Mom's Death Paperwork Filing Requirements

Introduction to Filing Requirements After a Loved One’s Passing

When a loved one passes away, the emotional toll can be overwhelming, and the last thing on one’s mind might be the paperwork and legal requirements that follow. However, understanding and completing these tasks is crucial for managing the deceased’s estate, ensuring that all legal and financial matters are properly handled, and minimizing potential complications or disputes. This guide is designed to walk you through the key steps and considerations when dealing with the paperwork and filing requirements after a mother’s passing, providing a comprehensive overview to help navigate this challenging time.

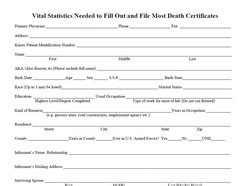

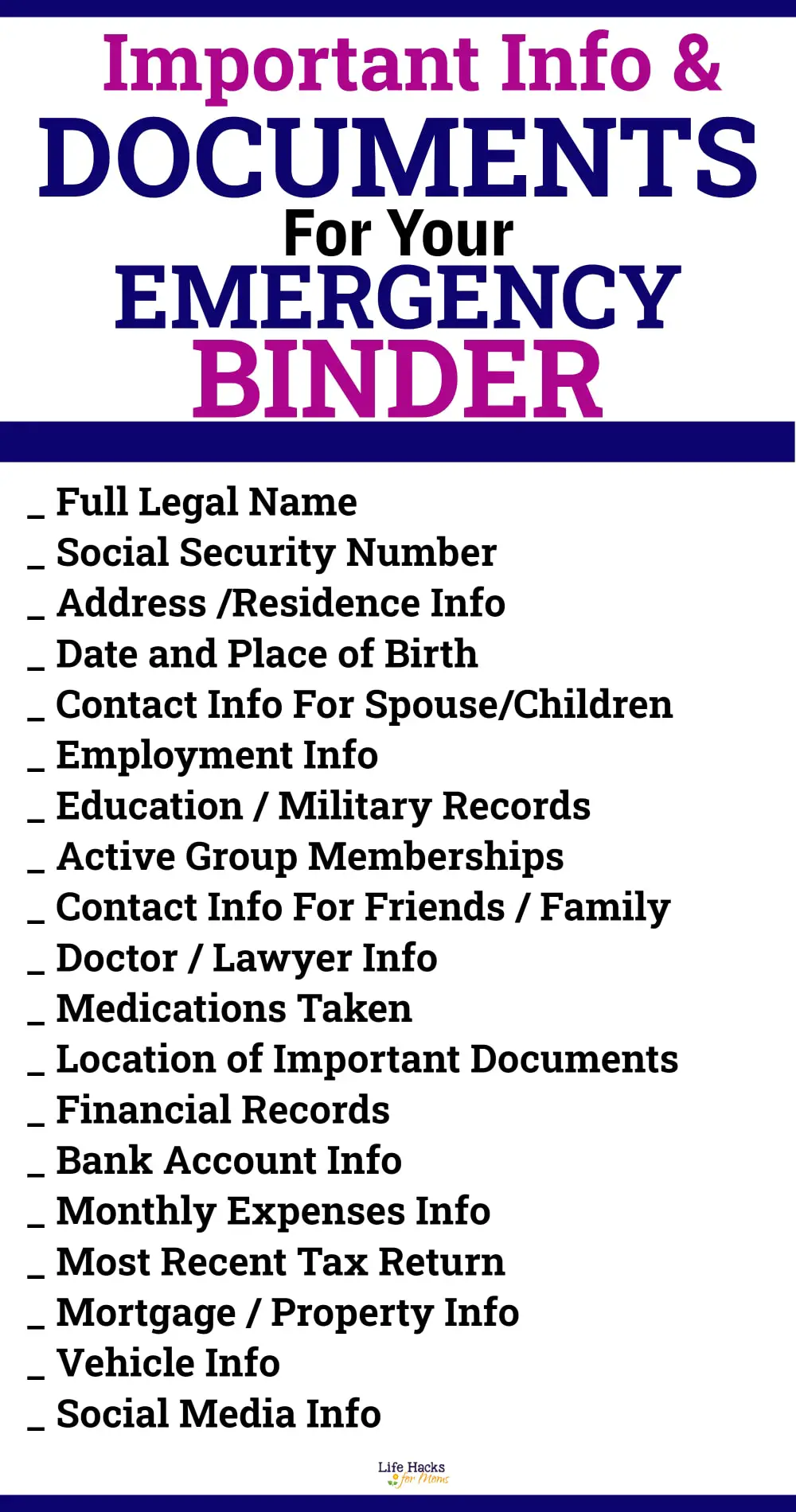

Immediate Steps and Notifications

After a mother’s passing, several immediate steps need to be taken. These include: - Obtaining a death certificate: This is a critical document that will be required for various legal and administrative tasks. It’s essential to obtain multiple copies, as you will need them for different purposes. - Notifying the social security administration: If your mother was receiving social security benefits, it’s crucial to inform the Social Security Administration to stop payments and potentially apply for survivor benefits. - Informing the relevant government agencies and institutions: This includes the Department of Veterans Affairs if your mother was a veteran, and any other government agencies from which she was receiving benefits.

Managing the Estate

Managing the estate involves several key components: - Locating the will: If your mother had a will, it should outline her wishes regarding the distribution of her estate. The will also names an executor, who is responsible for ensuring that these wishes are carried out. - Probate process: If there is a will, it typically needs to be probated, which involves validating the will through the court system. If there is no will, the estate will be distributed according to the state’s intestacy laws, and an administrator will be appointed by the court to manage the estate. - Inventory of assets: It’s essential to create a comprehensive list of your mother’s assets, including real estate, vehicles, personal property, bank accounts, investments, and any other valuables. - Paying off debts: The estate is responsible for paying off any debts your mother may have had, such as credit card debt, loans, and utility bills.

