Car Loan Paperwork Requirements

Introduction to Car Loan Paperwork

When considering purchasing a vehicle, understanding the car loan paperwork requirements is essential to ensure a smooth and efficient process. The paperwork involved in a car loan can be overwhelming, but being prepared and knowing what to expect can make all the difference. In this article, we will delve into the world of car loan paperwork, exploring the necessary documents, steps involved, and tips for a successful application.

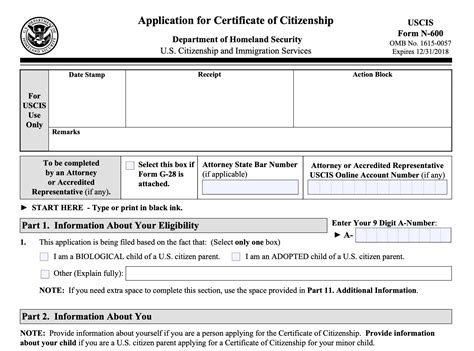

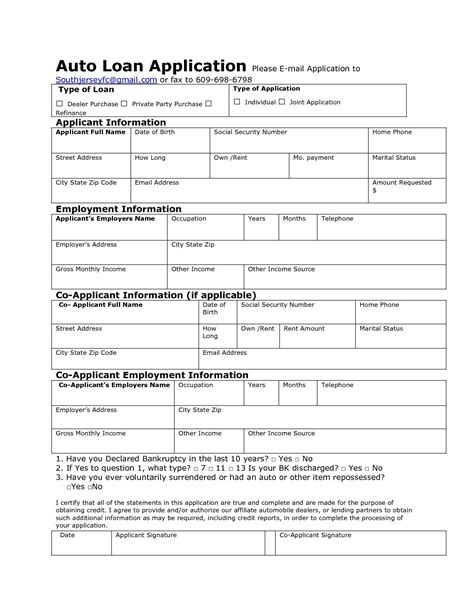

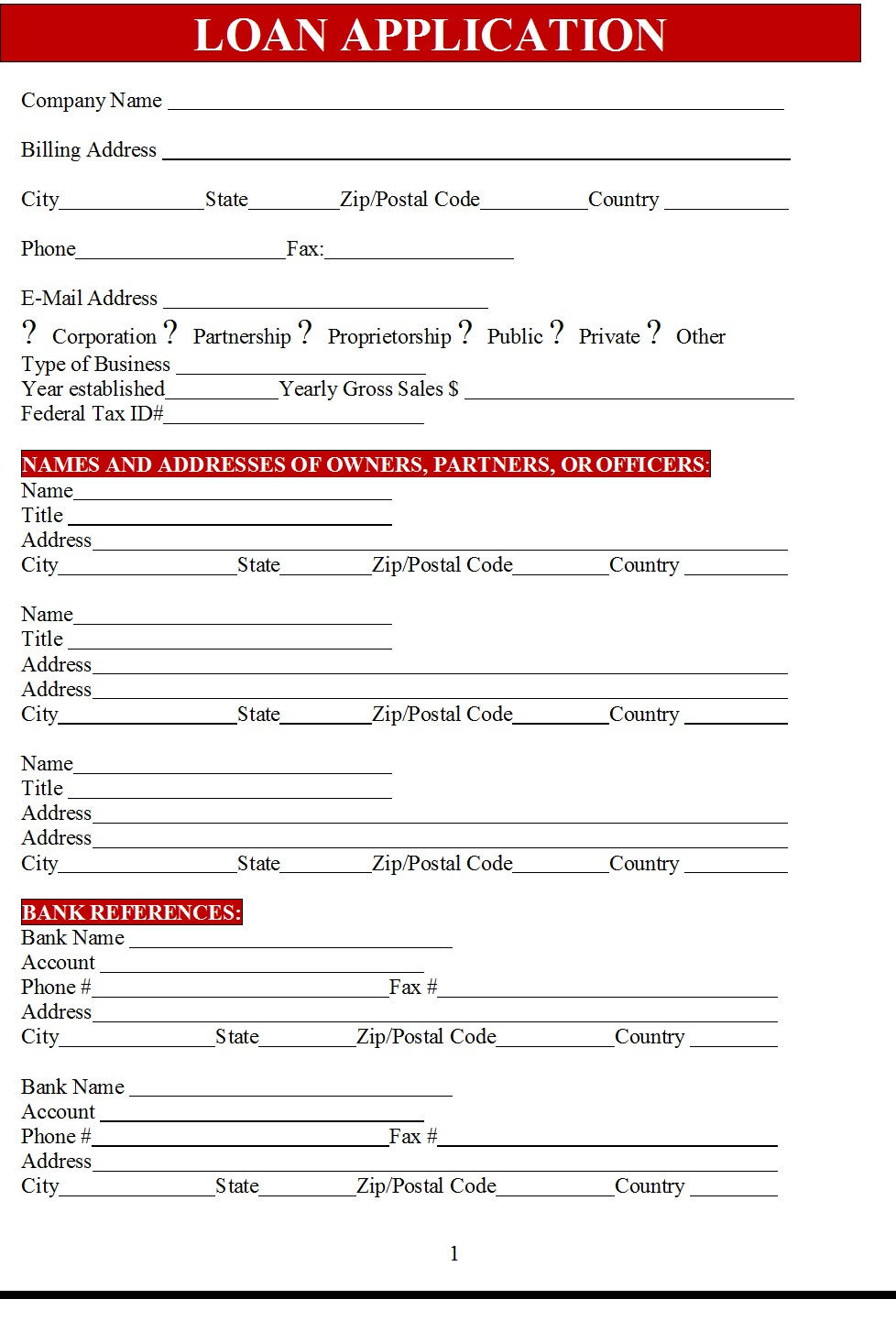

Required Documents for Car Loan Paperwork

To begin the car loan application process, you will need to gather various documents. These documents are crucial in verifying your identity, income, employment, and creditworthiness. The necessary documents include: * Identification: A valid government-issued ID, such as a driver’s license or passport * Income proof: Pay stubs, W-2 forms, or tax returns to demonstrate your income * Employment verification: A letter from your employer or a recent pay stub to confirm your employment status * Credit report: A copy of your credit report to assess your credit history and score * Vehicle information: The make, model, and Vehicle Identification Number (VIN) of the vehicle you wish to purchase * Insurance information: Proof of insurance or a quote from an insurance provider

