Paperwork

Insurance Paperwork After Claim

Understanding the Process of Insurance Paperwork After a Claim

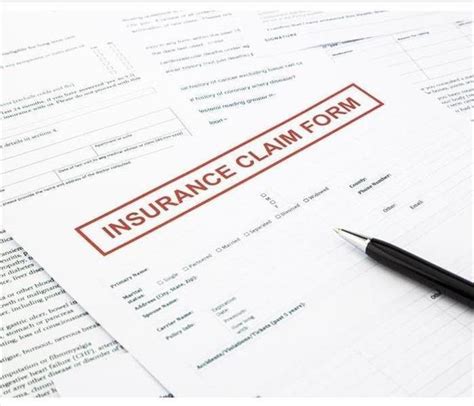

When dealing with insurance claims, the process can be complex and overwhelming, especially when it comes to the paperwork involved. Whether you’re filing a claim for health, auto, home, or life insurance, it’s essential to understand the steps and documents required to ensure a smooth and efficient claims process. In this article, we’ll delve into the world of insurance paperwork, exploring the types of documents you’ll need, how to navigate the claims process, and tips for avoiding common pitfalls.

Types of Insurance Paperwork

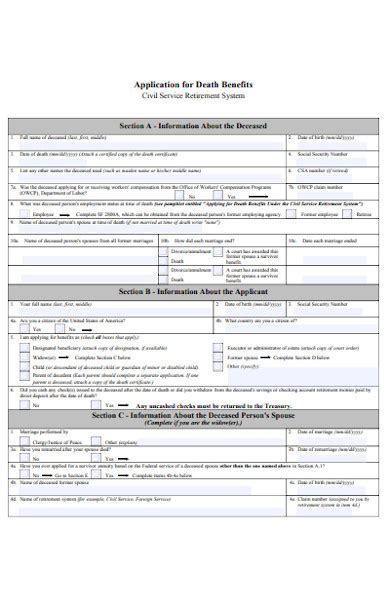

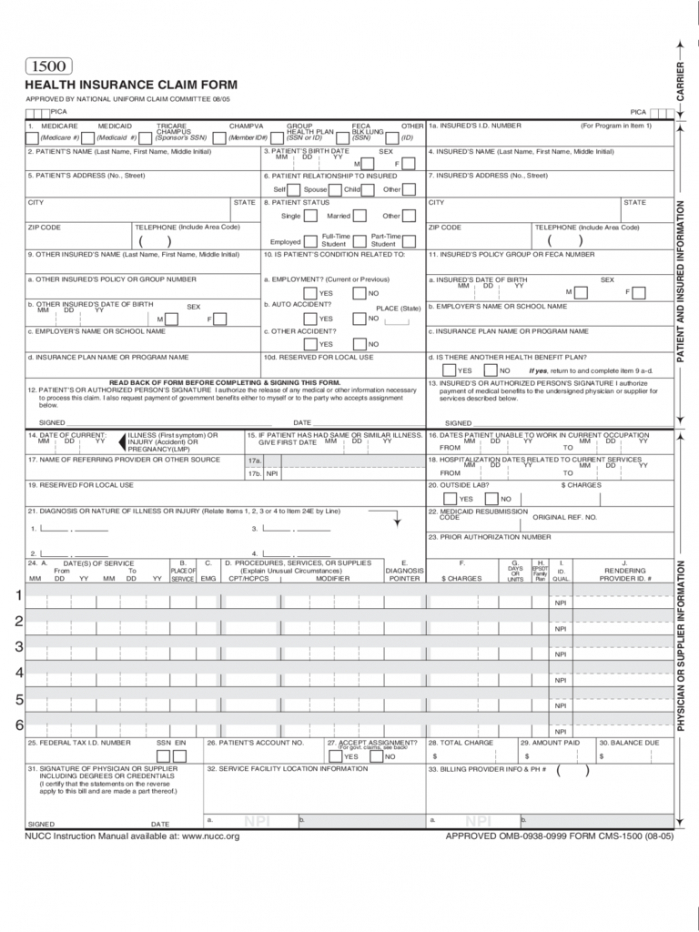

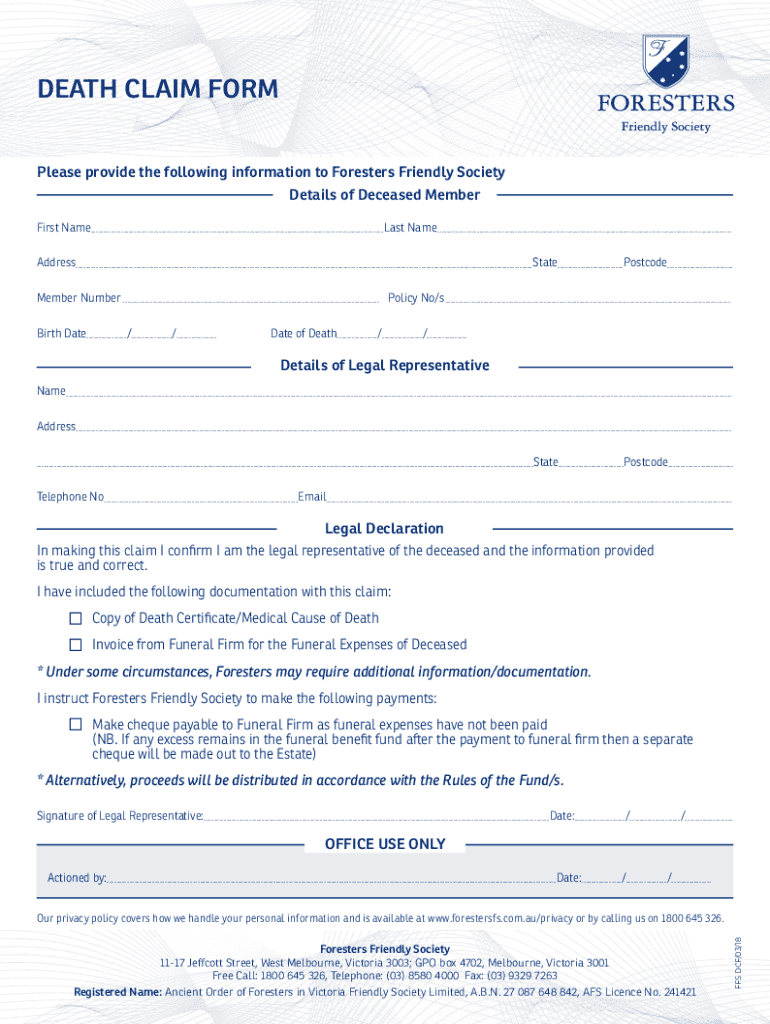

Insurance paperwork can vary depending on the type of claim you’re filing. However, there are some common documents that you’ll likely need to provide, including: * Claim form: This is the initial document that you’ll need to fill out to notify your insurance provider of your claim. It will typically ask for details about the incident, including dates, times, and descriptions of what happened. * Proof of loss: This document provides evidence of the loss or damage you’re claiming for. For example, if you’re filing a claim for a car accident, you may need to provide a police report, photos of the damage, and estimates for repairs. * Medical records: If you’re filing a claim for a medical condition or injury, you’ll need to provide medical records, including doctor’s notes, test results, and treatment plans. * Financial documents: Depending on the type of claim, you may need to provide financial documents, such as receipts, invoices, or bank statements, to support your claim.

Navigating the Claims Process

The claims process can be lengthy and involve multiple parties, including your insurance provider, adjusters, and potentially, lawyers. Here are some steps you can expect to take: * Notify your insurance provider: The first step is to notify your insurance provider of your claim. You can usually do this by phone, email, or online. * Fill out the claim form: Your insurance provider will provide you with a claim form to fill out. Make sure to complete it accurately and thoroughly. * Provide supporting documents: You’ll need to provide supporting documents, such as proof of loss, medical records, and financial documents. * Wait for the adjuster’s assessment: An adjuster will review your claim and may contact you for additional information or to schedule an inspection. * Receive the settlement offer: If your claim is approved, you’ll receive a settlement offer from your insurance provider.