Tax Obligations

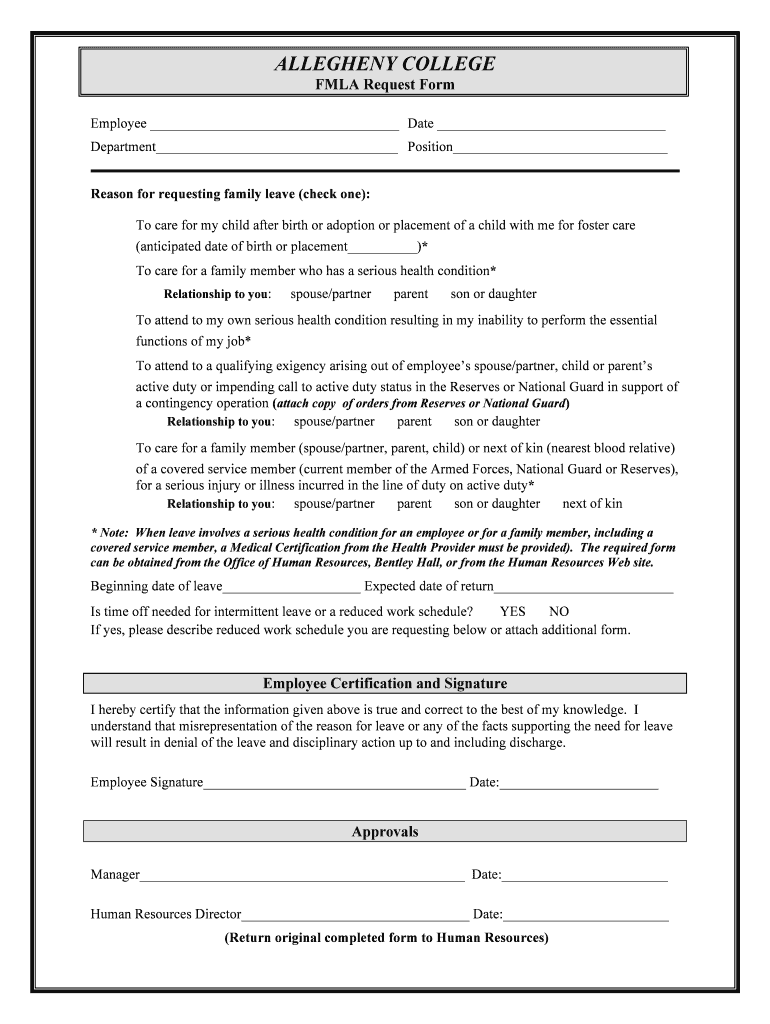

Dealing with tax obligations is a critical part of managing the estate. This includes: - Filing the final tax return: You will need to file a final income tax return for your mother, covering the period from the beginning of the tax year up to her date of death. - Estate tax return: Depending on the size of the estate, you may also need to file an estate tax return. The threshold for requiring an estate tax return can vary, so it’s crucial to consult with a tax professional to understand your obligations. - Potential for other tax filings: Depending on the estate’s assets and the deceased’s tax situation, other tax filings may be necessary, such as filings related to trusts or businesses.

Other Important Considerations

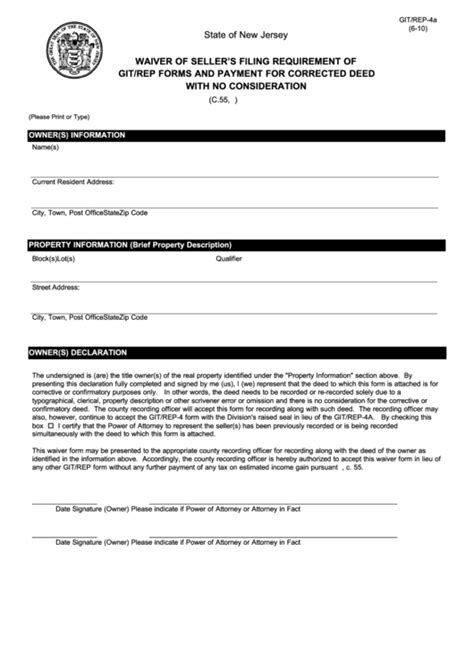

- Life insurance: If your mother had life insurance, you will need to file a claim to receive the benefits. - Retirement accounts: Beneficiaries of retirement accounts, such as 401(k)s or IRAs, will need to contact the account administrator to begin the process of distributing these assets according to the account’s beneficiary designation. - Real estate: If the estate includes real estate, there may be specific legal requirements for transferring ownership, which can vary significantly by jurisdiction.

Seeking Professional Advice

Given the complexity and potential legal implications of managing a deceased person’s estate, it is highly advisable to seek professional advice. This can include: - Attorney: An attorney specializing in estate law can provide invaluable guidance on navigating the legal aspects of probate, wills, and estate administration. - Accountant or tax professional: For help with tax filings and ensuring compliance with all tax obligations. - Financial advisor: To get advice on managing the estate’s assets and ensuring that beneficiaries receive their inheritances in the most tax-efficient manner possible.

💡 Note: The specific requirements and processes can vary significantly depending on your location and the specifics of your mother's estate. It's crucial to research and understand the laws and regulations in your area.

In summary, dealing with the paperwork and filing requirements after a loved one’s passing involves a series of complex and often time-sensitive tasks. From obtaining a death certificate and notifying relevant agencies, to managing the estate, handling tax obligations, and considering other important aspects such as life insurance and real estate, each step requires careful attention to detail and adherence to legal and administrative requirements. Seeking professional advice can be incredibly beneficial in ensuring that all necessary steps are taken correctly and efficiently.

What is the first step after a mother’s passing in terms of paperwork and legal requirements?

+

The first steps include obtaining a death certificate, notifying the Social Security Administration, and informing other relevant government agencies and institutions from which the deceased was receiving benefits.

Why is it important to understand the estate management process?

+

Understanding the estate management process is crucial for ensuring that the deceased’s wishes are respected, that all legal requirements are met, and that the estate is distributed correctly among beneficiaries, minimizing potential disputes or legal issues.

What role does a will play in the estate management process?

+

A will outlines the deceased’s wishes regarding the distribution of their estate and names an executor responsible for carrying out these wishes. If there is no will, the estate is distributed according to state intestacy laws, and an administrator is appointed by the court.