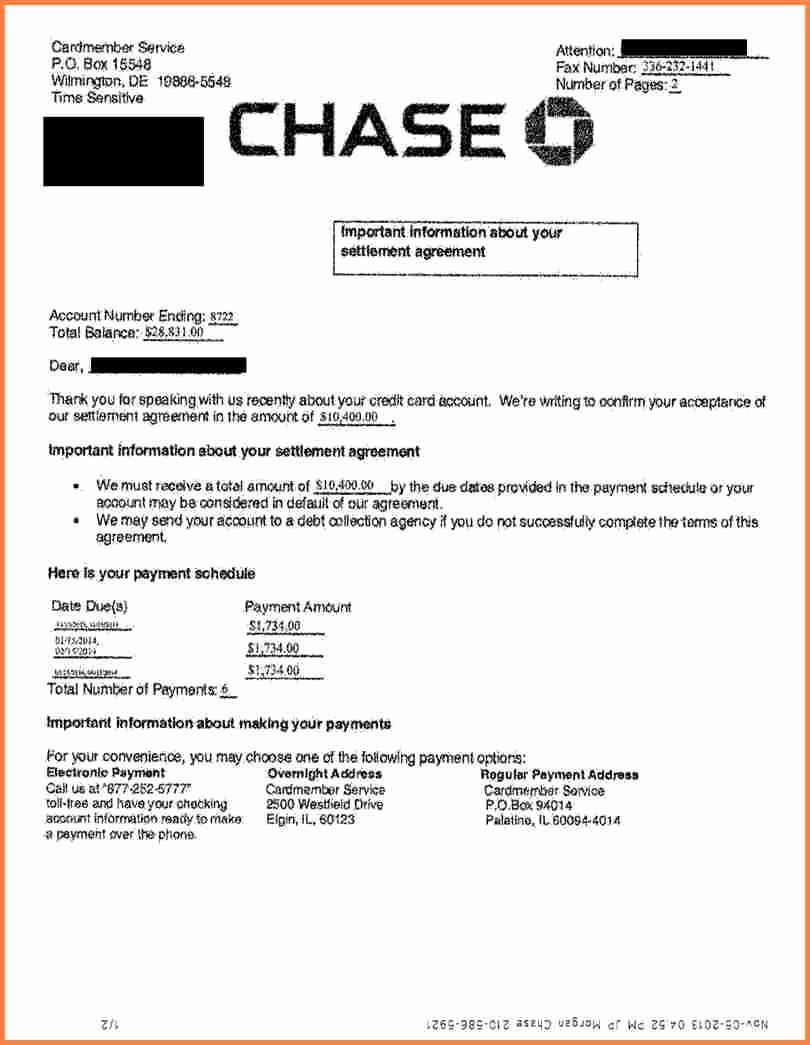

To streamline the process of opening a Chase business account, it’s advisable to gather all required documents beforehand and ensure that they are complete and up-to-date. This preparation can significantly reduce the time it takes to open the account. Additionally, businesses should be prepared to provide detailed information about their operations, financial projections, and the purpose of the account. Chase may also require a minimum opening deposit, which can vary depending on the type of account being opened.

Common Challenges and Solutions

- Incomplete Documentation: Ensure all documents are complete and correctly filled out. - Delays in EIN Application: Apply for an EIN well in advance of needing it to avoid delays. - Complexity in Beneficial Ownership: Clearly identify and document beneficial owners to comply with AML regulations.

| Business Type | Required Documents |

|---|---|

| Sole Proprietorship | Valid ID, SSN or ITIN, Fictitious Business Name Statement (if applicable) |

| Partnership | Partnership Agreement, EIN, Identification for All Partners |

| LLC/Corporation | Articles of Incorporation/Organization, Operating Agreement/Bylaws, EIN, Identification for Owners/Shareholders |

| Non-Profit | Non-Profit Certificate, Bylaws, EIN |

In summary, opening a Chase business account involves a thorough process that requires specific paperwork and documentation. Understanding these requirements and being prepared can make the process smoother and more efficient. By gathering all necessary documents, ensuring compliance with regulatory requirements, and being transparent about the business’s operations and ownership, businesses can successfully open a Chase business account and begin building their financial foundation.

What is the primary purpose of requiring an EIN for a business account?

+

The primary purpose of an EIN is to identify the business for tax purposes and to separate personal and business finances, making it easier to file tax returns, hire employees, and open a business bank account.

How long does it typically take to open a Chase business account?

+

The time it takes to open a Chase business account can vary depending on the complexity of the application and the completeness of the submitted documents. It can range from a few days to several weeks.

What happens if I don’t have all the required documents for opening a business account?

+

If you don’t have all the required documents, the account opening process will be delayed until all necessary documents are provided. It’s advisable to gather all documents beforehand to ensure a smooth process.