Tips for Avoiding Common Pitfalls

To avoid common pitfalls and ensure a smooth claims process, keep the following tips in mind: * Keep detailed records: Keep detailed records of all correspondence, including dates, times, and details of conversations. * Be thorough: Make sure to provide all required documents and information to avoid delays. * Don’t wait: Don’t wait to notify your insurance provider or file your claim. The sooner you start the process, the sooner you’ll receive your settlement. * Seek professional help: If you’re unsure about any aspect of the claims process, consider seeking professional help from a lawyer or insurance expert.

💡 Note: It's essential to read and understand your insurance policy before filing a claim. This will help you understand what's covered and what's not, as well as any specific requirements or deadlines.

Conclusion and Next Steps

In conclusion, insurance paperwork after a claim can be complex and time-consuming. However, by understanding the types of documents required, navigating the claims process, and avoiding common pitfalls, you can ensure a smooth and efficient experience. Remember to keep detailed records, be thorough, and don’t wait to notify your insurance provider. If you’re unsure about any aspect of the process, consider seeking professional help. By taking these steps, you can ensure that you receive the settlement you deserve and get back on your feet as quickly as possible.

What is the first step in filing an insurance claim?

+

The first step in filing an insurance claim is to notify your insurance provider. You can usually do this by phone, email, or online.

What documents do I need to provide to support my claim?

+

The documents you need to provide will depend on the type of claim you’re filing. However, common documents include proof of loss, medical records, and financial documents.

How long does the claims process typically take?

+

The length of time the claims process takes will depend on the complexity of your claim and the efficiency of your insurance provider. However, it’s usually several weeks or months.