Keep Paperwork For How Long

Introduction to Record Keeping

When it comes to managing personal or business finances, keeping track of paperwork is essential. From receipts and invoices to contracts and tax documents, paperwork can quickly pile up, leaving you wondering how long you should keep each type of document. In this article, we will explore the different types of paperwork and how long you should keep them.

Understanding the Importance of Record Keeping

Record keeping is crucial for both personal and business purposes. It helps you keep track of your income and expenses, making it easier to manage your finances and make informed decisions. Additionally, having accurate records can help you in case of an audit or if you need to prove your income or expenses for any other reason. Proper record keeping can also help you identify areas where you can cut costs and improve your overall financial health.

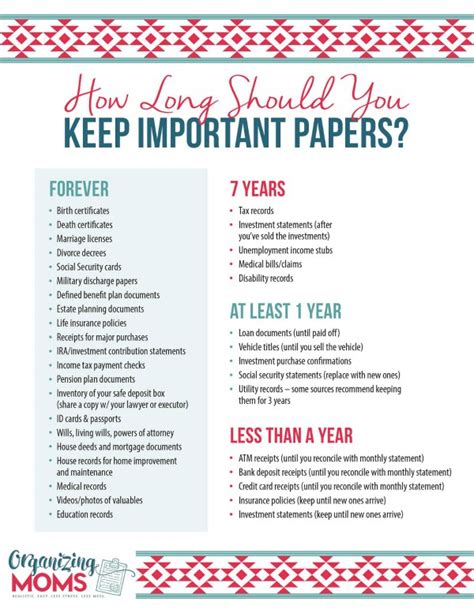

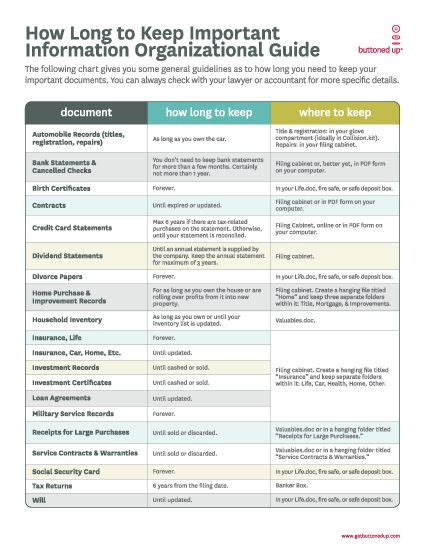

Types of Paperwork and Retention Periods

Here are some common types of paperwork and how long you should keep them: * Tax Documents: Keep tax documents, including receipts, invoices, and tax returns, for at least three to seven years in case of an audit. * Contracts: Keep contracts for as long as they are in effect, and for three to seven years after they expire. * Receipts and Invoices: Keep receipts and invoices for one to three years, or until you have verified that the transaction was accurate and complete. * Bank and Credit Card Statements: Keep bank and credit card statements for one to three years, or until you have verified that the transactions were accurate and complete. * Pay Stubs: Keep pay stubs for one year, or until you have verified that the information is accurate and complete. * Insurance Documents: Keep insurance documents, including policies and claims, for as long as the policy is in effect, and for three to seven years after it expires.

Organizing Your Paperwork

To keep your paperwork organized, consider using a filing system that includes: * A file cabinet or digital storage system to keep your documents safe and secure. * Labels and folders to categorize and organize your documents. * A scanner or shredder to digitize or destroy documents that are no longer needed.

Digital Record Keeping

Digital record keeping is becoming increasingly popular, and for good reason. It allows you to store your documents securely and access them from anywhere. Some benefits of digital record keeping include: * Increased security: Digital documents are less likely to be lost or stolen than physical documents. * Easy access: Digital documents can be accessed from anywhere, at any time. * Space-saving: Digital documents take up less space than physical documents.

| Type of Document | Retention Period |

|---|---|

| Tax Documents | 3-7 years |

| Contracts | As long as they are in effect, and 3-7 years after they expire |

| Receipts and Invoices | 1-3 years |

| Bank and Credit Card Statements | 1-3 years |

| Pay Stubs | 1 year |

| Insurance Documents | As long as the policy is in effect, and 3-7 years after it expires |

📝 Note: The retention periods listed above are general guidelines and may vary depending on your specific situation and local laws and regulations.

In the end, keeping track of your paperwork is essential for managing your finances and ensuring that you have the documents you need when you need them. By understanding the different types of paperwork and how long to keep them, you can create a system that works for you and helps you stay organized and in control of your finances. The key is to find a system that works for you and to stick to it, whether you prefer physical or digital record keeping. By doing so, you can ensure that your paperwork is always up to date and easily accessible, giving you peace of mind and allowing you to focus on more important things.