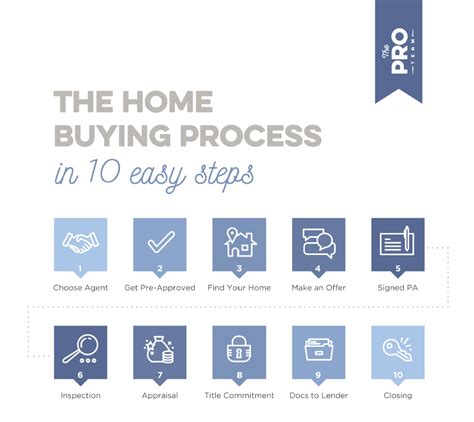

7 Steps Buying House

Introduction to Buying a House

Buying a house can be a daunting task, especially for first-time buyers. It involves a series of steps that require careful consideration and planning. From determining your budget to closing the deal, each step is crucial in ensuring that you find the right house and complete the purchase successfully. In this guide, we will walk you through the 7 steps to buying a house, highlighting key considerations and tips along the way.

Step 1: Determine Your Budget

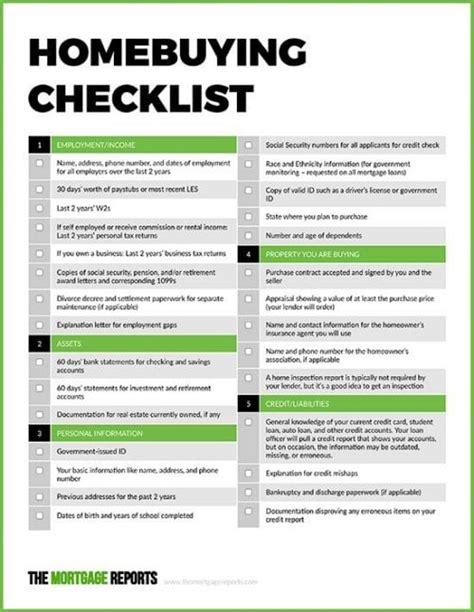

The first step in buying a house is to determine how much you can afford. This involves calculating your income, expenses, debts, and savings. It’s essential to consider not just the purchase price of the house but also additional costs such as stamp duty, legal fees, and moving expenses. You should also check your credit score, as a good credit score can help you qualify for better mortgage rates.