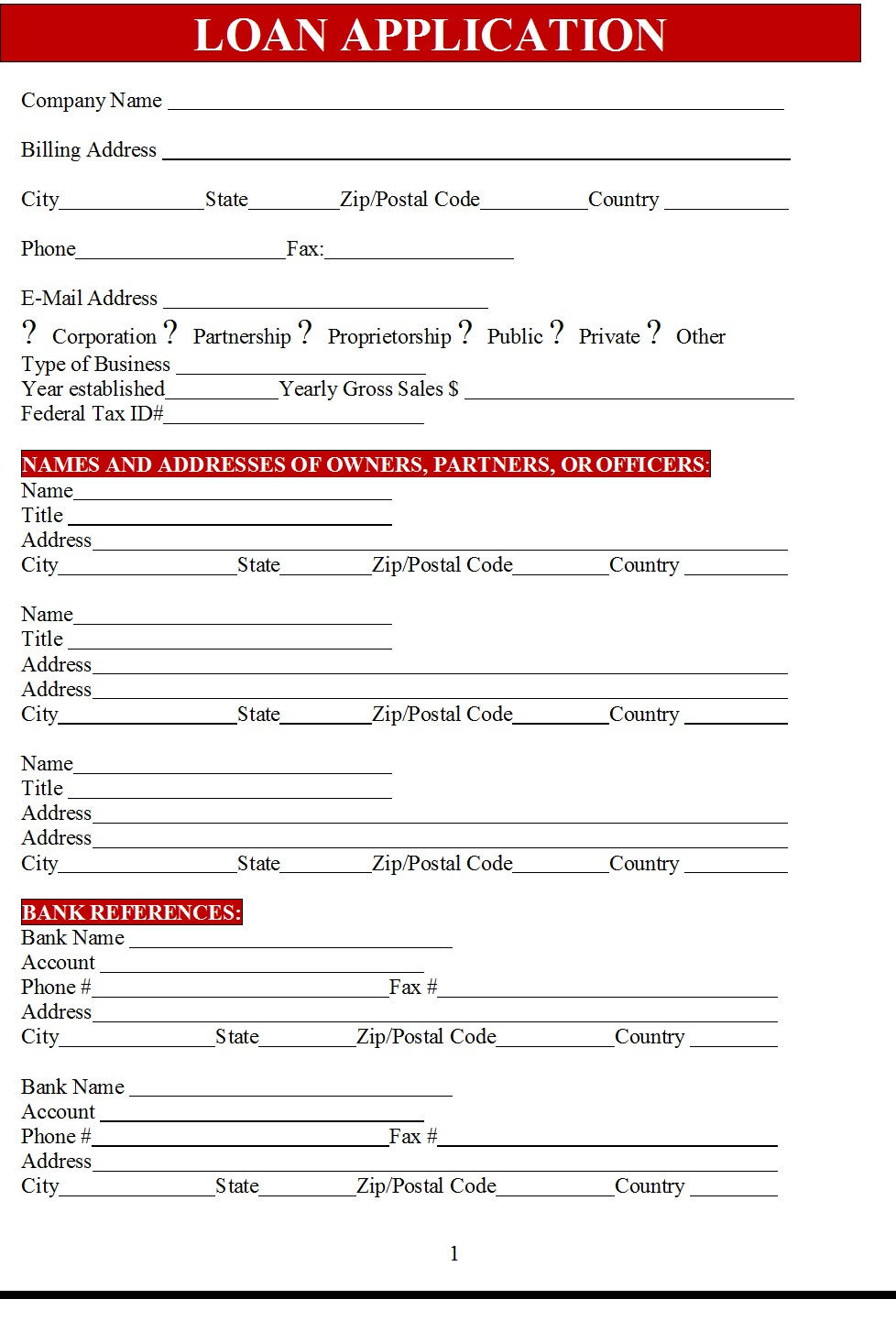

Steps Involved in Car Loan Paperwork

The car loan application process involves several steps, each requiring specific documents and information. The steps are: * Pre-approval: Submitting an application to determine the loan amount you are eligible for * Loan application: Completing a loan application, providing personal and financial information * Credit check: Allowing the lender to review your credit report and score * Loan approval: Receiving approval for the loan, including the interest rate and terms * Loan closing: Finalizing the loan, signing the paperwork, and transferring the funds

Tips for a Successful Car Loan Application

To increase your chances of a successful car loan application, consider the following tips: * Check your credit score: Knowing your credit score can help you understand your chances of approval and the interest rate you may qualify for * Gather all necessary documents: Ensuring you have all the required documents can speed up the application process * Compare loan offers: Researching and comparing loan offers from different lenders can help you find the best deal * Read and understand the terms: Carefully reviewing the loan agreement and terms can prevent unexpected surprises