- Calculate your gross income

- List all your monthly expenses

- Check your credit score

- Determine how much you can afford for a down payment

- Research and understand the additional costs involved in buying a house

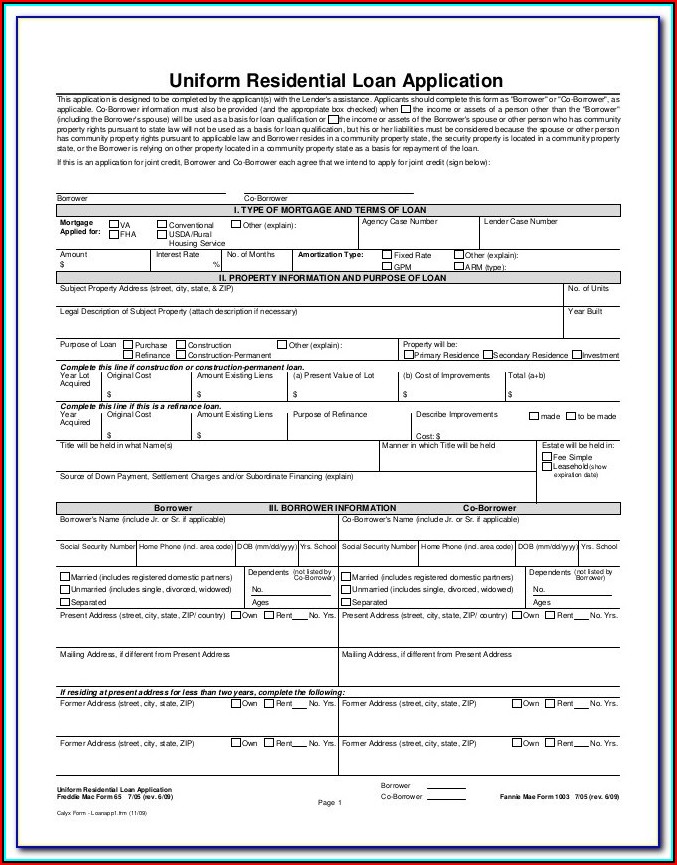

Step 2: Get Pre-Approved for a Mortgage

Once you have an idea of your budget, the next step is to get pre-approved for a mortgage. This involves contacting a lender and providing financial information to determine how much they are willing to lend you. Getting pre-approved gives you an advantage when making an offer on a house, as sellers are more likely to consider buyers who are already pre-approved for a mortgage.

- Research different lenders and their mortgage products

- Contact a lender and apply for pre-approval

- Provide the necessary financial documents

- Understand the terms of the pre-approval, including the amount and interest rate

Step 3: Identify Your Needs and Wants

Before starting your house hunt, it’s crucial to identify what you need and want in a house. Consider factors such as location, size, number of bedrooms and bathrooms, and amenities like a backyard or pool. Making a list of your needs and wants will help you focus your search and ensure that you find a house that meets your requirements.

- Location: proximity to work, schools, public transport

- Size: number of bedrooms and bathrooms, square footage

- Amenities: backyard, pool, garage, community facilities

- Age and condition of the house

- Potential for renovation or expansion

Step 4: Find a Real Estate Agent

A real estate agent can be incredibly valuable in your house hunt, providing knowledge of the local market, access to listings, and negotiation skills. When choosing an agent, look for someone who is experienced, knowledgeable, and communicative. They should understand your needs and wants and be able to guide you through the process.

- Ask for referrals from friends, family, or coworkers

- Research local agents and their experience

- Interview potential agents to find the best fit

- Ensure they are familiar with the area you’re interested in

Step 5: View Houses

With your agent’s help, start viewing houses that meet your criteria. It’s essential to approach each viewing with an open mind and a critical eye. Consider not just the house itself but also the neighborhood, local amenities, and potential for resale.

- View houses during different times of day and in various weather conditions

- Take notes and photos to compare properties

- Consider the condition and potential for renovation

- Research the neighborhood and local amenities

Step 6: Make an Offer

When you find a house you love, it’s time to make an offer. This involves working with your agent to determine a fair price based on the market value of the house and comparable sales. Your offer should include not just the price but also other terms such as contingencies for inspections and financing.

- Research the market value of the house

- Determine your offer price and terms

- Include contingencies for inspections, financing, and appraisal

- Be prepared to negotiate

Step 7: Close the Deal

The final step in buying a house is closing the deal. This involves signing the final documents, transferring the ownership, and paying the remaining balance of the purchase price. It’s a critical step that requires careful attention to detail to ensure everything goes smoothly.

- Review and sign the final documents

- Transfer the ownership and register the deed

- Pay the remaining balance of the purchase price

- Complete any final inspections or walk-throughs

🏠 Note: Closing costs can vary widely depending on the location and type of property, so it's essential to factor these into your budget from the outset.

In summary, buying a house is a complex process that requires careful planning, research, and execution. By following these 7 steps, you can navigate the process with confidence and find your dream home. Remember to stay focused on your needs and wants, and don’t hesitate to seek professional advice when needed. With patience and persistence, you’ll be holding the keys to your new home in no time.

What are the most important factors to consider when buying a house?

+

The most important factors include location, size, number of bedrooms and bathrooms, and amenities. Additionally, consider the age and condition of the house, potential for renovation, and resale value.

How do I determine my budget for buying a house?

+

To determine your budget, calculate your gross income, list all your monthly expenses, check your credit score, and determine how much you can afford for a down payment. Also, research and understand the additional costs involved in buying a house.

Why is it important to get pre-approved for a mortgage?

+

Getting pre-approved for a mortgage gives you an advantage when making an offer on a house, as sellers are more likely to consider buyers who are already pre-approved. It also helps you understand how much you can borrow and at what interest rate.