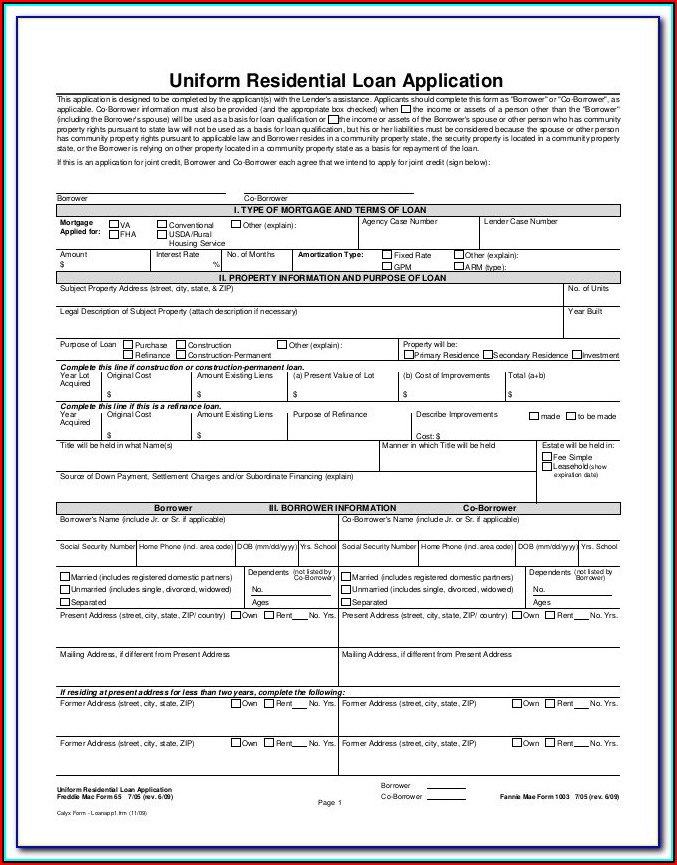

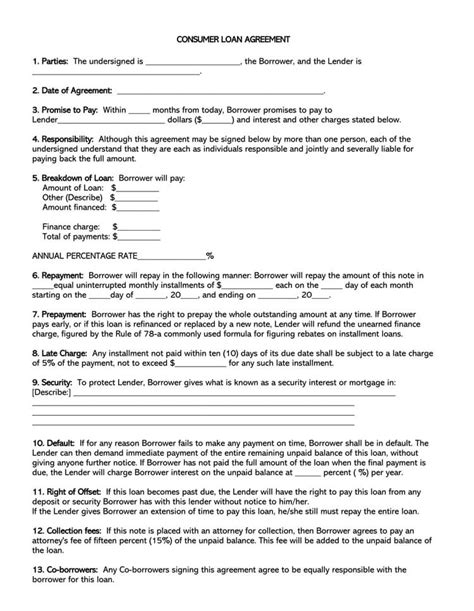

Understanding Car Loan Paperwork

The car loan paperwork itself is a critical component of the application process. The paperwork typically includes: * Loan agreement: Outlining the terms and conditions of the loan, including the interest rate, repayment term, and monthly payment amount * Promissory note: A promise to repay the loan, including the principal amount, interest rate, and repayment schedule * Security agreement: A document that outlines the terms of the collateral, in this case, the vehicle

| Document | Description |

|---|---|

| Loan agreement | Outlines the terms and conditions of the loan |

| Promissory note | A promise to repay the loan |

| Security agreement | Outlines the terms of the collateral |

📝 Note: It is essential to carefully review and understand all the documents involved in the car loan paperwork to ensure you are aware of your obligations and responsibilities.

In conclusion, understanding the car loan paperwork requirements is crucial for a successful application. By gathering the necessary documents, following the steps involved, and considering the tips outlined above, you can navigate the process with confidence. Remember to carefully review and understand the loan agreement, promissory note, and security agreement to ensure you are aware of your obligations and responsibilities.

What is the minimum credit score required for a car loan?

+

The minimum credit score required for a car loan varies depending on the lender and the type of loan. However, a credit score of 600 or higher is generally considered good for a car loan.

How long does the car loan application process typically take?

+

The car loan application process can take anywhere from a few minutes to several days, depending on the lender and the complexity of the application.

Can I apply for a car loan online?

+

Yes, many lenders offer online car loan applications, allowing you to apply from the comfort of your own home.